How does Medicare work when it is a secondary insurance?

Jun 14, 2021 · The insurance that picks up the remaining cost is the secondary payer. For example, if you had a X-ray bill of $100, the bill would first be sent to your primary payer, who would pay the amount...

Can Medicare be used as a secondary insurance?

Dec 01, 2021 · Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare. When Medicare began in 1966, it was the primary payer for all claims except for those covered by Workers' Compensation, Federal Black Lung benefits, …

Is Medicare ever used as a secondary insurance carrier?

Mar 11, 2020 · A secondary payer assumes coverage of whatever amount remains after the primary payer has satisfied its portion of the benefit, up to any limit established by the policies of the secondary payer coverage terms. When Medicare coordinates benefits with other health insurance coverage providers, there are a variety of factors that play into ...

Will Medicaid cover my co-pay as secondary insurance?

Jan 14, 2020 · The Medicare secondary payment is $100. When Medicare is the secondary payer, the combined payment made by the primary payer and Medicare on behalf of the beneficiary is $3,000. The beneficiary has no liability for Medicare-covered services since the primary payment satisfied the $520 deductible.

What is the cost of supplemental insurance for Medicare?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization. Several factors impact Medigap costs, including your age and where you live.

What is the difference between Medicare secondary and supplemental insurance?

Secondary health insurance provides the coverage of a full health care policy while supplemental insurance is intended only to augment an existing primary care plan. Choosing one of these health care routes may come down to finances and the coverage extended through your primary health insurance.Oct 25, 2017

Why are Medicare Supplement plans so expensive?

Younger buyers may find Medicare Supplement insurance plans that are rated this way very affordable. Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors.

What is a supplemental insurance for patients with Medicare as their primary insurance?

A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.Dec 1, 2021

Will secondary pay if primary denies?

If your primary insurance denies coverage, secondary insurance may or may not pay some part of the cost, depending on the insurance. If you do not have primary insurance, your secondary insurance may make little or no payment for your health care costs.

Does Medicare secondary pay primary deductible?

“Medicare pays secondary to other insurance (including paying in the deductible) in situations where the other insurance is primary to Medicare. There are some restrictions — it has to be a Medicare covered service, and the total amount paid must be equal to or less than the Medicare approved amount.”Sep 20, 2017

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

What is Medicare Plan G deductible for 2021?

Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

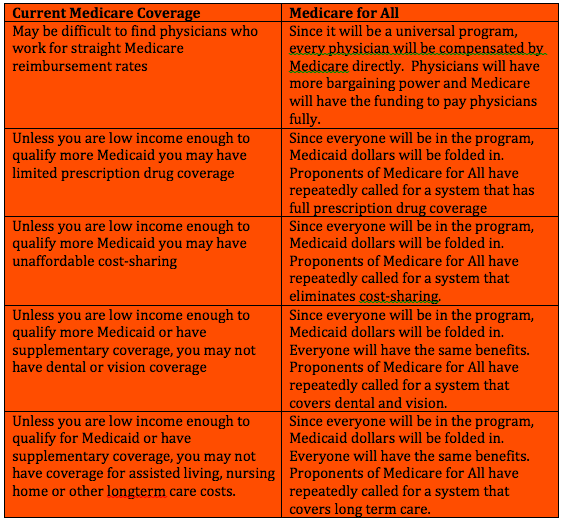

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Can I have two Medicare Supplement plans?

En español | By law, Medigap insurers aren't allowed to sell more than one Medigap plan to the same person.

Do I need to renew my Medicare Supplement every year?

The plain and simple answer to this question is no, you don't have to renew your Medigap plan each year. All Medicare Supplement plans are guaranteed renewable for life as long as you're paying your premium, either monthly, quarterly, semi-annually, or annually.Aug 7, 2019

What is not covered by Medicare?

Medicare does not cover: medical exams required when applying for a job, life insurance, superannuation, memberships, or government bodies. most dental examinations and treatment. most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry, acupuncture and psychology services.Jun 24, 2021

How much does Medicare Part B cover?

If your primary payer was Medicare, Medicare Part B would pay 80 percent of the cost and cover $80. Normally, you’d be responsible for the remaining $20. If you have a secondary payer, they’d pay the $20 instead. In some cases, the secondary payer might not pay all the remaining cost.

What is primary payer?

A primary payer is the insurer that pays a healthcare bill first. A secondary payer covers remaining costs, such as coinsurances or copayments. When you become eligible for Medicare, you can still use other insurance plans to lower your costs and get access to more services. Medicare will normally act as a primary payer and cover most ...

What is FEHB insurance?

Federal Employee Health Benefits (FEHBs) are health plans offered to employees and retirees of the federal government, including members of the armed forces and United States Postal Service employees. Coverage is also available to spouses and dependents. While you’re working, your FEHB plan will be the primary payer and Medicare will pay second.

How long can you keep Cobra insurance?

COBRA allows you to keep employer-sponsored health coverage after you leave a job. You can choose to keep your COBRA coverage for up to 36 months alongside Medicare to help cover expenses. In most instances, Medicare will be the primary payer when you use it alongside COBRA.

Does Medicare cover dental visits?

If you have a health plan from your employer, you might have benefits not offered by Medicare. This can include dental visits, eye exams, fitness programs, and more. Secondary payer plans often come with their own monthly premium. You’ll pay this amount in addition to the standard Part B premium.

Is Medicare Part A the primary payer?

Secondary payers are also useful if you have a long hospital or nursing facility stay. Medicare Part A will be your primary payer in this case.

Is FEHB a primary or secondary payer?

Coverage is also available to spouses and dependents. While you’re working, your FEHB plan will be the primary payer and Medicare will pay second. Once you retire, you can keep your FEHB and use it alongside Medicare. Medicare will become your primary payer, and your FEHB plan will be the secondary payer.

What is Medicare Secondary Payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare. When Medicare began in 1966, it was the primary payer for all claims except for those covered by Workers' Compensation, ...

What age is Medicare?

Retiree Health Plans. Individual is age 65 or older and has an employer retirement plan: Medicare pays Primary, Retiree coverage pays secondary. 6. No-fault Insurance and Liability Insurance. Individual is entitled to Medicare and was in an accident or other situation where no-fault or liability insurance is involved.

Why is Medicare conditional?

Medicare makes this conditional payment so that the beneficiary won’t have to use his own money to pay the bill. The payment is “conditional” because it must be repaid to Medicare when a settlement, judgment, award or other payment is made. Federal law takes precedence over state laws and private contracts.

How long does ESRD last on Medicare?

Individual has ESRD, is covered by a GHP and is in the first 30 months of eligibility or entitlement to Medicare. GHP pays Primary, Medicare pays secondary during 30-month coordination period for ESRD.

When did Medicare start?

When Medicare began in 1966 , it was the primary payer for all claims except for those covered by Workers' Compensation, Federal Black Lung benefits, and Veteran’s Administration (VA) benefits.

What is the purpose of MSP?

The MSP provisions have protected Medicare Trust Funds by ensuring that Medicare does not pay for items and services that certain health insurance or coverage is primarily responsible for paying. The MSP provisions apply to situations when Medicare is not the beneficiary’s primary health insurance coverage.

What is conditional payment?

A conditional payment is a payment Medicare makes for services another payer may be responsible for.

What is secondary payer?

A secondary payer assumes coverage of whatever amount remains after the primary payer has satisfied its portion of the benefit, up to any limit established by the policies of the secondary payer coverage terms.

Does Medicare pay conditional payments?

In any situation where a primary payer does not pay the portion of the claim associated with that coverage, Medicare may make a conditional payment to cover the portion of a claim owed by the primary payer. Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment.

Is Medicare a secondary payer?

Medicare is the secondary payer if the recipient is: Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization with more than 20 employees.

What is secondary health insurance?

A secondary insurance policy is a plan that you get on top of your main health insurance.

How does secondary insurance work?

If you have multiple insurance policies, there is a clear order in which the plans will pay for health care services.

What types of coverage can you get?

The category of secondary health insurance includes multiple types of insurance plans. Some plans help with the costs of your primary insurance policy by addressing things such as high deductibles or the cost of a hospital stay.

What's the cost of secondary health insurance?

Secondary health insurance can cost anywhere from $5 per month to hundreds of dollars per month, depending on the type of coverage and the level of support the plan provides.

How do you choose the best secondary insurance plan?

Just as there are multiple considerations when choosing the best health insurance company, asking yourself the following questions can help you choose the best secondary health insurance policy.

Frequently asked questions

Secondary health insurance policies can fill in any coverage gaps, such as vision coverage, and available policies can also reduce the cost of health care services, such as hospital indemnity to help you cover the cost of hospital care.

What is secondary health insurance?

Secondary health insurance is coverage you can buy separately from a medical plan. It helps cover you for care and services that your primary medical plan may not. This secondary insurance could be a vision plan, dental plan, or an accidental injury plan, to name a few. These are also called voluntary or supplemental insurance plans.

What is gap insurance?

Gap insurance is a type of secondary insurance. It's sometimes called "limited benefits insurance.". Gap insurance offers cash benefits. This means it can help pay health care costs related to your deductible, copay, coinsurance, and other out-of-pocket medical expenses.

What is accidental injury insurance?

An accidental injury plan is a type of secondary insurance that may give you a cash payout, or lump sum. You can use this money to help pay medical bills or household expenses.

What is a supplement plan?

Supplemental health plans like vision , dental , and cancer insurance can provide coverage for care and services not typically covered under your medical plan. Supplemental plans often have a deductible, copay, and coinsurance. When you meet the deductible then your plan starts sharing part of the costs with you.

What happens when you meet your deductible?

When you meet the deductible then your plan starts sharing part of the costs with you. When you see a provider you may have to pay a small fee, or copay, at the time of the visit. Lump sum insurance plans pay you a cash amount, should you suffer a covered illness or injury.

What does a vision plan cover?

A vision plan can provide coverage for routine eye exams and prescription glasses or contacts , depending on the plan. Dental: A dental plan can cover you for preventive care such as routine teeth cleanings and some X-rays. It may also help cover you for certain kinds of specialized dental care.

What is short term disability?

Disability: Short- and long-term disability plans are a type of secondary insurance coverage. It gives you benefits if you become injured or ill and can't work for any length of time. Life Insurance: A type of secondary insurance that pays out a lump sum to a beneficiary in the event of your death.

How much does Medicare pay for Part B?

Once you reach your deductible, you pay 20% of Part B costs; Medicare picks up the rest. Part D -- Once you reach the deductible, you pay 25% of the costs until you reach $4,020 in prescription drug costs and then 37% for generics and 25% on brand-name drugs until $6,350 in out-of-pocket costs. After you reach $6,350, you pay 5% ...

What is coinsurance in Medicare?

Coinsurance is your portion of the bill after you reach your deductible. Also, dig into the information from multiple Medicare Advantage plans -- not only one or two. If you’re comparing Medicare Advantage plans, you’ll additionally want to consider a plan’s design.

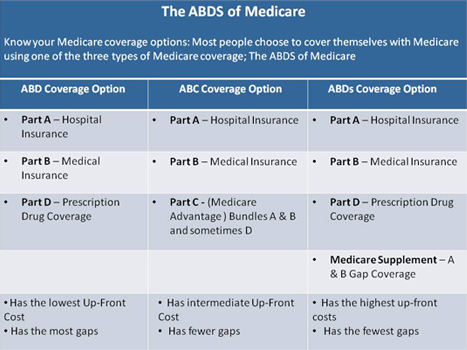

What is the difference between Medicare Advantage and Original?

Eligible Medicare beneficiaries choose between Original Medicare and Medicare Advantage. Original Medicare is Parts A and B. Medicare Advantage is Part C. Original Medicare covers you for hospital and physician costs, but it doesn’t have prescription drug benefits. You can add on a Part D prescription drug plan to help with those costs.

What is the right Medicare plan for me?

What’s the right Medicare plan for you depends on multiple factors, including the plans offered in your state, which plans your providers accept, co-payments, deductibles, coinsurance, out-of-pocket costs, quality of plans and supplemental offerings. You’ll want to first make sure your providers accept the Medicare plan before joining.

How much does a Medigap plan cost?

The cost of Medigap plans differs. High-deductible plans usually cost less than $100 monthly, but lower-deductible plans cost more than $300 a month. Medigap isn’t available for people with Medicare Advantage plans.

Do HMOs have deductibles?

HMOs require a primary care provider referral to see a specialist and you won’t be able to get covered for out-of-network care. A PPO gives you more flexibility, but that also comes with higher premiums. PPOs and HMOs often have similar deductibles and coinsurance.

What is secondary insurance?

A separate plan that offers additional benefits is called secondary insurance. Your secondary health insurance can be another medical plan, such as through your spouse. More often, it’s a different type of plan you’ve purchased to extend your coverage. In that case, you may hear it referred to as voluntary or supplemental coverage .

What is hospital indemnity plan?

A hospital indemnity plans is a popular add-on to a High-Deductible Health Plan (HDHP) . This supplemental plan gives you a lump-sum check if you’re admitted to the hospital.

How long does a short term disability last?

Short-term disability coverage can last anywhere between 9 and 52 weeks. After that, long-term disabilty coverage can kick in.

Where is Peggy from?

Peggy, 38, is a married mom living in Raleigh, NC. A front desk agent at a local hotel, she bought dental insurance from her employer even though the family has medical coverage through her husband Jim. She’s glad she did: Peggy cracked a filling on a popcorn kernel and needs a repair.

Does dental insurance cover dental cleaning?

For example, dental insurance typically covers routine teeth cleanings and preventive care as well as procedures like fillings and extractions. Vision insurance usually helps to cover the cost of prescription glasses, contact lenses, and routine eye exams.

What is a vision plan?

Vision plan: A window into your overall health. Vision plans usually cover routine eye exams and help cover prescription lenses (glasses or contacts) and frames. And like dental care, eye exams can also detect early signs of overall health problems, such as high blood pressure and lupus.

What goes on in your mouth?

What goes on in your mouth can have an effect on your overall health. Regular dental care is especially important for people with diabetes , who are more prone to gum disease. Dental plans typically cover routine teeth cleanings and preventive care, as well as procedures like fillings and extractions.