Does Medicaid pay for deductible?

2021 Medicare Deductibles According to Medicare.gov, the Part A hospital inpatient deductible for 2021 is $1,484 per benefit period. A benefit period begins the day you go into a hospital or skilled nursing facility and ends when you have been out for 60 days in a row.

Can I deduct Medicare costs on my income tax?

Nov 14, 2020 · The Medicare Part A benefit period deductible jumped from $1,408 in 2020 to $1,484 for 2021, while coinsurance rates jumped over 5 percent. Where beneficiaries paid $352 coinsurance per day of each benefit period between days 61-90 and $704 for days 91+, they will now pay $371 and $742, respectively. Medicare Part B

Is Medicare Part B premiums tax-deductible?

Feb 15, 2022 · The Medicare Part A deductible is increasing from $1,408 per benefit period in 2020 to $1,484 per benefit period in 2021 . Part A coinsurance is also on the rise, with beneficiaries owing $371 per day of an inpatient hospital stay, beginning on the 61st day of a benefit period (up from $352 per day in 2020).

What is the monthly premium for Medicare Part B?

Nov 03, 2021 · The costs may increase again in 2022. The Part A deductible in 2021 is $1,484 per benefit period, which is an increase of $76 from the 2020 Part A deductible. The Part A deductible amount may increase each year, and it will likely be higher in 2022. 2022 Medicare Part B …

What is the Medicare deductible amount for 2021?

$203Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the yearly deductible for Medicare?

The Medicare Part B deductible is $233. Once met, you pay 20 percent of the Medicare-approved amount for most doctor services, outpatient therapy and durable medical equipment.

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the deductible for Medicare Part D in 2022?

$480 inWhat is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.Mar 23, 2022

PinPoints

Medicare made some modifications to the 2021 deductible. The rising cost of healthcare necessitates an increase in Medicare premiums and deductibles.

What changes are made to Medicare Part A in 2021?

Medicare Part A covers hospitalization, nursing home care, and a portion of home healthcare.

The adjustments to Medicare Part B for 2021 are as follows

Part B of Medicare covers physician costs, outpatient treatments, some home health care services, medical equipment, and medications.

Medicare Part D will have the following changes in 2021

Medicare prescription medication coverage is another name for Medicare Part D.

What changes are coming to Medigap in 2021?

Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

To fight the coronavirus (COVID-19)

On March 20, 2020, Medicare was modified to fulfil the needs of enrollees.

Conclusion

Apart from increased Medicare premiums and deductibles, there are more ways to save money on healthcare.

How much is the Part B deductible for 2021?

The Part B deductible and coinsurance for 2021 is $203 plus 20 percent of the Medicare-approved amount for most doctor services after the deductible is met.

What is Medicare Advantage?

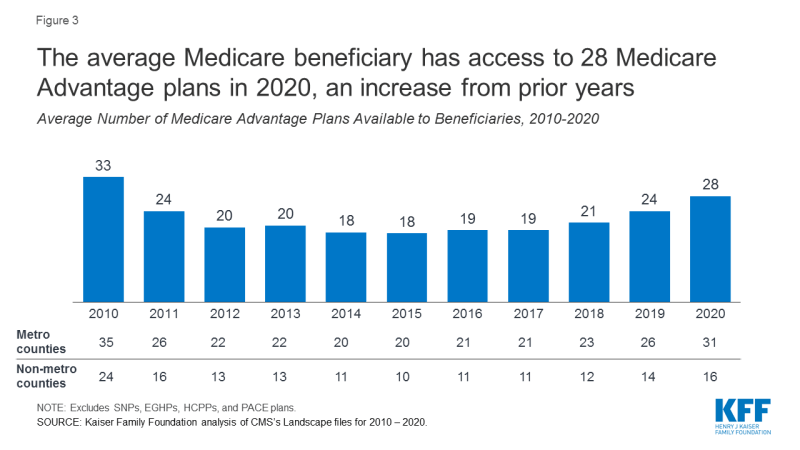

Medicare Advantage. If you want an alternative to Original Medicare, you may purchase a Medicare Advantage insurance policy. These insurance policies are sold by private companies that are approved by Medicare. They include coverage for Medicare Part A, Medicare Part B, and usually Medicare Part D.

Does Medicare Supplement pay for coinsurance?

If you have Original Medicare, Medicare Supplement insurance policies can help pay for some of the remaining health care costs. If you buy a Medicare Supplement insurance policy, it can help pay Medicare copayments, coinsurance, and deductibles.

Is United American a Medicare Supplement?

United American has been a prominent Medicare Supplement insurance provider since Medicare began in 1966. Additionally, we’ve been a long-standing participant in the task forces working on Medicare Supplement insurance policy recommendations for the National Association of Insurance Commissioners.

What is Medicare Part C?

Medicare Part C, also known as Medicare Advantage, includes the benefits of both Parts A and B of Original Medicare while adding some additional benefits, like prescription drug coverage on select plans. Part C is provided through private companies, so the rates for individual plans vary. Call us for help comparing Medicare Advantage premium rates at 888-446-9157.

Will Medicare increase in 2021?

Medicare’s Annual Enrollment Period is officially underway, and beneficiaries can expect a few changes for the coming year including Medicare rate increases. Beneficiaries can expect to see increases in 2021 Medicare premiums and deductibles.

What is the Medicare deductible for 2021?

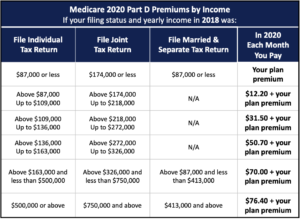

The table below shows what higher income earners will pay for Part B in the new year. The annual 2021 Medicare Part B deductible will increase to $203 for the year, up from its current level of $198.

How much will Medicare Part B cost in 2021?

The standard Medicare Part B premium, which nearly all beneficiaries pay, will increase to $148.50 per month in 2021 from its current rate of $144.60 in 2020. The $3.90 increase was much smaller than what had been originally forecasted during a year of larger-than-normal Medicare spending due to the COVID-19 pandemic.

How much will Medicare premiums increase in 2021?

Medicare Part A premiums increase in 2021 1 If a beneficiary or their spouse paid between 30 and 39 quarters of Medicare taxes, they will pay $259 per month for Part A premiums in 2021, up from $252 pre month in 2020. 2 If a beneficiary or their spouse paid fewer than 30 quarters of Medicare taxes, they will pay $471 per month in 2021, up from $458 per month in 2020.

What is the number to call for Medicare Part A?

1-800-557-6059 | TTY 711, 24/7. Premiums, deductibles and coinsurance for both Medicare Part A and Part B will be on the rise in the new year, as announced by the Centers for Medicare and Medicaid Services (CMS) on Nov. 6. Below is an overview of much you’ll pay.

How much is Part A coinsurance?

Part A coinsurance is also on the rise, with beneficiaries owing $371 per day of an inpatient hospital stay, beginning on the 61st day of a benefit period (up from $352 per day in 2020).

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

How much is Medicare Part B 2021?

2021 Medicare Part B Costs. The standard Part B premium in 2021 is $148.50 per month. That's an increase of $3.90 from the 2020 Part B premium. While most people pay the standard Part B premium, other beneficiaries may pay more if they had a higher reported income two years prior (2019).

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, provides coverage for certain Medicare Part A and Part B out-of-pocket expenses like deductibles, coinsurance and copayments . This cost figure is weighted, which means that some Medigap plans in some areas may offer lower premiums than what is listed above.

What is deductible medical expenses?

Any costs associated with the treatment or diagnosis of a medical condition or an injury can be deducted. This includes preventive care and the cost of any medical equipment or supplies. The IRS provides a list of deductible medical expenses. The list includes some items you might not expect.

What are the different types of deductions?

What Are the Four Major Categories of Tax Deductions? 1 Business Deductions 2 Standard Deductions 3 Above the Line Deductions 4 Below the Line Deductions

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Is Medicare free?

Medicare isn't free and we understand your desire to save money wherever you can. If you've been considering a Medigap plan but have been hesitant because of the price, we can help you compare plans and rates. Please call us at the number above or fill out our online rate form to get started.

What is the AGI for taxes?

The AGI is your gross income minus adjustments, such as student loan interest, retirement account contributions, and alimony payments. Another example is work-related moving expenses.

Is Medicare premium tax deductible?

The answer is yes; some Medicare premiums are tax-deductible. Most insurance premiums qualify for Form 1040’s Schedule A deductions but only over a certain threshold, including some Medicare premiums. This amount will be subtracted from your gross income. Your taxable income (after the deductions are made) will ultimately be used to determine ...

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $148.50 per month. The maximum cost of Medicare Part B coverage is $504.90 per month in 2021, and that's for individuals reporting half a million dollars or more in income in 2019.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,370 in 2021.