How much does Medigap insurance cost on average?

With this Medigap plan option, you typically pay a lower premium in exchange for a higher deductible. The average premium for high deductible Plan F in 2018 was $57.16 per month, or roughly one-third of the average monthly cost of the traditional Plan F. 2

What is ACA coverage gap?

The Democratic authors of the ACA did not envision any coverage gap when they created the health-care law that was enacted in 2010. Originally, the law sought to widen access to insurance in two ways. It would expand Medicaid nationwide and allow people to join even if their incomes were a little above the poverty line.

What is coverage gap discount?

- Your prescription drug plan’s yearly deductible

- The amount you pay for your prescription medications

- The 70% manufacturer discount for brand-name drugs while you’re in the coverage gap

What is the Medicaid coverage gap?

in the context of american public healthcare policy, medicaid coverage gap refers to the group of uninsured people in the states that have opted out of medicaid expansion under the affordable care act (aca), who are both ineligible for medicaid under its previous rules that still apply in these states and too poor to qualify for the aca's …

How much is the donut hole for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

How much is the donut hole for 2022?

In 2022, the coverage gap ends once you have spent $7,050 in total out-of-pocket drug costs. Once you've reached that amount, you'll pay the greater of $3.95 or 5% coinsurance for generic drugs, and the greater of $9.85 or 5% coinsurance for all other drugs. There is no upper limit in this stage.

What is the prescription donut hole for 2022?

$4,430You enter the donut hole when your total drug costs—including what you and your plan have paid for your drugs—reaches a certain limit. In 2022, that limit is $4,430. While in the coverage gap, you are responsible for a percentage of the cost of your drugs.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

Is the donut hole going away in 2021?

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold. See what your clients, the drug plans, and government will pay in each spending phase of Part D.

Is there a way to avoid the Medicare donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

How do I get out of the donut hole?

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement. However, there are ways to receive assistance for funding prescription drugs, especially if a person meets certain low income requirements.

How long does the donut hole last in Medicare?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

Do all Medicare Part D plans have a donut hole?

All Medicare Part D plans follow the same drug phases. Every prescription coverage plan involves the gap known as the donut hole. Will I enter the donut hole if I receive Extra Help? Those who get Extra Help pay reduced amounts for their prescriptions throughout the year, so they are unlikely to reach the donut hole.

Will the donut hole ever end?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

Is the coverage gap going away?

In 2022, until your total out-of-pocket spending reaches $7.050, you'll pay 25 percent for brand-name and generic drugs. Once total spending for your covered drugs exceeds $7,050 (the "catastrophic coverage" threshold for 2022), you are out of the coverage gap and you will pay only a small co-insurance amount.

What is the coverage gap amount for 2022?

$4,430The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,430 on covered drugs in 2022, you're in the coverage gap.

What are My Costs in the Coverage Gap?

Once you reach $4,430 in total spending on your covered drugs, you’re responsible for a certain percentage of the costs. When you enter the coverage gap, you’ll pay no more than 25% of the actual drug cost.

What Plans Provide Gap Coverage?

A Part D drug plan or Part C Medicare Advantage plan may include gap coverage, though these plans aren’t available everywhere and may have a higher premium. Plans are available by location, if you don’t live in the service area, you’re not eligible for that policy.

Is the Medicare Coverage Gap Going Away?

While the coverage gap has closed, it doesn’t mean that it goes away. After the Initial Coverage Period, people with Medicare will pay a higher portion of their drug costs.

Which Plan Covers My Medications at the Lowest Cost?

There is not one specific plan that suits everyone’s needs. Most of the time spouses will find they have different plan needs. Perhaps you have a brand-name medication that fewer plans cover, or maybe there is a plan option that allows you to avoid the donut hole.

What is a donut hole in Medicare?

What Is the Medicare Part D “Donut Hole”? Most Medicare Part D prescription drug plans have a coverage gap. More commonly, this has been known as the “donut hole.”. The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs. Once you and your Medicare Part D plan have spent a certain amount on ...

How much does Medicare pay for generic drugs?

For generic drugs: You’ll pay 25% of the price. Medicare pays 75% of the price. Only the amount you pay will count towards getting you out of the “donut hole.”. NOTE: Some plans may have coverage in the gap, so if this is true for you, you will get a discount after the plan’s coverage has been applied to the drug’s price. ...

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

Is the Donut hole going away?

The “donut hole” isn’t really going away, because Medicare Part D still has four payment stages. The “donut hole” is the third stage, and you move through the Part D payment stages based on how much you, your plan, and others on your behalf have paid for your drugs during the year.

Does a catastrophic plan pay for out of pocket drugs?

You may pay a small copay or coinsurance, and you will remain in this stage for the rest of the year. Your out-of-pocket drug costs, including copays, coinsurance amounts and your deductible, if any, count toward the dollar limits.

What happens if you spend $6,550 in 2021?

Once you've spent $6,550 out-of-pocket in 2021, you're out of the coverage gap. Once you get out of the coverage gap (Medicare prescription drug coverage), you automatically get "catastrophic coverage." It assures you only pay a small Coinsurance percentage or Copayment for covered drugs for the rest of the year.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

What is catastrophic coverage in 2021?

Catastrophic coverage. Once you've spent $6,550 out-of-pocket in 2021, you're out of the coverage gap. Once you get out of the coverage gap (Medicare prescription drug coverage), you automatically get "catastrophic coverage.". It assures you only pay a small. An amount you may be required to pay as your share of the cost for services ...

Take our quiz

Navigating Medicare can be challenging, especially since different types of coverage won’t necessarily cover all of your expenses. Choosing to purchase additional coverage may help. Find out which supplemental coverage option is best for you, Medicare Advantage or Original Medicare with Medigap.

What are the phases of a Part D plan?

Your drug coverage will change throughout the year, depending on how much you spend. If you don’t spend very much on drugs, or you have drug coverage from another source, you may never reach the donut hole phase.

How has the donut hole coverage gap changed?

The ACA began closing the donut hole in 2011, shrinking it little by little each year. The process began with a 50% reduction in brand-name drug prices and a 7% government subsidy on generic drugs within the coverage gap. The subsidies for generic drugs increased each year until 2020.

The bottom line

Even though policymakers say the Medicare Part D donut hole is now fully closed, prescription drug copayments still often increase after the initial coverage phase. To keep your costs down, look for a Part D plan with a formulary that charges less for your medications.

When did the Medicare donut hole go away?

Did the Medicare Donut Hole Go Away in 2020? The Medicare Donut Hole closed in 2019 for brand name drugs and disappeared in 2020 for generic drugs. Learn how this may affect your Part D costs.

How can Medicare help avoid the donut hole?

Medicare beneficiaries may be able to help themselves avoid the donut hole by choosing less expensive generic drugs over brand-name drugs when possible, shopping for prescription drug discounts, buying drugs in bulk through mail-order services and utilizing Medicare Extra Help (see below).

What happens when the donut hole goes away in 2020?

What happened when the donut hole went away in 2020? Once you reach the $6,550 threshold in 2021, you enter the final phase of Part D coverage. This is called catastrophic coverage. During the catastrophic coverage phase, you only pay a small coinsurance or copayment for your covered prescription drugs for the remainder of the year.

What happened to the Medicare donut hole in 2020?

What happened in the donut hole coverage gap in 2020? The Medicare donut hole coverage gap shrunk to its final cost level in 2020. We'll explain more below about what this means for your coverage. The Medicare donut hole is one of four coverage levels (coverage periods) that are in a Part D prescription drug plan.

What is the maximum deductible for Medicare 2021?

In 2021, the maximum deductible allowed by law is $445 for the year. Some Medicare prescription drug plans have a $0 deductible. After you meet your plan deductible, you enter the initial coverage period.

What happens after you meet your Part D deductible?

After you meet your Part D deductible, you enter the initial coverage period. During this phase, you pay a copayment (flat fee) or coinsurance (percentage) for your covered medications. Copayment and coinsurance amounts will vary by plan. Many plans will feature different amounts for generic and brand name drugs.

How much will generic drugs cost in 2021?

Once you and your plan combine to spend $4,130 for drugs during the calendar year in 2021, ...

What is the Medicare Advantage spending limit?

Medicare Advantage (Medicare Part C) plans, however, do feature an annual out-of-pocket spending limit for covered Medicare expenses. While each Medicare Advantage plan carrier is free to set their own out-of-pocket spending limit, by law it must be no greater than $7,550 in 2021. Some plans may set lower maximum out-of-pocket (MOOP) limits.

How much is Medicare Part A deductible in 2021?

You are responsible for paying your Part A deductible, however. In 2021, the Medicare Part A deductible is $1,484 per benefit period. During days 61-90, you must pay a $371 per day coinsurance cost (in 2021) after you meet your Part A deductible.

What is the Medicare donut hole?

Medicare Part D prescription drug plans feature a temporary coverage gap, or “ donut hole .”. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs. Once you and your plan combine to spend $4,130 on covered drugs in 2021, you will enter the donut hole. Once you enter the donut hole in 2021, you ...

What happens if you spend $6,550 out of pocket in 2021?

After you spend $6,550 out-of-pocket on covered drugs in 2021, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

What is Medicare Part B and Part D?

Medicare Part B (medical insurance) and Part D have income limits that can affect how much you pay for your monthly Part B and/or Part D premium. Higher income earners pay an additional amount, called an IRMAA, or the Income-Related Monthly Adjusted Amount.

What is Medicare Advantage Plan?

When you enroll in a Medicare Advantage plan, it replaces your Original Medicare coverage and offers the same benefits that you get from Medicare Part A and Part B.

How long does Medicare cover hospital care?

Depending on how long your inpatient stay lasts, there is a limit to how long Medicare Part A will cover your hospital costs. For the first 60 days of ...

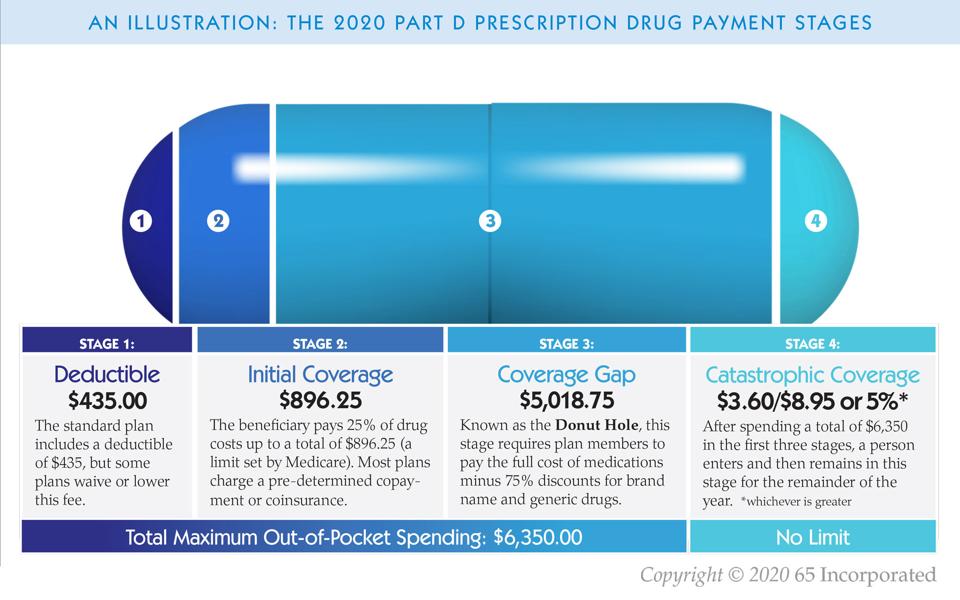

Part 1 of your drug coverage

The Initial Deductible Phase The standard Initial Deductible can change each year. In 2022 , the Initial Deductible is $480 ($445 in 2021). If your Medicare Part D plan has an Initial Deductible , you will usually pay 100% for your medications and the amount you pay will count toward the Donut Hole.

Part 2 of your drug coverage

The Initial Coverage Phase After the Initial Deductible (if any), you will continue into your Initial Coverage phase where your Medicare Part D plan covers a portion of your prescription costs and you pay some cost-sharing (co-payment or co-insurance).

Part 3 of your drug coverage

The Coverage Gap or Donut Hole You will leave the Initial Coverage phase and enter the Donut Hole when your total retail drug cost (what you spent plus what your Medicare drug plan spent) exceeds the Initial Coverage Limit ($4,430). As mentioned, the Coverage Gap this is the portion of your Medicare Part D coverage where you traditionally paid a larger percentage of the retail drug cost.

Part 4 of your drug coverage

The Catastrophic Coverage Phase You will stay in the Coverage Gap or Donut Hole phase until your out-of-pocket costs (called TrOOP or total drug spend) reaches a certain level. The TrOOP level in 2022 is $7,050 .