| Humana Medicare Prescription Drug Plans | Average Monthly Premium | Recommended for those who |

| Humana Walmart Value Rx Plan | $22.70 | Take few generic medications |

| Humana Basic Rx Plan | $50.60 | Take several generic medications or few ... |

| Humana Premier Rx Plan | $78.60 | Take multiple brand name or high-tier dr ... |

Full Answer

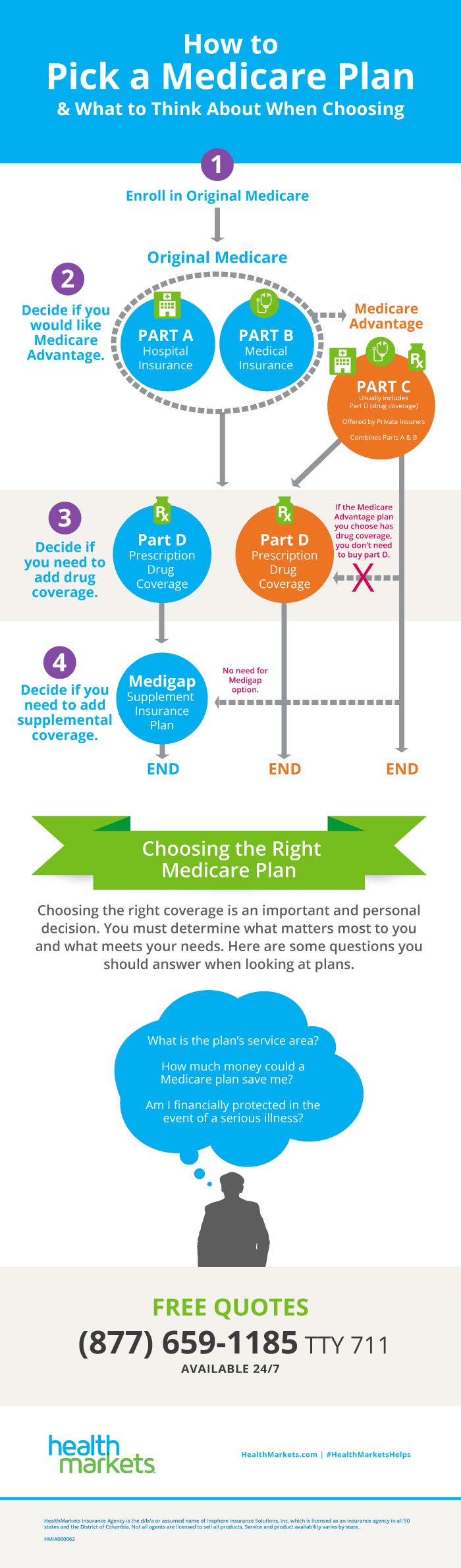

What is the cheapest Medicare plan?

The same insurance company may offer Medigap policies and Medicare drug plans. If you join a Medigap policy and a Medicare drug plan offered by the same company, you may need to make 2 separate premium payments for your coverage. ... The chart below shows your estimated prescription drug plan monthly premium based on your income as reported on ...

Can I have more than one Medicare Prescription Drug Plan?

If you belong to a Medicare Advantage Plan (like an HMO or PPO) or a Medicare Cost Plan that offers Medicare prescription drug coverage, the monthly premium you pay to the plan includes an amount for prescription drug coverage. Some plans charge no premium. You may be able to pick a plan with or without a monthly premium, deductible or supplemental gap coverage. To find …

When should you keep the same Medicare Prescription Drug Plan?

4 rows · Aug 11, 2021 · Humana Medicare Prescription Drug Plans: Average Monthly Premium: Recommended for those who: ...

Which Medicare Prescription Plan is best?

How to get prescription drug coverage. Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you. What Medicare Part D drug plans cover. Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and ...

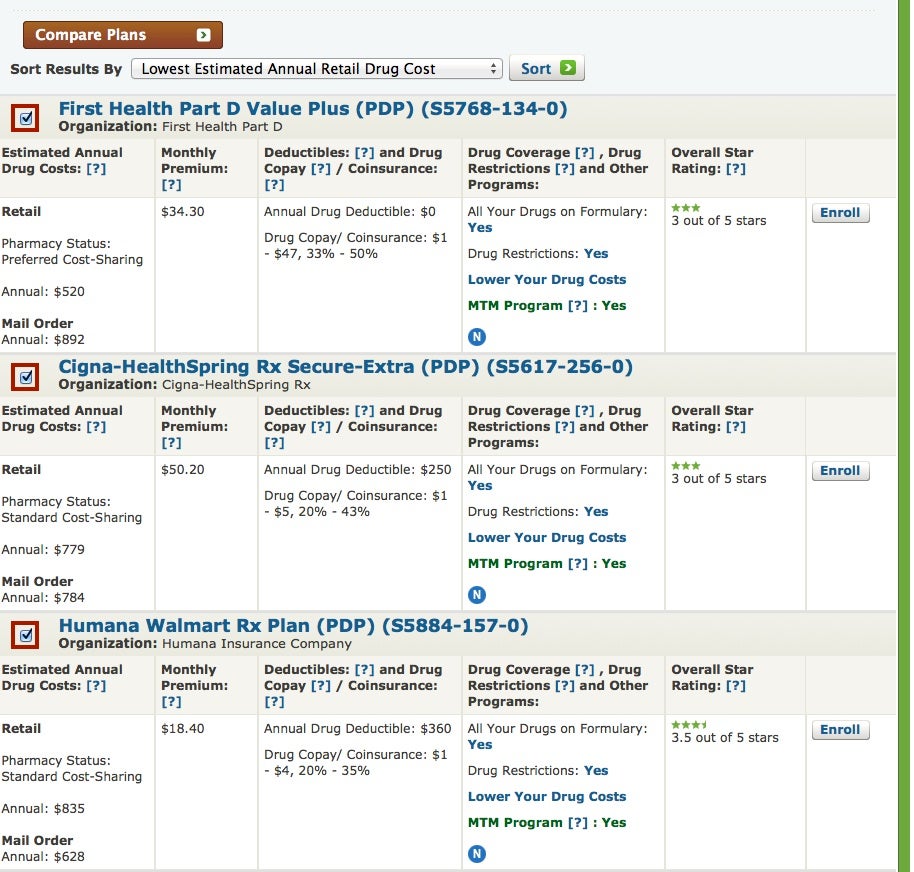

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

How much is Medicare Part D every month?

The national base beneficiary premium for Part D plans is $33.37 per month for 2022, according to the Centers for Medicare & Medicaid Services, which calculates this number in part by using the national average monthly bid amount submitted by private insurers.

What is the maximum out of pocket for Medicare Part D?

A Medicare Part D deductible is the amount you must pay every year before your plan begins to pay. Medicare requires that Medicare Part D deductibles cannot exceed $445 in 2021, but Medicare Part D plans may have deductibles lower than this. Some Medicare Part D plans don't have deductibles.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

Do I need a Medicare Part D plan?

En español | Part D drug coverage is a voluntary benefit; you are not obliged to sign up. You may not need it anyway if you have drug coverage from elsewhere that is “creditable” — meaning Medicare considers it to be the same or better value than Part D.

Is Part D deducted from Social Security?

You can have your Part C or Part D plan premiums deducted from Social Security. You'll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.Dec 1, 2021

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Will Social Security get a $200 raise?

0:0011:57$200 Raise for Social Security, SSDI, SSI, VA - Now is the Time! - YouTubeYouTubeStart of suggested clipEnd of suggested clip200 per month raise for social. Security including retirement disability ssdi survivors ssi and vaMore200 per month raise for social. Security including retirement disability ssdi survivors ssi and va beneficiaries.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

What is the difference between generic and brand name drugs?

Generic drugs are typically on lower tiers and cost less, while brand name drugs and specialty drugs are typically on higher tiers and cost more. Medicare Part D plans are sold by private insurance companies. These insurance companies are generally free to set their own premiums for the plans they sell.

Does Medicare Part D have coinsurance?

Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing. Some Medicare Part D plans have deductibles and copayments or coinsurance. The cost of your Part D premium may depend on the amounts of coinsurance or copayments you pay with your plan, ...

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

What is coinsurance and copayment?

Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin. A copayment is usually a fixed dollar amount (such as $5) while coinsurance is most often a percentage of the cost (such as 20 percent). Plans might have different copayment or coinsurance amounts for each tier of drugs.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Does Medicare cover emergency services?

In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for under Original Medicare (your Cost Plan pays for emergency services or urgently needed services ). with drug coverage, the monthly premium may include an amount for drug coverage.

What is the best Medicare plan for 2021?

SilverScript. Humana. Cigna. Mutual of Omaha. UnitedHealthcare. The highest rating a plan can have is 5-star. Just because a policy is 5-star in your area doesn’t mean it’s the top-rated plan in the country. There is no nationwide plan that has a 5-star rating.

When will Medicare Part D be updated?

Home / FAQs / Medicare Part D / Top 5 Part D Plans. Updated on June 3, 2021. Medicare prescription drug plan changes in 2021 are noteworthy. Also, by knowing what to expect, you can stay ahead of the game. Drugs can be costly, and new brand-name drugs can be the most expensive. With age, you’re more likely to require medications.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare. You can also find her over on our Medicare Channel on YouTube as well as contributing to our Medicare Community on Facebook.

What is the SilverScript plan?

SilverScript Medicare Prescription Drug Plans. There are three different plans available with SilverScript. The Choice, the Plus plan, and the SmartRx plan. All policies are a great option, depending on the medications you take, one could be more beneficial to you than the other.

Does Cigna have a pharmacy network?

As far as in-network, Cigna has contracts with over 63,000 pharmacies nationwide. Preferred pharmacies include Kroger, Rite Aid, Walmart, Sam’s Club, Walgreens, and MANY more. For the most savings, consider enrolling in their mail-order pharmacy program.

Does Medicare cover Part D?

Medicare’s standalone Part D plan can cover you. Part D plans have a monthly premium that insurance companies determine. There may be several plans as well as companies to choose from in your state. Policies vary by county, so moving may warrant a plan change.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What to do if you disagree with Medicare decision?

If you disagree with the decision we made about your eligibility for Extra Help, complete an Appeal of Determination for Extra Help with Medicare Prescription Drug Plan Costs. We also provide Instructions for Completing the Appeal.

Can you get help with Medicare?

With the Medicare Savings Programs (MSP), you can get help, from your state, paying your Medicare premiums. In some cases, MSPs may also pay Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) deductibles, coinsurance, and copayments if you meet certain conditions. If you qualify for certain MSPs, you automatically qualify ...

Can Medicare beneficiaries get extra help?

Table of Contents. Medicare beneficiaries can qualify for Extra Help paying for their monthly premiums, annual deductibles, and co-payments related to Medicare Part D (prescription drug coverage).

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

How to enroll in Medicare?

Enroll on the Medicare Plan Finder or on the plan's website. Complete a paper enrollment form. Call the plan. Call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started.

What is a PACE plan?

Programs of All-inclusive Care for the Elderly (PACE) organizations are special types of Medicare health plans. PACE plans can be offered by public or private companies and provide Part D and other benefits in addition to Part A and Part B benefits. with drug coverage.

What is creditable prescription drug coverage?

creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage. People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, ...

What is the late enrollment penalty for Medicare?

Part D late enrollment penalty. The late enrollment penalty is an amount that's permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other.

How long does it take for Medicare to reconsider?

In general, Medicare’s contractor makes reconsideration decisions within 90 days. The contractor will try to make a decision as quickly as possible. However, you may request an extension. Or, for good cause, Medicare’s contractor may take an additional 14 days to resolve your case.

What is extra help?

Extra Help. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. , you don't pay the late enrollment penalty.