How much does Medicare pay for inpatient hospital care?

Apr 27, 2021 · On average, medicare sales agent jobs pay around $65,000 annually, but top agents can earn six-figure incomes in just three years, suggests Redbird Network. Salary and Qualifications Medicare sales agent salary in the U.S. averaged $65,136 plus commission, as of 2021, according to the jobs website Indeed .

What are the total costs of Medicare?

Mar 24, 2022 · The amount of coinsurance you will pay under Medicare Part A depends on the benefit period. For the first 60 days you are in the hospital, you will pay no coinsurance. Beginning on day 61, you will pay $389 in 2022 for each day of the benefit period. 1.

How much does a skilled nursing facility cost under Medicare?

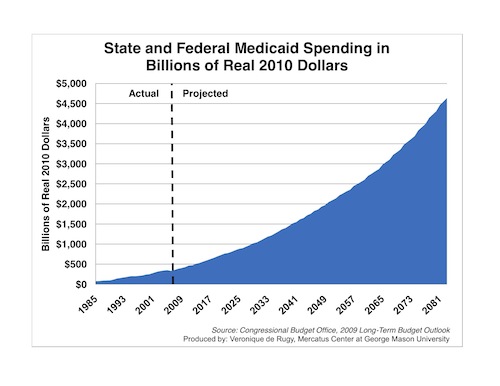

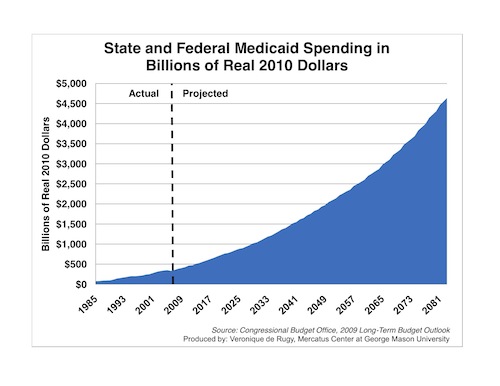

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

How much does Medicare pay for life insurance each day?

Once you stop working, Medicare will pay first and any retiree coverage or supplemental coverage that works with Medicare will pay second. Temporary coverage available in certain situations if you lose job-based coverage. coverage to continue your health insurance through the employer’s plan (usually up to 18 months).

Do employers pay for Medicare?

Employers can't pay employees' Medicare premiums directly. However, they can designate funds for workers to apply for health insurance coverage and premium payments with a Section 105 plan.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

What percentage of your income pays for Medicare?

For most beneficiaries, the government pays a substantial portion — about 75% — of the Part B premium, and the beneficiary pays the remaining 25%.

What is Medicare paid amount?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

How does working affect Medicare?

Generally, if you have job-based health insurance through your (or your spouse's) current job, you don't have to sign up for Medicare while you (or your spouse) are still working. You can wait to sign up until you (or your spouse) stop working or you lose your health insurance (whichever comes first).

Is Medicare Part B based on income?

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

How much money can you make before it affects your Medicare?

A Qualifying Individual (QI) policy helps pay your Medicare Part B premium. To qualify, your monthly income cannot be higher than $1,357 for an individual or $1,823 for a married couple. Your resource limits are $7,280 for one person and $10,930 for a married couple.

Does Medicare ever pay more than 80%?

A. In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

What does Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

What is the difference between Medicare-approved amount and amount Medicare paid?

Amount Medicare Paid: This is the amount Medicare paid the provider. This is usually 80% of the Medicare-approved amount. Maximum You May Be Billed: This is the total amount the provider is allowed to bill you.

What is the average commission for Medicare Supplement?

The average commission for medicare supplemental insurance is between 5 and 20 percent, according to Best Medicare Supplement. The Centers for Medicare & Medicaid Services caps the compensation paid by insurance companies to medicare sales reps. For example, the maximum commission allowed in 2021 for selling a medicare advantage plan ...

How much do Medicare sales agents make in 2021?

Average sales for medicare sales representatives varied considerably across the U.S. in 2021. In the Midwest, for example, medicare sales agent jobs paid $67,659 in Illinois and $70,990 in Minnesota, according to Indeed. Those in the South made around $61,513 and $48,587 per year, respectively, in Louisiana and Arkansas. These sales professionals earned $74,877 and $69,318 , respectively, in Hawaii and California in the West. In the Northeast, they earned $63,039 in New York and $72,355 in Maine, for instance.

Why do Medicare sales reps make more money?

One reason is that experienced reps usually have larger client bases – and they earn higher commissions when customers renew their medicare insurance through them.

What does a Medicare sales rep do?

What Does a Medicare Sales Rep Make? The best medicare sales reps have compassion for their clients, helping them find the best insurance for their long-term medical and pharmaceutical needs. Most medicare sales reps contact seniors by phone to set appoints and then present various medicare plans to them in person.

Why is the salary of a Medicare agent higher in New York?

Medicare insurance agent salary is higher in states like New York and California because of higher living and housing costs. For example, a medicare sales rep who earns $65,000 in Des Moines, Iowa, would need to make $180,458 in Manhattan to enjoy the same living standard, according to CNN Money's "Cost of Living" calculator.

What education do you need to be a Medicare sales rep?

The education requirements for a medicare sales rep are a high school diploma and two or more years of health care or insurance sales experience. Some employers may prefer a bachelor's degree. Medicare sales reps, as insurance reps, must also pass state insurance exams to become licensed in their states.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

How does Medicare work with my job-based health insurance when I stop working?

Once you stop working, Medicare will pay first and any retiree coverage or supplemental coverage that works with Medicare will pay second.

When & how do I sign up for Medicare?

You can sign up anytime while you (or your spouse) are still working and you have health insurance through that employer. You also have 8 months after you (or your spouse) stop working to sign up.

Do I need to get Medicare drug coverage (Part D)?

Prescription drug coverage that provides the same value to Medicare Part D. It could include drug coverage from a current or former employer or union, TRICARE, Indian Health Service, VA, or individual health insurance coverage.

How much does Medicare pay for a month?

If you paid between 30 and 39 quarters (9.75 years) of Medicare taxes, you’ll pay $259 per month. You’ll have a $1,484 deductible ...

How many people are covered by Medicare?

The program is administered by the Centers for Medicare & Medicaid Services and covers some 64 million people. Understanding how Medicare works is essential. Medicare is not to be confused with Medicaid, the medical coverage program for low-income Americans that’s run by ...

What is Medicare Supplement Insurance?

If you decide to enroll in Original Medicare, consider buying a Medigap plan also known as Medicare Supplement Insurance. Private insurers offer these insurance plans and they are designed to cover costs that Medicare does not, such as copayments and deductibles.

What is Medicare Part D?

Medicare Part D helps cover the costs of prescription drugs. If you’re enrolled in Medicare Part A or Part B, you may enroll in Part D to supplement your coverage. These plans will help you pay for prescription medications not covered by Medicare Part A or Part B.

How much is Medicare Part B deductible in 2021?

The annual deductible for Medicare Part B is $203 in 2021. After reaching your deductible, you’ll pay 20% of the amount approved by Medicare for doctor services, outpatient therapy and durable medical equipment. Source: Medicare.gov.

What happens if you are over 65 and have health insurance?

If you are over 65 and have qualifying health insurance through your job, you might have a bigger enrollment window. Talk to your employer’s benefits administrator to make sure you understand how your job coverage interacts with Medicare.

When is Medicare open enrollment?

Medicare’s open enrollment period runs every year between Oct. 15th and Dec. 7th. During this time, beneficiaries can pick a new Medicare Part D drug plan, a new Medicare Advantage plan, or switch from Original Medicare into a Medicare Advantage plan or vice versa.

How does Medicare Advantage work?

Agents selling Medicare Advantage and Part D plans get a flat dollar amount of money per application. This comes to them in the form of initial commissions and renewal commissions. Carriers pay out initial commissions when an agent makes a new sale or when the beneficiary enrolls in a new, “unlike” plan (different type). Each year and beyond, carriers pay out renewal commissions to the agent if the beneficiary remains enrolled in the plan or enrolls in a new, “like” plan (same type).

What does it mean when you assign commissions to the FMO?

When you assign your commissions to the FMO, this means the carrier will pay the FMO, who will then pay you . Agents signing an Assignment of Commissions contract must be careful, because depending on their contract, their upline could keep their renewals should they choose to leave.

Do carriers pay agents?

It’s important for agents to know that carriers pay agents and FMOs separately. Your relationship with an FMO is comparable to your clients’ relationship with you.

Do insurance carriers have to pay Medicare Advantage commissions?

The Centers for Medicare & Medicaid Services (CMS) set the maximum broker commissions for Medicare Advantage and Medicare Part D annually; however, insurance carriers aren’t required to pay these amounts. What you earn for Medicare Advantage and PDP sales could be less, depending on the carrier and your contract with them.

How much does Medicare Supplement pay for hospital visits?

(Under Medicare Supplement Plan N, you might have to pay a copayment up to $20 for some office visits, and up to $50 for emergency room visits if they don’t result in hospital admission.)

What does Medicare cover?

Medicare coverage: what costs does Original Medicare cover? Here’s a look at the health-care costs that Original Medicare (Part A and Part B) may cover. If you’re an inpatient in the hospital: Part A (hospital insurance) typically covers health-care costs such as your care and medical services. You’ll usually need to pay a deductible ($1,484 per ...

What type of insurance is used for Medicare Part A and B?

This type of insurance works alongside your Original Medicare coverage. Medicare Supplement insurance plans typically help pay for your Medicare Part A and Part B out-of-pocket costs, such as deductibles, coinsurance, and copayments.

How much is a deductible for 2021?

You’ll usually need to pay a deductible ($1,484 per benefit period* in 2021). You pay coinsurance or copayment amounts in some cases, especially if you’re an inpatient for more than 60 days in one benefit period. Your copayment for days 61-90 is $371 for each benefit period in 2021.

How much is coinsurance for 61-90?

Your copayment for days 61-90 is $371 for each benefit period in 2021. After you’ve spent more than 90 days in the hospital during a single benefit period, you’ll generally have to pay a coinsurance amount of $742 per day in 2021.

What does Part B cover?

Part B typically covers certain disease and cancer screenings for diseases. Part B may also help pay for certain medical equipment and supplies.

Does Medicare have a maximum spending limit?

Be aware that Original Medicare has no annual out-of-pocket maximum spending limit. If you meet your Medicare Part A and/or Part B deductibles, you still generally pay a coinsurance or copayment amount – and there’s no limit to what you might pay in a year.