What percentage of the budget is Medicare?

Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the...

What is Medicare annual budget?

Medicare consists of four "parts":

- Part A pays for hospital care;

- Part B provides medical insurance for doctor’s fees and other medical services;

- Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits;

- Part D covers prescription drugs.

What is Medicare SSA benefits?

The takeaway

- Medicare coverage is available for people with a disability who receive SSDI.

- You’ll automatically be enrolled in parts A and B after your 24th month of SSDI benefits.

- You can choose to decline Medicare Part B coverage if you have other options that work better for your budget.

What are the benefits of SSA?

Social Security's Disability Insurance Benefits are federally funded and administered by the U.S. Social Security Administration (SSA). Social Security pays disability benefits to you and certain members of your family if you have worked long enough... Social Security and Retirement.

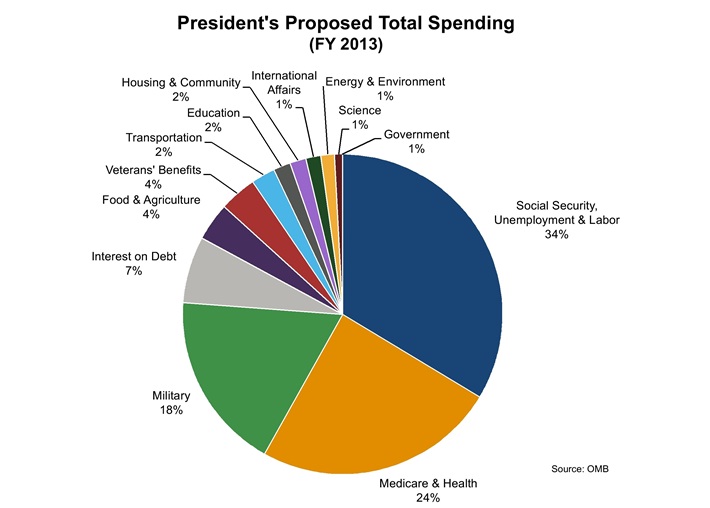

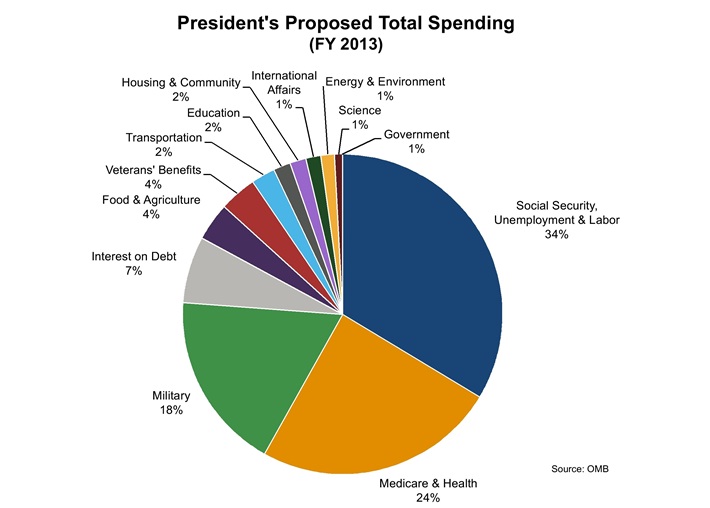

What percent of US budget is Social Security and Medicare?

Major categories of FY 2017 spending included: Healthcare such as Medicare and Medicaid ($1,077B or 27% of spending), Social Security ($939B or 24%), non-defense discretionary spending used to run federal Departments and Agencies ($610B or 15%), Defense Department ($590B or 15%), and interest ($263B or 7%).

What percentage of the budget is Medicare?

Key Facts. Medicare is the second largest program in the federal budget: 2022 Medicare expenditures, net of offsetting receipts, totaled $767 billion — representing 13 percent of total federal spending.

What percentage of federal spending is Social Security?

Social Security: In 2019, 23 percent of the budget, or $1 trillion, paid for Social Security, which provided monthly retirement benefits averaging $1,503 to 45 million retired workers in December 2019.

What is the biggest part of the US budget?

Social Security takes up the largest portion of the mandatory spending dollars. In fact, Social Security demands $1.046 trillion of the total $2.739-trillion mandatory spending budget. It also includes programs like unemployment benefits and welfare.

What percentage of US budget goes to social programs?

In 2019, major entitlement programs—Social Security, Medicare, Medicaid, Obamacare, and other health care programs—consumed 51 percent of all federal spending, larger than the portion of spending for other national priorities (such as national defense) combined.

What percentage of US GDP is spent on social programs?

Expenditure for Social PurposesCountryPublic social spending, % of GDP, 2019Total net social spending, % of GDP, 2017USA18.729.6HUN18.117.4CAN18*23.1EST17.714.535 more rows

What are the 3 largest categories of federal government spending?

The U.S. Treasury divides all federal spending into three groups: mandatory spending, discretionary spending and interest on debt. Together, mandatory and discretionary spending account for more than ninety percent of all federal spending, and pay for all of the government services and programs on which we rely.

How much money has the government borrowed from the Social Security fund?

The total amount borrowed was $17.5 billion.

Where does most of the US budget go?

More than half of FY 2019 discretionary spending went for national defense, and most of the rest went for domestic programs, including transportation, education and training, veterans' benefits, income security, and health care (figure 4).

What is the largest source of income for the federal government?

individual income taxesThis is especially important as the economic recovery from the pandemic continues. In the United States, individual income taxes (federal, state, and local) were the primary source of tax revenue in 2020, at 41.1 percent of total tax revenue.

What percentage of U.S. budget is military?

10 percentWhat percent of the US budget is spent on military? Military spending on defense accounts for more than 10 percent of the federal budget and nearly half of the discretionary spending. The annual federal funding accounts for around one-third of overall discretionary spending, including defense and non-defense spending.

How much does the US spend on welfare 2021?

Federal Spending in Fiscal Years 2019, 2020, and 2021 in Billions: The federal budget increased from $4.4 trillion in 2019 to $6.8 trillion in 2021. Welfare spending increased from $773 billion to $1,056 trillion.

Why are Social Security benefits part of the federal government?

The benefits these programs pay are part of the Federal Government’s mandatory spending because authorizing legislation ( Social Security Act) requires us to pay them. While Congress does not set the amount of benefits we pay each year, they decide funding for our administrative budget.

What is the purpose of the Justification of Estimates for Appropriations Committees?

The Justification of Estimates for Appropriations Committees informs members of Congress about SSA’s funding request, including how it will support performance goals and initiatives to improve service. For specific sections, please see the following:

What is Medicare Part A?

Medicare has two sections: The Medicare Part A Hospital Insurance program, which collects enough payroll taxes to pay current benefits. Medicare Part B, the Supplementary Medical Insurance Program, and Part D, the new drug benefit. Payroll taxes and premiums cover only 57% of benefits.

What does it mean when the government has a high level of mandatory spending?

In the long run, the high level of mandatory spending means rigid and unresponsive fiscal policy. This is a long-term drag on economic growth.

How much of Medicare will be paid by 2034?

That means Medicare contributes to the budget deficit. Rising health care costs mean that general revenues would have to pay for 49% of Medicare costs by 2034. 13 As with Social Security, the tax base is insufficient to pay for this.

How is Social Security funded?

Social Security is funded through payroll taxes.

What is mandatory program?

Congress established mandatory programs under so-called authorization laws. 3 These laws also mandated that Congress appropriate whatever funds are needed to keep the programs running. The mandatory portion of the U.S. budget estimates how much it will cost to fulfill these authorization laws.

How much is mandatory spending in 2021?

Mandatory spending is estimated to be $2.966 trillion for FY 2021. 1 The two largest mandatory programs are Social Security and Medicare. That's 38.5% of all federal spending. It's more than two times more than the military budget. 2.

Why is mandatory spending growing?

That's one reason mandatory spending continues to grow. Another reason is the aging of America. As more people require Social Security and Medicare, costs for these two programs will almost double in the next 10 years. 18 At the same time, birth rates are falling. As a result, the elder dependency ratio is worsening.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

What is Medicare recurring?

Recurring Publications. Medicare is the second-largest federal program and provides subsidized medical insurance for the elderly and certain disabled people. CBO’s work on Medicare includes projections of federal spending under current law, cost estimates for legislative proposals, and analyses of specific aspects of the program ...

What percentage of prescriptions were brand name drugs in 2015?

In 2015, brand-name specialty drugs accounted for about 30 percent of net spending on prescription drugs under Medicare Part D and Medicaid, but they accounted for only about 1 percent of all prescriptions dispensed in each program.

How much is Social Security spending?

Social Security ($845B or 24% of spending), Healthcare such as Medicare and Medicaid ($831B or 24%), other mandatory programs such as food stamps and unemployment compensation ($420B or 12%) and interest ($229B or 6.5%). As a share of federal budget, mandatory spending has increased over time.

How much did Medicare and Medicaid grow in 2016?

Medicare, Medicaid, and Social Security grew from 4.3% of GDP in 1971 to 10.7% of GDP in 2016. In the long-run, expenditures related to Social Security, Medicare, and Medicaid are growing considerably faster than the economy overall as the population matures.

What is discretionary spending?

Discretionary spending is typically set by the House and Senate Appropriations Committees and their various subcommittees.

How much will Social Security increase in 2035?

The Congressional Budget Office (CBO) estimates that Social Security spending will rise from 4.8% of GDP in 2009 to 6.2% of GDP by 2035, where it will stabilize. However, the CBO expects Medicare and Medicaid to continue growing, rising from 5.3% GDP in 2009 to 10.0% in 2035 and 19.0% by 2082.

How much of the federal budget is mandatory?

Around two thirds of federal spending is for "mandatory" programs. CBO projects that mandatory program spending and interest costs will rise relative to GDP over the 2016–2026 period, while defense and other discretionary spending will decline relative to GDP.

What is the federal budget?

The United States federal budget consists of mandatory expenditures (which includes Medicare and Social Security), discretionary spending for defense , Cabinet departments (e.g., Justice Department) and agencies (e.g., Securities & Exchange Commission ), and interest payments on debt. This is currently over half of U.S. government spending, the remainder coming from state and local governments.

What are some examples of reforms to Social Security?

Examples include reducing future annual cost of living adjustments (COLA) provided to recipients, raising the retirement age, and raising the income limit subject to the payroll tax ($106,800 in 2009).