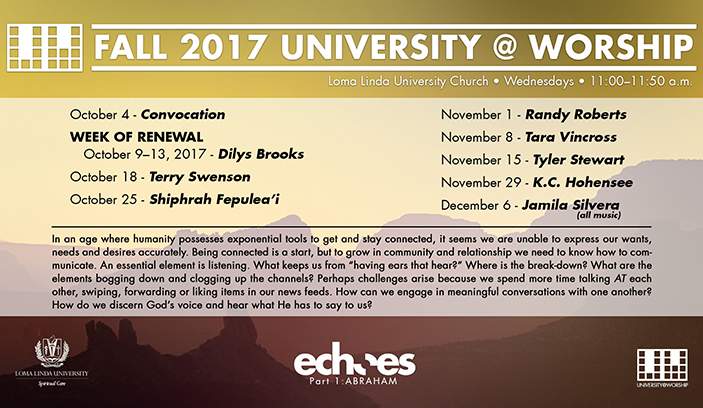

How much does Medicare deduct from my social security check?

How much does Medicare deduct in 2020 for Social Security? The standard monthly premium will be $144.60 for 2020, which is $9.10 more than the $135.50 in 2019. The annual deductible for Part B will rise to $198, up $13 from $185 this year.

How much does Medicare take out of your check?

- Premiums: The monthly payment just to have the plan

- Deductible: The amount you must pay on your own before insurance starts to cover the costs

- Copay: A flat fee you pay for covered services

- Coinsurance: The percentage of costs you pay after reaching your deductible

Does Medicare come out of my social security check?

To pay for the Original Medicare, the federal government takes the premium cost directly out of your Social Security check. Medicare Advantage gives you the option of paying your private health insurer directly instead of taking the money out of your social security check.

Can I Opt Out of paying Medicare or social security?

There are no other ways to remain a U.S. Citizen and not pay Social Security and Medicare taxes unless you’re willing to move out of the country. But the real question is whether Social Security will actually run out of benefits by the time today’s young people retire.

How much does Medicare take from Social Security?

What are the Medicare Part B premiums for each income group? In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

How much do they take out of your Social Security check for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

What deductions are taken out of Social Security checks?

You would pay taxes on 85 percent of your $18,000 in annual benefits, or $15,300. Nobody pays taxes on more than 85 percent of their Social Security benefits, no matter their income. The Social Security Administration estimates that about 56 percent of Social Security recipients owe income taxes on their benefits.

Does the cost of Medicare come out of your Social Security check?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Does Social Security automatically take out Medicare?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Do I have to pay for Medicare?

Most people don't have to pay a monthly premium for their Medicare Part A coverage. If you've worked for a total of 40 quarters or more during your lifetime, you've already paid for your Medicare Part A coverage through those income taxes.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

Do seniors pay taxes on Social Security?

Many seniors are surprised to learn Social security (SS) benefits are subject to taxes. For retirees who are still working, a part of their benefit is subject to taxation. The IRS adds these earnings to half of your social security benefits; if the amount exceeds the set income limit, then the benefits are taxed.

How many credits do you need to work to get Medicare?

You’re eligible to enroll in Medicare Part A and pay nothing for your premium if you’re age 65 or older and one of these situations applies: You’ve earned at least 40 Social Security work credits. You earn 4 work credits each year you work and pay taxes.

How long do you have to be married to get Social Security?

You were married for at least 9 months but are now widowed and haven’t remarried.

How much is Medicare Part B in 2021?

Your Part B premiums will be automatically deducted from your total benefit check in this case. You’ll typically pay the standard Part B premium, which is $148.50 in 2021. However, you might have a higher or lower premium amount ...

Is Medicare premium tax deductible?

Medicare premiums are tax deductible. However, you can deduct premiums only once your out-of-pocket medical expenses reach a certain limit.

Can a deceased spouse receive Medicare?

You can also receive Part A without paying a premium if you qualify because of a disability. You can qualify for Medicare because of a disability at any age.

Can I use my Social Security to pay my Medicare premiums?

Can I use Social Security benefits to pay my Medicare premiums? Your Social Security benefits can be used to pay some of your Medicare premiums . In some cases, your premiums can be automatically deducted If you receive Social Security Disability Insurance (SSDI) or Social Security retirement benefits.

Can Medicare be deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it’s either sent to you or deposited.

Not everyone pays for Medicare with their Social Security check

Lorraine Roberte is an insurance writer for The Balance. As a personal finance writer, her expertise includes money management and insurance-related topics. She has written hundreds of reviews of insurance products.

Who Is Eligible for Medicare?

Medicare is a social insurance program available to U.S. citizens and permanent residents 65 years of age or older. It’s also available to some younger Americans who are disabled or diagnosed with End-Stage Renal Disease (ESRD).

When Do You Have To Pay for Medicare?

If you don’t qualify for premium-free Part A coverage, you’ll need to pay a monthly premium. You’ll also have to pay a premium if you sign up for Part B, which is optional.

Medicare Costs You Can Deduct From Social Security

Most people who receive Social Security benefits will have their Medicare premiums automatically deducted. Here’s a closer look at what costs you can expect to see taken out of your checks.

Can You Change How You Pay for Medicare?

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you don’t qualify for Social Security benefits, you’ll get a bill from Medicare that you’ll need to pay via:

What does Medicare pay for?

Medicare pays for many different types of medical expenses. Part A covers inpatient hospital care, surgery, and home health care, among other items. Part B covers things such as preventive care, doctors’ visits, and durable medical equipment. Part D covers prescription drugs.

How much will I pay for Medicare?

The amount you’ll pay for Medicare depends on several factors, including your sign-up date, income, work history, prescription drug coverage, and whether you sign up for extra coverage with an Advantage or Medigap plan. The Medicare Plan Finder can help you compare costs between different plans.

When do you have to sign up for Medicare?

People are eligible for Medicare when they turn 65. You’ll sign up for coverage at that time.

When do you have to be 65 to get Medicare?

People become eligible for Medicare when they turn 65. They can sign up for Medicare coverage at that time.

How much is Medicare Advantage monthly?

Meanwhile, Medicare Advantage has different premiums depending on the plan. The average Medicare Advantage monthly premium is $21, but there are plans with zero premiums. Zero-premium plans often have higher deductibles. On the flip side, Medicare Advantage plans with higher premiums often have lower deductibles.

What is Medicare Advantage?

Medicare Advantage gives you the option of paying your private health insurer directly instead of taking the money out of your social security check.

What is the retirement age?

Federal law dictates your retirement age based on when you were born. The retirement age was once 65 . However, in the 1980s, Congress passed a law raising the retirement age for those born in 1938 and later.

Does Social Security cost you anything?

On the plus side, Social Security doesn’t cost you anything. You pay into the system while you’re employed, so you don’t have to pay for the benefit in retirement. On the other hand, Medicare usually charges a monthly premium. How much you pay depends on the type of Medicare plan and your income.

Can you take money from Social Security?

No matter the type of Medicare, people on Social Security can let the federal government take the money directly from your Social Security checks. Having the money removed directly from your check means you won’t have to remember to pay for coverage.

Does Medicare deduct premiums?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Is Medicare Part A free?

Medicare Part A, which covers hospitalization, is free for anyone who is eligible for Social Security, even if they have not claimed benefits yet. If you are getting Medicare Part C (additional health coverage through a private insurer) or Part D (prescriptions), you have the option to have the premium deducted from your Social Security benefit ...

How often does Medicare pay premiums?

Medicare-insured Americans receiving Social Security can pay premiums by automatic deduction. Without Social Security income, Medicare sends a bill every 3 months to those enrolled in Part B only. With Part A only, Medicare sends a monthly bill for premiums, if any. For private Part C or D, insurance premiums can be directly paid to ...

What happens if you don't pay Medicare?

They issue a first notice then a second notice. If the insured person does not pay after the second notice, then the government issues a notice of delinquency and a shutdown date for coverage.

What is Medicare Easy Pay?

Medicare Easy Pay is a free service from Medicare that deducts the payment from the member’s bank account on an agreed date of the month. Medicare offers the paper mail method for payments.

What is Medicare for older people?

In general terms, Medicare is the federal government program to provide hospitalization, medical care and prescription drug coverage to older or disabled Americans.

What are the benefits of Medicare?

Medicare consists of these major programs for older Americans citizens and legal residents: 1 First, Medicare Part A covers costs of hospital stays, and skilled nursing care, as well as hospice for end of life situations. 2 Second, Medicare Part B covers the costs of routine doctor’s care, mental health care, and durable medical equipment. 3 Thirdly, Medicare Advantage offers comprehensive health coverage on par with Original Medicare, which often includes prescription benefits. 4 Fourth, Medicare Part D prescription drug benefits.

What does Medicare Part A cover?

First, Medicare Part A covers costs of hospital stays, and skilled nursing care, as well as hospice for end of life situations.

What is Medicare Advantage?

Medicare Advantage is a set of private plans from insurance companies. Medicare pays these companies an agreed fee for each beneficiary who joins. In turn, the private company takes over as the Medicare insurance carrier.

When do you get your SSI if you live in a foreign country?

If your payment date falls on a federal holiday or weekend, you can expect to receive that month’s payment on the weekday immediately prior.

When do you get paid if you are born on the 11th?

If you were born on the 11th through the 20 th of the month, you’ll be paid on the third Wednesday of the month; and. If you were born after the 20 th of the month, you’ll be paid on the fourth Wednesday of the month. There are exceptions.

When are Social Security benefits deposited?

Social Security benefit payments are deposited on the second, third, or fourth Wednesday of each month, depending on your day of birth. This payment schedule has been in effect since June 1997.

How to contact Social Security about direct deposit?

Contact the Social Security Administration at 1-800-772-1213 or find a Social Security office near you if your direct deposit or debit card funds aren't made on time. The SSA asks that you wait three days before reaching out to them, however.

When will my federal stimulus payment come?

Your payment will come the weekday just before the usual date if your payment date falls on a weekend or a federal holiday.

When did Social Security start?

You started receiving benefits prior to May 1, 1997. You reside in another country. You're receiving both Social Security benefits and SSI payments. But there's an exception to the Social Security/SSI rule as well.

When do you get your unemployment check if you were born on the 4th Wednesday of the month?

On the fourth Wednesday if you were born between the 21st and the 31st day of the month 2. Children or spouses who receive benefits based on someone else's work record should receive their payments on the same day as that individual.

When is the second Wednesday of each month?

On the second Wednesday of each month if you were born on the first through the 10th day of the month. On the third Wednesday of the each month if you were born between the 11th and 20th day of the month. On the fourth Wednesday if you were born between the 21st and the 31st day of the month 2.

Do children get benefits on the same day as someone else?

Children or spouses who receive benefits based on someone else's work record should receive their payments on the same day as that individual.

When do you get your Medicare card?

If you are automatically enrolled in Medicare Part A and Part B because of your Social Security eligibility, you’ll receive your red, white and blue Medicare card in the mail three months before you turn 65, or three months before your 25 th month of Social Security disability benefits.

When do you automatically enroll in Medicare?

For instance, you are typically automatically eligible for Medicare if you are receiving Social Security benefits when you turn 65.

What is the number to drop Medicare Part B?

Medicare Part B is also optional. If you choose to drop your Medicare Part B coverage, you can do so by contacting a Social Security representative at 1-800-772-1213 (TTY: 1-800-325-0778).

How much is Medicare Part B 2021?

The Medicare Part B Premium. Most seniors pay a standard monthly premium for Medicare Part B. In 2021, that standard premium is $148.50 per month. It can be higher depending on your income. However, that cost might be lower for many people who are receiving Social Security benefits.

What Is The Medicare Part B Give Back Benefit?

The Give Back benefit is a benefit offered by some Medicare Advantage plan carriers that can help you reduce your Medicare Part B premium. You should know, however, that the Give Back benefit is not an official Medicare program. This benefit is provided as part of some Medicare Part C plans as a way to encourage participation in a specific plan.

Who Is Eligible For The Medicare Part B Give Back Benefit?

It is pretty easy to qualify for the Medicare Give Back benefit as the eligibility criteria are straightforward. First, you must be enrolled in Original Medicare. You need to have both Medicare Part A and Medicare Part B coverage. Next, you must pay your own monthly Part B premium.

Applying For A Medicare Part B Give Back Benefit

So, what is the enrollment process for the Give Back benefit? Many people are looking to save as much money as possible when it comes to their health care costs, so they want to know how to get signed up for this program. The process is quite simple, so here is how to do it.

The Bottom Line

Since most people on Medicare are receiving Social Security benefits, finding a way to reduce the cost of your health insurance is always a plus. The Medicare Give Back program can do just that by paying for a portion or even all of your Medicare Part B premium.

What is the deadline for Medicare give back benefit?

There is no deadline to qualify for the give back benefit. You must already be enrolled in Medicare Part A and Part B, and you must pay your own monthly Part B premium. You then simply need to enroll in a Medicare Advantage plan that offers this benefit.