Full Answer

What is the premium for Medicare Part A?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B.

Who qualifies for premium-free Medicare Part A?

If you are over 65 and qualify for Medicare, you are eligible for premium-free Part A if you or your spouse have at least 40 calendar quarters of work in a job where you paid payroll taxes to Social Security, or are eligible for Railroad Retirement benefits.

Does Medicare Part A have a premium?

They differ not only in the Medicare benefits covered but also in how the premiums are determined. Most people eligible for Part A have premium-free coverage. The premium is based on credits earned by working and paying taxes. When you work in the U.S., a portion of the taxes automatically deducted are earmarked for the Medicare program.

Who pays for Medicare Part a premium?

You can get premium-free Part A at 65 if:

- You already get retirement benefits The health care items or services covered under a health insurance plan. ...

- You're eligible to get Social Security or Railroad benefits but haven't filed for them yet.

- You or your spouse had Medicare-covered government employment.

Is there a monthly fee for Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

How much is taken out for Medicare Part A?

If you don't get premium-free Part A, you pay up to $499 each month. If you don't buy Part A when you're first eligible for Medicare (usually when you turn 65), you might pay a penalty. Most people pay the standard Part B monthly premium amount ($170.10 in 2022).

Is Medicare Part A completely free?

Medicare is a federal insurance program for people aged 65 years and over and those with certain health conditions. The program aims to help older adults fund healthcare costs, but it is not completely free.

Are Medicare Parts A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

How much is deducted from Social Security check for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

How much is the Part A deductible?

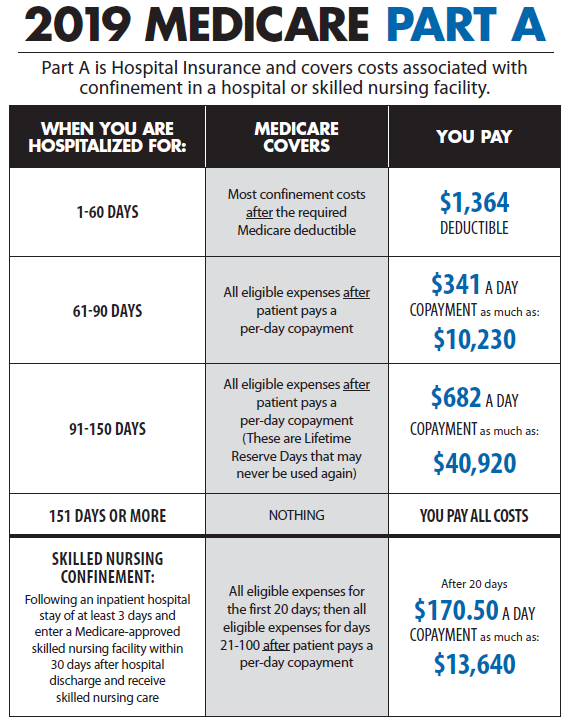

Part A Deductible: The deductible is an amount paid before Medicare begins to pay its share. The Part A deductible for an inpatient hospital stay is $1,556 in 2022. The Part A deductible is not an annual deductible; it applies for each benefit period.

What will Medicare cost in 2021?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What is Medicare Part C called?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

Does Medicare Part A cover emergency room visits?

Medicare Part A is sometimes called “hospital insurance,” but it only covers the costs of an emergency room (ER) visit if you're admitted to the hospital to treat the illness or injury that brought you to the ER.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How many quarters of Medicare do you have to pay?

If someone has not contributed 40 quarters (10 years) or more of Medicare taxes, however, they will be required to pay premiums for Medicare as follows. 1 . It is in your best interest to work up to 40 quarters if possible. This could mean delaying your retirement until you have met enough quarters of federally taxed employment. ...

How long does Medicare cover inpatient surgery?

This deductible covers all costs up to 60 days with the exception of physician fees which are covered by Part B.

How long does Medicare cover skilled nursing?

Medicare Part A covers the first 20 days of care received at a skilled nursing facility stay immediately following an inpatient hospital stay at no cost to you. Things can get tricky here because some people are placed under observation rather than admitted as an inpatient.

How much does a semi private room cost in 2019?

In 2019, the average rate for a semi-private room in a nursing facility was $247 per day ($7,513 per month).

How much can you save if you work 40 quarters?

If you work 40 or more quarters, it could save you tens of thousands of dollars in Part A premiums over your lifetime. This could have a significant impact on your ability to retire comfortably.

Does Medicare pay for nursing home care?

The bad news is that Medicare does not pay for care that is not associated with a hospital stay. People in need of long-term care will need to find another way to pay for a nursing home. For that reason, many seniors also need to sign up for Medicaid .

Will Medicare be increased in 2021?

Updated on November 11, 2020. The Centers for Medicare and Medicaid Services has announced Medicare costs for 2021. Everyone, regardless of their income, will be subjected to increases in out of pocket spending. Use these numbers to guide your healthcare expenses in the new year. Hero Images / Getty Images.

How much does Medicare pay for a month?

If you’re getting retirement benefits or are eligible for retirement benefits, Medicare Part A has a $0 monthly premium payment. The same rule applies if you’re under 65 years old and have been claiming federal disability benefits for at least 24 months, or if you’ve been diagnosed with end-stage renal disease or Lou Gehrig’s disease (amyotrophic lateral sclerosis, or ALS). Americans who are eligible for Medicare, but not other federal benefits, can still get coverage for a monthly premium up to $471.

What is Medicare Part A?

Medicare Part A, when combined with Medicare Part B (which covers outpatient insurance) is known as Original Medicare. Much of the care you receive through Medicare Part A is free, like home health services and hospice care.

How much is Medicare coinsurance for 2021?

Days 61-90 : $352 coinsurance per day ($371 in 2021) Day 91 and beyond : $704 coinsurance per day for each "lifetime reserve day" after the benefit period ($742 in 2021) You get 60 “lifetime reserve days” while on Medicare. These are extra days you can apply toward your qualified stay.

How long do you have to stay in the hospital?

If you are staying at the hospital, you’ll have to make sure you're an inpatient — that a doctor must order you to stay in the hospital for at least three days (two “midnights”). (The hospital or facility must accept Medicare.)

When do you enroll in Medicare Part A?

If you’re on federal retirement benefits, you get automatically enrolled in Medicare Part A and Medicare Part B on the first day of the month you turn 65. Otherwise, you will need to sign up yourself during your initial enrollment period, which starts three months before you turn 65.

Is Medicare Part A covered by Medicare Part B?

Not covered. Not covered. Medicare Part A and Medicare Part B work in tandem. You enroll in them, or opt for Medicare Advantage plans through Part C. Advantage plans are provided by private insurance companies that approved by the Medicare program. Lastly, prescription drug coverage is provided by Medicare Part D.

Does Medicare cover inpatient hospital?

Medicare Part A covers the cost of an inpatient hospital stay, but fees charged by a doctor or specialist physician will be covered by Part B. Medicare Part A does not cover the following at any hospital or facility: A private room, unless medically necessary. In-room television and phone services. Personal items.

What is Medicare Part A?

Medicare Part A Premiums Part A Costs Coverage and Enrollment FAQs. Medicare Part A, commonly referred to as “hospital insurance,” covers most inpatient services. To be eligible for Medicare Part A, you must be a U.S. resident age 65 or older. To qualify for Medicare Part A with no monthly premium, you must have paid Medicare taxes ...

How long does Medicare cover hospital expenses?

In the simplest terms, after you pay the deductible associated with a qualifying hospital stay, the hospital portion of your bill is covered for the first 60 days. Not everything is simple when it comes to Medicare Part A costs.

How long does Medigap cover?

All 10 of the standard Medigap plans offered by private insurance companies supplement your Part A coverage by paying 100% of coinsurance beginning with Day 61 of a hospital stay and extending that coverage for up to 365 days after you exhaust your lifetime reserve days.

What is Medicare Supplement?

Also known as Medicare supplement insurance, Medigap is private health insurance that supplements your coverage and helps with your healthcare costs. You must have Part A and Part B (“medical insurance”) of Original Medicare to add a Medigap plan.

What is a medical deductible?

A deductible is an amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs until you pay the first $1,000 yourself. ($1,484 in 2021).

How much coinsurance do you pay for a 90 day stay?

If your stay extends beyond 90 days, you pay $742 of coinsurance for up to 60 “lifetime reserve days.”. Lifetime reserve days can be used over multiple benefit periods. Once your lifetime reserve days are exhausted, Part A doesn’t provide any coverage.

Does Medigap cover Medicare Part A?

Some Medigap plans also cover the Medicare Part A deductible. If you live in Wisconsin, Minnesota or Massachusetts, your Medigap plan is not the same as other states. In most cases, a Medigap plan purchased in Illinois is the same if you find yourself in Texas. It’s standard.

How much is Medicare Part A 2021?

Medicare Part A has a deductible that is charged per benefit period. For 2021, this deductible amount is $1,484. A benefit period starts on the day when you enter a hospital or skilled nursing facility for care and ends when you have been out for 60 consecutive days. During this time, you may be in the hospital more than once.

How long can you use Medicare copays?

Hospital Copays for Medicare Part A. Hospital copays are determined by the number of days you’re in the hospital, and when you exceed 90 days , you begin to use your lifetime reserve days. These are a set number of covered hospital days you can use if you’re in the hospital for more than 90 days in a single benefit period.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is part A copay?

For hospice care, Part A copays exist for medications for pain and symptom management, durable medical equipment used in the home and for respite care. The costs for each for 2021 are below:

Is Medicare Part A premium free?

Medicare Part A costs will vary person-to-person, but for most people, Medicare Part A is premium-free. It still has a deductible, which you pay per benefit period, and it also requires copays for covered services in the hospital, a skilled nursing facility or for hospice.

Does Medicare cover all of the deductibles?

Medicare will cover all of them. Each benefit period charges the $1,484 Part A deductible. Medicare Part A also has copays for when you’re in the hospital, in a skilled nursing facility or in hospice. The copays and rules work differently for each.

Does Medicare cover skilled nursing?

Medicare Part A Copays for a Skilled Nursing Facility. For a skilled nursing facility, Medicare Part A charges copays per benefit period – similar to the Part A deductible—and by the number of days you spend in the facility receiving care. Below is a breakdown of the 2021 copay amounts for skilled nursing facility care.

What is Medicare Part A?

Medicare Part A is part of Original Medicare.

What is Medicare Part A deductible?

Medicare Part A Deductible. Most Part A costs come from the inpatient. Inpatient refers to medical care that requires admission to the hospital, usually overnight. hospital deductible. Inpatient care provided at a hospital or skilled nursing facility.

What is Medicare Part A coinsurance?

You’re responsible for a daily coinsurance. Coinsurance is the percentage of your medical costs that you pay after you meet your deductible.

How much does Medicare Part A coinsurance increase?

Part A coinsurance increases when your length of stay in a facility increases: 0 to 60 days. 61 to 90 days. You have a lifetime limit of reserve days to use if your stay lasts longer than 90 days. Medicare Part A daily coinsurance rates: Days 0-60: $0. Days 61-90: $371 per day. Lifetime Reserve Days: $742 per day.

How much is Medicare Part B 2021?

Medicare Part B premium 2021: $148.50. Your income plays a part in your Part B premium. For 2021, individuals making $88,000 per year or less, and couples making $176,000 or less, pay the standard monthly amount of $148.50 each.

Does Medicare Part A and Part B increase premiums?

Not enrolling on time can increase your premium amount. Medicare Part A and Part B cover most of your healthcare. Healthcare is the industry dedicated to maintaining or improving health and well-being. services (hospital and medical). You can add supplemental insurance to help cover the costs of Original Medicare (Parts A and B)

Does Medicare Advantage have an AEP?

It’s also important to know that Medicare Advantage also has its own Annual Enrollment Period (AEP). Medigap: Medicare Supplement Insurance (Medigap) Medicare Supplement Insurance (Medigap) is designed to provide coverage that Original Medicare (Parts A and B) does not.