Full Answer

How much money is spent on Medicare each year?

In 1970, some 7.5 billion U.S. dollars were spent on the Medicare program in the United States. Almost fifty years later, in 2018 this figure stood at some 740.6 billion U.S. dollars.

Will Social Security benefit amounts stay the same in 2016?

As a result, Social Security benefit amounts will stay the same in 2016. May 8, 2015, was the launch of our blog with the top ten baby names of 2014. Since 1987, Social Security has released the most requested baby names based on requests for Social Security numbers for newborns. In 2014, “Noah” won for the males and “Emma” won for the girls.

How much money does the federal government spend each year?

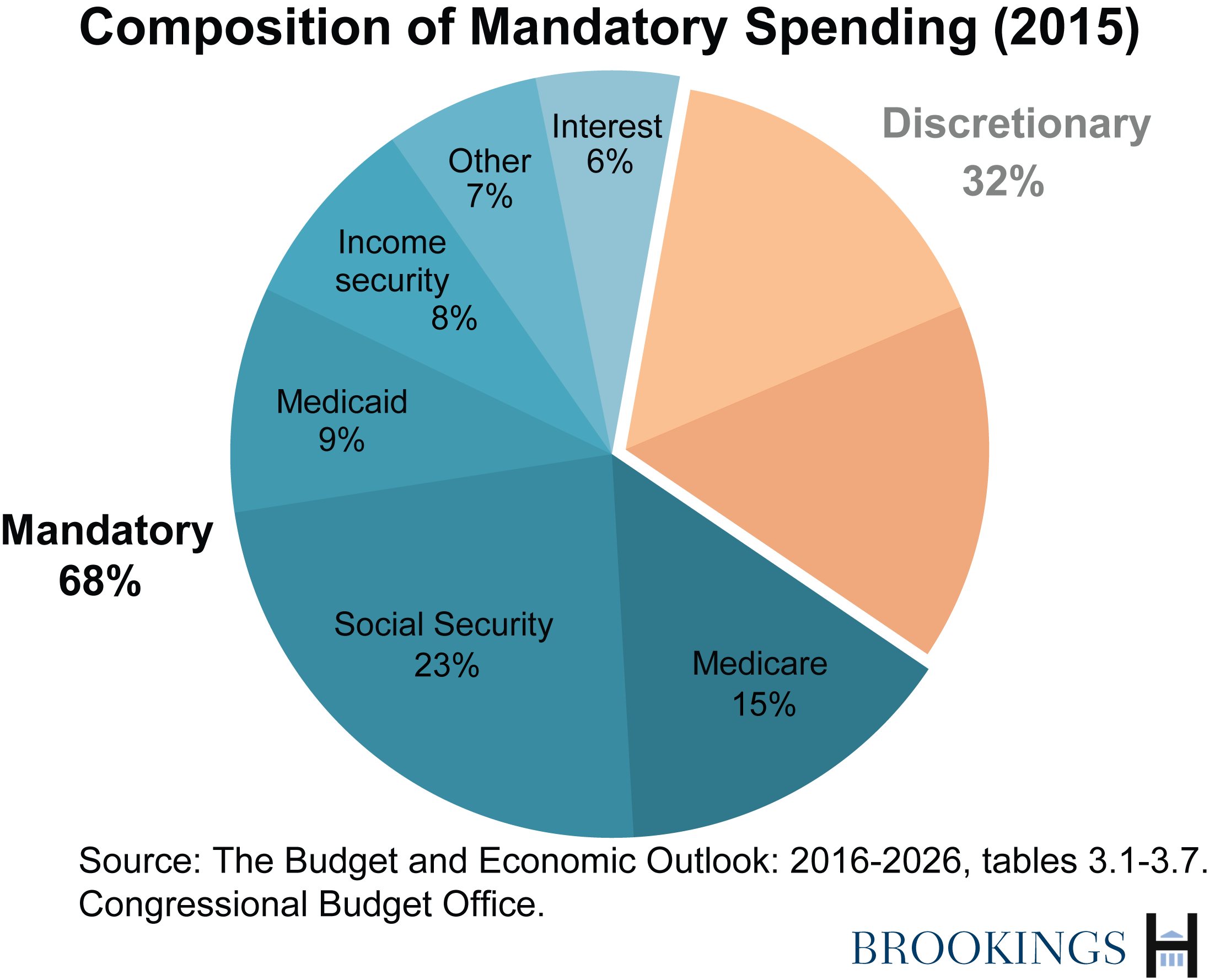

Most of federal spending went to two areas. Combined, they totaled $3.103 trillion. The first was the mandatory budget of $2.297 trillion. Add $80.3 billion for Health and Human Services. That's the agency that administers mandatory programs like Medicare, Medicaid, and the ACA. 10

Which budget proposals would have spent the most money in 2015?

Of the six budget proposals that received votes in the House, this was the proposal that would have spent the most money in 2015. The Congressional Progressive Caucus proposal would spend $3.2 trillion and included higher taxes on millionaires. It would also end the sequester.

How much did Social Security cost in 2015?

In FY 2015, we will pay about $60 billion in Federal benefits and State supplementary payments to approximately 8.5 million recipients per month.

How much does the US spend on Social Security and Medicare?

In 2020, the cost of the Social Security and Medicare programs was $2.03 trillion. The majority of Social Security and Medicare funding comes from tax revenue and interest on trust fund reserves. For 2020, income for these programs was $2.02 trillion.

What was the COLA for 2015?

0.0Social Security Cost-Of-Living AdjustmentsYearCOLA20150.020160.320172.020182.83 more rows

How much money was taken from the Social Security fund?

In other words, the borrowing fund was required to make the loaning fund whole at the end of the process. This authority was used twice, once in November 1982 and once in December 1982. The total amount borrowed was $17.5 billion.

When did Social Security start running a deficit?

2010Key Takeaways. Social Security's programs account for nearly one-quarter of all federal spending in 2016. Social Security began running deficits in 2010, and its trust funds will be exhausted by 2034.

How much did the US spend on Social Security 2020?

Mandatory spending by the federal government totaled $4.6 trillion in 2020, of which $1.9 trillion was for Social Security and Medicare.

Has Social Security kept up with inflation?

... but keeping up with inflation in the long term Over the course of an inflationary period, the COLA tracks inflation fairly well. In the past 20 years, the Social Security COLA has averaged a 2.1 percent annual gain while the CPI has risen an average of 2.2 percent.

How much does Social Security increase each year for inflation?

With COLAs, Social Security and Supplemental Security Income (SSI) benefits keep pace with inflation. The latest COLA is 5.9 percent for Social Security benefits and SSI payments. Social Security benefits will increase by 5.9 percent beginning with the December 2021 benefits, which are payable in January 2022.

How often is Social Security adjusted for inflation?

Apart from any earnings-based calculations, Social Security makes an annual cost-of-living adjustment (COLA) to your benefit based on inflation, if any.

What president took money from the Social Security fund?

3. The financing should be soundly funded through the Social Security system....President Lyndon B. Johnson.1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19646.REMARKS WITH PRESIDENT TRUMAN AT THE SIGNING IN INDEPENDENCE OF THE MEDICARE BILL--JULY 30, 196515 more rows

Did Congress steal from Social Security?

The Social Security Administration (SSA) says the notion is a myth and misinformation. "There has never been any change in the way the Social Security program is financed or the way that Social Security payroll taxes are used by the federal government," the agency said.

Who was the first president to dip into Social Security?

Which political party started taxing Social Security annuities? A3. The taxation of Social Security began in 1984 following passage of a set of Amendments in 1983, which were signed into law by President Reagan in April 1983.

Tax Rates

FICA and Self-Employment Tax Rates: The FICA tax rate for employees and their employers is a combination of payments to the Old Age, Survivors, and Disability Insurance (OASDI) Trust Fund, and the Hospital Insurance (HI) Trust Fund, from which payments under Medicare are made.

Social Security Disability Insurance (SSDI)

Quarters of Coverage: Eligibility for Retirement, Survivors, and Disability Insurance benefits is partially based on the number of quarters of coverage earned by any individual during periods of work. Anyone may earn up to four quarters of coverage in a single year.

Supplemental Security Income (SSI)

Standard SSI Benefit Increase: Beginning January 2015 the federal payment amounts for SSI individuals and couples are as follows: individuals, $733 a month; SSI couples, $1,100 a month.

Medicare

Medicare Deductibles and Coinsurance: Medicare Part A coverage provides hospital insurance to most Social Security beneficiaries. The coinsurance amount is the hospital charge to a Medicare beneficiary for any hospital stay. Medicare then pays the hospital charges above the beneficiary's coinsurance amount.

How much was spent on Social Security?

A total of $2.297 trillion was spent. That's lower than the $2.458 trillion budgeted. Social Security was the largest. It cost $882 billion, lower than the estimate of $896 billion. It's 100 percent paid for by payroll taxes, so it doesn't add to the deficit. Medicare was next at $540 billion.

How much did Medicaid cost in 2015?

In 2015, 51% of the program was funded by payroll taxes and premiums. 8. Medicaid cost $350 billion, more than the $336 billion budgeted. All other mandatory programs totaled $525 billion. These include food stamps, unemployment compensation, and supplemental security for the disabled.

How much money did Congress add to the Afghanistan War?

Congress added $73.7 billion in Overseas Contingency Operations funding to pay for the Afghanistan War. It added $13.4 billion in emergency funding for disaster relief and other programs. OCO and emergency funding isn’t subject to sequestration or the discretionary budget limit. 11.

How much was the budget deficit in 2014?

That created a $442 billion budget deficit. 1. On March 4, 2014, President Obama submitted the FY 2015 budget proposal to Congress. 2 This was a month late according to the traditional budget process. 3 But it didn't delay the rest of the budget schedule for the year. On December 13, 2014, Congress passed its $1.1 trillion spending bill.

How many people received Social Security in 2014?

64.2 million people received benefits from programs administered by the Social Security Administration ( SSA) in 2014. 5.4 million people were newly awarded Social Security benefits in 2014. 64% of aged beneficiaries received at least half of their income from Social Security in 2013.

What percentage of Social Security income was in 1962?

In 1962, Social Security, earnings, income from assets, and government employee and private pensions made up only 85% of the aggregate total income of couples and nonmarried persons aged 65 or older, compared with 96% in 2013.

What is the poverty rate for non-married women?

Nonmarried women and minorities have the highest poverty rates, ranging from 17.6% to 19.8%. Married persons have the lowest poverty rates, with 4.7% poor and 2.7% near poor. Overall, 9.5% are poor and 5.6% are near poor. Poverty status, by marital status, sex of nonmarried persons, race, and Hispanic origin.

When can disabled widows receive reduced benefits?

Disabled widow (er)s can receive reduced benefits at age 50. Spouses, children, and parents receive a smaller proportion of the worker's PIA than do widow (er)s. Average monthly benefit for new awards and for benefits in current-payment status (in dollars) Beneficiary. New awards.

What was the health care spending rate in 2015?

In 2015, per-capita health care spending grew by 5.0 percent and overall health spending grew by 5.8 percent, according to a study by the Office of the Actuary at the Centers for Medicare & Medicaid Services (CMS) published today as a Web First by Health Affairs . Those annual rates continue to be below the rates of most years prior to passage of the Affordable Care Act. And, even as millions of people gained coverage, per-enrollee spending growth in private health insurance and Medicare continue to be well below the average in the decade before passage of the Affordable Care Act.

How much did Medicare spend in 2015?

Medicare spending, which represented 20 percent of national total health care spending in 2015, grew 4.5 percent to $646.2 billion, slightly slower than the 4.8 percent growth in 2014 even as the leading edge of the baby boom generation joined Medicare.

How much did the US spend on prescription drugs in 2015?

Spending on prescription drugs increased 9.0 percent in 2015, lower than the 12.4 percent growth in 2014, yet significantly higher compared to 2.3 percent growth in 2013. On a per-enrollee basis, overall spending increased by 4.5 percent for private health insurance, 1.7 percent for Medicare, and 3.8 percent for Medicaid.

How much did prescriptions increase in 2015?

Retail prescription drug spending continued to outpace overall health expenditure growth in 2015, increasing 9.0 percent to $324.6 billion after rising 12.4 percent in 2014. Growth in prescription drug spending was faster than that of any other service in 2015.

How much did private health insurance spend in 2015?

Overall, private health insurance expenditures (33 percent of total health care spending) reached $1.1 trillion in 2015, and increased 7.2 percent in 2015. The faster rate of growth reflected increased enrollment in private health insurance associated with coverage expansions under the Affordable Care Act, and a notable increase in ...

How long do you have to report changes to Social Security?

These changes must be reported no later than 10 days after the end of the month in which the change is occurred.

When is Medicare open enrollment?

Medicare Open Enrollment: Five Things You Need to Do. The Medicare open enrollment period ran from October 15 through December 7. This was the time to make changes to your current Medicare coverage for 2016.

What are the two new online resources based on disability benefits?

Social Security released two new online data resources based on disability benefits: the state disability fact sheet and a national disability issue paper. Both of these online resources show how Social Security continues to fulfill our promise of support to America’s workers and their families.

What is BSO in Social Security?

Social Security helps employers too. Business Services Online (BSO) provides services for employers that make managing employee information quick, easy and secure. Once you register, you can interact directly with us through our online services to meet many of your needs. Disability Benefits: The Numbers Tell the Story.

How long does it take to get a replacement Social Security card?

You can order a replacement card easily with a my Social Security account. All you need is internet access and your card will arrive in the mail in about 30 days. The Best Age for YOU to Retire. Retirement is a very exciting time in a person’s life.

Is Social Security benefit the same in 2016?

As a result, Social Security benefit amounts will stay the same in 2016. May 8, 2015, was the launch of our blog with the top ten baby names of 2014. Since 1987, Social Security has released the most requested baby names based on requests for Social Security numbers for newborns. In 2014, “Noah” won for the males and “Emma” won for the girls.

How much did Medicare cost in 1970?

In 1970, some 7.5 billion U.S. dollars were spent on the Medicare program in the United States. Almost fifty years later, this figure stood at some 796.2 billion U.S. dollars. This statistic depicts total Medicare spending from 1970 to 2019.

How much will Alzheimer's cost in 2020?

In 2020, Alzheimer's disease was estimated to cost Medicare and Medicaid around 206 billion U.S. dollars in care costs; by 2050, this number is projected to climb to 777 billion dollars.

What is Medicare coverage?

Increasing Medicare coverage. Medicare is the federal health insurance program in the U.S. for the elderly and those with disabilities. In the U.S., the share of the population with any type of health insurance has increased to over 90 percent in the past decade.

Revenue

Spending

- The government spent $3.688 trillion. That's much less than the $3.9 trillion estimated in the president's budget. One reason is sequestrationlimited discretionary spending to $1.1 trillion. Also, mandatory spending was less than estimated. Here's the rundown: Mandatory – As usual, nearly two-thirds of the budget went toward mandatory programs. These were establishe…

The Bottom Line

- Most of federal spending went to two areas. Combined, they totaled $3.103 trillion. The first was the mandatory budget of $2.297 trillion. Add $80.3 billion for Health and Human Services. That's the agency that administers mandatory programs like Medicare, Medicaid, and the ACA.10 The second largest was military spending. It should also include the departments that support defen…

Deficit

- The Office of Management and Budget estimated the president's budget deficit to be $564 billion.9 Instead, it came in at $442 billion.1That's because spending was lower. A review of deficit by president reveals this was Obama's smallest deficit. A review of deficit by year reveals it was the smallest deficit since FY 2008. office

Compare to Other Federal Budgets

- Current FY 2021

- FY 2020

- FY 2019

- FY 2018