What was Medicare Part B premium in 2015?

What was the Medicare Part B premium in 2013?

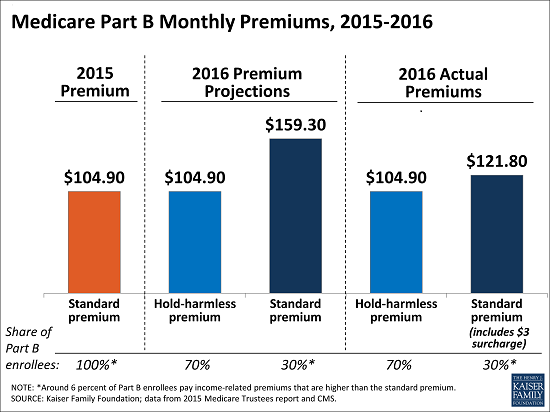

What was Medicare Part B premium in 2016?

What was the Medicare Part B premium in 2017?

What was the Medicare premium for 2014?

What was Medicare Part B premium in 2018?

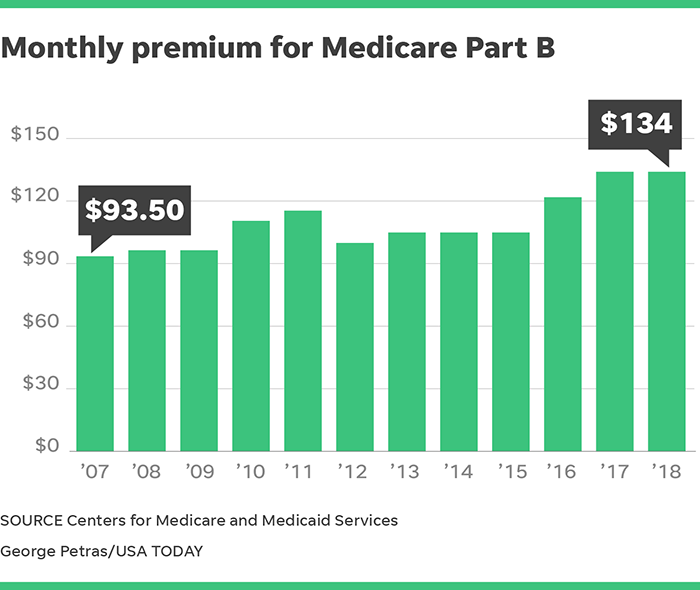

What was the Medicare Part B premium in 2010?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $110.50 in 2010. However, most Medicare beneficiaries will not see an increase in their monthly Part B premiums in 2010 because of a “hold-harmless” provision in current law.

What is the Medicare Part B deductible for 2020?

How much are Medicare premiums for 2019?

What is Medicare Part B premium 2019?

What is the Part B deductible for 2019?

The annual deductible for all Medicare Part B beneficiaries is $185 in 2019, an increase of $2 from the annual deductible $183 in 2018.Oct 12, 2018

What are the Medicare income limits for 2022?

| If your yearly income in 2020 (for what you pay in 2022) was | You pay each month (in 2022) | |

|---|---|---|

| File individual tax return | File joint tax return | |

| $91,000 or less | $182,000 or less | $170.10 |

| above $91,000 up to $114,000 | above $182,000 up to $228,000 | $238.10 |

| above $114,000 up to $142,000 | above $228,000 up to $284,000 | $340.20 |

What is fee for service in Medicare?

Since the inception of Medicare, fee-for-service claims have been processed by nongovernment organizations or agencies under contract to serve as the fiscal agent between providers and the federal government. These entities apply the Medicare coverage rules to determine appropriate reimbursement amounts and make payments to the providers and suppliers. Their responsibilities also include maintaining records, establishing controls, safeguarding against fraud and abuse, and assisting both providers and beneficiaries as needed.

How many days are covered by Medicare?

The number of SNF days provided under Medicare is limited to 100 days per benefit period (described later), with a copayment required for days 21 through 100.

When was Medicare first introduced?

When first implemented in 1966 , Medicare covered most persons aged 65 or older.

Does Medicare pay for hospice care?

However, if a hospice patient requires treatment for a condition that is not related to the terminal illness, Medicare will pay for all covered services necessary for that condition.

What is Medicare Advantage?

Medicare Advantage plans are offered by private companies and organizations and are required to provide at least those services covered by Parts A and B, except hospice services. These plans may (and in certain situations must) provide extra benefits (such as vision or hearing) or reduce cost sharing or premiums.

Is Medicare a social insurance?

Medicare Financial Status. Medicare is the largest health care insurance program—and the second-largest social insurance program—in the United States. Medicare is also complex, and it faces a number of financial challenges in both the short term and the long term.

Is Medicare a secondary payer?

For workers and their spouses aged 65 to 69, Medicare is the secondary payer when benefits are provided under an employer-based group health plan (applicable to employers with 20 or more employees who sponsor or contribute to the group plan).

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

How much is the 2021 Medicare premium?

The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

Who is Thomas Brock?

Thomas Brock is a well-rounded financial professional, with over 20 years of experience in investments, corporate finance, and accounting. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar.

Who is Dana Anspach?

Linkedin. Follow Twitter. Dana Anspach is a Certified Financial Planner and an expert on investing and retirement planning. She is the founder and CEO of Sensible Money, a fee-only financial planning and investment firm.

Latest News

As announced by the Centers for Medicare and Medicaid Services (CMS) last October, the standard 2014 Medicare Part B premium remained unchanged from the 2013 amount of $104.90 per month. Part B covers physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and other items.

Medicare Part B premiums in 2014

As announced by the Centers for Medicare and Medicaid Services (CMS) last October, the standard 2014 Medicare Part B premium remained unchanged from the 2013 amount of $104.90 per month. Part B covers physicians’ services, outpatient hospital services, certain home health services, durable medical equipment, and other items.

What is the Medicare premium for 2014?

2014 Medicare Part A Premium: The Medicare Part A premium, which only about 1 percent of Medicare recipients are required to pay, will be $426, a $15 decrease from the 2013 rate.

How much did Medicare pay in 2014?

For a hospital stay of 91-150 days, the per-day Medicare Part A co-payment in 2014 is $608, a $16 increase from 2013.

When did Medicare Part B and Part A change?

The Medicare administration has announced Medicare Part A and Part B rates for 2014, with changes taking effect Jan. 1, 2014.

What is Medicare Supplement Plan F?

An excellent, budget-friendly solution is Medicare Supplement Plan F, which covers all Medicare-approved costs not covered by Medicare Part A and Medicare Part B. With fixed premiums that can easily fit into your budget, Plan F covers all Medicare Part A and Part B deductibles along with “excess charges” you would otherwise have to pay out ...

2014 Part A (Hospital) Monthly Premium & Deductible

You usually don’t pay a monthly Premium for Part A coverage if you or your spouse paid Medicare taxes while working. If you aren’t eligible for premium-free Part A, you may be able to buy Part A if you meet one of the following conditions:

2014 Part B (Medical) Monthly Premium & Deductible

How Much Does Part B Coverage Cost? You pay the Part B premium each month. Most people will pay up to the standard premium amount.

2014 Part C (Medicare Advantage) Monthly Premium

Medicare Advantage plan premiums*, deductibles, and benefits will depend on the Medicare Advantage plans available in your service area (county or ZIP code). Along with your Medicare Advantage plan premium, you must continue to pay your Part B premium (and Part A premium if you do not receive your Medicare Part A coverage premium-free).

2014 Part D (Medicare Prescription Drug Plan) Monthly Premium & Deductible

Medicare Prescription Drug Plan (Part D) premiums*, deductibles, and benefits vary by plan and state. Remember that you can receive Part D prescription drug coverage from a stand-alone Medicare Part D plan (PDP) or a Medicare Advantage plan that includes drug coverage (MAPD).

News not so bad related to 2014 Medicare Premiums and deductibles

Anyone who has been enrolled in Medicare for a while knows that this is the time of year when CMS announces any changes in Medicare Premiums and deductibles.

2014 Medicare premiums

The following table shows Part B premiums based on income. The vast majority of people pay $104.90 per month. The 2014 Part B premiums are remaining at the same level as 2013 premiums.

Overview

Entitlement and Coverage

Program Financing, Beneficiary Liabilities, and Payments to Providers

Claims Processing

Administration

Medicare Financial Status

Data Summary

- The Medicare program covers 95 percent of our nation's aged population, as well as many people who receive Social Security disability benefits. In 2013, Part A covered almost 52 million enrollees with benefit payments of $261.9 billion, Part B covered almost 48 million enrollees with benefit payments of $243.8 billion, and Part D covered over 39 mi...

Medicare: History of Provisions