How much does Medicare Part a cost?

· The Medicare Part A deductible, which covers the first 60 days of Medicare-covered inpatient hospital care, will rise to $1,260 in 2015, a $44 increase from 2014. The daily coinsurance rate for ...

What is the average cost of Medicare Part B?

Medicare Costs at a Glance: 2015. As a health care professional, your patients may look to you for help with understanding ... 2015 Medicare Premium Costs for Beneficiaries. Medicare Part. Premium Costs for Beneficiaries; Part A; Hospital Insurance: Most beneficiaries pay : $0 per month: for Medicare Part A. Beneficiaries who buy Part A pay up ...

Do I have to pay a monthly premium for Medicare?

The 2015 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $407. The Medicare Part A deductible for all Medicare beneficiaries is $1,260 . 2015 Part B (Medical) Monthly Premium & Deductible

What do I need to know about Medicare Part A?

Part A is free for most of us, as we (often unknowingly) paid taxes toward it while working. Those who don't get Part A for free will pay up to $407 per month.

How much is Medicare Part A 2015?

The 2015 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $407.

How much is Medicare Advantage premium for 2015?

The 2015 Medicare Advantage plan premiums range from $0 to $348.

How much is Medicare Part B deductible in 2015?

If you have to pay a higher amount for your Part B premium and you disagree, you can appeal the IRMAA. The 2015 Medicare Part B annual deductible remains $147 (unchanged from 2014 and 2013).

What is Medicare Part D 2015?

2015 Part D (Medicare Prescription Drug Plan) Monthly Premium & Deductible. Medicare Prescription Drug Plan (Part D) premiums*, deductibles, and benefits vary by plan and state. Remember that you can receive Part D prescription drug coverage from a stand-alone Medicare Part D plan (PDP) or a Medicare Advantage plan that includes drug coverage ...

How much is the 2015 Part D premium?

The 2015 Part D plan premiums range from $0 to $172. The 2015 standard Part D plan deductible is $320, however the actual plan deductible can be anywhere from $0 to $320 .

What is the age limit for a Part B?

You’re 65 or older, and you have (or are enrolling in) Part B and meet the citizenship and residency requirements.

Do you pay Social Security if your adjusted gross income is above a certain amount?

However, if your modified adjusted gross income as reported on your IRS tax return from 2 years ago (the most recent tax return information provided to Social Security by the IRS) is above a certain amount (see chart below), you may pay more.

How much is Part B tax deductible?

Part B sports a deductible of $147 per year , and costs most people (individuals earning $85,000 or less, or couples filing jointly and earning $170,000 or less) $104.90 per month. Those earning more will pay more, with the highest earners paying $335.70 per month.

When did Medicare become law?

In a nutshell, Medicare, signed into law by President Johnson in 1965 , is a federal health insurance program for those aged 65 and up. (It also serves some younger people with disabilities and certain people with end-stage renal disease.)

What is covered by Part B?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. More specifically, it covers "medically necessary" services needed to diagnose or treat you, as well as preventive and early detection services such as certain vaccines and screenings. It also covers durable medical equipment (such as blood sugar monitors and home oxygen equipment), mental-health care, and limited prescription drugs.

Is Medicare free for adults?

Here's a quick review of what it is, how it works, and, importantly, what it costs. (It's worth noting, after all, that although it's a government-provided service , it's not free.)

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is premium free Part A?

Most people get premium-free Part A. You can get premium-free Part A at 65 if: The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

How much did Medicare cost in 2015?

In FY 2015, gross current law spending on Medicare benefits will total $605.9 billion. Medicare will provide health insurance to 55 million individuals who are 65 or older, disabled, or have end-stage renal disease (ESRD).

How many people will be on Medicare in 2015?

For 2015, the number of beneficiaries enrolled in Medicare Part D is expected to increase by about 3 percent to 41 million , including about 12 million beneficiaries who receive the lowincome subsidy.

What is the Medicare Part B deductible?

Modify Part B Deductible for New Enrollees: Beneficiaries who are enrolled in Medicare Part B are required to pay an annual deductible ($147 in calendar year 2014). This deductible helps to share responsibility for payment of Medicare services between Medicare and beneficiaries. To strengthen program financing and encourage beneficiaries to seek high-value health care services, this proposal would apply a $25 increase to the Part B deductible in 2018, 2020, and 2022 respectively for new beneficiaries beginning in 2018. Current beneficiaries or near retirees would not be subject to the revised deductible.

3.4 billion in savings over 10 years]

What percentage of Medicare beneficiaries are covered by Part B?

Part B coverage is voluntary, and about 92 percent of all Medicare beneficiaries are enrolled in Part B. Approximately 25 percent of Part B costs are financed by beneficiary premiums, with the remaining 75 percent covered by general revenues.

What is Medicare Shared Savings Program?

Medicare Shared Savings Program (MSSP): This initiative is a feeforservice program established by the Affordable Care Act designed to improve beneficiary outcomes and increase value of care. ACOs that meet certain quality objectives and reduce overall expenditures get to share in the savings with Medicare and may also be subject to losses. Since the first cohort of ACOs entered the program in 2012, 343 MSSP ACOs have been established. In the first year of the program, Medicare ACOs generated interim shared savings totaling $128 million for the Medicare trust fund. Fiftyfour ACOs had lower expenditures than projected, and 29 will share interim savings.

What is the Medicare sequestration for 2023?

Modifications to Medicare sequestration for fiscal year 2023 : The Bipartisan Budget Act of 2013 extended the sequestration of Medicare provider payments along with the sequestration of other non-exempt mandatory programs through FY 2023. An additional provision in the Pathway for SGR Reform Act of 2013 accelerates FY 2023 savings from sequestration by applying a higher percentage Medicare reduction to the first six months. (Savings: $2.1 billion from acceleration of Medicare spending reductions in FY 2023)

What is Medicare 1/?

1/ Represents all spending on Medicare benefits by either the Federal government or other beneficiary premiums. Includes Medicare Health Information Technology Incentives.

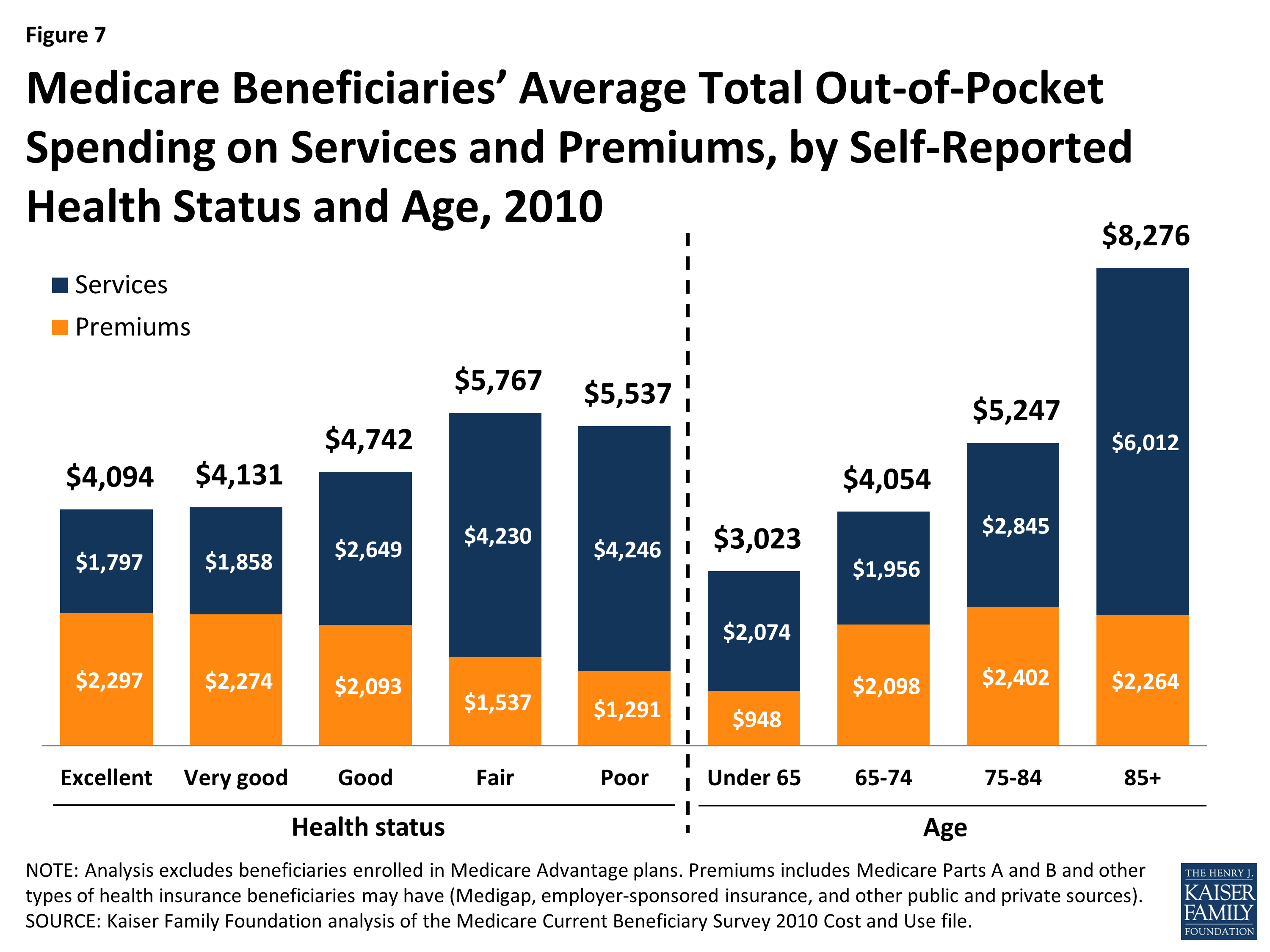

Options for Covering Medicare Costs

If you’re concerned about out of pocket costs, you may choose a Medicare Advantage plan (MA) that maxes out your out of pocket cost. MA plans usually covers prescription drugs and extras like dental and vision.

Stay in touch

Subscribe to be always on top of news on Medicare, Medigap, Medicare Advantage, Part D and more!