What is Medicare Part a deductible?

Medicare Part A Deductible. The program also strives to provide senior citizens with quality coverage and while the program eliminates many costs associated with health care for seniors, the system still has premiums, co-insurances, and deductibles that beneficiaries must pay out of pocket.

What does Medicare Part a cover?

After the initial Part A deductible has been paid by the beneficiary during the first 60 days, Medicare will cover all other costs associated with a room, meals, doctor and nursing services, treatment, and exams.

Does Medicare Part A have a deductible for assisted living?

The other portion of health care that Medicare Part A covers generally doesn’t require a deductible to be paid first. After a certain period of time, beneficiaries who require a stay in a skilled nursing facility will have to pay out of pocket for their stay. These costs include:

Does Medicare Part a cover in-home health services?

Beneficiaries who require in-home health services or stay in a hospice will face no deductible from their Part A coverage. The only out of pocket costs associated with Part A coverage for home health services and hospice stays involve premiums for medication and durable medical goods.

What is my deductible for Medicare Part A?

Part A Deductible: The deductible is an amount paid before Medicare begins to pay its share. The Part A deductible for an inpatient hospital stay is $1,556 in 2022. The Part A deductible is not an annual deductible; it applies for each benefit period.

How much did Medicare cost in 2013?

Most people will pay more for this government health care plan for seniors.2011 ADJUSTED GROSS INCOME$85,000 or less (single), $170,000 or less (joint)More than $214,000 (single), more than $428,000 (joint)2013 Medicare Part B monthly premium$104.90$335.702013 Medicare Part D monthly premiumpremium only$66.40 surcharge

What is the deductible for Medicare each year?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the annual deductible for Medicare Part A and B?

Yes—the deductible is the annual amount you pay for covered services before Medicare starts to pay. The Centers for Medicare & Medicaid Services recently released the 2022 Medicare Part A deductible ($1,556) and Part B deductible ($233).

What is the Medicare deductible for 2023?

$505CMS has released the following 2023 parameters for the defined standard Medicare Part D prescription drug benefit: Deductible: $505 (up from $480 in 2022); Initial coverage limit: $4,660 (up from $4,430 in 2022); Out-of-pocket threshold: $7,400 (up from $7,050 in 2022);

What is the Medicare Part B deductible 2012?

$140In 2012, the Part B deductible will be $140, a decrease of $22 from 2011.

How do I find out my deductible?

“Your deductible is typically listed on your proof of insurance card or on the declarations page. If your card is missing or you'd rather look somewhere else, try checking your official policy documents. Deductibles are the amount of money that drivers agree to pay before insurance kicks in to cover costs.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Does Medicare Advantage cover Part A deductible?

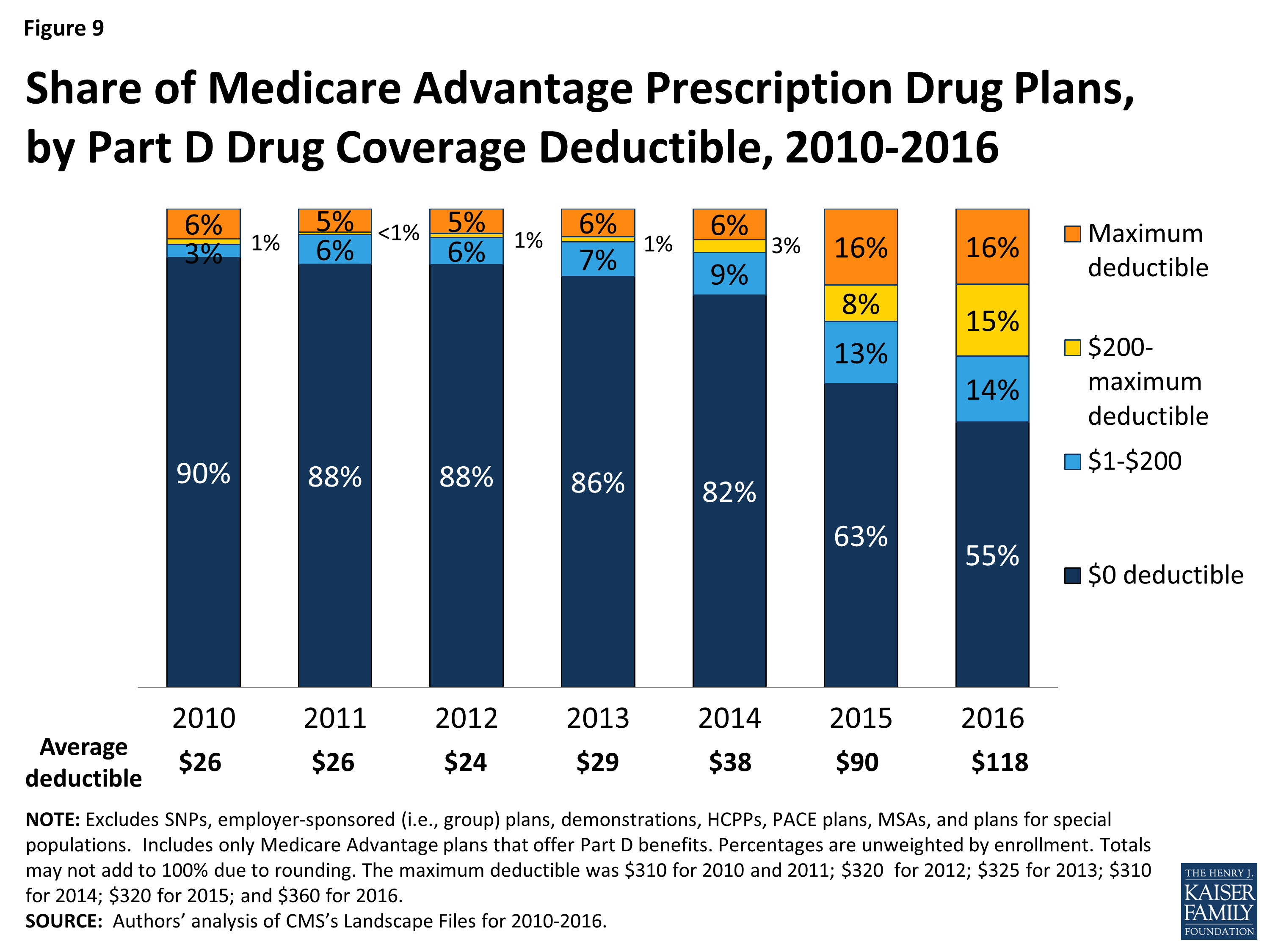

In the case of inpatient hospital stays, Medicare Advantage plans generally do not impose the Part A deductible, but often charge a daily copayment, beginning on day 1. Plans vary in the number of days they impose a daily copayment for inpatient hospital care, and the amount they charge per day.

What is the Medicare Part D deductible for 2022?

$480The initial deductible will increase by $35 to $480 in 2022. After you meet the deductible, you pay 25% of covered costs up to the initial coverage limit. Some plans may offer a $0 deductible for lower cost (Tier 1 and Tier 2) drugs.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Who pays for Medicare Part A?

Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums. If you or your spouse haven't worked at least 40 quarters, you'll pay a monthly premium for Part A.

Medicare Part B in 2013

The latest round of changes to Medicare premiums, deductibles, and copayments for hospitalization ( Part A) and medical care ( Part B) takes effect January 1st, 2013.

Medigap Protection Against Rate Increases

Perhaps you’ve noticed that you don’t have to pay many of the 2013 premiums and deductibles if you’re enrolled in a Medicare supplement plan. Medigap plans go far in helping eliminate Medicare out-of-pocket costs that seem to go up year after year.

How much is Part B deductible for 2013?

The Part B Deductible For 2013 Is $147. The good news for those who purchased or are considering purchase of either Plan G or Plan N is the nominal increase in the Part B deductible. The increase was only $7 – moving to $147 for 2013 – up from the current amount of $140 for 2012.

What is CMS 2013?

Every year The Center s for Medicare and Medicaid Services (CMS) make changes to the Medicare program. CMS has posted the numbers for 2013 and there are no alarming changes, but it is important to know what out of pocket expenses to expect going forward.

When will Medicare coinsurance increase?

Deductible and coinsurance amounts will increase January 1 and that will affect the cost sharing provisions of all Medicare supplement plans. Supplemental insurance plans are not “grandfathered-in.” Changes to Medicare by CMS affect all Medigap plans – both new and old.

Is there a cost sharing change for 2013?

For those who are new to Medicare or who have been enrolled for several years, it is important to note that there are no dramatic changes to the 2013 cost sharing amounts. Medigap Plan, F, G, N, K, L and High Deductible F are and will remain good choices for coverage.

Did Medicare Part B change in 2013?

2013 Medicare Part A and Part B Changes. At face value, there are no significant changes to the Medicare cost sharing amounts. As in past years, the limits to what certain Medicare supplement insurance and some Medicare Advantage plans must cover have only increased incrementally.

Is there a change in Medicare cost sharing?

At face value, there are no significant changes to the Medicare cost sharing amounts . As in past years, the limits to what certain Medicare supplement insurance and some Medicare Advantage plans must cover have only increased incrementally.

Is Plan G better than Plan F?

The cost share is low and will continue to remain that way. Thus, paying more for traditional Plan F is not necessarily the best option for some seniors. If Plan G is more than $12.25 less per month than Plan F, then Plan G can make good financial sense.

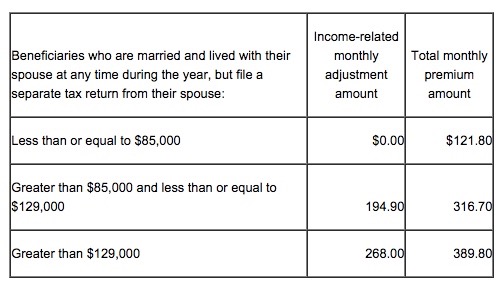

What is modified adjusted gross income?

Your modified adjusted gross income is your adjusted gross income plus your tax exempt interest income. Each year, Social Security will notify you if you have to pay more than the standard premium. The amount you pay can change each year depending on your income.

Can I get Medicare Part D?

Medicare Prescription Drug Plan (Part D) premiums*, deductibles, and benefits vary by plan and state. Remember that you can receive Part D prescription drug coverage from a stand-alone Medicare Part D plan (PDP) or a Medicare Advantage plan that includes drug coverage (MAPD).