Is Part B Medicare ever free?

Medicare Part B isn't free, and it doesn't cover everything Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California Life, Accident, and Health Insurance Licensed Agent, and CFA.

What is the monthly cost for Medicare Part B in 2022?

$170.10 forThe standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Will Medicare Part B premium go up in 2022?

If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022. That's a 14.5% increase, and is one of the steepest increases in Medicare's history.Jan 26, 2022

What is the basic cost for Medicare Part B?

The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the cost of Part B for 2022?

$170.102022. The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount.

Is Medicare premium based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the Medicare Part B deductible for 2020?

$198 inThe annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs.Nov 8, 2019

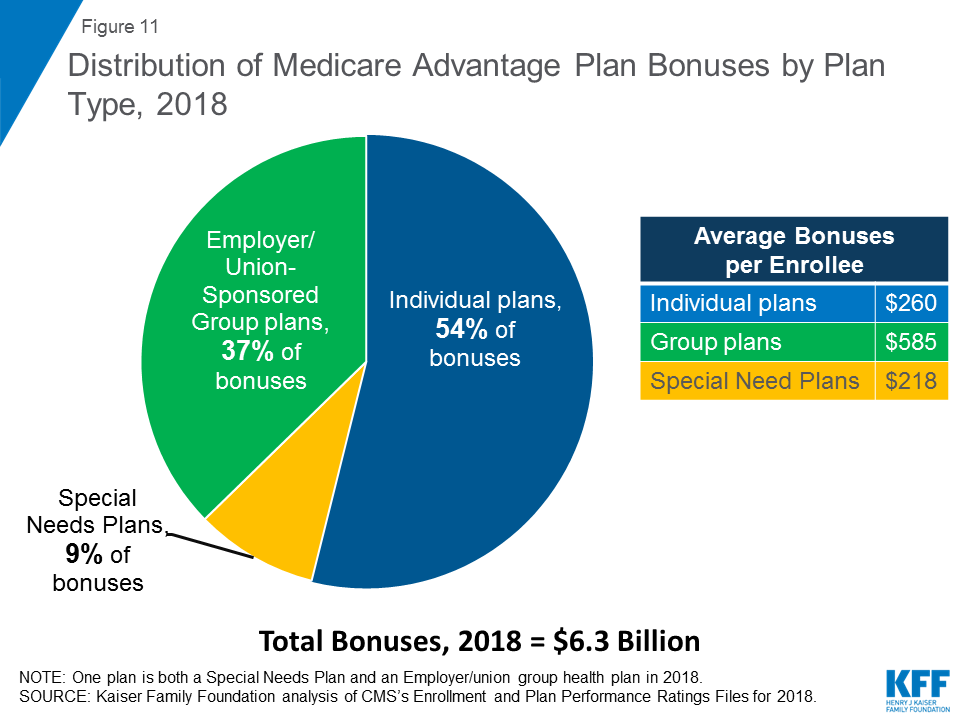

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much income is required to pay Part B?

Since 2007, people who earn more than $85,000 ($170,000 for a couple) have paid higher Part B premiums (and higher Part D premiums) based on their income. For the first time, the threshold for what counts as “high income” was adjusted for inflation as of 2020, increasing it to $87,000 for a single individual and $174,000 for a couple.

How much is the standard Part B premium in 2020?

The standard Part B premium increased by about $9/month in 2020. But the 1.6 percent Social Security COLA for 2020 increased the average beneficiary’s Social Security benefit by $24/month. Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees have been paying the standard premium in 2020.

What is the Medicare deductible for 2021?

Part B deductible also increased for 2021. Medicare B also has a deductible, which has increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20 percent of the Medicare-approved cost for Part B services.

How much is the Social Security Cola for 2021?

The high-income threshold (where premiums increase based on income) grew to $88,000 for a single person for 2021. The Part B deductible increased to $203 for 2021. Q: How much does Medicare Part B cost the insured? ...

How much is the 2020 Medicare premium?

Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month). But that’s in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium.

What is the income threshold for Part B?

For people with income above $87,000 ($174,000 for a couple) in 2020, Part B premiums for 2020 ranged from $202.40/month to $491.60/month. As explained by the math above, the high-income threshold has increased to $88,000 for a single individual and $176,000 for a couple in 2021.

How much is Part B insurance in 2021?

In 2021, most enrollees will be paying $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month).

What is the Social Security premium rate for 2021?

Beneficiaries new to Medicare and people on Medicaid will be subjected to the current premium rate. The Social Security COLA for 2021 is 1.3%. 3 This is estimated to be an additional $20 per month for the average recipient but the amount could be less.

What is Medicare Advantage Plan?

Medicare Advantage plans are offered by private insurance companies and will cover everything that Original Medicare offers and more.

How did price hikes affect people in 2019?

Price hikes predominantly affected people in the top three income brackets. In 2019, not only did the premium rates increase across all income brackets but the brackets changed again. Instead of five income brackets, there were six. The change in brackets affected those at the highest income level only.

How long do you have to pay Medicare premiums?

You pay monthly premiums for Medicare. If you do not pay your premiums in a timely manner, your coverage will be taken away. You are given a 90-day grace period to make payments before your Part B coverage is canceled.

Will Medicare premiums increase in 2021?

With a $3.90 increase in monthly premiums for 2021, it is unlikely that many people will have their premiums reduced this year. For those who are dual eligible, Medicaid will pay their Medicare premiums. They will be charged the higher Part B premium rates.

Does Medicare Part B premium apply to Part D?

However, keep in mind that the holds harmless provision does not apply to Medicare Part D.

Can everyone get hold harms?

Not everyone is eligible for the holds harms provision. Only people in the lowest income category who have already been on Medicare Part B and have had their premiums directly deducted from their Social Security checks for at least two months in the past year are considered.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much is Medicare Part B 2021?

Medicare Part B premium 2021: $148.50. Your income plays a part in your Part B premium. For 2021, individuals making $88,000 per year or less, and couples making $176,000 or less, pay the standard monthly amount of $148.50 each.

What is Medicare Part A deductible?

Medicare Part A Deductible. Most Part A costs come from the inpatient. Inpatient refers to medical care that requires admission to the hospital, usually overnight. hospital deductible. Inpatient care provided at a hospital or skilled nursing facility.

What is Medicare Part A coinsurance?

You’re responsible for a daily coinsurance. Coinsurance is the percentage of your medical costs that you pay after you meet your deductible.

How much does Medicare Part A coinsurance increase?

Part A coinsurance increases when your length of stay in a facility increases: 0 to 60 days. 61 to 90 days. You have a lifetime limit of reserve days to use if your stay lasts longer than 90 days. Medicare Part A daily coinsurance rates: Days 0-60: $0. Days 61-90: $371 per day. Lifetime Reserve Days: $742 per day.

What is Medicare Part A?

Medicare Part A is part of Original Medicare.

Does Medicare Part A and Part B increase premiums?

Not enrolling on time can increase your premium amount. Medicare Part A and Part B cover most of your healthcare. Healthcare is the industry dedicated to maintaining or improving health and well-being. services (hospital and medical). You can add supplemental insurance to help cover the costs of Original Medicare (Parts A and B)

Does Medicare Advantage have an AEP?

It’s also important to know that Medicare Advantage also has its own Annual Enrollment Period (AEP). Medigap: Medicare Supplement Insurance (Medigap) Medicare Supplement Insurance (Medigap) is designed to provide coverage that Original Medicare (Parts A and B) does not.

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

Is Medicare Advantage the lowest in 14 years?

The Medicare Advantage average monthly premium will be the lowest in fourteen years (since 2007). Premiums and deductibles for Medicare Advantage and Medicare Part D Prescription Drug plans are already finalized and are unaffected by this announcement.