Does Medicare charge a deductible?

Mar 19, 2021 · If you are a Medicare beneficiary and you go to the hospital, the hospital cannot refuse to admit or treat you based on lack of payment of your Medicare Part A deductible. In 2021, this amount is $1,484. Additionally, if you seek emergency treatment, you will have access to emergency services regardless of ability to pay, according to the Emergency Medical …

How long will Medicare pay for a hospital stay?

Dec 14, 2021 · Medicare Part D Deductible. Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible. Some Part D plans have $0 deductibles, but average Part D deductibles hover around $367 per year in 2022.

How much does Medicare pay for hospital stays?

Inpatient mental health care in a psychiatric hospital is limited to 190 days in a lifetime. It also includes inpatient care you get as part of a qualifying clinical research study. If you also have Part B, it generally covers 80% of the Medicare-approved amount for doctor’s services you get while you’re in a hospital.

Does Medicare Advantage have deductible?

Dec 10, 2021 · A study by the Kaiser Family Foundation found that the average out-of-pocket limit for Medicare Advantage recipients in 2021 was $5,091 for in-network services and $9,208 for combined in-network and out-of-network services.

What is the deductible for Medicare hospital?

$1,556Medicare Part A Deductible Medicare Part A covers certain hospitalization costs, including inpatient care in a hospital, skilled nursing facility care, hospice and home health care. It does not cover long-term custodial care. For 2022, the Medicare Part A deductible is $1,556 for each benefit period.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

PinPoints

Medicare made some modifications to the 2021 deductible. The rising cost of healthcare necessitates an increase in Medicare premiums and deductibles.

What changes are made to Medicare Part A in 2021?

Medicare Part A covers hospitalization, nursing home care, and a portion of home healthcare.

The adjustments to Medicare Part B for 2021 are as follows

Part B of Medicare covers physician costs, outpatient treatments, some home health care services, medical equipment, and medications.

Medicare Part D will have the following changes in 2021

Medicare prescription medication coverage is another name for Medicare Part D.

What changes are coming to Medigap in 2021?

Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

To fight the coronavirus (COVID-19)

On March 20, 2020, Medicare was modified to fulfil the needs of enrollees.

Conclusion

Apart from increased Medicare premiums and deductibles, there are more ways to save money on healthcare.

What is the Medicare deductible for 2021?

In 2021, this amount is $1,484.

What happens if you don't have Medicare?

If you have not enrolled in Medicare Part B (medical insurance) or a Medicare Advantage plan, and you don’t have other health insurance, the hospital may ask you to pay a deposit or show proof of ability to pay for the services of any staff doctor who might treat you during your stay.

How much is the Medicare deductible for 2021?

Assuming someone is ordered inpatient by a qualified practitioner and is a Medicare beneficiary, we can expect to get hit with a $1,484 deductible in 2021. This assumes the hospital stay is 60-days or less. *There are several nuances to the Medicare program that can’t always be anticipated.

What is Medicare Part A?

Medicare Part A is hospital insurance for Medicare beneficiaries. It is probably most well-known for covering services provided on an “inpatient” basis in the hospital. It also covers a few other skilled services I never want to use like hospice, home health, and skilled nursing care.

How long does Medicare last?

The benefit period only lasts for 60 inpatient days. So once the Medicare beneficiary ‘fills up’ their $1,484 bucket, Medicare covers them the rest of the way until they hit day 61. If the hospital stay goes on beyond 60 days, things get a little more complicated.

Does Medicare cover hospital stays?

Unfortunately, Medicare Part A does not cover the entire cost of the inpatient hospital stay. They pass the first $1,484 of the cost onto the Medicare beneficiary. So, an inpatient hospital stay will usually come hand-in-hand with the Medicare Part A deductible.

How much is Medicare Part B 2021?

For 2021, the Medicare Part B deductible is $203. This amount will be paid only once per year. The 2021 Part A deductible is $1,484 per benefit period. A benefit period in Part A begins on the first day you are admitted to the hospital and ends after you have spent 60 consecutive days out of the hospital.

How much is coinsurance for Medicare 2021?

For example, after you have paid the Medicare Part B (medical insurance) deductible for the year ($203 in 2021), you will be required to pay 20 percent of each service covered by Part B, and Medicare pays the remaining 80 percent. For Medicare Part A (hospital insurance), coinsurance is a set dollar amount that you pay for covered days spent in ...

What is the maximum out of pocket limit for Medicare?

The maximum out-of-pocket limit (MOOP) is the dollar amount beyond which your plan will pay for 100 percent of your healthcare costs. Copays and coinsurance payments go toward this limit, but monthly premiums do not. The 2021 maximum out-of-pocket limits are: 1 Original Medicare – No out-of-pocket limit. 2 Medicare Advantage – No Medicare Advantage plan can have a maximum out-of-pocket limit higher than $7,550, but not all plans will charge the full $7,550 amount. 3 Medigap – Some Medigap plans pay the Part A deductible and coinsurance so that your out-of-pocket costs don’t get too high. Beginning January 1, 2020, no Medigap plan covers the Part B deductible unless you already had a Plan C or Plan F. People eligible for Medicare before 2020 may still be able to purchase a Medigap Plan C or Plan F.

What is Medicare copay?

It’s important to know what Medicare copays , coinsurance, and deductibles are in order to find out what you’ll be paying for and to make the right decision about which Medicare coverage is right for you. Copays, coinsurance, and deductibles are all part of Medicare cost-sharing, or out-of-pocket costs . If these Medicare terms have got you ...

Who is Joan Biddle?

Joan Biddle is Lead Content Developer at Medicare World. Her 20 years of writing, editing, and research experience have prepared her to craft detailed, reliable articles that help people navigate complicated topics. She enjoys film, reading, poetry, and art.

What is a copay?

A copay, or copayment, is a predetermined, flat fee you pay for healthcare services at the time you receive care. For example, when you visit the doctor, purchase prescription drugs, or visit the hospital, you may be asked to pay before you receive your healthcare.

Does Medigap pay for coinsurance?

Medigap – Some Medigap plans pay the Part A deductible and coinsurance so that your out-of-pocket costs don’t get too high. Beginning January 1, 2020, no Medigap plan covers the Part B deductible unless you already had a Plan C or Plan F.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $148.50 per month. The maximum cost of Medicare Part B coverage is $504.90 per month in 2021, and that's for individuals reporting half a million dollars or more in income in 2019.

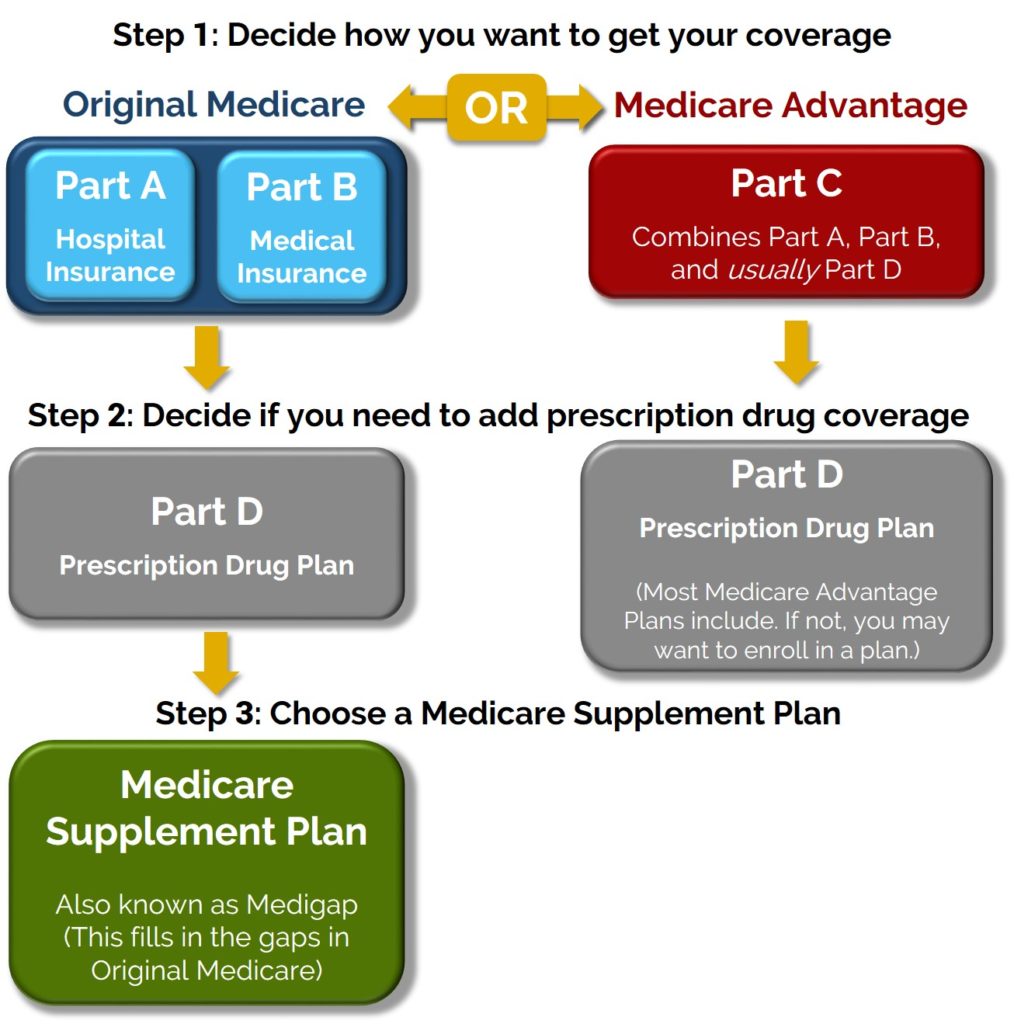

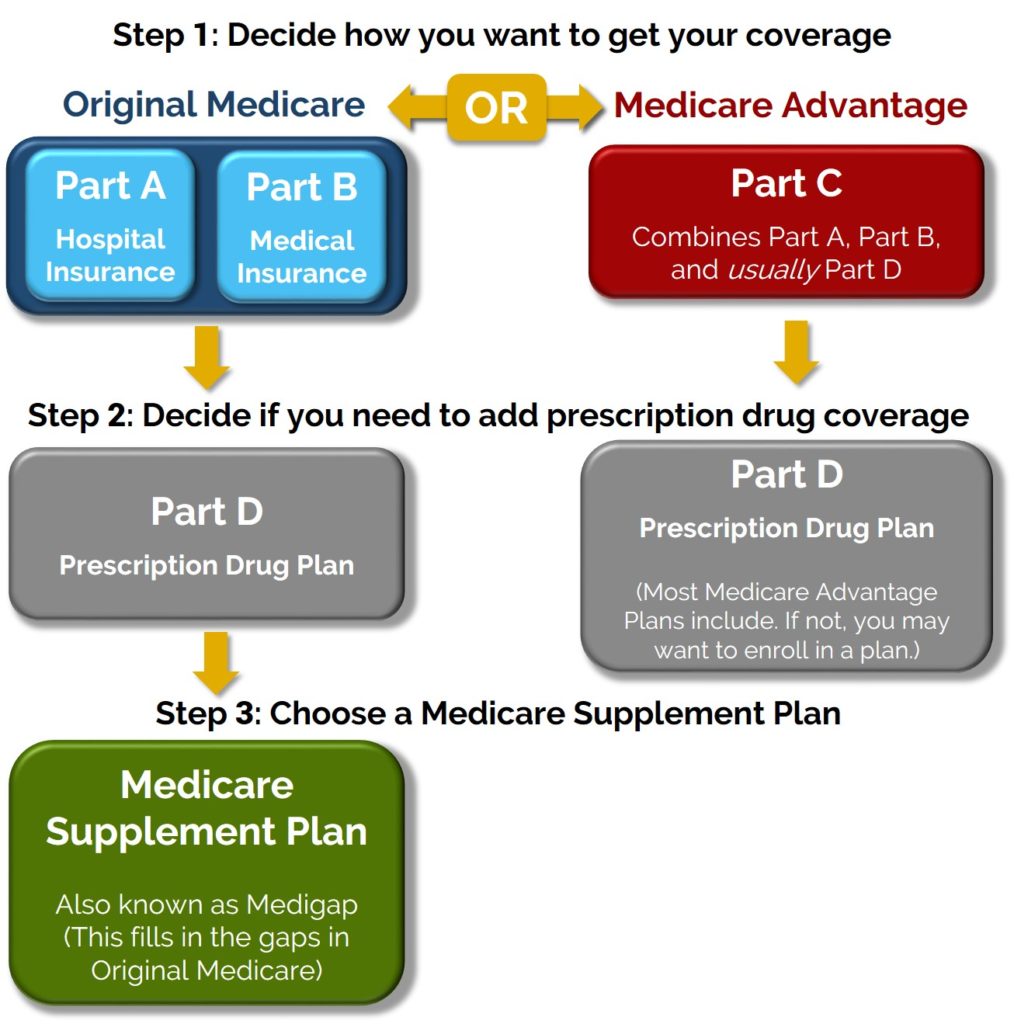

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,370 in 2021.

What is an inpatient hospital?

Inpatient hospital care. You’re admitted to the hospital as an inpatient after an official doctor’s order, which says you need inpatient hospital care to treat your illness or injury. The hospital accepts Medicare.

What is a critical access hospital?

Critical access hospitals. Inpatient rehabilitation facilities. Inpatient psychiatric facilities. Long-term care hospitals. Inpatient care as part of a qualifying clinical research study. If you also have Part B, it generally covers 80% of the Medicare-approved amount for doctor’s services you get while you’re in a hospital.

What is general nursing?

General nursing. Drugs as part of your inpatient treatment (including methadone to treat an opioid use disorder) Other hospital services and supplies as part of your inpatient treatment.

How much will Medicare cost in 2021?

In 2021, it costs $259 or $471 each month, depending on how long you paid Medicare taxes. 2 . That doesn’t mean you aren’t charged a deductible. For each benefit period, you pay the first $1,484 in 2021. A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days.

What is Medicare Part A 2021?

Medicare Part A Costs in 2021. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. 1 For most people, this is the closest thing to free they’ll get from Medicare, as Medicare Part A (generally) doesn't charge a premium. 2 . Tip: If you don't qualify for Part A, you can buy Part A coverage.

What does Medicare cover?

What you pay for Medicare depends on the type of enrollment you have: Parts A, B, C, and/or D. Part A covers inpatient hospitalization, skilled nursing facilities, home health care, and hospice care. It doesn't generally charge a premium. Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium ...

What is the cost of Part B insurance?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. Parts C and D are optional and may cover additional costs, including prescriptions.

How long does a hospital benefit last?

A benefit period begins when you enter the hospital and ends when you haven’t received any inpatient hospital services for 60 consecutive days . If you re-enter the hospital the day after your benefit period ends, you’re responsible for the first $1,484 of charges again. 3 .

What is the premium for Part B?

Part B is considered your medical insurance. It covers medical treatments and comes with a monthly premium of $148.50 in 2021. A small percentage of people will pay more than that amount if reporting income greater than $88,000 as single filers or more than $176,000 as joint filers. 3

Is Medicare free for 2020?

Updated December 29, 2020. You paid into Medicare all of your working career. You would think Medicare would be free once you enroll—but that’s only partially true. If you’re confused about what you’ll pay for Medicare, we have you covered.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.