Full Answer

How will the AHCA impact hospital revenues?

May 17, 2017 · The AHCA could hurt 11 million Medicare enrollees and the Medicare program itself. The AHCA’s per capita Medicaid caps could lead to cuts in services for low-income Medicare enrollees. “Don’t touch my Medicare” has been a rallying cry in recent years, first as Congress considered health reform and now as it debates the fate of the Affordable Care Act …

Will the American Health Care Act save money on Medicaid?

May 22, 2017 · A cap on Medicaid funding not only would affect low-income Medicare beneficiaries, it also could affect the Medicare program because of the close connections between Medicaid and Medicare. The AHCA...

How will the Senate Health Care Bill affect you?

May 18, 2017 · A cap on Medicaid funding not only would affect low-income Medicare beneficiaries, it also could affect the Medicare program because of the close connections between Medicaid and Medicare. The AHCA may on paper leave Medicare alone, but millions of Medicare beneficiaries and their families—and the Medicare program itself—would feel the …

How much will the Affordable Care Act cut Medicaid?

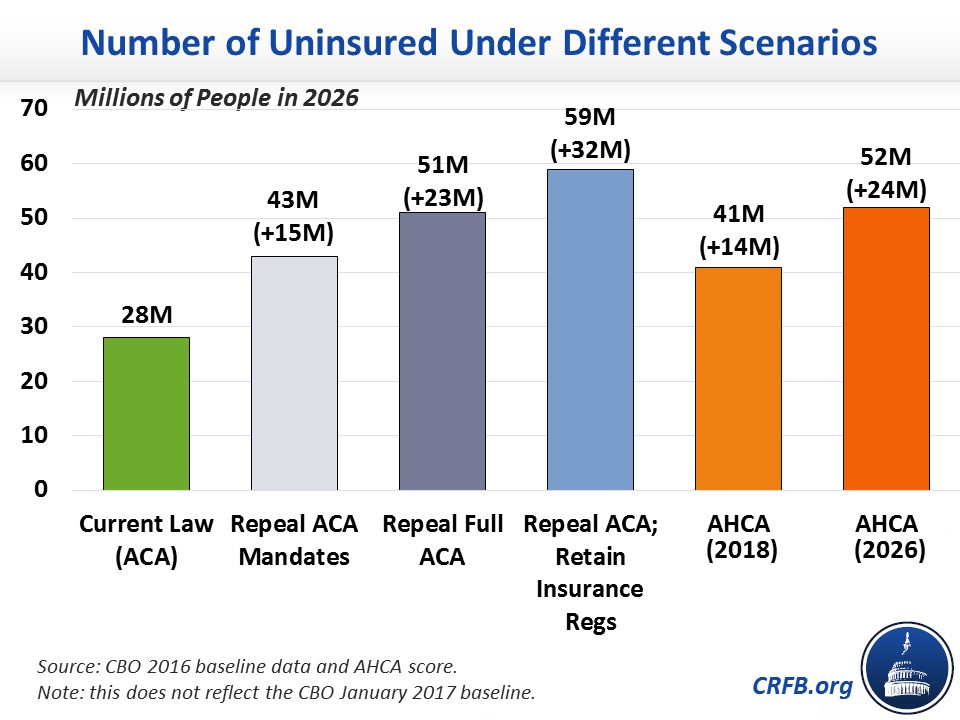

Mar 16, 2017 · Medicare pays what are called “disproportionate share hospital” payments to hospitals with many uninsured patients. As the AHCA leads more people to become uninsured, these Medicare payments would increase by $43 billion over the coming decade. Like the tax cut, this would impact the long-term health of Medicare.

What impact is the Affordable Care Act expected to have on Medicare?

The ACA made myriad changes to Medicare. Some changes improved the program's benefits. Others reduced Medicare payments to health care providers and private plans and extended the financial viability of the program. Still others provided incentives and created programs to encourage the system to provide better care.Oct 29, 2020

How will repealing Obamacare affect Medicare?

Dismantling the ACA could thus eliminate those savings and increase Medicare spending by approximately $350 billion over the ten years of 2016- 2025. This would accelerate the insolvency of the Medicare Trust Fund. Undoing the ACA would jeopardize these fiscal gains and harm Medicare's long term financial stability.Oct 29, 2020

What are the implications of repealing the Affordable Care Act for Medicare spending and beneficiaries?

Full repeal of the Medicare provisions in the ACA would increase payments to hospitals and other health care providers and Medicare Advantage plans, which would likely lead to higher premiums, deductibles, and cost sharing for Medicare-covered services paid by people with Medicare.

What are the implications of repealing the Affordable Care Act?

Before the crisis, ACA repeal was expected to cause 20 million people to lose coverage; millions more would likely lose coverage if the law were struck down during a recession, with commensurately larger impacts on access to care, financial security, health outcomes, and racial disparities in coverage and access to ...Oct 5, 2020

Who is the largest payer for healthcare in the US?

The Centers for Medicare & Medicaid Services (CMS) is the single largest payer for health care in the United States. Nearly 90 million Americans rely on health care benefits through Medicare, Medicaid, and the State Children's Health Insurance Program (SCHIP).

What preventive care services will Medicare beneficiaries receive as a result of the ACA?

The ACA now provides Medicare enrollees with access to specific preventive medical services at no out-of-pocket cost. These include flu shots, smoking cessation programs, an annual wellness visit for seniors, and screenings for cancer, diabetes and several other chronic diseases.

What impact did the Affordable Care Act have on the Centers for Medicaid and Medicare CMS in their effort to focus on both quality of care and cost reduction?

The Affordable Care Act reduces the practice of paying substantially more to private insurers that contract with Medicare than it would cost Medicare to cover those individuals in traditional Medicare.

Is the Affordable Care Act part of Medicare?

The 2010 Affordable Care Act (ACA) included many provisions affecting the Medicare program and the 57 million seniors and people with disabilities who rely on Medicare for their health insurance coverage.Dec 13, 2016

How does the Affordable Care Act affect the elderly?

"The ACA expanded access to affordable coverage for adults under 65, increasing coverage for all age groups, races and ethnicities, education levels, and incomes."Under the ACA, older adults' uninsured rate has dropped by a third, indicators of their health and wellness have improved, and they're now protected from ...May 13, 2021

Is Obamacare still in effect for 2021?

Is Obamacare still in effect? Yes, the Affordable Care Act (also called Obamacare) is still in effect.Dec 8, 2021

Can I stay on Obamacare instead of Medicare?

A: The law allows you to keep your plan if you want, instead of signing up for Medicare, but there are good reasons why you shouldn't. If you bought a Marketplace plan, the chances are very high that you do not have employer-based health care coverage.Sep 21, 2016

What effect will the repeal of the Patient Protection and Affordable Care Act have on health insurance markets?

Across the country, 29.8 million people would lose their health insurance if the Affordable Care Act were repealed—more than doubling the number of people without health insurance. And 1.2 million jobs would be lost—not just in health care but across the board.

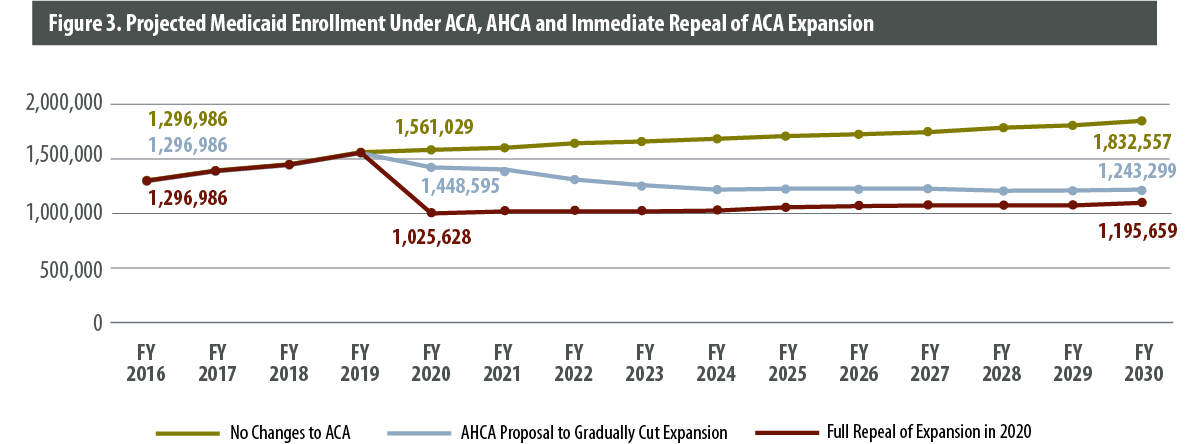

What is the AHCA per capita cap?

The AHCA’s Medicaid per capita caps would decouple the amount of federal financial support for Medicaid from actual costs and provide up to a preset capped payment for enrolled individuals. While today the federal government shares the actual cost of Medicaid expenditures, the AHCA would set federal funding based on state historic spending trended forward using national trend rates. The Congressional Budget Office projects that per-Medicaid enrollee health costs would grow faster than the annual increase in the capped federal payments, which is how the AHCA’s federal savings are achieved.

What percentage of dual eligibles receive full Medicaid?

The 72% of dual eligibles who receive full Medicaid benefits tend to be in poorer health than other Medicare and Medicaid beneficiaries and rely on Medicaid for high-cost services.

Does a cap on medicaid affect low income?

A cap on Medicaid funding not only would affect low-income Medicare beneficiaries, it also could affect the Medicare program because of the close connections between Medicaid and Medicare. The AHCA may on paper leave Medicare alone, but millions of Medicare beneficiaries and their families—and the Medicare program itself—would feel the impact.

What is the AHCA per capita cap?

The AHCA’s Medicaid per capita caps would decouple the amount of federal financial support for Medicaid from actual costs and provide up to a preset capped payment for enrolled individuals. While today the federal government shares the actual cost of Medicaid expenditures, the AHCA would set federal funding based on state historic spending trended forward using national trend rates. The Congressional Budget Office projects that per-Medicaid enrollee health costs would grow faster than the annual increase in the capped federal payments, which is how the AHCA’s federal savings are achieved.

What percentage of dual eligibles receive full Medicaid?

The 72% of dual eligibles who receive full Medicaid benefits tend to be in poorer health than other Medicare and Medicaid beneficiaries and rely on Medicaid for high-cost services.

Does a cap on medicaid affect low income?

A cap on Medicaid funding not only would affect low-income Medicare beneficiaries, it also could affect the Medicare program because of the close connections between Medicaid and Medicare. The AHCA may on paper leave Medicare alone, but millions of Medicare beneficiaries and their families—and the Medicare program itself—would feel the impact.

What are the effects of the American Health Care Act of 2017?

Included are the estimated impacts on net Federal expenditures, health insurance coverage, Medicaid enrollment and spending by eligibility group, gross and net premiums and out-of-pocket costs in the individual market, total national health expenditures, and the financial status of the Medicare Hospital Insurance (HI) trust fund. Not included in the estimates are the impacts of provisions that would affect other parts of the Federal Budget—such as those related changes in revenues associated with repealing taxes or fees that do not have a direct effect on the Medicare or Medicaid program—and Federal administrative costs.

What is not included in the federal budget?

Not included in the estimates are the impacts of provisions that would affect other parts of the Federal Budget—such as those related changes in revenues associated with repealing taxes or fees that do not have a direct effect on the Medicare or Medicaid program—and Federal administrative costs.

How will the American Health Care Act affect hospitals?

How the American Health Care Act’s Changes to Medicaid Will Affect Hospital Finances in Every State. The American Health Care Act (AHCA), as passed by the U.S. House of Representatives, will reduce federal spending on Medicaid by more than $834 billion over the next 10 years. And the recently released Senate bill appears to cut Medicaid even more ...

How much will Medicaid increase in 2026?

The hospitals in the District of Columbia and the 31 states that expanded Medicaid are projected to see a 78 percent increase in uncompensated care costs between 2017 and 2026. Eleven of these states will see uncompensated care costs at least double between 2017 and 2026.

How much will rural hospitals lose in Medicaid?

On average, rural hospitals in Medicaid expansion states may see an 18 percent reduction in Medicaid revenue, compared to a 14 percent decline for all hospitals in those states. For 10 states—including Michigan, New Mexico, Kentucky, and Nevada —rural hospitals would see a decline in Medicaid revenues of more than 20 percent between 2017 and 2026.

What will the operating margin be in 2026?

On average, operating margins for hospitals in expansion states will drop to –5.3 percent in 2026 under the AHCA. This means that hospitals will lose 5 cents on every dollar of patient revenue. Hospitals in 28 of the states that have expanded Medicaid are predicted to have negative operating margins under the AHCA by 2026.

Does the Senate bill cut Medicaid?

And the recently released Senate bill appears to cut Medicaid even more deeply. In addition to repealing the Medicaid expansion, the bills place caps on the federal dollars that states receive to provide health insurance to millions of low-income Americans, including the elderly, disabled, and people with opioid addiction.

Will operating margins decline over the next 10 years?

Operating margins—an important measure of a hospital’s financial health—for hospitals in all states are expected to decline over the 10-year period. This decline will be especially large for hospitals in expansion states as well as rural hospitals in nonexpansion states.

When will non grandfathered health plans be required to provide essential health benefits?

Starting on December 31, 2019 , non-grandfathered health plans in the individual and small group markets would no longer be required to provide all of the following Essential Health Benefits required under the ACA which include:

When will the FMAP rate be extended?

Beginning in January 2020, the bill would allow states to continue to receive the Federal Medical Assistance Percentage (FMAP) expansion rate for individuals who are already enrolled in Medicaid as of December 31, 2019, as long as they do not have a break in eligibility for more than a month. After January 1, 2020, the state could only enroll newly eligible individuals at the state’s traditional FMAP and not at the expansion rate.