Does the Senate Republicans’ plan end Social Security and Medicare?

The Democratic Senatorial Campaign Committee claimed that the "Senate Republicans’ plan" would "end Social Security" and "end Medicare." The ad refers not to a plan from Senate Republicans but from one Republican, Scott. The plan would sunset all federal laws after five years, requiring Congress to renew the laws it wants to keep.

Are Social Security and Medicare imperiled by Rick Scott’s plan?

Claims that Social Security and Medicare are imperiled are common during election campaigns. The DSCC attack goes too far in framing Scott’s idea as a broadly supported death sentence for Medicare and Social Security. The first thing to know is that Scott’s plan, released Feb. 22, was proposed by him — not a group of Senate Republicans.

What would happen to Medicare and Medicaid if Congress reversed Obamacare?

Congress would have to renew the laws it wants to keep. As the New York Times reported: "Taken literally, that would leave the fate of Medicare, Medicaid and Social Security to the whims of a Congress that rarely passes anything so expansive."

Did Rick Scott call for Medicare and Medicaid to be 'phased out'?

As the New York Times reported: "Taken literally, that would leave the fate of Medicare, Medicaid and Social Security to the whims of a Congress that rarely passes anything so expansive." As PolitiFact Wisconsin reported, Scott’s statement was generic and did not directly call for the phasing out of either program.

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

Is Medicare funded by Social Security?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare.

Are we going to lose Social Security?

As a result of changes to Social Security enacted in 1983, benefits are now expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted.

Where does funding for Medicare come from?

Medicare is funded through multiple sources: 46% comes from general federal revenue such as income taxes, 34% comes from Medicare payroll taxes and 15% comes from the monthly premiums paid by Medicare enrollees. Other sources of funding included taxation of Social Security benefits and earned interest.

What tax funds the Social Security and Medicare programs?

As you work and pay FICA taxes, you earn credits for Social Security benefits. How much is coming out of my check? An estimated 171 million workers are covered under Social Security. FICA helps fund both Social Security and Medicare programs, which provide benefits for retirees, the disabled, and children.

Who was the first president to dip into Social Security?

Which political party started taxing Social Security annuities? A3. The taxation of Social Security began in 1984 following passage of a set of Amendments in 1983, which were signed into law by President Reagan in April 1983.

What happens if Social Security runs out of money?

Reduced Benefits If no changes are made before the fund runs out, the most likely result will be a reduction in the benefits that are paid out. If the only funds available to Social Security in 2033 are the current wage taxes being paid in, the administration would still be able to pay around 75% of promised benefits.

What would replace Social Security?

In the proposals presented to the Commission, the use of retirement bonds--and annuities based on bond accumulations- would also replace the entire benefit structure of Social Security for the future.

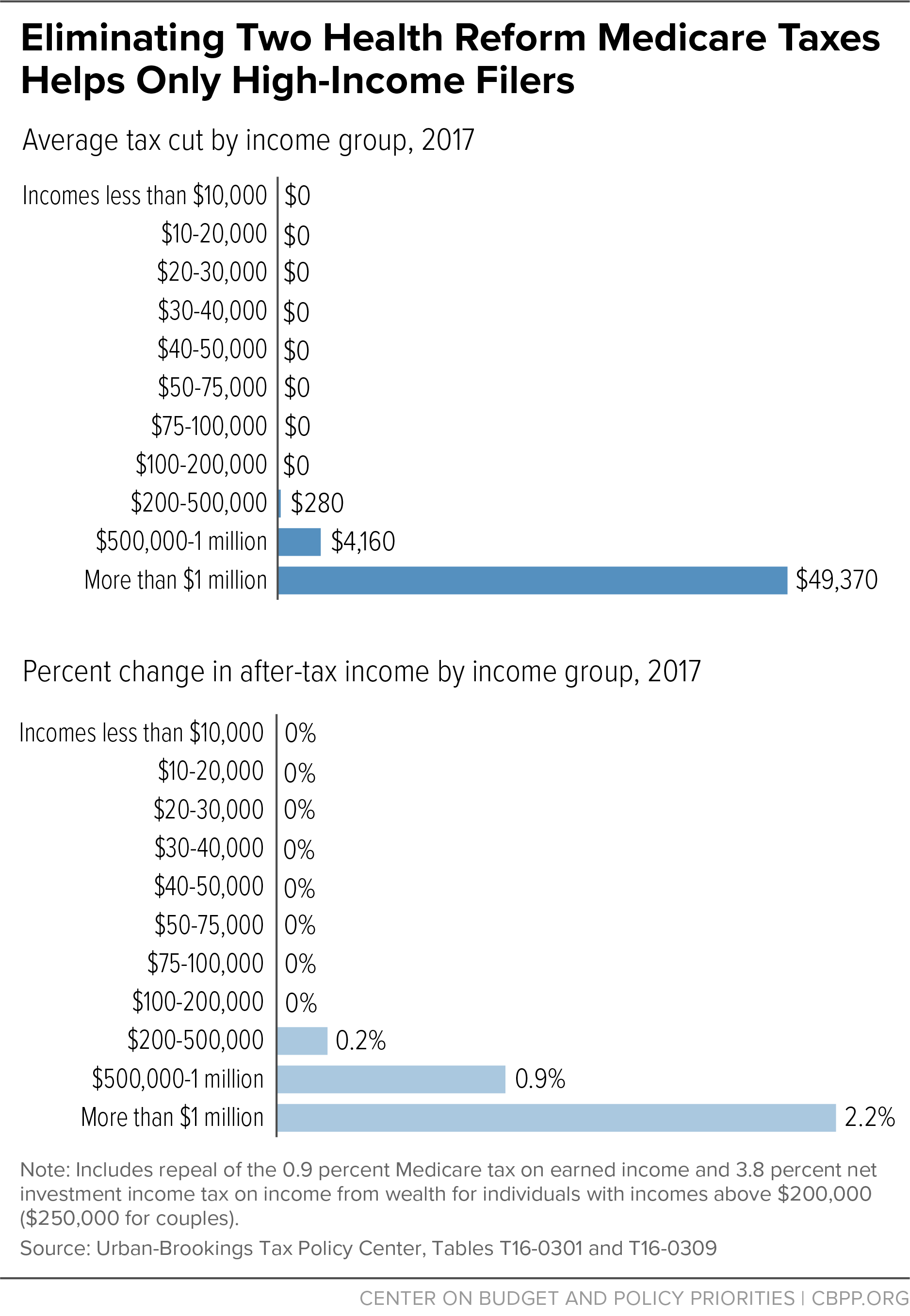

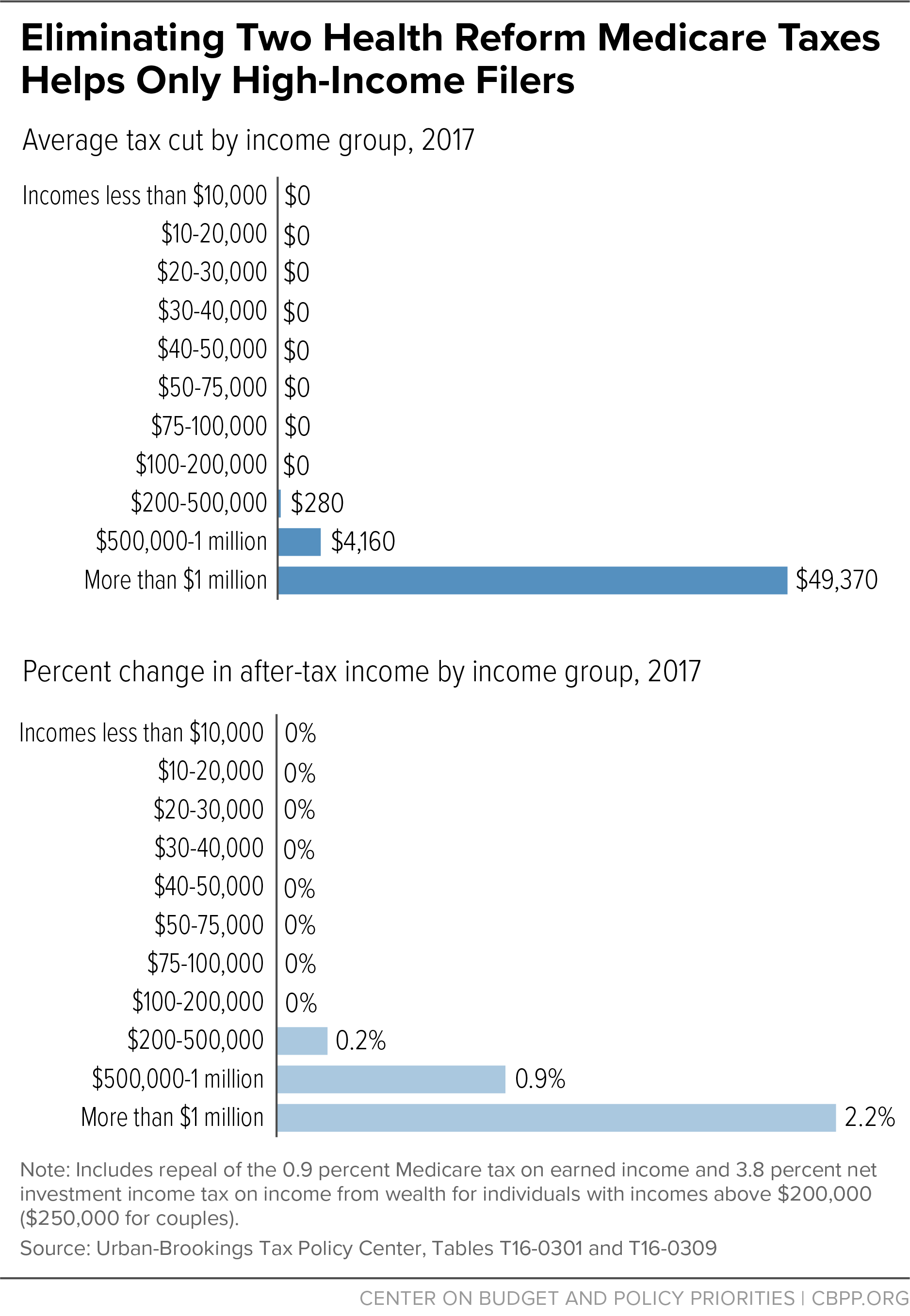

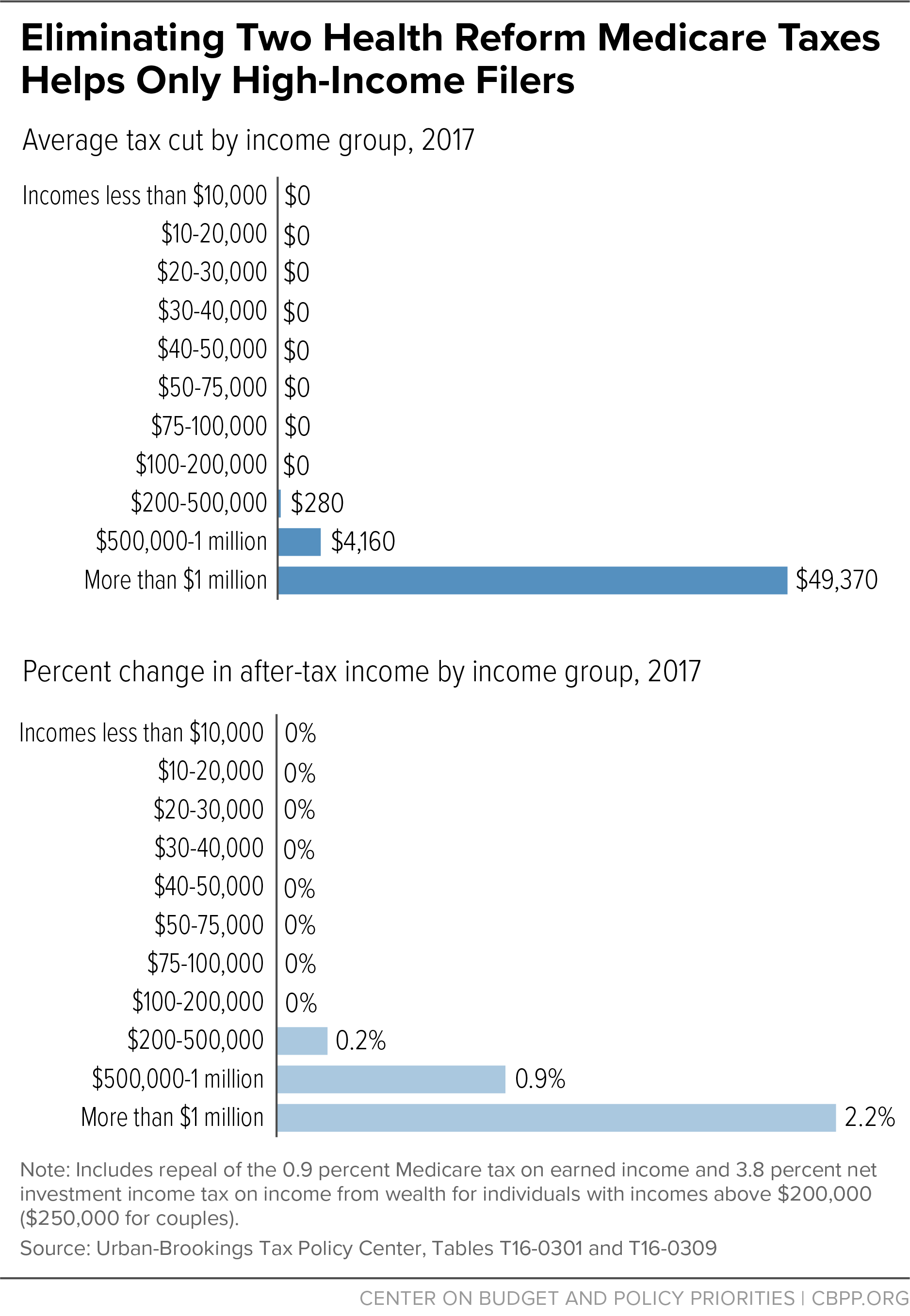

What is the Republican tax plan?

Republican Tax Plan: Tax Cuts for the Rich, Paid for by Everyone Else. This budget’s primary purpose is to provide reconciliation instructions for tax reform, but the Republican plan is not tax reform – it is a $2.4 trillion tax cut for the wealthy at the expense of everyone else. The inequities are startling.

What are the steps of the GOP?

This is step one of the GOP’s three steps to giving to the rich and making American families pay for it Republicans are trying to take away critical investments and benefits in a deceitful three-step process: Step 1: Cut taxes for the rich, and claim that economic growth will pay for it.

What is the step 3 of the tax cut?

Step 3: Cut important benefits for American families, like Medicare, Social Security, and education assistance, while doing nothing to make millionaires pay their fair share. Gives a massive tax cut to millionaires ― Millionaires get an average tax cut of $230,000 each year, once the plan is fully phased in 2027.

Which class pays for the tax cuts?

Middle class pays for the tax cuts for big corporations, wealthy partnerships, and rich estates ― Individual income taxes actually go up by $471 billion, while big corporations, wealthy passthroughs, and rich estates get their taxes cut by $2.9 trillion.

Will the middle class get taxed in 2027?

For every provision in the Republican plan which might help the middle class, Republicans take away other middle-class tax benefits, and many see their taxes go up. By 2027, nearly 30 percent of households earning $50k to $150k would see a tax increase, and 45 percent of all households with children face a tax increase.

What are the immediate benefits of a tax increase?

The immediate benefits are less inequality and better health outcomes, both of which ultimately support stronger economic growth. Improving revenues for these programs by, for example, increasing payroll taxes on the top income earners will ultimately result in stronger growth and shrinking federal deficits.

What was Donald Trump's signature legislative achievement?

Donald Trump’s signature legislative achievement was the Tac Cuts and Jobs Act of 2017. It showered trillions of dollars on highly profitable corporations and the richest American households that had seen the largest economic gains in the wake of the Great Recession from 2007 to 2009. Moreover, many provisions of this tax legislation are now permanent fixtures of the tax code and many temporary ones, such as tax cuts for high-income earners will likely become permanent, if past supply-side tax cuts are any indication.

When did the American Rescue Plan expire?

Most of its provisions expired in the second half of 2020. The newly elected Congress then enacted the American Rescue Plan in March 2021. It supports people, businesses and state and local governments with substantial yet temporary financial relief.

Does the Cares Act help the economy?

In contrast, the CARES Act offered much needed relief amid the worst unemployment crisis since the Great Depression, while it helped to stem the tide on declining economic growth. And experts predict that ARPA will boost economic growth to its highest rate in decades.

Is a balanced budget a public goal?

But a balanced budget is a completely arbitrary public finance goal. A country that has strong growth amid historically low interest rates can and will shrink its debt burden – defined as either the ratio of debt to gross domestic product (GDP) or as the share of interest payments out of GDP.

Did the Republican senators push for Medicare and Social Security?

Republican Senators Push Social Security, Medicare And Medicaid Cuts After Supporting Ineffective Tax Cuts. Opinions expressed by Forbes Contributors are their own. The economy is recovering from the depths of the pandemic in large part due to the massive relief packages that Congress passed in 2020 and 2021.