To appeal a higher Medicare Part B Premium, you must appeal the number that they use to set that premium which is the Income-Related Monthly Adjustment Amount. To do this, you must file the Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event form. This is Form SSA The United States Social Security Administration is an independent agency of the U.S. federal government that administers Social Security, a social insurance program consisting of retirement, disability, and survivors' benefits. To qualify for most of these benefits, most workers pay Social …Social Security Administration

What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

How much will you pay for Medicare Part B?

The standard Part B premium in 2021 is $148.50 per month, though you could potentially pay more, depending on your income. Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior.

How is the premium calculated for Medicare Part B?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

How to calculate your Medicare Part B premium?

The standard monthly premium for Part B is $148.50 for 2021. The total Medicare cost is what you get out of Medicare. Simply add up the Original Medicare (Part A and B) costs and the other benefits you get.

Why is my Medicare Part B bill so high?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How do I get my $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How do I appeal Part B Irmaa?

Even if you haven't experienced a life-changing event, you can still appeal an IRMAA. Request an appeal in writing by completing a request for reconsideration form. To get an appeal form, you can go into a nearby Social Security office, call 800-772-1213, or check the Social Security website.

Are Medicare Part B premiums recalculated each year?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How can I lower my Medicare Part B premium?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

How do I appeal Medicare Part B penalty?

To appeal, follow the directions on the letter informing you about the penalty. If you do not have an appeal form, you can use SSA's request for reconsideration form. You can appeal to remove the penalty if you think you were continuously covered by Part B or job-based insurance.

How do you win a Medicare appeal?

File a written request asking Medicare to reconsider its decision. You can do this by writing a letter or by filing a Redetermination Request form with the Medicare administrative contractor in your area. The address should be listed on your Medicare summary notice.

What is the standard Medicare Part B premium for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How do I get my Medicare premium refund?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.

Modified Adjusted Gross Income

Your MAGI amount is made up of your total adjusted gross income plus any tax-exempt interest income. These are line items 37 and 8b, respectively,...

Qualifying Reasons For A Medicare Part B Premium Appeal

There are a number of reasons that you might qualify for a lower premium. Social Security calls these Life-Changing Events.The most common reason i...

How to File Your Medicare Reconsideration Request

If you wish to appeal your IRMAA, you should visit the Social Security website. Find the form called Request for Reconsideration. This form gives y...

Part D Income Adjustments

IRMAA also affects your Part D premium. Unlike Medicare Part B, your Part D premium varies based on which Part D drug plan you have chosen to enrol...

Plan The Timing of Your Medicare Enrollment

Social Security automatically adjusts your premium at the start of each new year. You will receive a letter December or January notifying you of yo...

Plans That Save You Money

Plan G is a very popular plan among our higher income clients. In return for covering a small, once annual Part B deductible (currently $166 in 201...

How to contact SSA about Medicare Part B?

Contact the SSA at 800-772-1213 to learn how to file this request. If the reconsideration is successful, then the Medicare Part B enrollee’s Part B premium amount will be corrected.

How much is Medicare Part B premium for 2020?

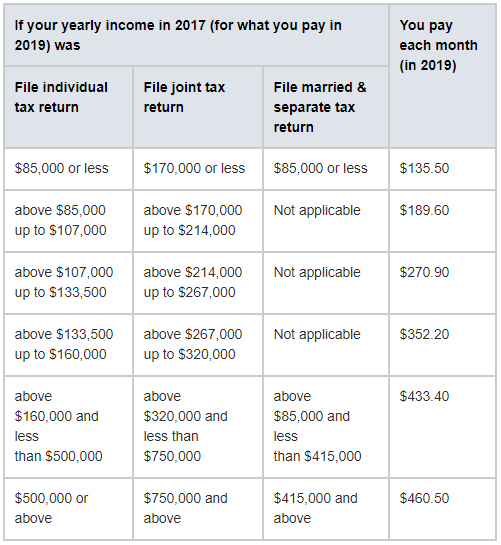

For 2020, the Medicare Part B monthly premiums are shown in the following table: Note the following: (1) the standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019; and. (2) Medicare Part B enrollees whose modified adjusted income above a certain level must pay an income-related ...

Why don't Medicare beneficiaries pay Medicare Part A?

About 99 percent of Medicare beneficiaries do not pay a Part A premium because they have at least 40 quarters of Medicare hospital insurance-covered employment. This means these individuals have been paying the Medicare Part A payroll tax (hospital insurance tax) for at least 10 years. Medicare Part B covers physician services, ...

How long does it take to appeal a Medicare Part B denial?

If the Council denies the enrollee’s appeal, then the Medicare Part B enrollee can choose to appeal to the Federal District Court within 60 days of the date on the Council denial.

What documentation is needed for Medicare Part B?

The Medicare Part B enrollee needs to provide documentation of either the correct income or the life-changing event that caused the Medicare Part B enrollee’s income to decrease.

What is Medicare Part B?

Medicare Part B covers physician services, outpatient hospital services, durable medical equipment and certain other medical and home health care services not covered by Medicare Part A. By being enrolled in a Federal Employees Health Benefits (FEHB) program health insurance plan and in Medicare Parts A and B, a federal annuitant will minimize, ...

When will Medicare Part B be released?

For 2020, in late November or early December 2019 Medicare Part B enrollees received notification about their 2020 Medicare Part B monthly premiums, as well as whether they will have to pay an IRMAA.

How much is IRMAA 2021?

Right now in 2021, Part D premiums range from around $7 to over $180/month, depending on where you live. (For more on finding the right Part D plan, visit our pages about Part D .)

What happens if Medicare denies your appeal?

If they deny your appeal, they will provide instructions on how to appeal the denial to an Administrative Law Judge. Be aware that you will continue to pay the higher Medicare Part B premium while your appeal is in process. However, if your appeal is approved, it could be retroactive for any months you have already paid.

How much is Part B deductible in 2021?

In return for covering a small, once annual Part B deductible ($203 in 2021) you can sometimes find premiums as much as $250 lower than a Plan F. That keeps money in your pocket. Medigap plans L, M, N and High Deductible F are also great solutions for high income individuals.

What happens if you owe a higher premium?

If they determine you owe a higher premium based on your MAGI, they will send you a letter to notify you of your new amount. They will also give you the reason for their determination. If you disagree with this amount, you have the right to appeal it via a reconsideration request.

What is MAGI on SSA-44?

Your MAGI amount is made up of your total adjusted gross income plus any tax-exempt interest income. (The Form SSA-44 has instructions which explain which line numbers from your IRS Tax return that you will use to calculate this number).

How Medicare Part B Premiums are Determined

When you add your total adjusted gross income and tax-exempt interest income the resulting figure is your Modified Adjusted Gross Income or MAGI. Your MAGI is taken from your most recent tax returns. This means your Part B premium is based on your income from 2 years ago. For example, the 2021 premium was based on the 2019 tax return information.

When to File a Medicare Part B Premium Appeal

When your life changes dramatically and that has a substantial impact on your finances, Social Security will reconsider the amount that you are being asked to pay. For instance, when you retire, your income will be far less than when you worked full time. Social Security will likely readjust the amount to fit your new income.

Should I Appeal a Medicare Part B Premium?

If you have had a change in income and you feel that you are being asked to pay too much you should appeal your Medicare Part B Premium. It doesn’t ever hurt to double check or to try. As long as you represent honest information, the worst thing they can do is say no.

How to Appeal a Higher Medicare Part B Premium

To appeal a higher Medicare Part B Premium, you must appeal the number that they use to set that premium which is the Income-Related Monthly Adjustment Amount. To do this, you must file the Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event form. This is Form SSA-44 and is available online to be printed out.

Part D Income Adjustments

Income-Related Monthly Adjustment Amount (IRMAA) is also used in setting your Part D premiums. If there is a decision that your IRMAA is wrong or it is readjusted this will also affect your Part D premiums.

Saving Money with Medicare Planning

It is a good idea to work with a financial planner. They can help you to time the distribution of your retirement benefits so it will have as little of an effect on your Medicare coverage as possible.

Lowering Your Part B Premium

Individuals on Medicare (Medicare beneficiaries) have the right to appeal the amount you are paying for your Medicare Part B coverage. This is the monthly amount either paid directly – or deducted from your Social Security benefits.

Appeal Medicare Charges: What Is IRMAA?

If your income is above a certain amount (set by the government) you may have to pay an Income-Related Monthly Adjustment Amount (IRMAA). This is in addition to your Medicare Part B and/or Medicare Part D premiums.

If Any Of These Occur, You Can Seek A Reduction

You can appeal for two reasons. First, you believe that the income information used was incorrect or outdated. For example, you filed an amended (corrected) tax return.

You Can Appeal An IRMAA Decision

Even if you don’t qualify based on the reasons above, but you still disagree with the IRMAA amount, you can request a ‘reconsideration’. You do this by contacting the Social Security hotline or make an appointment at your local office.

How long does it take for Medicare to adjust?

Yet it might take Medicare — which charges higher earners more for premiums — a couple years to adjust when income falls below the threshold.

How much is Part D insurance?

For Part D, the surcharges range from $12.20 to $76.40. That’s in addition to any premium you pay, whether through a standalone prescription drug plan or through an Advantage Plan, which typically includes Part D coverage. While the premiums vary for prescription coverage, the average for 2020 is about $42.

How many people pay Medicare monthly surcharges?

Of Medicare’s 62 million beneficiaries, about 7% — 4.3 million people — pay those monthly surcharges, due to various legislative changes over the years that have required higher-earners to pay a greater share of the program’s costs.

Did Medicare have your 2018 tax return for 2020?

In other words, for 2020, that would have meant your 2018 tax return was used. “They did the adjustment late last year and, at that point, they only had your 2018 tax return because you hadn’t prepared your 2019 return yet,” explained Roger Luchene, a Medicare agent with Hammer Financial Group in Schererville, Indiana.

What is an appeal in Medicare?

An appeal is the action you can take if you disagree with a coverage or payment decision by Medicare or your Medicare plan. For example, you can appeal if Medicare or your plan denies: • A request for a health care service, supply, item, or drug you think Medicare should cover. • A request for payment of a health care service, supply, item, ...

What to do if you didn't get your prescription yet?

If you didn't get the prescription yet, you or your prescriber can ask for an expedited (fast) request. Your request will be expedited if your plan determines, or your prescriber tells your plan, that waiting for a standard decision may seriously jeopardize your life, health, or ability to regain maximum function.

How long does Medicare take to respond to a request?

How long your plan has to respond to your request depends on the type of request: Expedited (fast) request—72 hours. Standard service request—30 calendar days. Payment request—60 calendar days. Learn more about appeals in a Medicare health plan.

How to ask for a prescription drug coverage determination?

To ask for a coverage determination or exception, you can do one of these: Send a completed "Model Coverage Determination Request" form. Write your plan a letter.

How long does it take to appeal a Medicare denial?

You, your representative, or your doctor must ask for an appeal from your plan within 60 days from the date of the coverage determination. If you miss the deadline, you must provide ...

How long does it take for a Medicare plan to make a decision?

The plan must give you its decision within 72 hours if it determines, or your doctor tells your plan, that waiting for a standard decision may seriously jeopardize your life, health, or ability to regain maximum function. Learn more about appeals in a Medicare health plan.

How long does it take to get a decision from Medicare?

Any other information that may help your case. You’ll generally get a decision from the Medicare Administrative Contractor within 60 days after they get your request. If Medicare will cover the item (s) or service (s), it will be listed on your next MSN. Learn more about appeals in Original Medicare.

What is a request for reconsideration?

A Request for Reconsideration is a petition that you can file with Social Security if you feel your premium amount is unwarranted or based on inaccurate information (more on that below). Once you retire, your income is likely to drop. Yet, the IRMAA can cause you to pay may more even though at retirement your income is lower.

How long does it take to file an appeal with the ALJ?

You must submit any new evidence within 10 days of filing your appeal to the ALJ. Contact the ALJ to learn how to submit this. You can ask the ALJ for an extension if you are unable to submit new evidence within 10 days. If your ALJ appeal is successful, your premium amount will be corrected.

How long ago was Social Security based on MAGI?

So the amount that they are basing your premium on could be your MAGI from 18-24 months ago.

What happens if the MAC denies your appeal?

If the MAC denies your appeal, you can choose to appeal to the federal judicial district has at least one courthouse, and most districts have more than one. Each state has at least one judicial district. The level in the Medicare process of appeals that comes after the Medicare Appeals Council (MAC) level.

How long does it take to appeal a reconsideration?

If your reconsideration is denied, you can appeal to the Administrative Law Judge (ALJ) within 60 days of the date on the reconsideration denial. Follow the directions on the denial to file an appeal with the ALJ.

How much will Social Security pay for Part B in 2021?

Most people pay the standard Part B premium amount ($148.50 in 2021). Social Security will tell you the exact amount you’ll pay for Part B in 2021. You pay the standard premium amount if: ■ You enroll in Part B for the first time in 2021. ■ You don’t get Social Security benefits.

What is the most common loss of pension income?

Loss or reduction of certain kinds of pension income. The most common of these is work reduction or work stoppage. If you were making $100,000 when you retired two years ago and your retirement income is now $40,000, you have a pretty good case for having your premium reduced.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is IRMAA in insurance?

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.