Most railroad workers enroll in Medicare by contacting their local Railroad Retirement Board The U.S. Railroad Retirement Board is an independent agency in the executive branch of the United States government created in 1935 to administer a social insurance program providing retirement benefits to the country's railroad workers.Railroad Retirement Board

Full Answer

What is the difference between Medicare and Medicare railroad?

You can get Medicare Part A at age 65 without paying any premiums if:

- You receive Railroad Retirement Board benefits; or

- You are eligible to receive Railroad Retirement Board benefits or Social Security benefits but have not yet filed for them; or

- You or your spouse had Medicare-covered government employment.

Do you pay into Railroad Retirement?

Railroad employees pay into the Railroad Retirement system instead of paying Social Security tax and receive similar benefits. Some of these benefits may be taxable. Railroad retirement pension benefits fall into several categories with varying tax consequences.

Is Medicare and the Railroad Retirement Act related?

The Medicare program covers railroad workers just like workers under social security. Railroad retirement payroll taxes include a Medicare hospital insurance tax just like social security payroll taxes.

Is railroad Medicare different than Medicare?

There is not much difference between Railroad Medicare and regular Medicare. The first difference is that Railroad Medicare is given to railroad retirement annuitants. This type if Medicare extends to their families as well. You will want to think of this Medicare as basically like receiving Social Security benefits upon retirement.

Who is entitled to railroad Medicare?

-- Most people age 65 or older who are citizens or permanent residents of the United States are eligible for free Medicare hospital insurance (Part A). You are eligible at age 65 if you receive or are eligible to receive railroad retirement or social security benefits.

Is there a difference between railroad Medicare and regular Medicare?

A: The only difference is that retired railroad beneficiaries have their Part B benefits administered by the Palmetto GBA Railroad Retirement Board Specialty Medicare Administrative Contractor (RRB SMAC) regardless of where they live. Members should be certain to advise providers of this when they receive treatment.

How do I contact railroad Medicare?

Provider Contact Center: 888-355-9165 Representatives are available Monday through Friday from 8:30 a.m. to 4:30 p.m. for all time zones with the exception of PT, which provides service from 8 a.m. to 4 p.m.

What is railroad Medicare?

The Federal Medicare program provides hospital and medical insurance protection for railroad. retirement annuitants and their families, just as it does for social security beneficiaries.

Can I collect social security and Railroad Retirement?

If a railroad retirement annuitant is also awarded a social security benefit, the Social Security Administration determines the amount of the social security benefit due, but a combined monthly dual benefit payment should, in most cases, be issued by the RRB after the railroad retirement annuity has been reduced by the ...

How do I submit a claim to railroad Medicare?

You can either file electronic claims to Railroad Medicare through a clearinghouse or other third-party claims submitter, or you can submit paperless claims directly through Palmetto GBA's online provider portal eServices eClaims option.

Is Railroad Medicare an Advantage plan?

Yes, Railroad Medicare beneficiaries can choose to enroll in Medicare Advantage plans.

Does Railroad Medicare have a provider portal?

Events. Palmetto GBA Railroad Medicare is pleased to offer eServices, our free Internet-based, provider self-service portal. The application provides information access over the Web for the following online services: Eligibility.

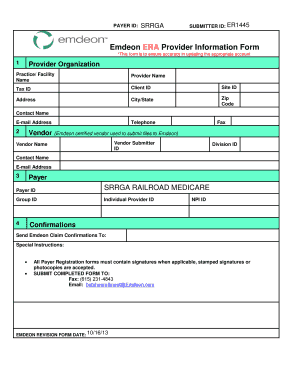

What is the payer ID for railroad Medicare?

MR018Payer Name: Medicare - Railroad|Payer ID: MR018|Professional (CMS 1500)

Does Railroad Retirement pay more than social security?

Benefits awarded by the RRB in fiscal year 2020 to aged and disabled widow(er)s of railroaders averaged about $2,340 a month, compared to approximately $1,355 under social security.

What is the difference between Railroad Retirement and social security?

The most obvious difference between the benefits that the Railroad Retirement program and Social Security provide is the additional Tier II benefit available for railroad workers. As noted previously, the Tier II benefit is designed to resemble a comparable private defined benefit pension.

How much is the average railroad pension?

In January 2022, the average regular railroad retirement employee annuity will increase $138 a month to $3,104 and the average of combined benefits for an employee and spouse will increase $194 a month to $4,501.

What to do if you are not collecting Railroad Retirement?

If you are not collecting Railroad Retirement benefits when you turn 65, you should contact your local RRB field office to enroll in Medicare. If you are under 65 and have a disability, you will have to fulfill different eligibility requirements to qualify for Medicare.

What Medicare Parts does RRB automatically enroll you in?

If you are receiving Railroad Retirement benefits or railroad disability annuity checks when you become eligible for Medicare, RRB should automatically enroll you in Medicare Parts A and B . You should receive your red, white, and blue Medicare card and a letter from RRB explaining that you have been enrolled in Medicare.

Does Medicare Part B get deducted from your check?

If you receive Railroad Retirement benefits or railroad disability annuity checks, your Medicare Part B premium should be automatically deducted from your check each month. If you do not qualify for premium-free Part A, it will also be deducted from your check.

Where is the railroad retirement board on my Medicare card?

Your Medicare card is similar to the new Medicare cards that all beneficiaries receive, with the exception that “Railroad Retirement Board” is printed in a red banner at the bottom of the card .

What happens if you receive a railroad retirement?

If you receive Railroad Retirement benefits or disability annuity benefits from the railroad at the time of eligibility for Medicare, you are automatically enrolled in Medicare Parts A and B by the RRB. After the RRB automatically enrolls you, you receive your Medicare card together with a letter from the RRB explaining ...

What is the RRB?

The RRB administers insurance and retirement benefits to all railroad workers in the country. Instead of getting retirement benefits from the U.S. Social Security Administration as other workers do, the RRB provides railroad workers and their families with retirement benefits, along with unemployment and sickness benefits, ...

Do you have to go through the Social Security Administration if you are employed by the railroad?

However, if you have end-stage renal disease (ESRD) and qualify for Medicare, you must go through the Social Security Administration even if you are employed by the railroad.

Does Medicare cover railroad employees?

Medicare offers coverage to railroad employees just as it does for people who have Social Security. The payroll taxes of railroad employees include railroad retirement and Medicare hospital insurance taxes.

What is the number to call a railroad retirement board?

Call a Licensed Agent: 833-271-5571. Due to COVID-19, the Railroad Retirement Board closed offices as of March 16, 2020. We’ll keep you updated on when offices reopen. In the meantime, visit RRB.gov to learn about your online self-serve options.

How long do you have to enroll in Medicare if you have end stage renal disease?

Whether you become eligible for Medicare via age or disability, you’ll have seven months, called your Initial Enrollment Period (IEP), in which to enroll.

What is the RRB in 2020?

Licensed Insurance Agent and Medicare Expert Writer. June 15, 2020. Before the Social Security Administration (SSA) was formed, the Railroad Retirement Board (RRB) developed retirement, disability, and unemployment benefits for railroad workers who were hit hard by the Great Depression. Today, the RRB offers railroad workers a similar safety net.

When do you become eligible for Medicare?

Typically, you’ll become eligible when you turn 65 or reach your 25th month of receiving disability benefits. The main difference is that the RRB classifies disability differently than the SSA does, so check with a representative ...

Does Medicare pay through the RRB?

Generally, your Medicare costs through the RRB will be the same as those paid by people who qualify for Medicare via Social Security. Just like workers outside the railroad industry, you’ll see Medicare deductions from your paycheck during your working years.

Does RRB have Medicare?

Today, the RRB offers railroad workers a similar safety net. RRB beneficiaries can tap into Medicare benefits, much like Social Security beneficiaries, with a few differences. If you are a railroad worker, learn what you can expect from Medicare in terms of eligibility, enrollment, costs, and health benefits—and how your RRB benefits differ ...

Do you pay Medicare Part D premiums through RRB?

If you add Medicare Part D, Medigap, or Medicare Advantage, you’ll pay additional premiums for these as well, but not through your RRB income checks. You’ll pay for each of these coverages separately, directly to the insurance company that provides each plan.

How does Medicare work with my job-based health insurance when I stop working?

Once you stop working, Medicare will pay first and any retiree coverage or supplemental coverage that works with Medicare will pay second.

When & how do I sign up for Medicare?

You can sign up anytime while you (or your spouse) are still working and you have health insurance through that employer. You also have 8 months after you (or your spouse) stop working to sign up.

Do I need to get Medicare drug coverage (Part D)?

Prescription drug coverage that provides the same value to Medicare Part D. It could include drug coverage from a current or former employer or union, TRICARE, Indian Health Service, VA, or individual health insurance coverage.

How old do you have to be to retire from the railroad?

You can start drawing railroad retirement at age 60 with 30 years of experience, but applying before full retirement age means you’ll receive a reduction if you don’t have enough years of service.

When can I start collecting railroad benefits?

You can begin receiving your benefits: At age 60, if you have 30 or more years of qualified work, or. At age 62.

What is the RRB?

The Railroad Retirement Board (RRB) works with Social Security to provide retirement and disability benefits for qualified railroad workers and their qualified survivors. If you’re already receiving railroad benefits or Social Security, you’ll be automatically enrolled in Medicare. Original Medicare is a fee-for-service health insurance program ...

What are the benefits of railroad retirement?

One of the enormous benefits of receiving railroad retirement is how well it works with Social Security and Medicare. Quick history lesson: The Railroad Retirement Act of 1934 didn’t just protect railroad workers–it laid the groundwork for Social Security the following year. Because of this, the Social Security and the Railroad Retirement Board ...

Does Railroad Retirement work with Social Security?

Remember, railroad retirement works with Social Security, not in addition to it. That means your RRB benefit subtracts the amount you receive from Social Security. For example, let’s say your RRB monthly annuity payment is $1,000, and your Social Security payment is $800 per month. The RRB will reduce its amount by $800.

Do you get Social Security if you work for the railroad?

You do–one of the benefits of working for the railroad is that your time worked and taxes paid are automatically transferred to the regular Social Security system if you leave the industry and don’t qualify for railroad retirement benefits.

Is Medicare easier for railroad retirees?

If you receive railroad retirement benefits, chances are the Medicare process will be easier for you than most. Because Social Security doles out Medicare benefits, that close relationship between the RRB and Social Security typically means:

Provider Contact Center: 1-888-355-9165

Call the Provider Contact Center (PCC) to speak with representatives in Customer Service, Provider Enrollment, Electronic Data Interchange, eServices and Telephone Reopenings.

Interactive Voice Response (IVR): 1-877-288-7600

Use the IVR to request routine claim status, beneficiary eligibility, and payment information and to request a duplicate remittance advice.

Email Us

Use our contact form to submit general inquiries or to provide feedback on our website. For security reasons please do not submit requests involving PHI/PII with this form.

Contact Palmetto GBA Departments

For information on contacting a specific department by phone, email, fax, or for instructions on submitting documentation by mail, please select a department:

Feedback to the Railroad Retirement Board (RRB)

If you would like to send any feedback to the RRB regarding your experience with Palmetto GBA, please direct your comments to: [email protected] .

How to contact Railroad Healthcare?

Every employee’s situation can be unique. You must contact Customer Service at 1-800-842-5252 at least one month prior to retirement for information and questions, requests for GA-46000, and GA-23111 coverage books and COBRA FORMS.

What is the maximum Medicare coverage for 2011?

The 2011 calendar year lifetime maximum is $126,200. Coverage will end when a covered individual becomes eligible for Medicare. An individual may become eligible for Medicare: Due to age, and eligibility is effective the first day of the month the individual turns 65 (MCA), OR.