In order to apply for Part F and be approved for it, you need to be age 65 or at least eligible for Medicare in some way. People who have disabilities or who are diagnosed with kidney disease (end stage renal disease) can qualify for Medicare Original and Medicare Supplements before age 65.

Full Answer

What is Medicare Part B Part F?

Medicare Part B costs. Plan F is one of two Medicare Supplement plans that covers Part B excess charges (what some doctors charge above what Medicare pays for a service). Plan C is the other. Like many other Medigap policies, Plan F also covers Part B copayments and the deductible.

Can I still enroll in Medicare Plan F?

People who became eligible for Medicare before 2020: You can still enroll in Plan F, even if you've never had this particular plan before. Or enter your zip code below to request a free Medicare quote. John is 73, and he has end-stage renal disease (ESRD).

What is Medicare Plan F and how does it work?

Medicare Plan F covers more expenses than any other supplement plans. It’s one of just two plans that pay for the Part B deductible. It also covers the Part B excess charge, a benefit that’s just as rare. Monthly premiums are typically higher than other plans, however.

How do I get Medicare Part A and Part B?

We’ll mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts. You get Part A automatically. If you want Part B, you need to sign up for it. If you don’t sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

How long after you sign up for Part A do you have to sign up for Part B?

How long do you have to sign up for Part A?

How long before Medicare card is sent out?

How to contact railroad retirement board?

See more

About this website

Can I still purchase Plan F?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.

How much does AARP Plan F Cost?

Below are the average AARP Medicare Supplement costs in each of these three categories....1. AARP Medigap costs in states where age doesn't affect the price.Plan nameAverage monthly cost for AARP MedigapPlan B$242Plan C$288Plan F$2567 more rows•Jan 24, 2022

Can you still enroll in Medicare Part F?

Medicare Plan F has not been discontinued, but it is only available for people who were eligible for Medicare before Jan 1, 2020. If you are currently enrolled in Plan F, your enrollment remains active unless you choose a different plan or fail to pay your premiums.

Can you get Plan F in 2021?

Plan F also has a high-deductible option. If you choose this option, you have to pay a deductible of $2,370 for 2021 before the plan pays anything. This amount can go up each year. High-deductible policies have lower premiums, but if you need to use your benefits, you may have higher out-of-pocket costs.

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Is Plan G cheaper than Plan F?

Even though it has similar coverage, Medigap Plan G's monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

Can I get Medicare Plan F in 2020?

As of January 1, 2020, Medigap plans sold to people new to Medicare can no longer cover the Part B deductible. Because of this, Plans C and F are no longer available to people new to Medicare on or after January 1, 2020.

Can I switch from plan N to plan F?

Medicare Supplement Plan N's coverage is very similar to Plan F's, and you can use your Plan N anywhere that you can use your Plan F.

Is Medicare Part F still available 2022?

Previously, anyone enrolled in original Medicare could purchase Medigap Plan F. However, this plan is now being phased out. As of January 1, 2020, Medigap Plan F is only available to those who were eligible for Medicare before 2020.

What is Medicare Plan F being replaced with?

Popular Plan F Replacements Include Medicare Supplement Plan G and Plan N. There are no explicit replacements for Plan F – you'll have to choose from a number of existing Medicare Supplement plans.

What is the premium for plan F?

Premium costs for Medigap Plan F can range from as low as $150.00 per month to as high as $400.00 per month or more. Factors that determine your cost include your ZIP Code, gender, age, tobacco use, and more.

Are Medicare Part F premiums tax deductible?

Are Medicare Plan F premiums tax-deductible? When filing your federal tax return, Medicare Plan F premiums would be tax-deductible. Additionally, any medical expenses that you pay for out of pocket can also be deducted on your taxes.

How do I enroll in Medicare? | HHS.gov

Administration at 1-800-772-1213 to enroll in Medicare or to ask questions about whether you are eligible. You can also visit their web site at www.socialsecurity.gov. The Medicare.gov Web site also has a tool to help you determine if you are eligibile for Medicare and when you can enroll.

Apply Online for Medicare — Even if You Are Not Ready to Retire

2 • Medicare Part D (Medicare prescription drug coverage) helps cover the cost of prescription drugs. • You have choices for how you get Medicare coverage.

Sign up | Medicare

Most people get Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) when first eligible (usually when turning 65). Answer a few questions to check when and how to sign up based on your personal situation. Learn about Part A and Part B sign up periods and when coverage starts.

APPLICATION FOR ENROLLMENT IN MEDICARE PART B (MEDICAL INSURANCE)

or did not sign up when you applied for Medicare, but now want Part B. • If you want to sign up for Part B during the General Enrollment Period (GEP) from January 1 – March 31

Medicare Annual Enrollment Period: What Changes Can I Make?

Medicare’s annual enrollment period (AEP) is from October 15 to December 7. During AEP, you can make changes to your Medicare health and drug plans.

What is Medicare Part F?

Medicare Part F can also be called Medicare Plan F. This is a Medicare Supplement Plan that fills the gap in the services rendered by Medicare, hence the term Medigap plan. As a supplementary plan, it requires you to be an existing Medicare holder for it to take effect and be usable. This enables you to have a more solid health plan by shouldering your out of pocket expenses.

Who Can Sign Up for Part F?

Eligibility includes being of the age 65 or at least eligible for Medicare in some way. For those with preexisting disabilities or kidney disease, they still can qualify for the Original Medicare and Supplements before turning 65.

Is Medicare Part F expensive?

Medicare Part F offer a very comprehensive coverage. It usually comes expensive because of that. De spite that fact, you still have the option to get a more affordable deal by doing your homework. You can still find a good quote by comparing prices.

Does Medicare cover blood?

Emergency situations can happen and you never know when you need extra support in this matter. Again, Medicare covers you some blood but if that covers run out, Plan F steps in and give you more.

How long after you sign up for Part A do you have to sign up for Part B?

You get Part A automatically. If you want Part B, you need to sign up for it. If you don’t sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

How long do you have to sign up for Part A?

You get Part A automatically. If you want Part B, you need to sign up for it. If you don’t sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

How long before Medicare card is sent out?

We’ll mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

How to contact railroad retirement board?

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

What Is Part F?

Medicare Part F is simply another name for Medicare Plan F, which is a Medicare Supplement plan or Medigap plan.

Who Can Sign Up for Part F?

In order to apply for Part F and be approved for it, you need to be age 65 or at least eligible for Medicare in some way.

Where to Apply for Part F

If you want Medicare Supplement Plan F, then you won’t be going to Medicare directly for it.

Cigna

If you sign with Cigna, you get access to a global insurance network and a wide range of sophisticated health insurance tools.

Aetna

Through Aetna, you have access to a wide range of insurance options, covering way more than just medical insurance.

Mutual of Omaha

What makes Mutual Omaha stand out is their dedication to exceptional customer service.

AARP

AARP has been operating as a senior care company for decades now, and they have developed a reputation that is exemplary in that time.

Medicare Eligibility, Applications, and Appeals

Find information about Medicare, how to apply, report fraud and complaints.

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 ( PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA ( 1-800-772-1213) to get this form.

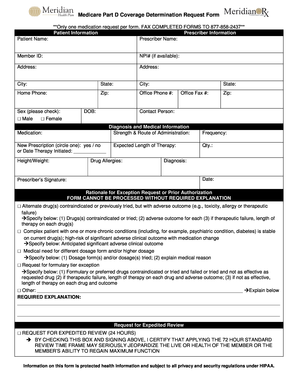

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.

Do you have a question?

Ask a real person any government-related question for free. They'll get you the answer or let you know where to find it.

How to qualify for Medicare premium free?

To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child. To receive premium-free Part A, the worker must have a specified number of quarters of coverage (QCs) and file an application for Social Security or Railroad Retirement Board (RRB) benefits. The exact number of QCs required is dependent on whether the person is filing for Part A on the basis of age, disability, or End Stage Renal Disease (ESRD). QCs are earned through payment of payroll taxes under the Federal Insurance Contributions Act (FICA) during the person's working years. Most individuals pay the full FICA tax so the QCs they earn can be used to meet the requirements for both monthly Social Security benefits and premium-free Part A.

When do you have to apply for Medicare if you are already on Social Security?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B. People living in Puerto Rico who are eligible for automatic enrollment are only enrolled in premium-free Part A.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

Why does Part A end?

There are special rules for when premium-free Part A ends for people with ESRD. Premium Part A and Part B coverage can be voluntarily terminated because premium payments are required. Premium Part A and Part B coverage ends due to: Voluntary disenrollment request (coverage ends prospectively); Failure to pay premiums;

How long after you sign up for Part A do you have to sign up for Part B?

You get Part A automatically. If you want Part B, you need to sign up for it. If you don’t sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

How long do you have to sign up for Part A?

You get Part A automatically. If you want Part B, you need to sign up for it. If you don’t sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

How long before Medicare card is sent out?

We’ll mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

How to contact railroad retirement board?

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.