There are four ways to apply:

- Online at fepblue.org/mra

- Via the EZ Receipts app, available at the App Store or Google Play

- By fax at 877-353-9236

- By mail at P.O. Box 14053, Lexington, KY 40512

Full Answer

Who is eligible for Medicare Part B premium reimbursement?

Who is eligible for Medicare Part B premium reimbursement? Only the member or a Qualified Surviving Spouse/Domestic Partner enrolled in Parts A and B is eligible for Medicare Part B premium reimbursement. 4. How do I get $144 back from Medicare?

Are you eligible for a Medicare reimbursement?

Only the member or a Qualified Surviving Spouse/Domestic Partner enrolled in Parts A and B is eligible for Medicare Part B premium reimbursement. 4. I received a letter stating that I pay a higher Part B premium based on my income level (Income-Related Monthly Adjustment Amount, i.e., IRMAA).

Will Medicare reimburse me?

While people on Medicare are not able to seek reimbursement for at-home tests, you can instead order one for free through the federal government. The government will send out 500 million at-home test kits. You can order one through the forthcoming government website.

How does income affect monthly Medicare premiums?

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage or Reduction

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment

How do I get reimbursed from Medicare?

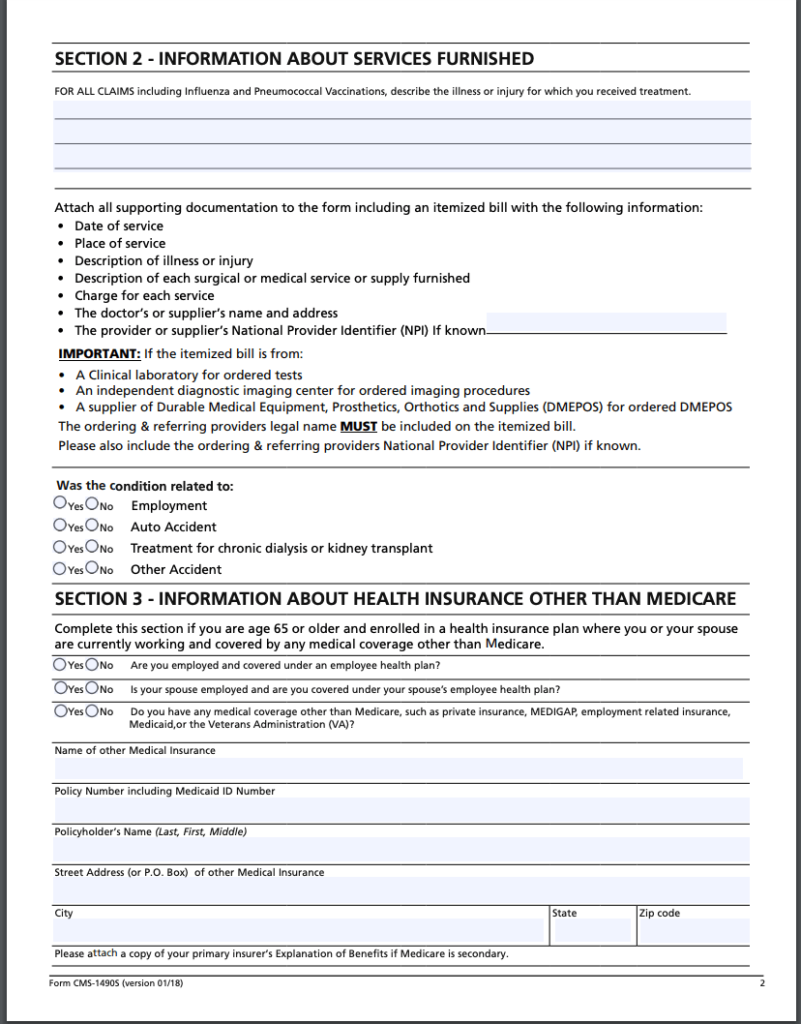

How do you file a Medicare reimbursement claim?Once you see the outstanding claims, first call the service provider to ask them to file the claim. ... Go to Medicare.gov and download the Patient Request of Medical Payment form CMS-1490-S.Fill out the form by carefully following the instructions provided.More items...

Does Medicare offer reimbursement?

The Centers for Medicare & Medicaid Services (CMS) sets reimbursement rates for Medicare providers and generally pays them according to approved guidelines such as the CMS Physician Fee Schedule. There may be occasions when you need to pay for medical services at the time of service and file for reimbursement.

What is Medicare Part reimbursement?

Find Plans. Medicare reimbursement is the process by which a doctor or health facility receives funds for providing medical services to a Medicare beneficiary. However, Medicare enrollees may also need to file claims for reimbursement if they receive care from a provider that does not accept assignment.

Can I submit a claim to Medicare myself?

If you have Original Medicare and a participating provider refuses to submit a claim, you can file a complaint with 1-800-MEDICARE. Regardless of whether or not the provider is required to file claims, you can submit the healthcare claims yourself.

How long does it take to get Medicare reimbursement?

Claims processing by Medicare is quick and can be as little as 14 days if the claim is submitted electronically and it's clean. In general, you can expect to have your claim processed within 30 calendar days.

Who determines Medicare reimbursement?

The Centers for Medicare and Medicaid Services (CMS) determines the final relative value unit (RVU) for each code, which is then multiplied by the annual conversion factor (a dollar amount) to yield the national average fee. Rates are adjusted according to geographic indices based on provider locality.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How do I get Part B reimbursement?

benefit: You must submit an annual benefit verification letter each year from the Social Security Administration which indicates the amount deducted from your monthly Social Security check for Medicare Part B premiums. You must submit this benefit verification letter every year to be reimbursed.

Who is eligible for Part B reimbursement?

How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B. 2.

What is the first step in submitting Medicare claims?

The first thing you'll need to do when filing your claim is to fill out the Patient's Request for Medical Payment form. ... The next step in filing your own claim is to get an itemized bill for your medical treatment.More items...•

How long does it take for Medicare to pay?

Medicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. If a claim isn't filed within this time limit, Medicare can't pay its share. For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020.

What to call if you don't file a Medicare claim?

If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227) . TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got. If it's close to the end of the time limit and your doctor or supplier still hasn't filed the claim, you should file the claim.

How do I file a claim?

Fill out the claim form, called the Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB). You can also fill out the CMS-1490S claim form in Spanish.

How to file a medical claim?

Follow the instructions for the type of claim you're filing (listed above under "How do I file a claim?"). Generally, you’ll need to submit these items: 1 The completed claim form (Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB]) 2 The itemized bill from your doctor, supplier, or other health care provider 3 A letter explaining in detail your reason for submitting the claim, like your provider or supplier isn’t able to file the claim, your provider or supplier refuses to file the claim, and/or your provider or supplier isn’t enrolled in Medicare 4 Any supporting documents related to your claim

What is an itemized bill?

The itemized bill from your doctor, supplier, or other health care provider. A letter explaining in detail your reason for submitting the claim, like your provider or supplier isn’t able to file the claim, your provider or supplier refuses to file the claim, and/or your provider or supplier isn’t enrolled in Medicare.

What happens after you pay a deductible?

After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). , the law requires doctors and suppliers to file Medicare. claim. A request for payment that you submit to Medicare or other health insurance when you get items and services that you think are covered.

When do you have to file Medicare claim for 2020?

For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020. Check the "Medicare Summary Notice" (MSN) you get in the mail every 3 months, or log into your secure Medicare account to make sure claims are being filed in a timely way.

Which states require a healthcare provider to file a claim for reimbursement?

The states of Massachusetts, Minnesota, and Wisconsin standardize their plans differently. If an individual has traditional Medicare and a Medigap plan, the law requires that a healthcare provider files claims for their services. An individual should not need to file a claim for reimbursement.

How much does Medicare reimburse for out of network services?

Medicare allows out-of-network healthcare providers to charge up to 15% more than the approved amount for their services. Medicare calls this the limiting charge.

How long does a non-participating provider have to pay for a healthcare bill?

The individual will pay the full cost of the services to the healthcare provider directly. The provider has 1 year to submit a bill for their services to a Medicare Administrative Contractor on behalf of the individual.

What is Medicare certified provider?

A Medicare-certified provider: Providers can accept assignments from Medicare and submit claims to the government for payment of their services. If an individual chooses a participating provider, they must pay a 20% coinsurance.

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is the limiting charge for Medicare?

Medicare calls this the limiting charge. Some states set a lower limiting charge. For example, in the state of New York, the limiting charge is 5%. An individual may be responsible for a 20% coinsurance and expenses over the agreed amount.

Can you opt out of Medicare?

An opt-out provider: An individual may still be able to visit a healthcare provider who does not accept Medicare. However, they may have to pay the full cost of treatment upfront and out-of-pocket.

What is included in a demand letter for Medicare?

The demand letter also includes information on administrative appeal rights. For demands issued directly to beneficiaries, Medicare will take the beneficiary’s reasonable procurement costs (e.g., attorney fees and expenses) into consideration when determining its demand amount.

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

Does a waiver of recovery apply to a demand letter?

Note: The waiver of recovery provisions do not apply when the demand letter is issued directly to the insurer or WC entity. See Section 1870 of the Social Security Act (42 U.S.C. 1395gg).

Who has the right to appeal a demand letter?

This means that if the demand letter is directed to the beneficiary, the beneficiary has the right to appeal. If the demand letter is directed to the liability insurer, no-fault insurer or WC entity, that entity has the right to appeal.

Can an insurer appeal a WC?

The insurer/WC enti ty’s recovery agent can request an appeal for the insurer/WC entity if the insurer/WC entity has submitted an authorization, such as a Letter of Authority, for the recovery agent. Please see the Recovery Agent Authorization Model Language document which can be accessed by clicking the Insurer NGHP Recovery link.

Can CMS issue more than one demand letter?

For ORM, there may be multiple recoveries to account for the period of ORM, which means that CMS may issue more than one demand letter. When Medicare is notified of a settlement, judgment, award, or other payment, including ORM, the recovery contractor will perform a search of Medicare paid claims history.

Can Medicare waive recovery of demand?

The beneficiary has the right to request that the Medicare program waive recovery of the demand amount owed in full or in part. The right to request a waiver of recovery is separate from the right to appeal the demand letter, and both a waiver of recovery and an appeal may be requested at the same time. The Medicare program may waive recovery of the amount owed if the following conditions are met:

How Does Medicare Reimbursement Work?

If you are on Medicare, you usually don’t have to submit a claim when you receive medical services from a doctor, hospital or other health care provider so long as they are participating providers.

How to Get Reimbursed from Medicare

While most doctors simply bill Medicare directly, some other health care providers may require you to file for reimbursement from Medicare.

Reimbursement for Original Medicare

You won’t likely see a bill for services covered by Original Medicare. Participating providers will simply bill Medicare directly.

Medicare Advantage

You will never have to file a Medicare reimbursement claim if you have a Medicare Advantage plan. Medicare pays the private companies that manage Medicare Advantage plans to handle your claims for you.

Part D Prescription Drug Plan Reimbursement

Medicare Part D Prescription Drug plans are administered by private insurance companies. Generally, these companies handle any reimbursement process so you don’t have to worry about filing one.

How long does it take to get a reimbursement for $800?

There are no restrictions on how you can use your $800 reimbursement. Most claims will be reviewed within one to two business days after they have been received. Upon approval, you will receive reimbursement by direct deposit or check, depending on how you set up your account.

How much does Medicare Part A cost?

Medicare Part A is free for most people. For Part B, you pay a premium. Basic Option members who have Medicare Part A and Part B can get up to $800 with a Medicare Reimbursement Account. All you have to do is provide proof that you pay Medicare Part B premiums. Each eligible active or retired member on a contract with Medicare Part A and Part B, including covered spouses, can get their own $800 reimbursement.

How much back is Medicare Part A?

Basic Option members with Medicare Part A and Part B can get up to $800 back. Medicare Part A is free for most people. For Part B, you pay a premium. Basic Option members who have Medicare Part A and Part B can get up to $800 with a Medicare Reimbursement Account.

How to submit proof of premium payment?

You can submit proof of premium payments through the online portal, EZ Receipts mobile app (available at the App Store® and Google Play™) or by mail or fax. You have until December 31 of the following benefit year to submit your claim for reimbursement.

What does it mean to be dually eligible for Medicare?

If you're dually eligible, it means you have both Medicare and Medicaid.

What happens if you don't pay Medicare Part B?

If you don't pay your monthly Medicare Part B premiums through Social Security, the giveback benefit would be credited to your monthly statement. Instead of paying the full $148.50, you'd only pay the amount with the giveback benefit deducted.

What is the Part B premium reduction benefit?

The giveback benefit, or Part B premium reduction, is when a Part C Medicare Advantage (MA) plan reduces the amount you pay toward your Part B monthly premium. Your reimbursement amount could range from less than $1 to the full premium amount, which is $170.10 in 2022.

What is the Medicare premium for 2021?

In 2021, the standard Medicare Part B monthly premium is $148.50. Beneficiaries also have a $203 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

How to find Part B buy down?

If you enroll in a plan that offers a giveback benefit, you'll find a section in the plan's summary of benefits or evidence of coverage (EOC) that outlines the Part B premium buy-down. Here, you'll see how much of a reduction you'll get. You can also call us toll-free at 1-855-537-2378 and one of our knowledgeable, licensed agents will answer your questions and explain your options.

Can you enroll in Medicare Advantage if you have Medicaid?

This means anyone with Medicaid or other forms of assistance that pay the Part B premium cannot enroll in one of these Medicare Advantage plans.

Does Medicare give back Medicare?

The Medicare giveback benefit, or Part B premium reduction plan, is becoming more available and popular among beneficiaries. Medicaid also offers programs that pay your Part B premium if you meet certain qualifications, and some retiree health plans may offer reimbursement benefits.

When will Medicare Part B reimbursements be issued?

Medicare Part B 2019 differential reimbursements were issued in March 2021. Please check your bank account/statement (or the mail, if you are receiving a physical check) for your payment.

When will Medicare Part B payments be processed?

For those retirees/eligible dependents who are not eligible for IRMAA, Medicare Part B 2019 differential payments up to $318 will be issued once the Medicare Part B and IRMAA payments are processed in calendar year 2020. Those retirees/eligible dependents who are eligible for 2019 Medicare Part B differential reimbursements must submit ...

When will Medicare Part B be released?

Medicare Part B 2020 reimbursements were issued in April 2021. Please check your bank account/statement (or the mail, if you are receiving a physical check) for your payment.

How does a pension refund work?

If you are currently receiving your pension check through Electronic Fund Transfer (EFT) or direct deposit, your reimbursement will be deposited directly into your bank account. This will be separate from your pension payment.

When Do I Need to File A Claim?

How Do I File A Claim?

- Fill out the claim form, called the Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB). You can also fill out the CMS-1490S claim form in Spanish.

What Do I Submit with The Claim?

- Follow the instructions for the type of claim you're filing (listed above under "How do I file a claim?"). Generally, you’ll need to submit these items: 1. The completed claim form (Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB]) 2. The itemized bill from your doctor, supplier, or other health care provider 3. A letter explaining in detail your reason for subm…

Where Do I Send The Claim?

- The address for where to send your claim can be found in 2 places: 1. On the second page of the instructions for the type of claim you’re filing (listed above under "How do I file a claim?"). 2. On your "Medicare Summary Notice" (MSN). You can also log into your Medicare accountto sign up to get your MSNs electronically and view or download them an...

Medicare’s Demand Letter

- In general, CMS issues the demand letter directly to: 1. The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. 2. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals ...

Assessment of Interest and Failure to Respond

- Interest accrues from the date of the demand letter, but is only assessed if the debt is not repaid or otherwise resolved within the time period specified in the recovery demand letter. Interest is due and payable for each full 30-day period the debt remains unresolved; payments are applied to interest first and then to the principal. Interest is assessed on unpaid debts even if a debtor is pu…

Right to Appeal

- It is important to note that the individual or entity that receives the demand letter seeking repayment directly from that individual or entity is able to request an appeal. This means that if the demand letter is directed to the beneficiary, the beneficiary has the right to appeal. If the demand letter is directed to the liability insurer, no-fault insurer or WC entity, that entity has the ri…

Waiver of Recovery

- The beneficiary has the right to request that the Medicare program waive recovery of the demand amount owed in full or in part. The right to request a waiver of recovery is separate from the right to appeal the demand letter, and both a waiver of recovery and an appeal may be requested at the same time. The Medicare program may waive recovery of the amount owed if the following con…