- Sign up for Part B on time. ...

- Defer income to avoid a premium surcharge. ...

- Pay your premiums directly from your Social Security benefits. ...

- Get help from a Medicare Savings Program.

How to appeal a higher Medicare Part B premium?

Mar 28, 2022 · This means that if certain circumstances apply, you can delay Part B enrollment to avoid paying this premium. You can delay Medicare Part B enrollment if you’re 65 or older and covered under a group health plan or your spouse’s group health plan, or if you are disabled and on a group health plan you may delay enrolling in Part B. Remember that you can enroll in Part …

What is the standard premium for Medicare Part B?

Mar 07, 2022 · If you have other creditable coverage, you can delay Part B and postpone paying the premium. You can sign up later without penalty, as long as you do it within eight months after your other coverage ends. If you don’t qualify to delay Part B, you’ll need to enroll during your Initial Enrollment Period to avoid paying the penalty.

How do I reduce my Medicare premium?

Jul 30, 2021 · To avoid paying these late penalties, you’ll want to enroll in Medicare during your Initial Enrollment Period or Special Enrollment Period. We discussed these enrollment periods in more detail in an earlier blog, which you can find here .

How much will you pay for Medicare Part B?

Jan 07, 2022 · If the MAGI of the individual or couple crosses a threshold, there is no way to avoid paying IRMAA. Failing to pay the adjustments will result in cancellation of coverage, leaving many out-of-pocket expenses uncovered. Plus, without Part B, a beneficiary cannot purchase a Medigap policy or a Medicare Advantage plan . Last updated: 01-07-2022

Does everyone have to pay for Part B Medicare?

Does Everyone Pay the Same for Medicare Part B? No, each beneficiary will have a Part B premium that's based on their income.Mar 16, 2022

Is Medicare Part B ever free?

Medicare Part B isn't free, and it doesn't cover everything Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 licensed holder, State of California Life, Accident, and Health Insurance Licensed Agent, and CFA.

What happens if I don't want Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

How do you qualify for $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

Is Medicare Part B going up 2022?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

Who is eligible for Medicare Part B reimbursement?

How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B. 2.

What parts of Medicare are mandatory?

There are four parts to Medicare: A, B, C, and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse.

How do I opt out of Medicare?

To opt out, you will need to:Be of an eligible type or specialty.Submit an opt-out affidavit to Medicare.Enter into a private contract with each of your Medicare patients.Dec 1, 2021

Do you have to take Medicare if you take Social Security?

No, it isn't mandatory to join Medicare. People can opt to sign up, or not. If you don't qualify for Social Security retirement benefits yet, you may need to manually enroll in Medicare at your local Social Security office, online or over the phone when you turn 65.Jan 20, 2022

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

How much is Medicare Part B 2021?

The standard premium for Medicare Part B is $148.50 per month in 2021 – but that assumes you’re not a higher earner. Those with higher income levels are subject to higher premium costs.

How long can you go without Medicare?

But for each 12-month period you go without Medicare coverage despite being eligible, you’ll be hit with a penalty that raises your Part B premium cost by 10 percent.

Can you defer income to future taxes?

If you’re able to defer income strategically to future tax years so that you can report a lower total on your tax return, you might save yourself a higher premium charge for at least a year, since those surcharges are based on previous tax returns.

Is Medicare Part A free for 2021?

July 13, 2021. facebook2. twitter2. While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here’s how you can pay less for them. 1.

Medicare Enrollment

If you are eligible for Medicare and choose not to sign up, you will face late penalties if you later choose to enroll; these penalties will apply to the entire period during which you were eligible for but not enrolled in Medicare. Importantly, these penalties are for life.

Should I Delay Medicare Enrollment?

Many of you may delay your enrollment for good reason — you still have coverage from an employer or a spouse’s employer. If this is the case, you will not face penalties for delayed enrollment (as long as you have creditable coverage ).

Medicare Part B Late Penalty

Medicare Part B covers things like medically necessary services and preventative services.

Medicare Part D Late Penalty

Medicare Part D is essentially prescription drug coverage. Part D Plans can cover the medications not otherwise covered under Medicare Part A and Part B.

What is the income limit for Medicare Part A?

The income limits are higher (up to $4,339/month for an individual, and $5,833 for a couple in 2020), but the asset limit is lower, at $4,000 for an individual and $6,000 for a couple.

What is extra help for Medicare?

Medicare offers “ Extra Help ” for Medicare enrollees who can’t afford their Part D prescription drug coverage. In 2020, if you’re a single person earning less than $1,615 per month ($2,175 for a couple), with financial resources that don’t exceed $14,610 ($29,160 for a couple), you may be eligible for “Extra Help.”.

Why do people apply for MSP?

Medicare urges beneficiaries to apply for MSP benefits if there’s any chance they might be eligible, even if they initially think that their income or resources are too high to qualify. This is particularly important given that states can have more lenient eligibility rules than the federal guidelines.

Does Medicare cover long term care?

Medicare does not cover custodial long-term care, but Medicaid does, if the person has a low income and few assets. Almost two-thirds of the people living in American nursing homes are covered by Medicaid (almost all of them are also covered by Medicare).

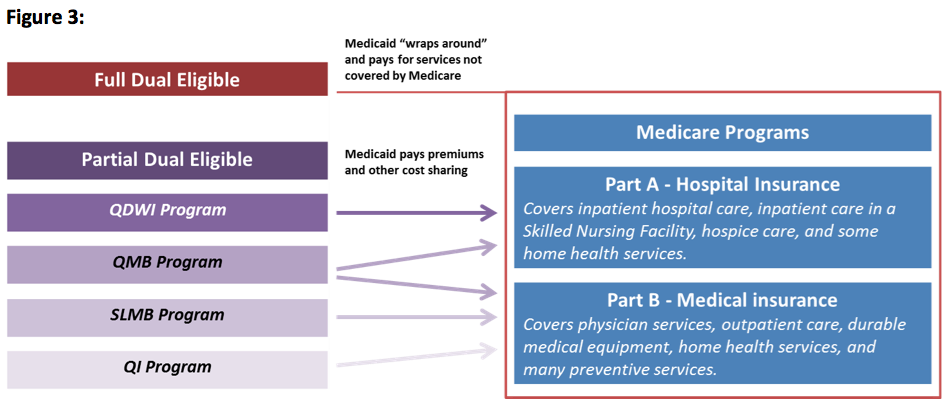

Is Medicare a dual program?

Medicare-Medicaid dual eligibility. People who are eligible for MSPs are covered by Medicare, but receive assistance with premiums (and in some cases, cost-sharing) from the Medicaid program. But some low-income Medicare enrollees are eligible for full Medicaid benefits, in addition to Medicare. About 20 percent of Medicare beneficiaries are dually ...

How much does Medicare premium go up if you have Part B?

If you get hit with the late enrollment penalty, your premium may go up 10 percent for each full year that you could have had Part B, but didn’t. That means you can get hit more than once! Visit medicare.gov to see what your Part B premium is.

What is the Part D penalty?

Part D penalty. The government requires everyone on Medicare to have creditable prescription drug coverage (Part D coverage that’s at least as good as Medicare’s standard). Let’s say you’re about to turn 65 and become eligible for Medicare.

How long can you go without prescription coverage?

If you go without creditable prescription drug coverage for 63 days in a row (or more) after you sign up for Medicare, you may have to pay a late enrollment penalty. This penalty is added to your monthly Part D premium and you’ll have to pay it for as long as you have a Medicare drug plan.

Does medicaid cover nursing?

Medicaid may cover services Original Medicare doesn’t. For example, Medicaid can cover care in a designated nursing facility if you don’t have money, assets or long-term care insurance to pay for it. You may be dual eligible for Medicare and Medicaid and get a plan at reduced costs.

Can you get Medicare and Medicaid in Minnesota?

You may be dual eligible for Medicare and Medicaid and get a plan at reduced costs. In Minnesota, this type of plan is called Minnesota Senior Health Options (MSHO). For no monthly premium, it covers medical, prescription drugs, dental, long-term care and other benefits and services.

How much is the Part B penalty for health insurance?

The Part B penalty alone would raise your Part B premium from $134 a month to nearly $228 (using a 70 percent penalty). These penalties last the rest of your life, so they are a big stone in the road for you.

What is the difference between Part A and Part B?

Having Part A provides you hospital insurance but you need Part B for doctors, outpatient and durable medical equipment expenses. Without Part B, you are dangerously exposed to ruinous health care bills that you so far have avoided. I have become a scold if not a scourge for healthy people like you. While you have dodged a health care bullet so ...

What happens if my husband's insurance stops covering me?

Once your husband’s plan stops covering you, you will have a special enrollment period in which to get Medicare. If Medicare improperly charges you a Part B premium, you can appeal this. Here’s a form Medicare may require to confirm that you have employer insurance. The best approach here is to be proactive.

Does Medicare pay for long term care?

It helps pay Medicare expenses and , more importantly for you, will pay for long-term care expenses should you need such care and are unable to afford it. Given that Medicare is not such a great deal for you now, I think you should give a lot of thought to how you would spend down your assets and qualify for Medicaid.

Can you get Social Security if you own a home?

These penalties last the rest of your life, so they are a big stone in the road for you. Your Social Security payments would not be affected by owning your home. Neither would your Medicare, at least not directly. As you may know, people on Medicare with little income or personal wealth may qualify for Medicaid.

Can I get Medicare at 65?

At your age, I fear that signing up for Medicare Part B would expose you to big late-enrollment penalties. Unless you have had active employer health insurance, you needed to get Medicare at age 65 to avoid such penalties. While you have dodged a health care bullet so far, the odds are you will need substantial health care in your later years.

What to do if you have a higher income on Medicare?

If you’re a Medicare beneficiary with a higher-than-average income, the Social Security Administration ( SSA) could tack an extra charge onto the Medicare premiums you pay each month.

What is Medicare Part B premium for 2021?

For example, if your annual income in 2019 was more than $500,000 as a single taxpayer or more than $750,000 as a married couple, your 2021 Part B premium would be $504.90 for Medicare Part B and an additional $77.10 added onto your plan premium ...

What is IRMAA in Medicare?

What is IRMAA? IRMAA is an extra charge added to your monthly premiums for Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage). The income surcharge doesn’t apply to Medicare Part A (hospital insurance) or Medicare Part C, also known as Medicare Advantage. IRMAA charges are based on your income.

How much Medicare premiums will I pay in 2021?

In 2021, most people pay for $148.50 per month for Medicare Part B. If your income is higher than those amounts, your premium rises as your income increases.

Does Medicare increase your monthly premiums?

Medicare increases monthly premiums for Part B and Part D coverage if your income is higher than certain limits. To avoid these surcharges, you’ll need to reduce your modified adjusted gross income. Talk with a CPA or financial adviser to determine which income-lowering strategy is best for your situation. If you’re a Medicare beneficiary ...

Is a Medicare savings account tax exempt?

Contributions to a Medicare savings account (MSA) are tax-exempt. If you contribute to an MSA, the withdrawals are tax-free as long as you’re spending the money on qualifying healthcare expenses. These accounts can lower your taxable income while giving you a way to pay for some of your out-of-pocket medical expenses.

Does Medicare charge an IRMAA?

Medicare may charge you an increased amount, called an IRMAA, for your Part B and Part D premiums if your income is higher than average. Because an IRMAA is based on the income reported in your income tax records, most ways of avoiding an IRMAA involve lowering your MAGI. Charitable donations, MSAs, and tax-free income streams, ...