Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”)

- Buy Generic Prescriptions. Many common brand-name medications have generic alternatives available, and they are often...

- Order your Medications by Mail and in Advance. Many Medicare Part D prescription drug plans offer medications at a...

- Ask for Drug Manufacturer’s Discounts. Some pharmaceutical...

When will the Medicare Donut Hole go away?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year. That limit is not just what you have spent but also includes the amount of any discounts you received in the donut hole.

Is there still a donut hole in Medicare?

The Medicare donut hole is a colloquial term that describes a gap in coverage for prescription drugs in Medicare Part D. For 2020, Medicare are making some changes that help to close the donut hole more than ever before. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs.

What does the donut hole mean with Medicare?

The donut hole is a gap in prescription drug coverage during which you may pay more for prescription drugs. You enter the donut hole once your Medicare Part D plan has paid a certain amount toward your prescription drugs in 1 coverage year.

How to avoid these big Medicare mistakes?

Mistakes at a Glance

- Missing the enrollment window

- Botching the special enrollment window

- Misunderstanding your job’s insurance

- Ignoring late enrollment penalties

- Not fully weighing your options

- Delaying a Medigap buy

- Not understanding your out-of-pocket costs

- Picking a plan that doesn’t have your doctors

- Taking a drug plan that doesn’t meet your needs

How do I get out of Medicare donut hole?

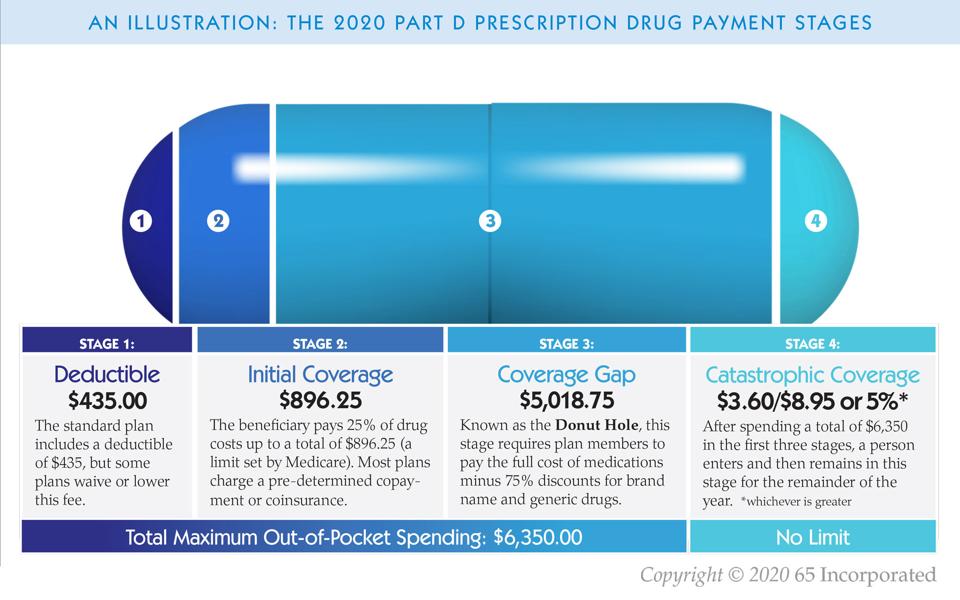

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement.

Will the Medicare donut hole ever go away?

Key Takeaways The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold. See what your clients, the drug plans, and government will pay in each spending phase of Part D.

What will the donut hole be in 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

Do all Medicare D plans have a donut hole?

Can I find Medicare Part D plans without the donut hole? No, all Medicare prescription drug plans include the donut hole. If you anticipate reaching the donut hole and have trouble with costs, you can apply for Extra Help with Medicare Part D.

Can you avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

What will the donut hole be in 2022?

$4,430For example, in 2022 the coverage gap — or donut hole — begins once you reach your plans Part D initial coverage limit of $4,430 in prescription costs. While you're in the coverage gap, you'll pay 25% coinsurance for covered generic drugs and 25% coinsurance for covered brand-name drugs.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

What happens when the donut hole ends in 2020?

The Medicare donut hole is closed in 2020, but you still pay a share of your medication costs. Your coinsurance in the donut hole is lower today than in years past, but you still might pay more for prescription drugs than you do during the initial coverage stage.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

How much is the donut hole for 2022?

$4,430In a nutshell, you enter the donut hole when the total cost of your prescription drugs reaches a predetermined combined cost. In 2022, that cost is $4,430.

Does SilverScript have a donut hole?

With SilverScript, you have access to more than 65,000 pharmacies, as well as many preferred pharmacies. The SilverScript Plus plan has no deductible and more coverage during the Part D donut hole, while the SilverScript Choice and SilverScript SmartRx plans offer lower monthly premiums.

What is the coverage gap for 2022?

In 2022, you pay 25% of the cost of your prescriptions, both brand-name and generic, once you reach the Medicare donut hole. So, if a certain medication costs $100, and you were paying a Tier 3 copay of $46 before you reached the gap, the same medication will now cost you $25 when you are in the gap.

How much is the donut hole for 2020?

The donut hole for 2020 begins at $4,200. Ten months of a $425 retail drug adds up to $4,250, so you’ll be in the donut hole for November and December and the drug will cost more than $100 per month. Medicare drug stages reset yearly on January 1.

What is a donut hole?

The term donut hole is a metaphoric reference to the coverage gap in drug costs for Medicare recipients. The four stages of this yearly cycle are: Understanding what costs are applied during the different stages of the yearly Medicare cycle of drug coverage is paramount in lowering out-of-pocket costs. Medicare drug plans mask the true cost of ...

How to reduce out of pocket in stage 2?

Purchase your generic drugs and pay the cash price at a pharmacy that does not have your insurance information. Then, purchase your brand-name drugs at another pharmacy and pay the insurance copay amount. This strategy will reduce your out-of-pocket in Stage 2 and often keep you from falling in the Stage 3 donut hole.

Does Medicare cover copays?

Medicare drug plans mask the true cost of medications behind copays. Once in the donut hole, standard copays are no longer relative and you become responsible for 25% of the retail cost of drugs whether they are generic or brand name. For example: If your drug costs $425 per month at retail prices, it can land you in the donut hole after ...

What is a Medicare donut hole?

The Medicare donut hole is a gap in coverage that some Medicare beneficiaries may experience at some point during their plan year. The good news? You can save money by knowing how to avoid it and what do to once you’re in it.

How much is the Medicare donut hole for 2021?

The Medicare donut hole for 2021 starts once you hit $4,130 in out-of-pocket prescription drug costs, and it extends to $6,550. If your prescription drug spending reaches $6,550 in 2021, you’ll have catastrophic coverage for the rest of the year.

What is the Medicare coverage gap in 2021?

After you and your drug plan have combined to spend a set amount for the prescription drugs covered by your plan ($4,130 in 2021), you move into the center of the donut (i.e., the hole) which is your Medicare coverage gap. While you’re in the donut hole coverage gap, you’re responsible for 25% of your prescription drug costs for both brand name ...

How many stages of Medicare Part D coverage?

Basically, there are four Medicare Part D coverage stages you need to understand. Your first Medicare Part D coverage phase can be represented by the left side of the donut ring. On this side of the donut, you pay the entire amount for your prescription drugs until you meet your deductible (assuming your plan has one, but not all Part D plans do). ...

How much is a 2021 deductible?

The good news is that once you meet your deductible ( which can be no higher than $445 in 2021 though some plans may offer $0 deductibles) you move to your initial coverage period. If your plan features a $0 deductible, then your coverage starts in this phase.

When does the catastrophic coverage period end for 2021?

Finally, your policy period ends on December 31, ...

When did Medicare Part D start?

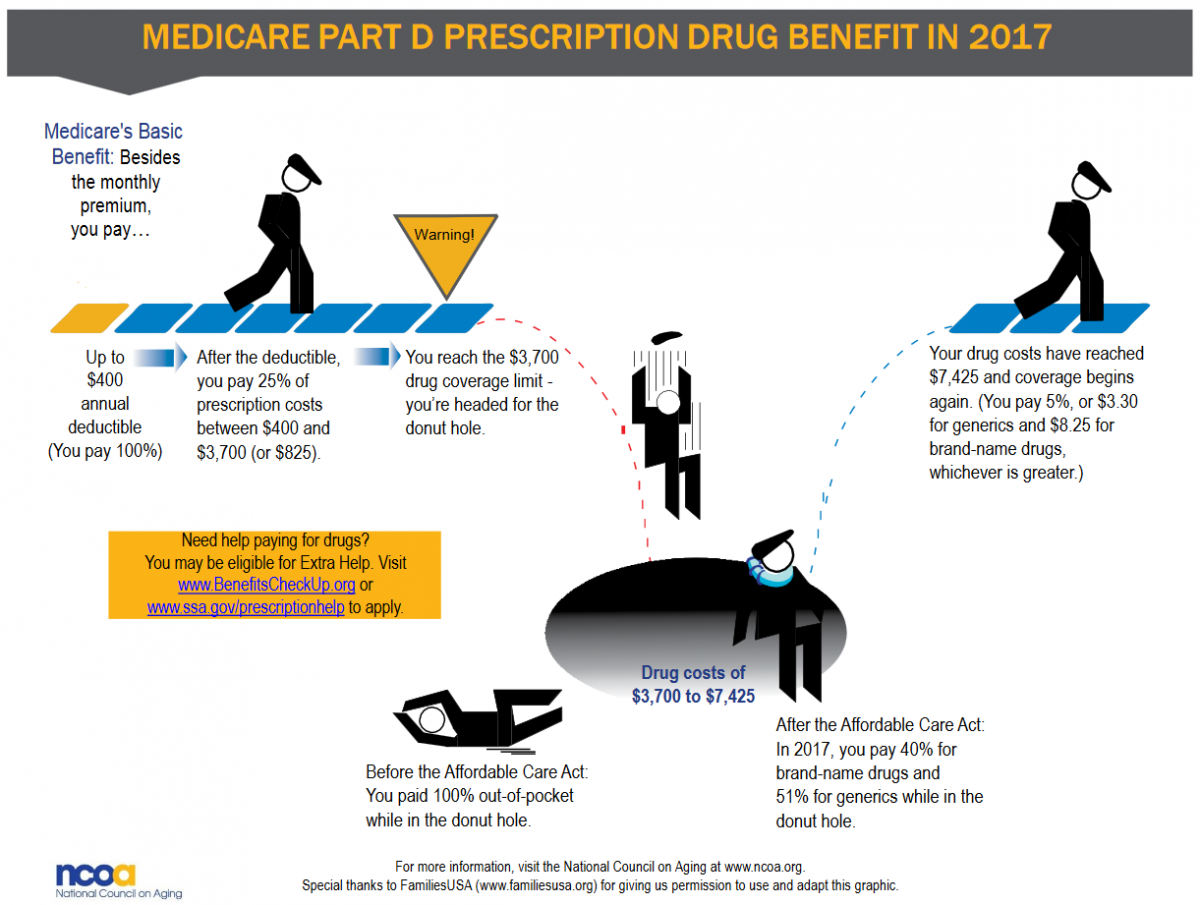

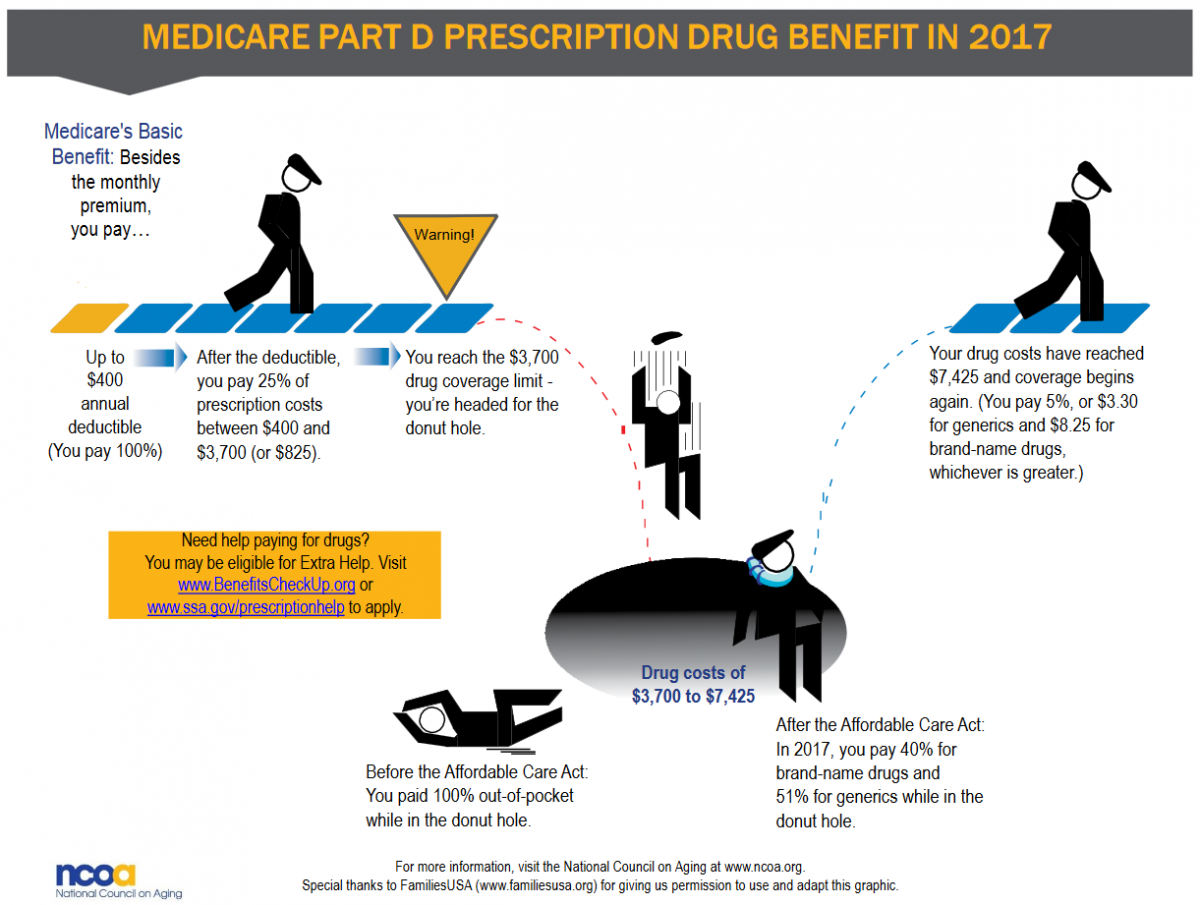

Previously, when Medicare Part D was first rolled out in 2007 and prior to the Affordable Care Act, beneficiaries paid 100% of drug costs while in the donut hole.

What is Part D drug plan?

Part D Drug Plans are offered by a variety of insurance companies and other private companies approved by Medicare, and each company has its own drug formulary. The formulary determines what medications are covered and how much your copay will be, and it can change every year. This means that even if your medications don’t change, if you keep the same plan, you could be paying more next year than you are right now. We encourage our clients to shop their Drug Plan each year during the Annual Election Period, October 15th through December 7th.

Can you split a pill in half?

In addition, you may be able to split certain pills in half, which may be to your advantage. For this to work, your doctor would prescribe you double your usual dose, and you would physically cut your medication in half to get the correct dose.

What is Medicare Donut Hole?

Summary. The Medicare donut hole is a colloquial term that describes a gap in coverage for prescription drugs in Medicare Part D. For 2020, Medicare are making some changes that help to close the donut hole more than ever before. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs.

How much does the insurance company add up to the donut hole?

The insurance company will add up what a person has paid out-of-pocket for medications in the donut hole. Once this total reaches $6,350, a person has crossed the donut hole. A person is now in the catastrophic coverage stage of their medication coverage.

What does closing the donut hole do?

Closing the donut hole can help a person reduce prescription drug costs. However, they will still be responsible for 25% of costs, once they reach the donut hole. If an individual has difficulty paying for medications, state, federal, and private organizations can assist. Public Health.

What was the Affordable Care Act in 2011?

2011: The Affordable Care Act required pharmaceutical manufacturers to introduce discounts of up to 50% for brand name drugs and up to 14% for generic drugs, making it easier for people to buy medications once in the donut hole. 2012‑2018: The discounts continued to increase. 2018: The Bipartisan Budget Act sped up changes to prescription drug ...

Why did the Donut Hole change?

The aim of these changes was to make drugs more affordable once a person reached the donut hole, which would encourage people to continue taking their medications and reduce the risk of a break in treatment . A person pays their co-payment for their prescription drugs, depending upon their drug plan.

What is Medicare Part D?

Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs. A person enrolled in Medicare does not have to choose Medicare Part D. However, they must have some other prescription drug coverage, usually through private- or employer-based insurance. In this article, we define the donut hole and how it applies ...

Why do people stop taking drugs after reaching the donut hole?

The issue with the donut hole is that many people in the United States stop taking their medications upon reaching the donut hole because they cannot afford to pay the high costs for the drugs. They often have to pay thousands of dollars for prescription drugs until they cross this coverage gap.

1. Use generic medications instead of brand name if possible

Talk to your pharmacist about how much it would cost if you switched to a generic version of your medication.

4. Consider switching your Part D Prescription Drug Plan during the Annual Election Period

The Annual Election Period (AEP) is from October 15 to December 7 every year. (It is also referred to as the Annual Enrollment Period.) At this time, you will want to make an appointment with your insurance agent to review the current plan of your insurance company. At this time, you are eligible to enroll in a new plan.

5. Look into state assistance programs or apply for Extra Help

Medicare has a Low-Income Subsidy Program (also called Extra Help) that offers financial assistance with Part D costs. There are qualifications an applicant must meet in order to qualify for help, and they may change each year.

Use Generics

If it’s possible, always opt to take generic medications. Now, there are not always generic equivalent alternatives to your medication, but many times there are, and they are typically just as effective as the name-brand. And they cost much less, meaning it will take longer to reach your deductible and/or your retail cost threshold.

Get Samples

The second way to avoid the donut hole stage is to get free samples from your doctor. Oftentimes, doctors are willing and able to bill to give you free samples and since they're free, those meds are not counted towards the retail cost threshold.

Pay Cash

The third way to avoid the donut hole stage is to pay cash. If you’re on expensive meds, sometimes it’s better to pay cash and get a coupon, because when you use coupons, you're paying a cash price. Which is not going toward your total retail costs.

MedicareSchool.com

If you’re tired of conflicting and confusing Medicare information, sign up for our free workshop today.