If a provider continues to refuse to bill Medicare, you may want to try filing the claim yourself. Submit a Patient’s Request for Medicare Payment form (also called the CMS-1490S form) to the Medicare Administrative Contractor (MAC) in your area. You must send bills or receipts for the service along with the form.

Full Answer

What happens if my provider refuses to Bill Me Medicare?

Your provider refuses to bill Medicare and does not specify why. A refusal to bill Medicare at your expense is often considered Medicare fraud and should be reported. To report fraud, contact 1-800-MEDICARE, the Senior Medicare Patrol (SMP) Resource Center (877-808-2468), or the Inspector General’s fraud hotline at 800-HHS-TIPS.

How to bill for Medicare and Medicaid?

HOW TO DO BILLING FOR MEDICARE AND MEDICAID? Just like when you bill to the private third-party payer, billers must send claims to Medicare and Medicaid. These claims are very similar to the claims you’d send to a private third-party payer, with a few notable exceptions.

What does it mean when a Doctor accepts no Medicare reimbursement?

These docs accept no Medicare reimbursement, and Medicare doesn't pay for any portion of the bills you receive from them. That means you are responsible for paying the total bill out of pocket. Opt-out physicians are required to reveal the cost of all their services to you upfront.

What to do when your doctor doesn't take Medicare?

What to do when your doctor doesn't take medicare 1 Stick with Your Doc and Pay the Difference. 2 Request a Discount. If your doctor is what’s called an "opt-out provider," he or she may still be... 3 Go to a Doc in the Box. Most urgent care centers and walk-in clinics accept Medicare. 4 Ask for a Referral. If you simply cannot afford to stick...

Can you bill a Medicaid patient if you are not a participating provider Washington?

A: You can bill the client but must refund and bill ProviderOne if the client receives coverage.

When the patient is covered by both Medicare and Medicaid what would be the order of reimbursement?

gov . Medicare pays first, and Medicaid pays second . If the employer has 20 or more employees, then the group health plan pays first, and Medicare pays second .

When a patient is covered through Medicare and Medicaid which coverage is primary?

Medicaid can provide secondary insurance: For services covered by Medicare and Medicaid (such as doctors' visits, hospital care, home care, and skilled nursing facility care), Medicare is the primary payer. Medicaid is the payer of last resort, meaning it always pays last.

Can a provider refuse to bill Medicare?

In summary, a provider, whether participating or nonparticipating in Medicare, is required to bill Medicare for all covered services provided. If the provider has reason to believe that a covered service may be excluded because it may be found not to be reasonable and necessary the patient should be provided an ABN.

When a patient has Medicaid coverage in addition to other third party payer coverage Medicaid is always considered the?

For individuals who have Medicaid in addition to one or more commercial policy, Medicaid is, again, always the secondary payer.

When Medicaid and a third party payer cover the patient Medicaid is always the payer of last resort?

A Fordney Ch 12QuestionAnswerPrior approval or authorization is never required in the Medicaid programFalseAll states that do not optically scan their claim forms must bill using the CMS-1500 claim formTrueWhen Medicaid and a third-party payer cover the patient, Medicaid is always the payer of last resort.True48 more rows

Which is a combination Medicare and Medicaid option that combines medical?

What are dual health plans? Dual health plans are designed just for people who have both Medicaid and Medicare. They're a special type of Medicare Part C (Medicare Advantage) plan. Dual health plans combine hospital, medical and prescription drug coverage.

Can you have Medicare and Medicaid at the same time?

Yes. A person can be eligible for both Medicaid and Medicare and receive benefits from both programs at the same time.

Can you have Medicare and Medicaid?

If you are eligible for both Medicare and Medicaid (dually eligible), you can have both. They will work together to provide you with health coverage and lower your costs.

When a provider does not accept assignment from Medicare the most that can be charged to the patient is ____ percent of the Medicare approved amount?

15%Non-participating providers can charge up to 15% more than Medicare's approved amount for the cost of services you receive (known as the limiting charge). This means you are responsible for up to 35% (20% coinsurance + 15% limiting charge) of Medicare's approved amount for covered services.

When a provider is non-participating they will expect?

When a provider is non-participating, they will expect: 1) To be listed in the provider directory. 2) Non-payment of services rendered. 3) Full reimbursement for charges submitted.

Does Medicare pay non-participating providers?

Non-participating providers haven't signed an agreement to accept assignment for all Medicare-covered services, but they can still choose to accept assignment for individual services. These providers are called "non-participating."

How to start the medical billing process for Medicaid?

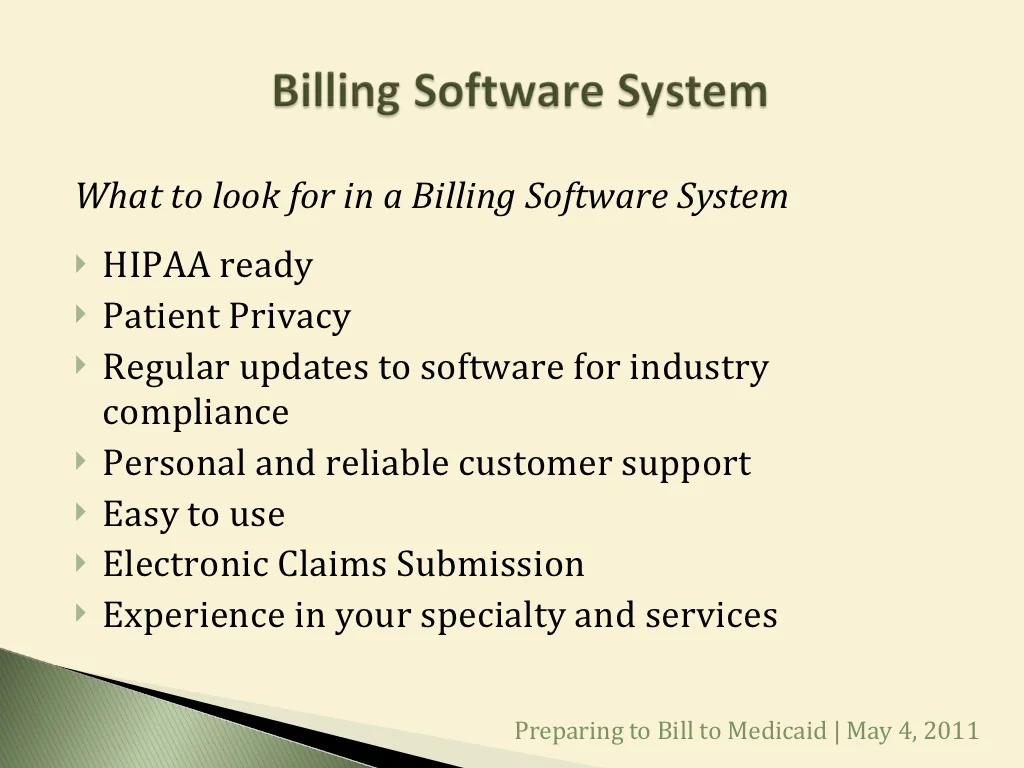

You will start the medical billing process for Medicaid by filling out a state claim form for the services and procedures covered. Most state Medicaid claim forms will be divided into main two parts: information regarding the patient and/or the insured person and information regarding the healthcare provider.

What form do you need to bill Medicare?

If a biller has to use manual forms to bill Medicare, a few complications can arise. For instance, billing for Part A requires a UB-04 form (which is also known as a CMS-1450). Part B, on the other hand, requires a CMS-1500. For the most part, however, billers will enter the proper information into a software program and then use ...

What happens if a provider doesn't provide an ABN?

If the provider doesn’t offer the ABN or the patient doesn’t sign the notice before services are rendered, the patient doesn’t have to pay for that service. When billing for traditional Medicare (Parts A and B), billers will follow the same protocol as for private, third-party payers, and input patient information, NPI numbers, procedure codes, ...

What is an ABN in Medicare?

A provider who furnishes a service that Medicare probably won’t cover can ask the patient to sign an advanced beneficiary notice (ABN). By signing an ABN, the patient agrees to be financially responsible for the service if Medicare denies payment.

Is Medicaid more complicated than Medicare?

BILLING FOR MEDICAID. Medicaid programs differ from state to state medical billing for Medicaid is much more complicated than Medicare. Some citizens eligible for care in one state may not be eligible for care in another state, or they may receive more or fewer benefits depending on the state in which they receive care.

Can Medicare bill for Part D?

Only those providers who are licensed to bill for Part D may bill Medicare for vaccines or prescription drugs provided under Part D. If the provider is not a licensed Part D provider, the biller must assign that total directly to the patient (or the patient’s secondary insurance, if they have it, and if it covers that procedure or prescription).

Does Medicare have a claim processing system?

In addition, its claims processing system is highly refined. Any claim that is submitted with errors or without the correct information does not process.

What Information Do You Need To Fill Out This Form

Medicare will need you to fill out a patient request form with some basic information about yourself as well as the service or medical item you are filing about. Youll need to provide:

Find Cheap Medicare Plans In Your Area

Medicare reimbursement is the process by which a doctor or health facility receives funds for providing medical services to a Medicare beneficiary. However, Medicare enrollees may also need to file claims for reimbursement if they receive care from a provider that does not accept assignment.

Medicare Claims And Reimbursement

In most cases, you wont have to worry about filing Medicare claims. Here are some situations where you might or might not need to get involved in the claim process.

What Do I Do If My Doctor Does Not Accept Medicare

You can choose to stay and cover the costs out-of-pocket, but this is not an affordable option for most Americans. Instead, you can ask your doctor for a referral to another healthcare provider that does accept Medicare, do your own research, or visit an urgent care facility. Most urgent care offices accept Medicare.

How Long Do I Have To File A Claim

Original Medicare claims have to be submitted within 12 months of when you received care. Medicare Advantage plans have different time limits for when you have to submit claims, and these time limits are shorter than Original Medicare. Contact your Advantage plan to find out its time limit for submitting claims.

You Should Only Need To File A Claim In Very Rare Cases

Medicare claims must be filed no later than 12 months after the date when the services were provided. If a claim isn’t filed within this time limit, Medicare can’t pay its share. For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020.

How Do I File A Medicare Claim

Medicare beneficiaries occasionally have to submit their own healthcare claims instead of relying on a provider to submit them. | Photo credit: Helloquence | Unsplash

What does it mean when a doctor is a non-participating provider?

If your doctor is what’s called a non-participating provider, it means they haven’t signed an agreement to accept assignment for all Medicare-covered services but can still choose to accept assignment for individual patients . In other words, your doctor may take Medicare patients but doesn’t agree to ...

How many people were in Medicare in 1965?

President Lyndon B. Johnson signed Medicare into law on July 30, 1965. 1 By 1966, 19 million Americans were enrolled in the program. 2 . Now, more than 50 years later, that number has mushroomed to over 60 million; more than 18% of the U.S. population.

What does it mean when a long time physician accepts assignment?

If your long-time physician accepts assignment, this means they agree to accept Medicare-approved amounts for medical services. Lucky for you. All you’ll likely have to pay is the monthly Medicare Part B premium ($148.50 base cost in 2021) and the annual Part B deductible: $203 for 2021. 6 As a Medicare patient, ...

Will all doctors accept Medicare in 2021?

Updated Jan 26, 2021. Not all doctors accept Medicare for the patients they see, an increasingly common occurrence. This can leave you with higher out-of-pocket costs than you anticipated and a tough decision if you really like that doctor.

Do urgent care centers accept Medicare?

Many provide both emergency and non-emergency services including the treatment of non-life-threatening injuries and illnesses, as well as lab services. Most urgent care centers and walk-in clinics accept Medicare. Many of these clinics serve as primary care practices for some patients.

Can a doctor be a Medicare provider?

A doctor can be a Medicare-enrolled provider, a non-participating provider, or an opt-out provider. Your doctor's Medicare status determines how much Medicare covers and your options for finding lower costs.

What does it mean when a provider is not to bill the difference between the amount paid by the state Medicaid plan and

Basically, this means that a provider is not to bill the difference between the amount paid by the state Medicaid plan and the provider’s customary charge to the patient, the patient’s family or a power of attorney for the patient.

Do federal guidelines always take precedence over state guidelines?

The federal guidelines always take precedence over the state guidelines, as the federal guidelines sets the minimum requirements that each state must follow. The individual states may then expand their programs as long as they do not contradict federal guidelines.

Does a balance in Medicaid mean coinsurance?

NOTE: A balance does not constitute, “coinsurance” due. A state plan must provide that the Medicaid agency must limit participation in the Medicaid program to providers who accept, as payment in full, the amounts paid by the agency plus any deductible, coinsurance or copayment required by the plan to be paid by the individual.

Is Medicaid billed by the state or federal?

Billing for Medicaid can be tricky, as both federal and state guidelines apply. The Centers for Medicare and Medicaid (CMS) administers Medicaid under the direction of the Department of Health and Human Services (HHS). The federal guidelines always take precedence over the state guidelines, as the federal guidelines sets ...

Is Medicaid the payer of last resource?

It’s also important for providers to understand that Medicaid is considered to be the payer of last resource, meaning that if the patient has other coverages, they should be billed prior to billing Medicaid.

When do hospitals report Medicare beneficiaries?

If the beneficiary is a dependent under his/her spouse's group health insurance and the spouse retired prior to the beneficiary's Medicare Part A entitlement date, hospitals report the beneficiary's Medicare entitlement date as his/her retirement date.

Does Medicare pay for the same services as the VA?

Veteran’s Administration (VA) Benefits - Medicare does not pay for the same services covered by VA benefits.

Does Medicare pay for black lung?

Federal Black Lung Benefits - Medicare does not pay for services covered under the Federal Black Lung Program. However, if a Medicare-eligible patient has an illness or injury not related to black lung, the patient may submit a claim to Medicare. For further information, contact the Federal Black Lung Program at 1-800-638-7072.

Is Medicare a primary or secondary payer?

Providers must determine if Medicare is the primary or secondary payer; therefore, the beneficiary must be queried about other possible coverage that may be primary to Medicare. Failure to maintain a system of identifying other payers is viewed as a violation of the provider agreement with Medicare.

Why won't my Medicare claim be filed?

Your provider believes Medicare will deny coverage. Your provider must ask you to sign an Advance Beneficiary Notice (ABN).

What does it mean when a provider opts out of Medicare?

Your provider has opted out of Medicare. Opt-out providers have signed an agreement to be excluded from the Medicare program. They do not bill Medicare for services you receive. You should not submit a reimbursement request form to Medicare for costs associated with services you received from an opt-out provider.

How to report Medicare fraud?

To report fraud, contact 1-800-MEDICARE, the Senior Medicare Patrol (SMP) Resource Center (877-808-2468), or the Inspector General’s fraud hotline at 800-HHS-TIPS. If a provider continues to refuse to bill Medicare, you may want to try filing the claim yourself.

What to do before signing an ABN?

Before signing an ABN, ask additional questions to find out whether your provider considers the service to be medically necessary, and whether they will help you appeal. Ask your provider to still file a claim with Medicare, even if they believe coverage will be denied. You may be able to appeal if Medicare denies coverage.

Can non-participating providers receive Medicare?

Non-participating providers are allowed to request payment up front at the time of service. Ask your provider to file a claim with Medicare on your behalf, so you can receive Medicare reimbursement (80% of the Medicare-approved amount ). Your provider has opted out of Medicare.

Can you appeal a Medicare deny?

You may be able to appeal if Medicare denies coverage. Your provider may ask that you pay in full for services. If you are seeing a participating provider, ask your provider to submit the claim to Medicare. Medicare should let you know what you owe after it has processed the claim.

What is a CPL for Medicare?

A CPL provides information on items or services that Medicare paid conditionally and the BCRC has identified as being related to the pending claim. For cases where Medicare is pursuing recovery from the beneficiary, a CPL is automatically sent to the beneficiary within 65 days of issuance of the Rights and Responsibilities letter (a copy of the Rights and Responsibilities letter can be obtained by clicking the Medicare's Recovery Process link). All entities that have a verified Proof of Representation or Consent to Release authorization on file with the BCRC for the case will receive a copy of the CPL. Please refer to the Proof of Representation and Consent to Release page for more information on these topics. The CPL includes a Payment Summary Form that lists all items or services the BCRC has identified as being related to the pending claim. The letter includes the interim total conditional payment amount and explains how to dispute any unrelated claims. The total conditional payment amount is considered interim as Medicare might make additional payments while the beneficiary’s claim is pending.

How long does a CPN take to respond to a judgment?

After the CPN has been issued, the recipient is allowed 30 days to respond.

Does Medicare require a copy of recovery correspondence?

The beneficiary does not need to take any action on this correspondence.

Can you get Medicare demand amount prior to settlement?

If the beneficiary is settling a liability case, he or she may be eligible to obtain Medicare's demand amount prior to settlement or to pay Medicare a flat percentage of the total settlement. Click the Demand Calculation Options link to determine if the beneficiary's case meets the required guidelines.

Does Medicare pay for a secondary plan?

Under Medicare Secondary Payer law (42 U.S.C. § 1395y (b)), Medicare does not pay for items or services to the extent that payment has been, or may reasonably be expected to be, made through a no -fault or liability insurer or through a workers' compensation entity. Medicare may make a conditional payment when there is evidence that the primary plan does not pay promptly conditioned upon reimbursement when the primary plan does pay. The Benefits Coordination & Recovery Center (BCRC) is responsible for recovering conditional payments when there is a settlement, judgment, award, or other payment made to the Medicare beneficiary. When the BCRC has information concerning a potential recovery situation, it will identify the affected claims and begin recovery activities. Beneficiaries and their attorney (s) should recognize the obligation to reimburse Medicare during any settlement negotiations.