The “Medicare wages and tips” portion is box number 5 on the W-2 form. It indicates the total wages and tips that are subject to Medicare tax withholding. The number that is indicated in this Medicare wages and tips on box number 5 is typically the same as the “wages, tips, other compensation” section.

What are Medicare W-2 wages and tips?

The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding. The number included in this box will usually be identical to the “wages, tips, other compensation” section on the W-2 form.

What is box 5 in Medicare wages and tips?

Box 5: Medicare wages and tips. Box 5 reports the amount of wages subject to Medicare taxes. There is no maximum wage base for Medicare taxes. The amount shown in Box 5 may be larger than the amount shown in Box 1.

What are boxes 1 3 and 5 on a W-2?

Knowing the differences in Boxes 1, 3, and 5, on a W-2 is important in determining income. “Wages, tips, and other compensation,” “Social security wages,” and “Medicare wages and tips” do not appear to be all that different. In some cases, the amounts in those boxes are the same.

How is Medicare tax withholding calculated on a W-2?

The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding. The number included in this box will usually be identical to the “wages, tips, other compensation” section on the W-2 form. These matching numbers show that the Medicare tax is based on 100% of an employee’s earnings.

What does Medicare wages and tips mean on W-2?

What Are Medicare Wages and Tips on a W-2? The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding. The number included in this box will usually be identical to the “wages, tips, other compensation” section on the W-2 form.

What is included in Box 5 W-2?

Box 5: Medicare wages and tips. Box 5 reports the amount of wages subject to Medicare taxes. There is no maximum wage base for Medicare taxes. The amount shown in Box 5 may be larger than the amount shown in Box 1.

What Medicare wages include?

Medicare Wages and Taxes Pretax benefits include those offered under a cafeteria – or Section 125 – plan, such as medical, dental, vision, life, accident and disability insurance; and flexible spending accounts such as dependent care, and health savings and adoption assistance reimbursement accounts.

What is the difference between line 1 and line 5 on W-2?

However, depending on the level and source of income, the amount in these three boxes could be very different. Box 1 includes income subject to federal income tax. Box 3 includes income subject to employee Social Security tax. Box 5 includes income subject to Medicare tax.

How are Medicare wages and tips calculated?

Medicare Wages and Tips may also be calculated by taking the amount in Box 1 and ADDING all of your TIAA-CREF retirement deductions. Retirement contributions are not taxable for federal income tax, however, they are taxable for Medicare (Medic) tax.

Does Box 5 on W-2 include health insurance?

FICA Taxes Therefore, when you get your W-2, your box 3, income subject to Social Security taxes, and box 5, income subject to Medicare taxes, will include your pretax health insurance premiums.

What is the difference between wages and tips and Medicare wages and tips?

Box 1 (Wages, Tips and Other Compensation) represents the amount of compensation taxable for federal income tax purposes while box 3 (Social Security Wages) represents the portion taxable for social security purposes and box 5 (Medicare Wages) represents the portion taxable for Medicare tax purposes.

What is not included in Medicare wages and tips?

The non-taxable wages are deductions appearing on the pay stub under 'Before-Tax Deductions. ' These include medical, vision, and dental insurance premiums, Flexible Spending Account Health Care, and Flexible Spending Account Dependent Care.

Why is Medicare wages higher on w2?

How is that possible? Certain amounts that are taken out of your pay are not subject to federal income tax, so they are not included in box 1, but they are subject to Social Security and Medicare taxes, so they are included in boxes 3 and 5.

Why is Box 5 higher than box 1 W-2?

Medicare taxes generally do not include any pretax deductions and will include most taxable benefits. That, combined with the fact that unlike Social Security wages, there is no cap for Medicare taxes, means that the figure in box 5 may be larger than the amounts shown in box 1 or box 3.

What goes on line 5 on w4?

Line 5 – Number of allowances. This line helps your employer calculate how much federal income tax will be withheld from your paycheck. The more “allowances” you claim, the less money will be withheld from your paycheck for federal taxes, and the larger your paycheck will be.

What is the difference between Medicare wages and social security wages?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How much is Medicare withholding?

This means that, for those whose earnings are above the given threshold, their Medicare tax withholding will be 2.35% which is 1.45% plus the additional 0.9%. Employers are not required to give contributions to this additional tax from their end.

What is Medicare tax?

Medicare taxes that are collected from workers and employers are used to fund the Medicare program. This is a program that helps Americans older than 65 with disabilities by helping with the costs of the following:

What is Workstream hiring?

Workstream is an all-in-one hiring & texting solution based in San Francisco. Join thousands of happy hiring managers. Call or text message us:(415) 767-1006

What is the purpose of the Medicare tax?

It aims to provide health insurance to Americans who are uninsured because of economic challenges.

What is the Medicare tax rate for 2021?

Medicare taxes are paid by both the employer and employee. The present rate in 2021 is 1.45% for each. Again, the rate will depend on the annual income of the employee.

Is there a wage cap on Medicare?

Keep in mind that there is no wage base limit or cap for Medicare tax because it is based on a hundred percent of the earnings of the employee. All employees need to pay Medicare tax no matter how much they earn. The specific amount that a worker is taxed will depend on their annual earnings. But there are specific pre-tax deductions that are exempt from Social Security and Medicare taxes. Examples are 401(k) retirement contributions and life insurance premiums.

Do employers stay updated on tax rates?

A tip to both employers and employees, always stay updated on the current tax rates.

What is the box 1 in the income tax form?

Box 1 includes income subject to federal income tax. Box 3 includes income subject to employee Social Security tax. Box 5 includes income subject to Medicare tax. It is important to understand how these boxes are different to properly determine the income of an opposing spouse. Where to begin?

What are the different boxes on a W-2?

Knowing the differences in Boxes 1, 3, and 5 , on a W-2 is important in determining income. “Wages, tips, and other compensation,” “Social security wages,” and “Medicare wages and tips” do not appear to be all that different. In some cases, the amounts in those boxes are the same. However, depending on the level and source of income, the amount in these three boxes could be very different. Box 1 includes income subject to federal income tax. Box 3 includes income subject to employee Social Security tax. Box 5 includes income subject to Medicare tax. It is important to understand how these boxes are different to properly determine the income of an opposing spouse.

Why do you need to use the boxes on your W-2?

Using these boxes on a W-2 is critical in properly determining the income of a spouse. Knowing not only the amount of spouse’s income, but the type of income is an important first step in determining income. For more detail, see the IRS Form W-2 instructions on IRS.gov. They change every year!

What is box 1 in 401(k)?

Start with Box 1. This box shoes the total wages, tips, and other compensation paid to the employee during the year. It does not include elective deferrals, such as 401 (k) or 403 (b), or contributions to a SIMPLE retirement account. Box 1 does, however, include Roth contributions. The amount in Box 1 is also going to be subject to Social Security ...

Which box is Medicare taxed?

Box 5 is the most thorough listing of income. Box 3 reflects income subject to Social Security tax. The income subject to Medicare tax in Box 5 will also be subject to Social Security tax.

Is Box 3 of W-2 lower than Box 5?

While the same income subject to Medicare tax will be subject to Social Security tax, the amount in Box 3 could be lower than the amount in Box 5 depending on whether the employee’s income is above the wage base limit. Using these boxes on a W-2 is critical in properly determining the income of a spouse. Knowing not only the amount of spouse’s ...

Does Box 1 include Roth contributions?

Box 1 does, however , include Roth contributions. The amount in Box 1 is also going to be subject to Social Security and Medicare taxes, which means it will be included in Boxes 3 and 5. Box 5 includes income subject to federal income tax (Box 1) as well as income that is not subject to federal income tax. This is the amount subject to Medicare tax.

How is Medicare calculated on W2?

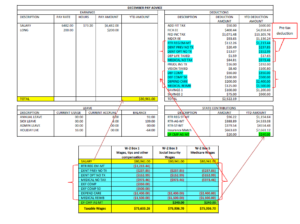

How are Medicare wages calculated on w2? It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages. Employers are required to withhold 1.45% of employee's Medicare wages as Medicare tax and submit a matching amount to cover the costs of the Medicare program. Click to see full answer.

How to calculate wages on W2?

Similarly, how are wages calculated on w2? Find the amount of local, state, and income taxes on your paystub that are withheld from your earnings. Next, multiply these numbers by the number of times you get paid every year. For example, if you get paid twice a month, you would multiply these numbers by 24.

How to determine taxable Medicare wages?

The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction.

What is Medicare payroll tax?

Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the "Medicare tax.". Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to retirees and the.

Where to find taxable wages on W-2?

Use your last pay stub for the year to calculate the taxable wages in boxes 1 and 16 in your W-2. Begin with the Gross Pay YTD (year-to-date) and make the following adjustments, if applicable:

What to call if your W-2 does not match Box 1?

If you find that after making these adjustments to your Gross Pay YTD per your final pay stub, the result does not match Box 1 Federal Wages and Box 16 State Wages on your W-2, call Central Payroll, 617-495-8500, option 4, for assistance.

Why are W-2s different from Social Security?

The most common questions relate to why W-2 Wages differ from your final pay stub for the year, and why Federal and State Wages per your W-2 differ from Social Security and Medicare Wages per the W-2. The short answer is that the differences relate to what wage amounts are taxable in each case. The following steps will walk you through the calculations of the W-2 wage amounts and enable you to reconcile these to your final pay stub for the year.

What to call if your W-2 does not match Social Security?

If you find that after making these adjustments to your Gross Pay YTD per your final pay stub, the result does not match Box 3 Social Security Wages and Box 5 Medicare Wages on your W-2, call Central Payroll, 617-495-8500, option 4 for assistance.

What is the Social Security base for 2019?

The Social Security Wage Base for 2019 was $132,900. To determine Social Security and Medicare taxable wages on your W-2, again begin with the Gross Pay YTD from your final pay stub and make the following adjustments if applicable:

What is box 5 in Medicare?

Box 5: Medicare wages and tips. Box 5 reports the amount of wages subject to Medicare taxes. There is no maximum wage base for Medicare taxes. The amount shown in Box 5 may be larger than the amount shown in Box 1. Medicare wages include any deferred compensation, retirement contributions, or other fringe benefits that are normally excluded from the regular income tax. In other words, the amount in Box 5 typically represents your entire compensation from your job.

What is Medicare wages?

Medicare wages include any deferred compensation, retirement contributions, or other fringe benefits that are normally excluded from the regular income tax. In other words, the amount in Box 5 typically represents your entire compensation from your job. Box 6: Medicare tax withheld.

What is box 1 in a tax return?

Box 1: Wages, tips, and other compensation. Box 1 reports your total taxable wages for federal income tax purposes. This figure includes your wages, salary, bonuses, and other taxable compensation. Any taxable fringe benefits (such as group term life insurance, personal use of a College vehicle, rent-free housing, etc.) are also included in your Box 1 wages.

What is the Medicare tax rate?

The Medicare tax is a flat tax rate of 1.45% of your total Medicare wages. Box 10: Dependent Care Benefits. Box 10 reports any amounts deducted for dependent care expenses under flex spending programs, in addition to employee discounts received from the Dickinson College Children’s Center.

What is the box 3 on Social Security?

Box 3: Social Security wages. Box 3 reports the total amount of wages subject to the Social Security tax. For 2010, the Social Security tax is assessed on wages of $106,800 or less. This limit is called the Social Security wage base. If your total wages are under $106,800, then the amounts reported in Boxes 3 and 5 should be the same.

What happens if you pay too much Social Security?

If you have two or more jobs during the year, and your total wages exceed $106,800, you may have paid-in too much Social Security tax. You will claim the excess Social Security tax withholding as a credit on your Form 1040 (if applicable).

How many boxes are there in Box 13?

Box 13: Check the Box. There are three check boxes in Box 13. Boxes will be checked off if any of these situations apply to you as an employee.

Why are Box 1 wages lower than Box 3 wages?

The employee elected to contribute to a retirement plan. If an employee elected to contribute to a pre-tax retirement plan, their W-2 Box 1 wages are likely lower than their Box 3 wages.

What is Box 2 in Social Security?

Box 2 shows how much federal income tax you withheld from Box 1 wages throughout the year. The numbers in Box 1 and Box 2 help determine an employee’s tax refund or liability. Most benefits that are exempt from federal income tax are not exempt from Social Security tax.

What is the difference between Box 1 and Box 3?

3. The employee earned above the SS wage base. In some instances, Box 1 can be higher than Box 3. After an employee earns above the Social Security wage base, they no longer need to pay Social Security tax. Because earnings above the Social Security wage base aren’t subject to SS tax, don’t report them in Box 3.

What is Box 1?

Box 1—wages, tips, other compensation—conta ins an employee’s total wages subject to federal income tax. Do not include pre-tax benefits in Box 1.

Why are boxes 1 and 3 different?

Because some benefits are not subject to federal income tax, Boxes 1 and 3 (as well as Box 5) can have different values. Likewise, you may see W-2 Box 1 and Box 16 differ. And, the values in Box 1 and Box 18 may also vary.

What is the Social Security wage base for 2021?

The 2020 wage base is $137,700. For 2021, the Social Security wage base is $142,800.

Which box is higher than box 1?

If retirement contributions are exempt from state income tax, Boxes 1 and 16 may be the same. If contributions are subject to state income tax, Box 16 may be higher than Box 1.