To submit claims, beneficiaries should call their Part D plan and request an out-of-network pharmacy claim form as soon as they are able, and should check their Part D Evidence of Coverage for any applicable deadlines. The Centers for Medicare and Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Full Answer

How much will I pay in Medicare Part D costs?

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

How much does it cost for Medicare Part D?

As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state. What affects Medicare Part D costs each year?

What is Medicare Part D, and do I need It?

What Is Medicare Part D and Do I Need It? CA Medicare January 19, 2015 Announcement. Medicare Part D is a federal-government program introduced in 2003 to help eligible Medicare recipients get subsidized prescription drug coverage. The plans are sold through private insurance companies (approved by Medicare) and often have an additional premium.

How do you qualify for Medicare Part D?

- Moving outside your plan's service area

- Becoming eligible for Medicaid

- Qualifying for Extra Help with Medicare drug costs

- Receiving facility-based long-term services, such as a skilled nursing facility

How do I submit Medicare Part D?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

How is Medicare Part D reimbursed?

Medicaid beneficiaries also typically receive covered drugs through pharmacies, which are reimbursed for these drugs by State Medicaid agencies. Most States typically calculate reimbursement based upon the AWP discounted by a specified percentage plus a dispensing fee.

What is billed under Medicare Part D?

PART D COVERED DRUGS Medicare law defines the drugs that are covered under Part D in relation to their coverage under the federal Medicaid program and other parts of Medicare. [32] Drugs that are mandatory under Medicaid may be covered under Part D; drugs that are optional under Medicaid are excluded under Part D.

How is Medicare Part D calculated?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $. 10 and added to your monthly Part D premium.

How does pharmacy reimbursement work?

Pharmacy reimbursement under Part D is based on negotiated prices, which is usually based on the AWP minus a percentage discount, plus a dispensing fee (more on dispensing fees later). Private third-party payers currently base their reimbursement formula on AWP.

What is a DIR fee in pharmacy?

What are DIR fees? DIR are the fees that pharmacies may see PBMs charge outside of administration fees and are generally collected after the point of sale. We see them in many forms. Originally, DIR fees were more commonly seen via a reconciliation between the claim and the negotiated price.

What are the 4 phases of Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

Is Medicare Part D commercial insurance?

Stand-Alone Drug Insurance The Part D program operates both as a stand-alone benefit and as an add-on to the MA program; so-called Medicare Advantage-Prescription Drug (MA-PD) plans operate like commercial insurance policies in covering the full range of medical spending.

Do I have to pay for Medicare Part D?

You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums. If you don't pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back.

Can Medicare Part D be deducted from Social Security?

You can have your Part C or Part D plan premiums deducted from Social Security. You'll need to contact the company that sells your plan to set it up. It might take several months to set up and for automatic payments to begin.

How do I pay Part D Irmaa?

It's your responsibility to pay it even if your employer or a third party (e.g., retirement system) pays your Part D plan premiums. You'll get a bill each month from Medicare for your Part D IRMAA and can pay it the same way you pay your Part B premiums.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is the call for Part D?

The beneficiary or physician can call the Part D Plan to discuss what the cost sharing and allowable charges would be for the vaccine as part of the plan’s out-of-network access or inquire as to the availability of any alternative vaccine access options. Plan contact information is available at

What is a Part D plan?

Part D plans are required to provide access to vaccines not covered under Part B. During rulemaking, CMS described use of standard out-of-network requirements to ensure adequate access to the small number of vaccines covered under Part D that must be administered in a physician’s office. CMS’ approach was based on the fact that most vaccines of interest for the Medicare population (influenza, pneumococcal, and hepatitis B for intermediate and high risk patients) were covered and remain covered under Part B. Under the out-of-network process, the beneficiary pays the physician and then submits a paper claim to his or her Part D plan for reimbursement up to the plan’s allowable charge. As there likely would be no communication with the plan prior to vaccine administration, the amount the physician charges may be different from the plan’s allowable charge, and a differential may remain that the beneficiary would be responsible for paying. As newer vaccines have entered the market with indications for use in the Medicare population, Part D vaccine in-network access has become more imperative. Requiring the beneficiary to pay the physician’s full charge for a vaccine out of pocket first and be reimbursed by the plan later is not an optimal solution, and CMS has urged Part D plans to implement cost-effective, real time billing options at the time of administration. With consideration to improve access to vaccines under the Drug Benefit without requiring up-front beneficiary payment, in May 2006, CMS issued guidance to Part D sponsors to investigate alternative approaches to ensure adequate access to Part D vaccines. CMS emphasized a solution incorporating real-time processing, given that cost sharing under Part D for non-full subsidy beneficiaries can differ depending upon where the beneficiary is in the benefit (e.g., deductible, coverage gap, and catastrophic range). CMS has outlined the following options to Part D sponsors for their consideration in a letter dated 12/1/06. (See

What is covered under Part B?

Part B covers influenza vaccine, pneumococcal vaccine and Hepatitis B vaccine for intermediate and high risk beneficiaries, The Part B program also covers vaccines that are necessary to treat an injury or illness. For instance, should a beneficiary need a tetanus vaccination related to an accidental puncture wound, it would be covered under Part B. However, if the beneficiary simply needed a booster shot of his or her tetanus vaccine, unrelated to injury or illness, it would be covered under Part D. Medicare Part B does not cover administration of Part D vaccines

Is a 351 a part D?

Any vaccine licensed under section 351 of the Public Health Service Act is available for payment under the Part D benefit when it is not available for payment under Medicare Part B (as so prescribed and dispensed or administered). Unlike other Part D Drugs that may be excluded when not reasonable and necessary for the diagnosis or treatment of illness or injury or to improve the functioning of a malformed body member, Part D vaccines may be excluded from coverage only when their administration is not reasonable and necessary for the prevention of illness. Therefore, although a Part D plan’s formulary might not list all Part D vaccines, the beneficiary must be provided access to such vaccines when the physician prescribes them for an appropriate indication reasonable and necessary to prevent illness in the beneficiary.

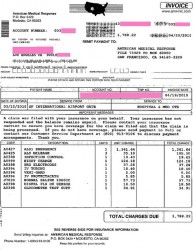

What form do you need to bill Medicare?

If a biller has to use manual forms to bill Medicare, a few complications can arise. For instance, billing for Part A requires a UB-04 form (which is also known as a CMS-1450). Part B, on the other hand, requires a CMS-1500. For the most part, however, billers will enter the proper information into a software program and then use ...

Who pays for Part B?

On the other hand, in a Part B claim, who pays depends on who has accepted the assignment of the claim. If the provider accepts the assignment of the claim, Medicare pays the provider 80% of the cost of the procedure, and the remaining 20% of the cost is passed on to the patient.

What is 3.06 Medicare?

3.06: Medicare, Medicaid and Billing. Like billing to a private third-party payer, billers must send claims to Medicare and Medicaid. These claims are very similar to the claims you’d send to a private third-party payer, with a few notable exceptions.

What is a medical biller?

In general, the medical biller creates claims like they would for Part A or B of Medicare or for a private, third-party payer. The claim must contain the proper information about the place of service, the NPI, the procedures performed and the diagnoses listed. The claim must also, of course, list the price of the procedures.

How long does it take for Medicare to process a claim?

The MAC evaluates (or adjudicates) each claim sent to Medicare, and processes the claim. This process usually takes around 30 days .

Is it harder to bill for medicaid or Medicare?

Billing for Medicaid. Creating claims for Medicaid can be even more difficult than creating claims for Medicare. Because Medicaid varies state-by-state, so do its regulations and billing requirements. As such, the claim forms and formats the biller must use will change by state. It’s up to the biller to check with their state’s Medicaid program ...

Can you bill Medicare for a patient with Part C?

Because Part C is actually a private insurance plan paid for, in part, by the federal government, billers are not allowed to bill Medicare for services delivered to a patient who has Part C coverage. Only those providers who are licensed to bill for Part D may bill Medicare for vaccines or prescription drugs provided under Part D.

What is Medicare Part B?

When a patient is in outpatient observation status at a hospital, Medicare Part B is billed, and pays for, 80% of the hospital services provided (Part A pays for inpatient hospital admissions). However, outpatient prescription drugs received in the hospital while a patient is in observation status are not billed to Part B.

Do individual plans have different forms?

However, individual plans will likely have different forms . Beneficiaries should submit the completed claim form supplied by their plan and include the bill for medications from the hospital as well as a letter explaining that they were in observation status at the hospital and could not get to an in-network pharmacy.

Can you get outpatient drugs from a pharmacy?

In essence, patients in observation status at a hospital cannot be expected to get their outpatient drugs from a pharmacy that contracts with their Part D plan (like a CVS or Walgreens). Rather, they must take the drugs given to them by the hospital, dispensed from the hospital's out-of-network pharmacy. To submit claims, beneficiaries should call ...

What is Medicare Part D?

Medicare Part D is Medicare’s prescription drug coverage program. Unlike Original Medicare Parts A and B, Part D plans are optional and sold by private insurance companies that contract with the federal government. Part D was enacted in 2003 as part of the Medicare Modernization Act and became operational on January 1, 2006.

What happens if you have Medicare Part D and another insurance?

If someone has Medicare Part D and another insurance policy with drug coverage, there will be a coordination of benefits between the separate policy companies to determine which policy is the primary payer and which is the secondary. The determination of payments for prescription drugs will be based on the enrollee’s personal situation.

What is the spending gap for Medicare Part D?

Beginning in 2020, the spending gap is reduced to a ‘standard’ co-payment of 25%, the same as required in initial spending policies. Even with the wide range of co-payments and deductibles, Medicare Part D drug coverage has proven beneficial for policy enrollees who otherwise could not afford their life-saving medications.

Is Medicare Part D private or union?

There are dozens of variables in the available Medicare Part D plans, private drug coverage plans, employer- provided plans for those still working and those retired, and union plans for those still working and those retired. Medicare Part D enrollees can benefit from a consultation with a prescription drug plan provider ...

Is Medicare the primary payer?

When Medicare Part D is the Primary Payer: • When someone is retired and enrolled in Part D while also having another health insurance policy with drug coverage, Medicare is the primary payer. The other insurance policy is the secondary payer on any remaining amount due up to the limits of the policy. If there is still any remaining unpaid amount, ...

How to become a Medicare provider?

Become a Medicare Provider or Supplier 1 You’re a DMEPOS supplier. DMEPOS suppliers should follow the instructions on the Enroll as a DMEPOS Supplier page. 2 You’re an institutional provider. If you’re enrolling a hospital, critical care facility, skilled nursing facility, home health agency, hospice, or other similar institution, you should use the Medicare Enrollment Guide for Institutional Providers.

How long does it take to change your Medicare billing?

To avoid having your Medicare billing privileges revoked, be sure to report the following changes within 30 days: a change in ownership. an adverse legal action. a change in practice location. You must report all other changes within 90 days. If you applied online, you can keep your information up to date in PECOS.

How to get an NPI?

If you already have an NPI, skip this step and proceed to Step 2. NPIs are issued through the National Plan & Provider Enumeration System (NPPES). You can apply for an NPI on the NPPES website.

Can you bill Medicare for your services?

You’re a health care provider who wants to bill Medicare for your services and also have the ability to order and certify. You don’t want to bill Medicare for your services, but you do want enroll in Medicare solely to order and certify.