Search for Aetna’s website and then fill up an application form. The whole process is designed to be easy. If you apply within six months of turning 65, you will be approved for the AARP Medicare Supplement

Medigap

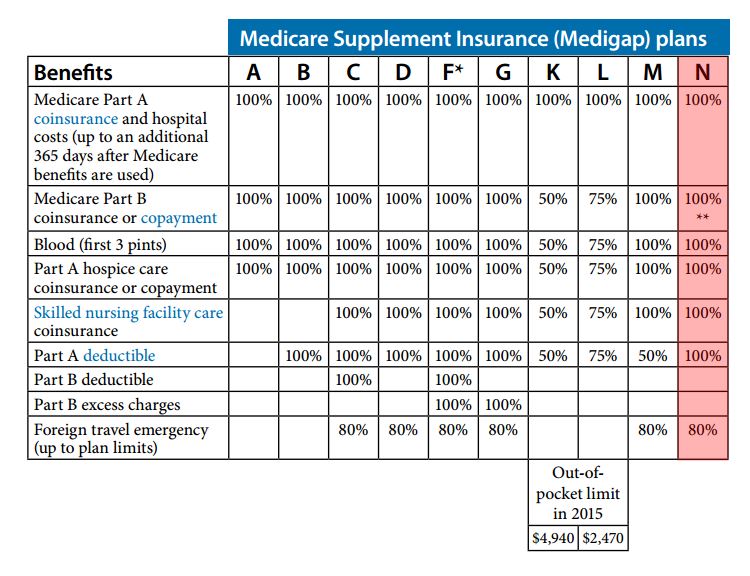

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What are Medicare supplement plans does Aetna offer?

What is an Aetna Medicare Supplement Plan? An Aetna Medicare Supplement plan may help you pay for certain out-of-pocket costs associated with Original Medicare, including copayments, coinsurance, and deductibles. This coverage could give you some peace of mind, considering that Original Medicare has no out of pocket maximum.

What Medicare plans does Aetna cover?

All plans acquired through Aetna that cover parts A and B of Original Medicare are called Medicare Advantage plans because they are acquired through a private Medicare-approved provider. These plans are considered Part C of Medicare.

What is the best Aetna plan?

- Aetna offers $0 premium Medicare part A plans with a $0 deductible

- Easy to get a quote and enroll in a Medicare plan online

- Good dental insurance plans with a large network of 120,000 providers

What insurances does Aetna offer?

Most of the U.S. Aetna does offer Life Insurance. However, on their website, Aetna states that the Life insurance coverage that they offer is available through employer-provided plans only. Their life insurance policies are not available to individuals for private sales. Aetna life insurance plans are called group term insurance or group coverage.

Does Aetna offer Plan F?

Aetna offers Medicare Supplement Plans A, B, F, high-deductible F, G, and N in most states. Plan G has a high-deductible option as of January 1, 2020, which you may be able to get in your area. Plans C and D are also available, but only in certain states.

Can you get Plan F in 2021?

Written by Jason B. Medicare Supplement Plan F is the most comprehensive of the standardized Medicare Supplement plans available in most states. These plans are being phased out, starting in 2021.

How do I get Medicare F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.

Can I enroll in a plan F?

Plan F is still available for people who were eligible for Medicare before January 1st, 2020. However, anyone who became eligible for Medicare on or after Jan 1, 2020 can no longer enroll in Plan F.

Why is plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

What is the cost for Medicare Plan F in 2022?

The average premium for Medicare Supplement Insurance Plan F in 2022 is $172.75 per month, or $2,073 per year. Here is how the average estimated premiums of Plan F compare with that of other Medicare Supplement Insurance plans in 2022.

What is the cost of Medicare Part F?

Since Medicare Plan F is the most comprehensive Medigap policy, the premium can be costly. Typically, the cost ranges from $161 to $410 per month for a 65-year-old. However, the exact cost will be determined by your location, plan provider, current health condition, age and gender.

What is the premium for plan F?

Premium costs for Medigap Plan F can range from as low as $150.00 per month to as high as $400.00 per month or more.

What is a plan F Medicare Supplement?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

Who can enroll into a plan F?

Who Can Enroll in Plan F? Any Medicare beneficiary who was Medicare-eligible prior to January 1, 2020, can enroll in Plan F. If you are within the first six months of having enrolled in Medicare Part B, you are able to enroll in Plan F under the guarantee issue period.

Is Medicare Part F still available 2022?

Previously, anyone enrolled in original Medicare could purchase Medigap Plan F. However, this plan is now being phased out. As of January 1, 2020, Medigap Plan F is only available to those who were eligible for Medicare before 2020.

Can I switch back to plan F?

You pay for Medicare-covered costs up to the $2,490 deductible (as of 2022) before the plan begins to pay for anything. If you currently have Medicare Supplement Plan F, you can switch to high-deductible Plan F by contacting your insurance provider.

Medicare Plan F

Aetna Medicare Plan F is the single full coverage Medicare Supplement plan, and what that essentially means is that it is the one Supplement plan to include coverage for all the supplemental medical expenses, which are medical costs that the Original Medicare plan does not cover.

Aetna Medicare Supplement Plan F – Coverage

There are a lot of different medical expenses that are going to be covered under Plan F. We will cover them all for you here and you can look through the list to see if they all apply to you. If you only think few of them pertain to your situation, then you should try to find a lower coverage plan.

Plan F Benefits

Many people are signed up for Medicare automatically once they reach a certain age. However, you have to choose to be signed up for a Supplement plan. You have to pick your Supplement plan and you have to choose a provider to get it from. Unlike basic Medicare, Supplement plans are not only available from a single source.

Aetna Medicare

Aetna has been in the medical insurance business for a very long time, and in that time they have built up their reputation and established themselves, and become a prime choice for seniors looking for medical coverage.

Aetna Medicare Plan F

To enroll in a Plan F from any company, you must have been enrolled in Medicare Part A and B prior to the date of January 1st, 2020.

Enrolling in Aetna Medicare Plan F

This is really a twofold question because you need to determine if you are better off with Aetna as your insurance provider and you need to determine if Plan F is the best Supplement plan for you out of all that is available.

Purchasing from Aetna

Aetna boasts of a solid history in the medical insurance arena and has evolved to be one of the highly reputable insurance providers. As you do you search and comparison process, you might see that there are cheaper options of Plan F in contrast to the Plan F offered by Aetna.

How Plan F Benefits You

The benefits associated with Plan F is standardized as set out by Medicare. Aetna’s Medicare Supplement Plan F is similar to the versions of Plan F by other companies. Simply remember that rates may change among providers despite standard benefits.

What is Aetna Supplement Plan F?

Aetna Medicare Supplement Plan F is a great option for Medicare beneficiaries to consider if they want to reduce their health care expenses. Medicare Part A and Medicare Part B, which is often just known as Original Medicare, provides a lot of coverage for its beneficiaries. Beneficiaries who want additional benefits should consider Aetna Medicare Supplement Plan F. Plan F is a Medigap policy that you can count on for its robust benefits, and Aetna is an insurance company that you can count on for good customer service and reliable health insurance coverage.

Why is Aetna Medigap Plan F so popular?

This leads to more stable rates.

What is high deductible plan F?

Aetna High Deductible Medicare Supplement Plan F. Another Medicare Supplement insurance option you can look into is Medicare Supplement high deductible Plan F from Aetna. On top of your standard Medicare benefits, high deductible Plan F still covers the same medical services and medical expenses as standard Plan F.

Why is Medicare Plan F the highest?

Rates for Medigap Plan F are the highest of all of the Medicare Supplements because of the robust coverage. In many cases, Plan F rates are more stable. This is true because so many people have Plan F, so risks are more spread out than with less popular plans like Plan A, Plan B or Medigap Plan N. Doing a comparison of Aetna Medicare Supplement ...

What is SNF insurance?

Skilled nursing facility care (SNF) coinsurance. As you can probably see, Medicare Plan F offers many great benefits for doctor’s visits, emergency room visits and more. Aetna Medicare Supplement plans like Plan F can help you save money on doctor’s office visits and other medical care.

Will Medicare Supplement Plan F be available in 2020?

In 2020, there are going to be some changes when it comes to Medigap plans. The federal government will no longer allow Medicare Supplement plans that cover Medicare Part B deductible. This means that neither Medigap Plan F or Plan C will be available.

Does Aetna offer Medicare Supplemental?

Aetna offers Supplemental insurance in many areas of the United States, although you’ll need to check to see if their Medicare insurance options are available in your area. Aetna is a well-known American health insurance and life insurance option that has been around for a long time. Aetna Medicare Supplement Plan F Vs. Plan G.

How to enroll in Aetna over the phone?

Phone. Or, enroll in an Aetna Medicare plan over the phone by calling a licensed agent at 1-855-335-1407 (TTY: 711), Monday to Friday, 8 AM to 8 PM.

What is a D-SNP?

Dual-Eligible Special Needs Plan (D-SNP) Dual-Eligible Special Needs Plan (D-SNP) If you have Medicare and Medicaid already and live in one of 23 states in one of our covered counties, then you may be eligible to enroll in a D-SNP. Phone.

What is the number to call for D-SNP?

Medicare Supplement Insurance (Medigap) Plan. To enroll in a Medicare Supplement Insurance plan, please call us at 1-800-358-8749 (TTY: 711) , Monday to Friday, 8 AM to 8 PM ET. Aetna is the brand name for insurance products ...

What is Medicare Supplement?

With a Medicare Supplement plan, you’ll enjoy a variety of benefits, including: No restrictive provider networks. The freedom to visit any physician, specialist or hospital that accepts Medicare patients.

Does Medicare cover out of pocket expenses?

A reliable way to limit your out-of-pocket costs. Medicare provides you with coverage for health-related expenses, but it doesn’t cover everything. There may be some gaps in Medicare coverage. A Medicare Supplement Insurance plan can help you with out-of-pocket expenses.

What is the star rating for Aetna?

The weighted overall star rating for Aetna Medicare Advantage plans is 4.3 out of 5 stars. Also, the majority of beneficiaries in an Aetna Advantage plan have a 4.5 star or higher policy.

How much does Aetna rate increase?

Aetna rate increases, like most companies, fall between 3% and 10% depending on various factors.

How much does a Plan G cost?

Plan G can cost around $120 with some areas costing much less, and other regions are more expensive. But, if you don’t mind trading out of pocket costs for a lower premium, you can consider a Plan N or High Deductible Plan G.

Is Aetna a good Medicare supplement?

Our expert opinion is yes; Aetna is a good Medicare Supplement. But, we also believe there are many good Medicare Supplements. Since Medigap plans agree to cover the other portion of claims Medicare approves, denials aren’t an issue, making these plans an excellent choice.

Does Aetna cover Medicare Part D?

Aetna Medicare Part D. Aetna does offer Part D plans to cover your prescription medications. You can enroll in a Part D plan to supplement your Aetna Medigap plan. However, just because you choose to enroll in an Aetna Medigap plan, doesn’t automatically mean that their Part D options are the best ones for you.

Is Aetna Medicare Supplement Plan G good?

Aetna Medicare Supplement Plan G. Plan G reviews are excellent no matter which company you choose. Plan G is perfect for those that are money savvy; you pay the Part B deductible yourself and save quite a bit of money in premium costs.

Does Aetna have a low premium?

A low premium doesn’t always equate to an excellent policy. Sometimes, paying more in premiums can save you money. Our expert opinion of Aetna is that when it comes to their Medicare Advantage plans, they have a broad range of doctors in-network and some of the most affordable policies.