Just the Essentials...

- Overall, Medicare sequestration reduces government spending to meet budgetary goals.

- Essentially, sequestration reduces what Medicare pays its providers for health services by two percent.

- However, Medicare beneficiaries bear no responsibility for the cost difference.

How to calculate Medicare sequestration?

Jan 06, 2021 · Latest Update on Sequestration. Section 3709 of the Coronavirus Aid, Relief, and Economic Security (CARES) Act temporarily suspends the 2% payment adjustment currently applied to all Medicare fee-for-service claims due to sequestration. The suspension is effective for claims with dates of service from May 1 through December 31, 2020.

What does sequestration mean in Medicare?

Apr 06, 2022 · Sequestration means that Medicare pays its providers two-percent less. Medicare beneficiaries are not responsible for the cost difference. Designed to prevent additional debt, but does not burden providers. It is 2% reduction in the case of Medicare. Use IRS Letter 6475 to get stimulus payments.

When will Medicare sequestration end?

Mar 29, 2022 · Medicare and Budget Sequestration Sequestration is the automatic reduction (i.e., cancellation) of certain federal spending, generally by a uniform percentage. The sequester is a budget enforcement tool that was established by Congress in the Balanced Budget and Emergency Deficit Control Act of

Does sequestration affect Medicare Advantage?

Jan 12, 2022 · However, sequestration affects how much Medicare reimburses the beneficiary. The non-participating fee schedule approved amount is $95.00 with $50.00 applied to the deductible. A balance of $45.00 remains. Medicare normally reimburses the beneficiary 80% of the approved amount after the deductible is met, which is $36.00 ($45.00 x 80% = $36.00).

Why is there a Medicare sequestration?

"Sequestration" is a process of automatic, largely across-the-board spending reductions under which budgetary resources are permanently canceled to enforce certain budget policy goals.

How long does Medicare sequestration last?

The Senate today passed by 90-2 vote a bill that, among other health care provisions, would eliminate the 2% across-the-board cut to all Medicare payments, known as sequestration, until the end of 2021. To pay for the change, the bill would increase the fiscal year 2030 sequester cuts.Mar 25, 2021

How is Medicare sequestration calculated?

Medicare normally would reimburse the beneficiary for 80% of the approved amount after the deductible is met, which is $36 ($45 x 80% = $36). However, due to the sequestration reduction, 2% of the $36 calculated payment amount is not paid to the beneficiary, resulting in a payment of $35.28 instead of $36 ($36 x .Feb 3, 2022

How much is Medicare sequestration?

The Coronavirus Aid, Relief, and Economic Security (CARES) Act suspended the sequestration payment adjustment percentage of 2% applied to all Medicare Fee-for-Service (FFS) claims from May 1 through December 31, 2020.

Is sequestration still in effect in 2021?

3, 2021 Update: Congress has passed legislation that continued the moratorium on sequestration. As a result, CMS has extended the moratorium on sequestration until December 31, 2021.Dec 22, 2021

Does sequestration apply to Medicare Advantage?

The payment reduction, referred to as sequestration, is applied to the Net Capitation Payment (NCP) made to the plans, including MAOs. Therefore, Medicare rates and fee schedules remain unaffected by sequestration.

Who imposed Medicare sequestration?

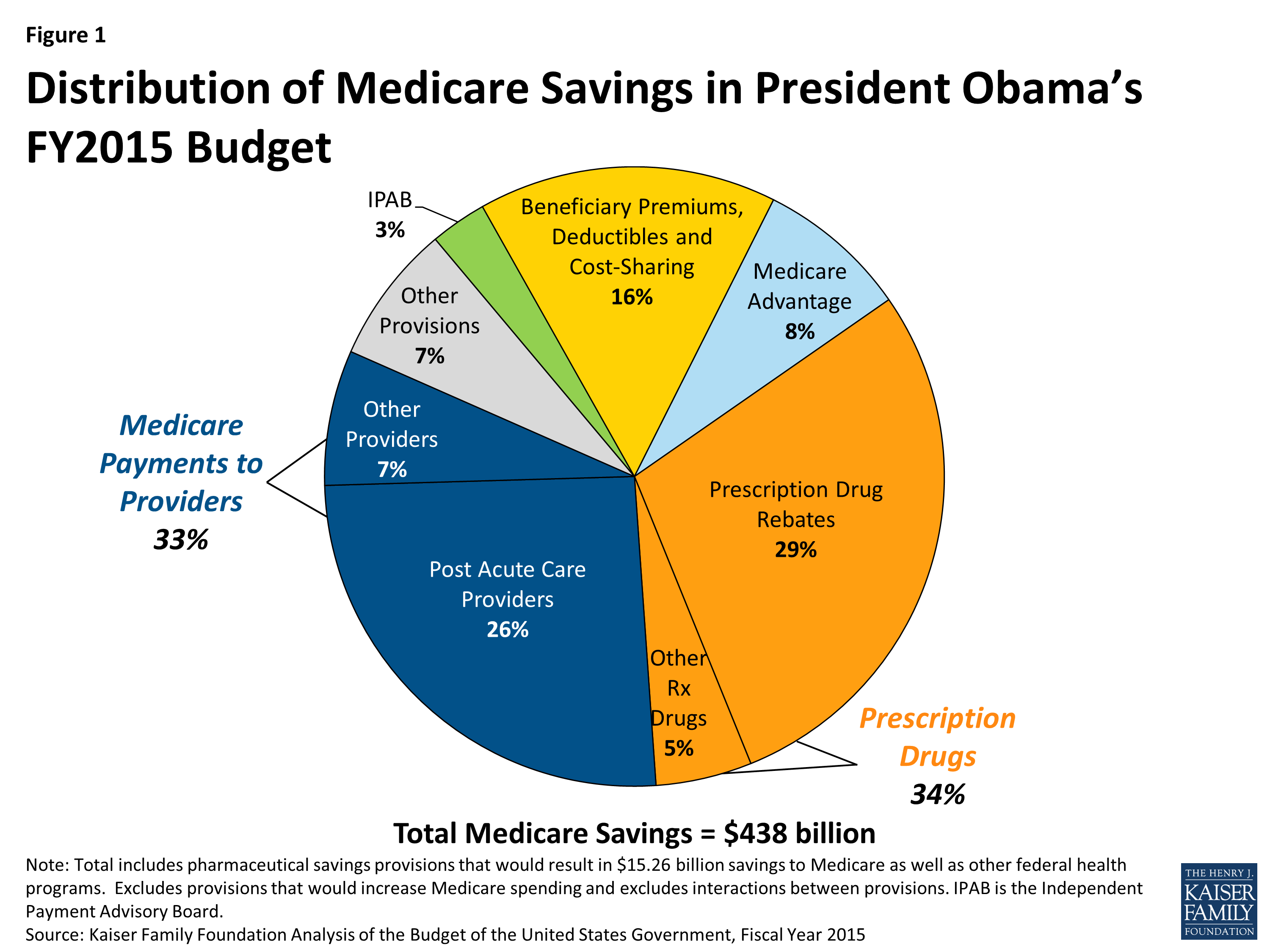

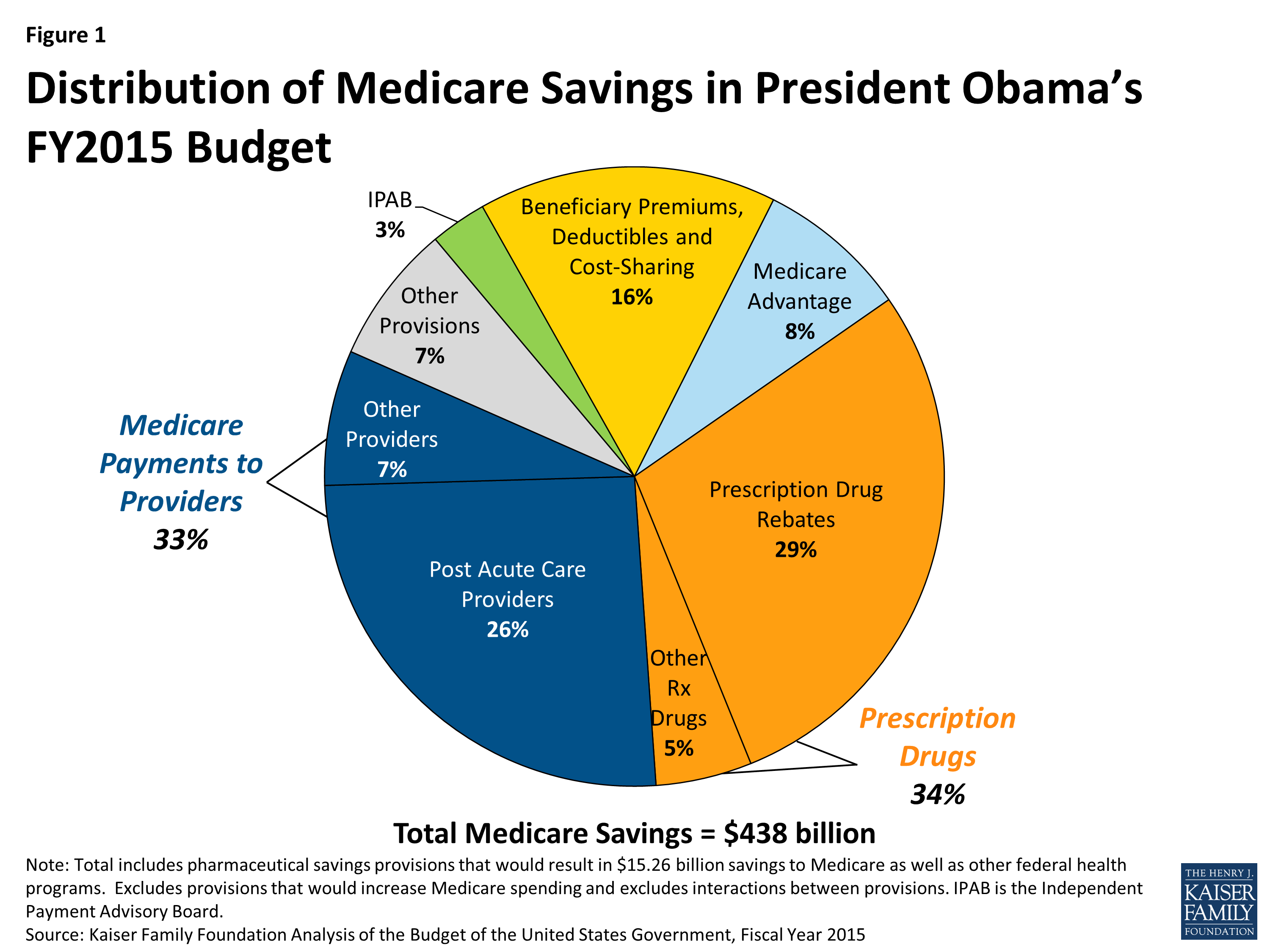

History. The Budget Control Act of 2011 requires, among other things, mandatory across-the-board reductions in Federal spending, also known as sequestration. The American Taxpayer Relief Act of 2012 postponed sequestration for 2 months. As required by law, President Obama issued a sequestration order on March 1, 2013.Nov 9, 2021

Does sequestration apply to Medicare B?

Generally, Medicare's benefit structure remains unchanged under a mandatory sequestration order and beneficiaries see few direct impacts. However, Medicare plans and providers see reductions in payments.Mar 29, 2022

Does sequestration apply to drugs?

Under the current sequester, Medicare payments to doctors, hospitals, and other health care providers, as well as to health plans and drug plans, are to be reduced by 2 percent for services provided on or after April 1. This also covers physician-administered drugs included on your claims.Apr 3, 2013

When will the Sequestration Act be extended?

Sequestration. Act to Prevent Across-the-Board Direct Spending Cuts, and for Other Purposes, signed into law on April 14, 2021, extends the suspension period to December 31, 2021. The Consolidated Appropriations Act, 2021, extended the suspension period to March 31, 2021. The Coronavirus Aid, Relief, and Economic Security (CARES) ...

When did Obama sequester Medicare?

The American Taxpayer Relief Act of 2012 postponed sequestration for 2 months. As required by law, President Obama issued a sequestration order on March 1, 2013. For additional information, please refer to the Mandatory Payment Reductions in the Medicare Fee-for-Service (FFS) Program – “Sequestration”.

What is a non-participating provider bill?

Example: A non-participating provider bills a non-assigned claim for a service with a limiting charge of $109.25. The beneficiary remains responsible to the provider for this full amount. However, sequestration affects how much Medicare reimburses the beneficiary.

What adjustments are required for sequestration?

Payment adjustments required under sequestration apply to all claims after determining the Medicare payment including application of the current fee schedule, coinsurance, any applicable deductible, and any applicable Medicare secondary payment adjustments.

When did the 2% sequestration reduction end?

Yes, the 2% sequestration reduction applies to electronic health records and physician quality reporting system incentive payments for a reporting period that ended on or after April 1, 2013.

What is reduced fee schedule?

The “reduced fee schedule” refers to the fact that Medicare’s approved amount for claims from non-participating physicians/practitioners is 95% of the full fee schedule amount). This reimbursed amount to the beneficiary is subject to the 2% reduction, just like payments to physicians on assigned claims.

What adjustments are required for sequestration?

Answer: Payment adjustments required under sequestration are applied to all claims after determining the Medicare payment including application of the current fee schedule, coinsurance, any applicable deductible, and any applicable Medicare Secondary Payment adjustments.

When did Obama issue the sequestration order?

As required by law, President Obama issued a sequestration order on March 1, 2013. The Administration continues to urge Congress to take prompt action to address the current budget uncertainty and the economic hardships imposed by sequestration. Medicare Fee-for-Service (FFS) claims with dates-of-service or dates-of-discharge on/after April 1, ...

Is Medicare deductible a 2 percent reduction?

Though beneficiary payments for deductibles and coinsurance are not subject to the 2 percent payment reduction, Medicare's payment to beneficiaries for unassigned claims is subject to the 2 percent reduction.

Can a physician collect more than the limiting charge?

If the Limiting Charge applies to the service rendered , physicians/practitioners cannot collect more than the Limiting Charge amount from the beneficiary. Example: A non-participating provider bills an unassigned claim for a service with a Limiting Charge of $109.25.

Is Medicare 2% reduction?

Answer: Though beneficiary payments toward deductibles and coinsurance are not subject to the 2% payment reduction, Medicare's payment to beneficiaries for unassigned claims is subject to the 2% reduction.