Steps to Buying Medicare Supplement Insurance Plans

- Step 1: Qualify to buy a Medicare Supplement insurance plan. Medicare Supplement insurance plans are not available to...

- Step 2: Compare Medicare Supplement insurance plan benefits. Medicare plans cover a range of benefits, with some plans...

- Step 3: Understand Medicare Supplement insurance plan pricing. Medicare...

Full Answer

What is the best Medicare insurance plan?

Apr 06, 2022 · There are two ways to get Medicare drug coverage: Add a Medicare Prescription Drug Plan (Part D) to your Medicare-approved insurance policy. Get a Medicare Advantage Plan (Part C) such as an HMO or PPO that offers Medicare prescription drug coverage. Learn more about Medicare Part D.

Is there a monthly premium for Medicare?

Steps to Buying Medicare Supplement Insurance Plans Step 1: Qualify to buy a Medicare Supplement insurance plan. Medicare Supplement insurance plans are not available to... Step 2: Compare Medicare Supplement insurance plan benefits. Medicare plans cover a range of benefits, with some plans... Step ...

How to get help when you have problems with Medicare?

Mar 24, 2022 · Shopping through an online marketplace is an easy way to look at rates for specific plan types across multiple companies if you’re still unsure which company you should purchase a policy from. Unfortunately, United Medicare Advisors doesn’t let you apply for a policy online. You have to place a phone call to their insurance agents to apply.

What is monthly premium for Medicare?

If you don't qualify for premium-free Part A, you can buy Part A. People who buy Part A will pay a premium of either $274 or $499 each month in 2022 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also:

Can you buy into Medicare?

If you do not qualify on your own or through your spouse's work record but are a U.S. citizen or have been a legal resident for at least five years, you can get full Medicare benefits at age 65 or older. You just have to buy into them by: Paying premiums for Part A, the hospital insurance.Nov 15, 2021

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

How likely is a person to purchase Medicare insurance online?

Increasing online Medicare insurance enrollments: 22 percent of all Medicare Advantage and Medicare Supplement enrollments at eHealth in the fourth quarter of 2018 occurred online, compared to 13 percent in the fourth quarter of 2017 – a year-over-year increase of 69 percent.Apr 2, 2019

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What is not covered by Medicare?

Medicare does not cover: medical exams required when applying for a job, life insurance, superannuation, memberships, or government bodies. most dental examinations and treatment. most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry, acupuncture and psychology services.Jun 24, 2021

What Medicare is free?

Part AMost people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.Dec 1, 2021

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How do I enroll in Medicare for the first time?

Apply online (at Social Security) – This is the easiest and fastest way to sign up and get any financial help you may need. You'll need to create your secure my Social Security account to sign up for Medicare or apply for Social Security benefits online. Call 1-800-772-1213. TTY users can call 1-800-325-0778.

Do I automatically get Medicare when I turn 65?

Medicare will automatically start when you turn 65 if you've received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday. You'll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

How much does Medicare cost at age 83?

How much does the average Medicare Supplement Plan F cost?Age in yearsAverage monthly premium for Plan F80$221.0581$226.9382$236.5383$220.8118 more rows•Dec 8, 2021

Medicare Eligibility, Applications, and Appeals

Find information about Medicare, how to apply, report fraud and complaints.What help is available?Medicare is the federal health insurance program...

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 to the Social Secur...

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.EligibilityPrescript...

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:Log into your MyMedicare.gov account and reque...

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.Original Medica...

Medicare Eligibility, Applications, and Appeals

Find information about Medicare, how to apply, report fraud and complaints.

Voluntary Termination of Medicare Part B

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 ( PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA ( 1-800-772-1213) to get this form.

Medicare Prescription Drug Coverage (Part D)

Part D of Medicare is an insurance coverage plan for prescription medication. Learn about the costs for Medicare drug coverage.

Replace Your Medicare Card

You can replace your Medicare card in one of the following ways if it was lost, stolen, or destroyed:

Medicare Coverage Outside the United States

Medicare coverage outside the United States is limited. Learn about coverage if you live or are traveling outside the United States.

Do you have a question?

Ask a real person any government-related question for free. They'll get you the answer or let you know where to find it.

What is Medicare Supplement?

Medicare Supplement insurance plans are standardized in most states, meaning that plans of the same letter offered by different companies must cover the same basic benefits. However, pricing for the same plan may differ from company to company. Insurance companies use three ways to price Medicare Supplement insurance plans:

Is Medicare Supplement available to everyone?

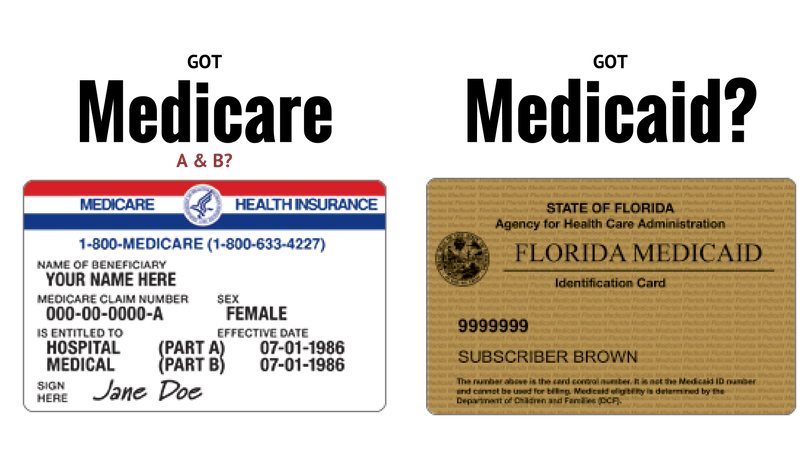

Medicare Supplement insurance plans are not available to everyone. The first requirement is to be enrolled in Medicare Part A and Part B. When you become eligible for Medicare, you may have the choice to stay with Original Medicare (Part A and Part B) or go with a Medicare Advantage plan that covers your Medicare hospital and medical benefits (except for hospice care, which Part A still covers). Many Medicare Advantage plans also offer additional benefits, such as routine dental care. If you have Medicare Advantage, you can’t be sold a Medicare Supplement insurance plan.

Does Medicare Supplement cover out of pocket costs?

You may have heard that a Medicare Supplement (Medigap) insurance plan can help you pay for Original Medicare’s out-of-pocket costs, such as copayments, coinsurance and deductibles . Following the below steps may help you as shop for and enroll in a Medicare Supplement insurance plan.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

What does Medicare Part B cover?

Both plans also cover Medicare Part B coinsurances and copays, the first three pints of blood, Part A hospice care coinsurances or copays, skilled nursing facility care coinsurances, and the Part A deductible, but not at 100% like other plans. Plan K covers these benefits at 50% and Plan L covers them at 75%.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What is covered benefits and excluded services?

Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board. You're eligible to get Social Security or Railroad benefits but haven't filed for them yet. You or your spouse had Medicare-covered government employment.

What is premium free Part A?

Most people get premium-free Part A. You can get premium-free Part A at 65 if: The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

What costs are not covered by original Medicare?

By itself, original Medicare (Parts A and B) generally pays about 80% of the cost for doctors, hospitals, and medical procedures. The patient is responsible for paying the rest, and there is no limit on out-of-pocket expenses.

What does the standard Medigap coverage provide?

In general, Medigap covers your coinsurance bill once you’ve paid the Medicare deductible. Some plans (B, D, G, and N) pay your Part A deductible as well. (Plans C and F also pay the Part A deductible but aren’t available to new enrollees.)

When is the best time to buy a Medigap policy?

In most cases, the best time to buy a Medigap policy is during your open-enrollment period. This period may start either in the month you turn 65 and enroll in Medicare Part B, or when your employer-provided group healthcare coverage ends and you enroll in Part B.

How do I identify which Medigap plan I need?

When picking a Medigap plan, think about both your current and future healthcare needs. It’s important to choose carefully, because there’s no guarantee you’ll be able to switch plans later .

How do I shop for a Medigap policy?

There are a few ways to find out what policies are available in your area.

The bottom line

Medigap plans help cover costs related to Medicare Parts A and B that you'd otherwise pay yourself. The best time to choose a Medigap plan is generally when you first sign up for Medicare, when you won't have to go through medical underwriting.

How does Medicare buy in work?

The Medicare Buy-In Program: What It Is and How It Works 1 The Medicare buy-in program helps eligible beneficiaries pay for some of the costs of original Medicare. 2 Availability of state Medicare buy-in programs varies by location. 3 You must meet state income and asset requirements to be eligible. 4 If eligible, you’ll also be automatically qualified for the Extra Help program, which helps you cover some prescription drug costs.

What is the buy in program for Medicare?

The Medicare buy-in program helps pay for certain out-of-pocket healthcare costs. To qualify, you must meet financial need criteria through state ...

How many people pay Medicare Part B?

According to the Centers for Medicare & Medicaid Services (CMS), the Medicare buy-in program enables states to help more than 10 million Americans pay their monthly Medicare Part B premiums and more than 700,000 people pay their Part A premiums. All states offer buy-in for Part B, but fewer states offer Part A buy-in.

What is Medicare Part B?

Medicare Part B is the second part of original Medicare. It covers medical and outpatient services. Most people will pay a $148.50 monthly premium in 2021. This amount could be higher, depending on your income level. On the other hand, if your income is below a certain level, you may be eligible to apply for an MSP.

What do I need to get extra help?

Social Security card. birth certificate. proof of address. Once you apply and meet the requirements, states can automatically enroll you in the Part B buy-in program to help cover your premium. If you enroll in Medicaid, SSI, or an MSP, you also automatically qualify for Extra Help.

What is extra help for Medicare?

If you enroll in Medicaid, SSI, or an MSP, you also automatically qualify for Extra Help. This is a program that helps you pay your Part D premium. Part D is prescription drug coverage offered by Medicare. Extra Help removes the enrollment penalty for Part D if you didn’t apply when you were first eligible.

How long does it take to get a notice of action for Medicaid?

Once you apply, you’ll receive an eligibility notice of action within 45 days of filing your application. If you’re approved for an MSP, Medicaid will start paying your Part B premium immediately. For the QMB program, benefits start the month after the notice of action.