For purposes of figuring out your Medicare Part B premium, MAGI is your adjusted gross income (line 11 on the IRS Form 1040 for the 2020 tax year) plus any tax exempt (municipal) bond interest (line 2A on Form 1040). Add the two together and that’s your MAGI that will be used to

Does TurboTax calculate Magi?

(Just Now) Modified Adjusted Gross Income (MAGI) Part B monthly premium amount. Prescription drug coverage monthly premium amount. Individuals with a MAGI of less than or equal to $91,000. 2022 standard premium = $170.10. Your plan premium. Individuals with a MAGI above $91,000 and less than $409,000. Standard premium + $374.20. Url: Visit Now

How do you calculate Magi?

Dec 08, 2017 · A. To calculate your modified adjusted gross income (MAGI) take your adjusted gross income (AGI) and add back certain deductions. Depending on your deductions, it’s possible that your MAGI and your AGI could be the same. Here are the deductions you add back to your AGI in order to come up with your MAGI. ½ of self-employment tax

How to calculate Magi income?

Modified Adjusted Gross Income (MAGI) Part B monthly premium amount Prescription drug coverage monthly premium amount; Individuals with a MAGI of less than or equal to $91,000: 2022 standard premium = $170.10: Your plan premium: Individuals with a MAGI above $91,000 and less than $409,000: Standard premium + $374.20: Your plan premium + $71.30

How is Medicare Magi calculated?

Sep 20, 2021 · Calculating your MAGI is an important step in determining if you qualify for a premium tax credit and other deductions. Here's a quick overview of how to calculate your modified adjusted gross income: Step 1: Calculate your gross income; Step 2: Calculate your adjusted gross income; Step 3: Calculate your modified adjusted gross income

What is the Magi for Medicare for 2021?

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2021, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.Oct 22, 2021

How is Medicare Part B Irmaa calculated?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually.

What is modified adjusted gross income for Medicare Part B?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is the Medicare Part B Irmaa for 2020?

Combined Medicare Part B premiums and IRMAA surcharges will range from $220.40 per month to $491.60 per month per person in 2020. High-income Medicare beneficiaries are also subject to monthly surcharges for their Medicare Part D prescription drug plans.Nov 11, 2019

How do you calculate Magi for Medicare premiums?

Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI). If that total for 2019 exceeds $88,000 (single filers) or $176,000 (married filing jointly), expect to pay more for your Medicare coverage.Oct 10, 2021

How do I calculate Magi?

To calculate your MAGI:Add up your gross income from all sources.Check the list of “adjustments” to your gross income and subtract those for which you qualify from your gross income. ... The resulting number is your AGI.More items...

What is the difference between AGI and Magi?

AGI can reduce the amount of your taxable income by subtracting certain deductions from your gross income. But MAGI can add back those deductions, where the IRS disallows certain deductions and credits.

What counts as modified adjusted gross income?

MAGI is adjusted gross income (AGI) plus these, if any: untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest. For many people, MAGI is identical or very close to adjusted gross income. MAGI doesn't include Supplemental Security Income (SSI).

Does Medicare Part B premium change every year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

What is the Magi for Medicare for 2020?

3. Married filing separately tax filing statusIf MAGI in 2020 (or 2019 if 2020 is not available) was:Then the Part B Premium* is:Prescription Drug Coverage Premium** is:More than $91,000 but less than $409,000 Greater than or equal to $409,000$544.30 $578.30$ 71.30 + Plan premium $77.90 + Plan PremiumDec 6, 2021

What is the Irmaa for 2021?

The maximum IRMAA in 2021 will be $356.40, bringing the total monthly cost for Part B to $504.90 for those in that bracket. The top IRMAA bracket applies to married couples with adjusted gross incomes of $750,000 or more and singles with $500,000 or more of income.Nov 19, 2020

How is Irmaa calculated 2021?

Your 2021 IRMAA amount is determined by your reported income in 2019. The income used to calculate the Medicare IRMAA is taken from your Modified Adjusted Gross Income (MAGI) – which is your total adjusted gross income plus any tax-exempt interest – from two years prior.Jul 19, 2021

What Is Adjusted Gross Income?

Generally, your adjusted gross income is your household's income minus various adjustments. Adjusted gross income is calculated before the itemized...

What Is Modified Adjusted Gross Income?

Generally, your modified adjusted gross income (MAGI) is the total of your household's adjusted gross income plus any tax-exempt interest income yo...

How to Calculate Your Gross Income

Your gross income (GI) is the money you earned through wages, interests, dividends, rental and royalty income, capital gains, business income, farm...

How to Calculate Your Adjusted Gross Income

Once you have gross income, you "adjust" it to calculate your AGI. You make adjustments by subtracting qualified deductions from your gross income....

How to Calculate Your Modified Adjusted Gross Income

Once you have adjusted gross income, you "modify" it to calculate your MAGI. For most people, MAGI is the same as AGI.Specifically, Internal Revenu...

What is MAGI for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $176,000, you’ll pay higher premiums for your Part B and Medicare prescription drug coverage.

What is the MAGI for Social Security?

Your MAGI is your total adjusted gross income and tax-exempt interest income.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

What happens if your MAGI is greater than $88,000?

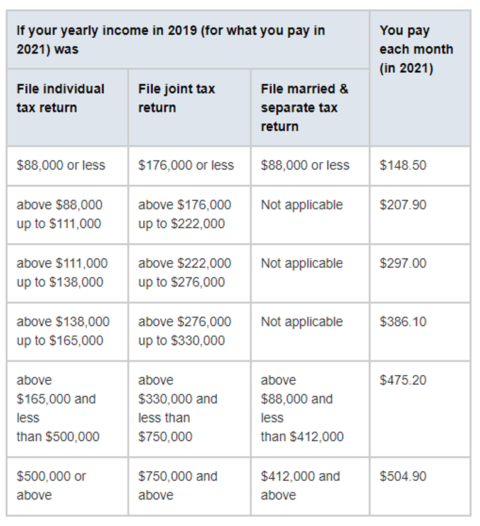

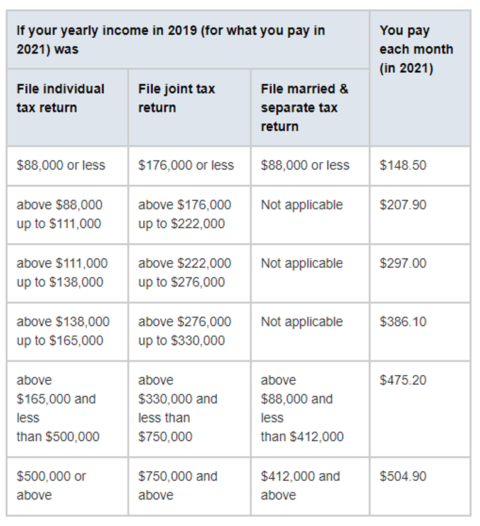

If you file your taxes using a different status, and your MAGI is greater than $88,000, you’ll pay higher premiums (see the chart below, Modified Adjusted Gross Income (MAGI), for an idea of what you can expect to pay).

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What happens if you don't get Social Security?

If the amount is greater than your monthly payment from Social Security, or you don’t get monthly payments, you’ll get a separate bill from another federal agency , such as the Centers for Medicare & Medicaid Services or the Railroad Retirement Board.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

How to calculate MAGI?

According to Internal Revenue Code ( (d) (2) (B)), you should add the following to your AGI to determine your MAGI: 1 Any amount excluded from gross income in section 911 (Foreign earned income and housing costs for qualified individuals) 2 Any amount of interest received or accrued by the taxpayer during the taxable year which is exempt from tax 3 Any amount equal to the portion of the taxpayer’s social security benefits (as defined in Section 86 (d)) which is not included in gross income under section 86 for the taxable year. (Any amount received by the taxpayer by reason of entitlement to a monthly benefit under title II of the Social Security Act, or a tier 1 railroad retirement benefit.)

What is the MAGI for health insurance?

The tax credits will cover the rest. The “household income” figure here is your modified adjusted gross income (MAGI). Your MAGI is a measure used by the IRS to determine if you are eligible to use certain deductions, credits (including premium tax credits), or retirement plans. The percentage of income you must pay for individual health insurance ...

How to calculate adjusted gross income?

Calculating your adjusted gross income. Once you have gross income, you "adjust" it to calculate your AGI by subtracting qualified deductions from your gross income. Adjustments can include items like some contributions to IRAs, moving expenses, alimony paid, self-employment taxes, and student loan interest.

What is a Social Security interest exemption?

Any amount of interest received or accrued by the taxpayer during the taxable year which is exempt from tax. Any amount equal to the portion of the taxpayer’s social security benefits (as defined in Section 86 (d)) which is not included in gross income under section 86 for the taxable year.

What is gross income?

Your gross income (GI) is the money you earned through wages/salary, interests, dividends, rental and royalty income, capital gains, business income, farm income, unemployment, and alimony received. This is the basis for your AGI calculation.

Is MAGI the same as AGI?

Most people don’t have any of the income just described so their MAGI is the same as their AGI. Once you know your MAGI, you can shop the ACA marketplace or your state exchange for plans. These sites will ask for your MAGI and household size, then calculate tax credits for you.

Do premium tax credits work with ICHRA?

Note: Premium tax credits work with the qualified small employer health reimbursement arrangement ( QSEHRA ), but you must report your HRA allowance amount to avoid tax penalties. They do not work with an individual coverage HRA ( ICHRA ).

What is the premium for Part B?

Part B premium based on annual income. The Part B premium, on the other hand, is based on income. In 2020, the monthly premium starts at $144.60, referred to as the standard premium.

What is Medicare's look back period?

How Medicare defines income. There is a two-year look-back period, meaning that the income range referenced is based on the IRS tax return filed two years ago. In other words, what you pay in 2020 is based on what your yearly income was in 2018. The income that Medicare uses to establish your premium is modified adjusted gross income (MAGI).

How many credits can you earn on Medicare?

Workers are able to earn up to four credits per year. Earning 40 credits qualifies Medicare recipients for Part A with a zero premium.

How does Medicare affect late enrollment?

If you do owe a premium for Part A but delay purchasing the insurance beyond your eligibility date, Medicare can charge up to 10% more for every 12-month cycle you could have been enrolled in Part A had you signed up. This higher premium is imposed for twice the number of years that you failed to register. Part B late enrollment has an even greater impact. The 10% increase for every 12-month period is the same, but the duration in most cases is for as long as you are enrolled in Part B.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What is IRMAA in insurance?

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How Are Medicare Part D Premiums Calculated

Medicare Part D prescription drug plans are also sold by private insurance companies, so premiums will vary from one plan to the next.

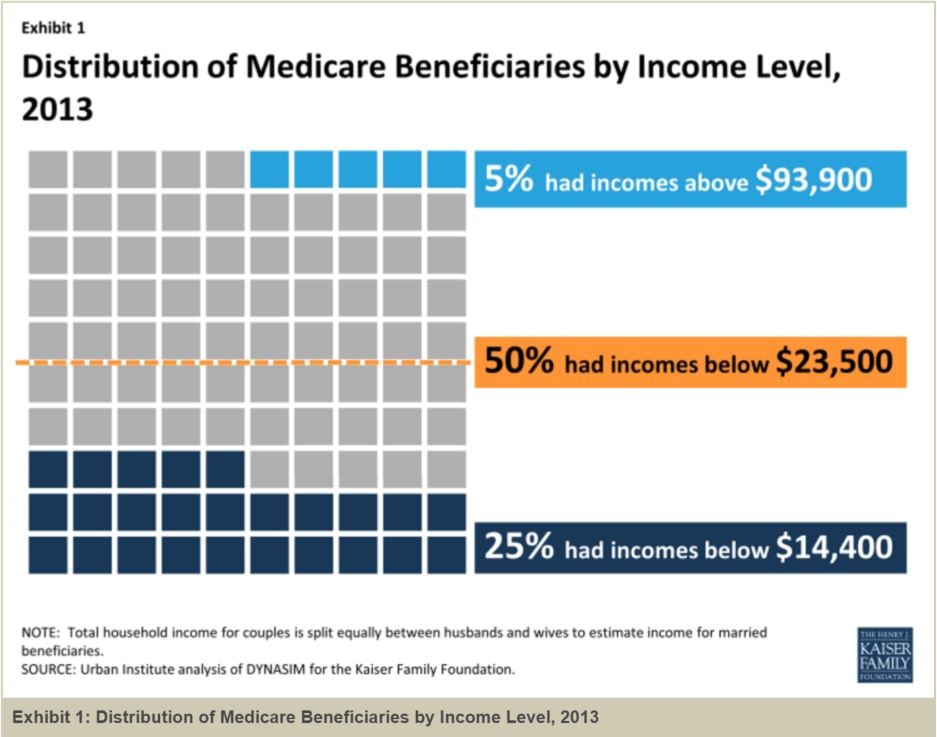

Medicare Part B Part D Irmaa Premium Brackets

Seniors age 65 or older can sign up for Medicare. The government calls people who receive Medicare beneficiaries. Medicare beneficiaries must pay a premium for Medicare Part B that covers doctors services and Medicare Part D that covers prescription drugs.

What Income Is Used To Determine Medicare Premiums

Did you know that not everyone pays the same amount for Medicare premiums? As you are planning for retirement or if you are already in retirement, it is important to understand the effects that your financial decisions can have on your Medicare premiums. It could be the difference of hundreds of dollars a month.

Medicare Part B Premium Appeals

OMHA handles appeals of the Medicare programs determination of a beneficiarys Income Related Monthly Adjustment Amount , which determines a Medicare beneficiarys total monthly Part B insurance premium.

How Record Social Security Cost

News that inflation rose to a historic high in November probably comes as no surprise to retirees.

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

How To Calculate Medicare Premiums

As you hit the retirement milestone, one of the items you’ll likely need to address is enrolling in Medicare. Medicare has many complexities and the calculation of premiums that you will pay is one of them. The questions and confusion can be endless.

What does MAGI mean on taxes?

The IRS also uses your MAGI to determine whether you're allowed to take a tax deduction for tuition and fees. These limits don't just change based on your filing status. They are also changed each tax year. You'll need to consult a tax adviser or tally the numbers yourself to see where you stand with your MAGI.

What is the difference between AGI and MAGI?

Your AGI and your MAGI are likely to be fairly close in value to one another. Your AGI is the total amount of income you make in a year, minus certain expenses that you are allowed to deduct. 5. Adjusted gross income is your taxable income for the year, so it is what your income tax bill is based on.

What is MAGI 2021?

Updated May 14, 2021. The Balance / Bailey Mariner. Your modified adjusted gross income (MAGI) determines whether you are allowed to claim certain benefits on your taxes. These include whether you can deduct contributions to an individual retirement account (IRA). It also impacts what you can put in a Roth IRA each tax year. 1 2.

How to lower your AGI?

One way to lower your AGI is to subtract as many tax-deductible expenses as possible from the total . If you are not sure how to do this on your own, a tax professional can help you. You can also use tax preparation software, which will help you find legal ways to lower your AGI.

What does it mean to lower your AGI?

The lower your AGI, the lower your tax bill will be. That means it's often in your best interest to lower your AGI as much as possible. How much you can do this will depend on your different earnings and sources of income.

Is MAGI based on income?

Certain education-related tax benefits and income tax credits are based on MAGI. Under the Affordable Care Act, your household MAGI also impacts whether you can get income-based Medicaid or subsidized health insurance through the Marketplace. 3. In 2021, the American Rescue Plan allowed more households to access subsidized health insurance ...

Can I take an IRA deduction in 2021?

For example, as of tax year 2021, if you are a single or head-of-household filer on your tax return and are covered by a retirement plan at work, you can't take an IRA deduction if you had a MAGI of $76,000 or higher. These limits change based on your tax filing status.