1. Add the annual gross income on your past two years’ W2 forms and divide by 24 to arrive at your gross monthly income -- GMI, if you’re a salaried employee. Get a letter from your employer verifying an increase in salary or earnings going into the current year, and submit current pay stubs to the loan originator to substantiate this claim. 2.

What wages are subject to Medicare tax?

What wages are taxable for Medicare?

- Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee’s wages.

- Employers also pay 1.45%.

- The Medicare tax for self-employed individuals is 2.9% to cover both the employee’s and employer’s portions.

Why are Medicare wages higher than wages?

The most common reason why medicare wages are higher is due to 401(k) contributions (W2, Box 12, Code D) or other pre-tax retirement plan contributions. They are subject to medicare tax but not to federal or state income tax.

What's included in Medicare wages?

Medicare Wages and Taxes Pretax benefits include those offered under a cafeteria – or Section 125 – plan, such as medical, dental, vision, life, accident and disability insurance; and flexible spending accounts such as dependent care, and health savings and adoption assistance reimbursement accounts.

How to calculate federal taxable wages?

How to File Federal Income Taxes for Small Businesses

- Collect your records. Gather all business records. Before filling out any tax form to report your business income, you should have all records in front of you that report ...

- Find the right form. Rep. ...

- Fill out your form. Fill out your Schedule C or Form 1120. ...

- Pay attention to deadlines. Be aware of different filing deadlines. ...

Is Medicare calculated on gross income?

Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago. This is the most recent tax return information provided to Social Security by the IRS.

How is Medicare calculated in payroll?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What is Medicare taxable income?

Key Takeaways. Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax. 2. Employers also pay 1.45%.

What is Medicare tax withheld on W-2?

Box 6: Medicare Tax Withheld. This amount represents the total amount withheld from your paycheck for Medicare taxes. The Medicare tax rate is 1.45%, and a matching amount of 1.45% is paid by W&M. Once you earn $200,000 annually, there is an additional . 9% that the employee pays which makes a total of 2.35%.

How is Medicare tax calculated example?

For example, if an employee's taxable wages are $700 for the week, their social security contribution would be: $700.00 x 6.2% = $43.40. Their Medicare contribution would be: $700.00 x 1.45%= $10.15.

Is Medicare tax based on gross or taxable income?

The tax is based on "Medicare taxable wages," a calculation that uses your gross pay and subtracts pretax health care deductions such as medical insurance, dental, vision or health savings accounts.

Is Medicare included in federal income tax?

FICA is not included in federal income taxes. While both these taxes use the gross wages of the employee as the starting point, they are two separate components that are calculated independently. The Medicare and Social Security taxes rarely affect your federal income tax or refunds.

How do you calculate Box 3 on W-2?

The following steps are an example of how to recalculate Box 3 of your W-2:Go to the Payroll YTD Totals screen.Add any contributions you (do not add employer contributions) made to a tax deferred retirement account (45,839.33 + 2,795.62 = 48,634.95). ... Social security wages have a maximum taxable amount.

How do you calculate Medicare tax 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

Why is Medicare wages higher on W-2?

There is no maximum wage base for Medicare taxes. The amount shown in Box 5 may be larger than the amount shown in Box 1. Medicare wages include any deferred compensation, retirement contributions, or other fringe benefits that are normally excluded from the regular income tax.

Where does additional Medicare tax go on W-2?

This new tax is calculated on Federal Form 8959 Additional Medicare Tax and that form also reconciles the amount of tax owed against what an employer has already withheld from an employee's paycheck (and so is included as withholding in box 6 of the Form W-2 along with the regular Medicare tax withholding).

Is Medicare a tax deduction?

Medicare expenses, including Medicare premiums, can be tax deductible. You can deduct all medical expenses that are more than 7.5 percent of your adjusted gross income.

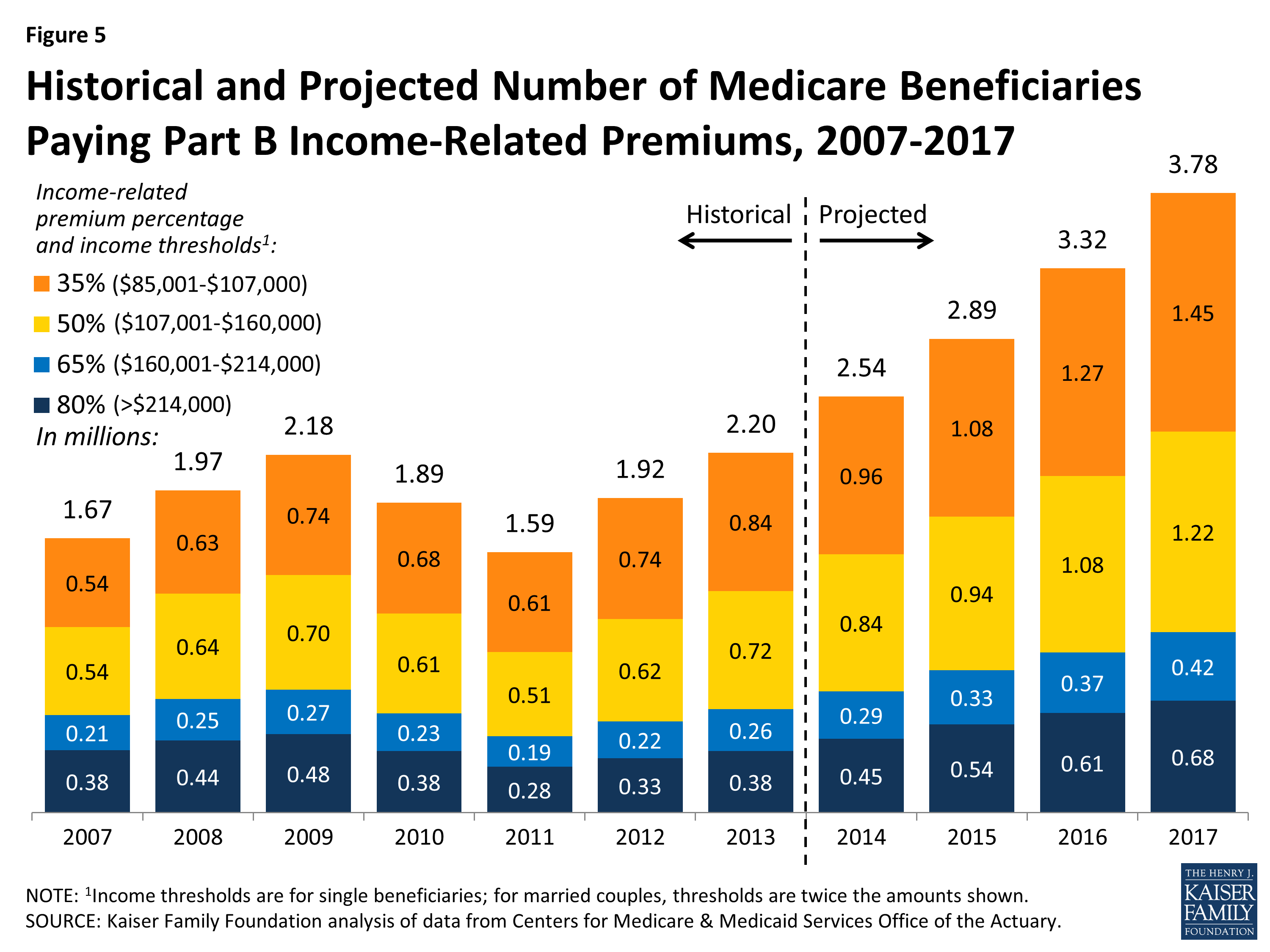

How much is Medicare Part B insurance?

For 2020, the rate is $144.60 per month. Medicare charges higher premiums to people across different income ranges.

How many years prior to the effective date of the new Medicare rate?

The basis for where you fall within these ranges is your tax return two years prior to the effective date of the new rate. As an example, the IRS provides Social Security with 2018 tax return data on which to evaluate individual premiums due for Medicare coverage in 2020.

Do Medicare beneficiaries pay taxes?

The majority of Medicare beneficiaries qualify for Medicare Part A coverage at no cost, depending their contribution through taxes while working over a period of time. For those who have paid Medicare taxes for under 40 quarters, a monthly premium is charged.

What is Medicare tips on W-2?

What Are Medicare Wages and Tips on a W-2? The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding.

What is Medicare tax?

Medicare taxes go toward the Medicare program—a federal health insurance program for Americans who are older than 65 or have certain disabilities and diseases. The funds taken from Medicare taxes cover three areas.

What is the Medicare tax rate for 2020?

If you are self-employed, the 2020 Medicare tax rate is 2.9% on the first $137,700 of your yearly earnings.

How much do employers have to match for Medicare?

An employer is also required to match 1.45% of an employee’s withholding for Medicare wages and tips. For example, if an employee makes $2,000 during their pay period, that employee would have $29 withheld from their paycheck, and their employer would match that contribution with an additional $29 paid toward Medicare.

Is Medicare taxed on wages?

Almost all wages earned by an employee in the United States are subject to the Medicare tax. How much an individual is taxed will depend on their yearly earnings. However, certain pretax deductions are exempt from the FICA tax, which includes Social Security and Medicare taxes.

How to determine Medicare tax amount?

To determine the amount of Medicare tax an employee should pay, you must first figure the wages. Determine whether the employee has voluntary pretax deductions. These are deductions the employer offers and the employee accepts.

How much Medicare tax is paid if there is no pretax deduction?

If the employee has no pretax deductions, her entire gross pay is also her Medicare wages. Calculate Medicare tax at 1.45 percent of the employee’s Medicare wages to arrive at the amount of tax to withhold. Notably, the employer pays an equal portion of Medicare tax.

What is pretax deduction?

Pretax deductions are those that meet the requirements of IRS Section 125 code, such as a traditional 401k plan, a Section 125 medical or dental plan or a flexible spending account. Subtract applicable pretax deductions from the employee’s gross pay – earnings before deductions – to arrive at Medicare wages.

Is Medicare based on wages?

Unlike federal income tax, which depends on varying factors such as the employee’s filing status and allowances, Medicare tax is based on a flat percentage of wages. Furthermore, unlike Social Security tax, which has an annual wage limit, Medicare has none.

Can an employer withhold Medicare from employee wages?

An employer is legally required to withhold Medicare tax from employee wages. The employee is exempt from withholding only if an exception applies, such as if she works for a university at which she is also a student.

Is It Better To Withhold Taxes

Remember, one of the big reasons you file a tax return is to calculate the income tax on all of your taxable income for the year and see how much of that tax youve already paid via withholding tax. If it turns out youve overpaid, youll probably get a tax refund. If it turns out youve underpaid, youll have a tax bill to pay.

Other Payroll Tax Items You May Hear About

FUTA tax: This stands for Federal Unemployment Tax Act. The tax funds a federal program that provides unemployment benefits to people who lose their jobs. Employees do not pay this tax or have it withheld from their pay. Employers pay it.

Monitoring Ss And Medicare Status

The Research Foundation is solely responsible for processing the correct withholding or exemption of SS and Medicare taxes. Error where the RF has not withheld the taxes can result in significant risk of fines and penalties from the government. SS and Medicare status for all Research Foundation employees should be monitored periodically.

What Is The Fica Tax

The FICA tax is a U.S. federal payroll tax paid by employees and their employers. It consists of:

Before You Calculate Fica Tax Withholding

To calculate FICA taxes from an employee’s paycheck, you will need to know:

Pay Attention To Your Paycheck

Its important that you regularly track your paystub with your employer, particularly because of the temporary end-of-year changes. Calculate the dollar amount that you expect to see withheld every paycheck and make sure that the numbers are accurate. Mistakes happen, so its important to track things closely.

What Is The Medicare Tax Rate For 2021

The Medicare tax rate is 1.45%. But the Federal Insurance Contributions Act tax combines two rates. FICA taxes include both the Social Security Administration tax rate of 6.2% and the Medicare tax rate.

What to consider when figuring out W-2?

When figuring out your W-2 income tax, it's important to consider what your adjusted taxable income will look like. To figure out your adjusted gross income, you'll need to decide how you want to handle deductions. For most people, the 2020 standard deduction makes the most sense.

How to figure out what you owe?

To figure out what you might still owe, look at the total amount of federal taxes withheld for the year. You'll then want to subtract that number from the total number paid from your wages already. If the number is larger than the amount of federal taxes withheld for the year, you owe the remaining balance.

How much is the 2020 standard deduction?

The 2020 standard deductions are $12,400 for single/married filing separately, $24,800 for married filing jointly and $18,650 for head of household.

What is box 3 in Social Security?

Box 3 represents the amount of social security wages that are subject to social security tax. In general, Box 3 is calculated the same as Box 1 with a few exceptions.

What is box 5 in Medicare?

Box 5 represents the amount of Medicare wages that are subject to Medicare tax. In general, Box 5 is calculated the same as Box 3. The main difference stems from there being no limit on Medicare taxable wages.

What is the most important thing to know about W-2?

Your W-2 gives a lot of information, but the most important is that it shows your total income and your salary as taxable wages. If you have pretax deductions or nontaxable wages, these are not included in your taxable wages. To determine your total salary from your W-2, look at your taxable wages and then consider any nontaxable wages ...

Why are Medicare and Social Security taxes called FICA?

Both Social Security and Medicare taxes are commonly called FICA taxes because they are collected under the authority of the Federal Insurance Contributions Act. Your taxable wages for those two taxes might be the same, or they might differ because Social Security has an annual wage limit and Medicare has none.

Do salaried employees pay federal taxes?

As a salaried employee, you are required to pay federal income tax, Social Security tax, Medicare tax, and, if applicable, state and local income tax. Knowing how to calculate your W-2 wages can help you to know your total salary and taxable income.