/payroll-taxes-3193126-FINAL-ef94c8b30eda48fdbde6ab58d9a30d49.png)

Just multiply an employee's gross pay by each tax rate—that's 0.062 for Social Security and 0.0145 for Medicare—and subtract that number from the gross pay. Employees who make more than $200,000 a year pay an additional Medicare tax of 0.09%, which employers don't need to match. Learn more about the Additional Medicare Tax on the IRS's website.

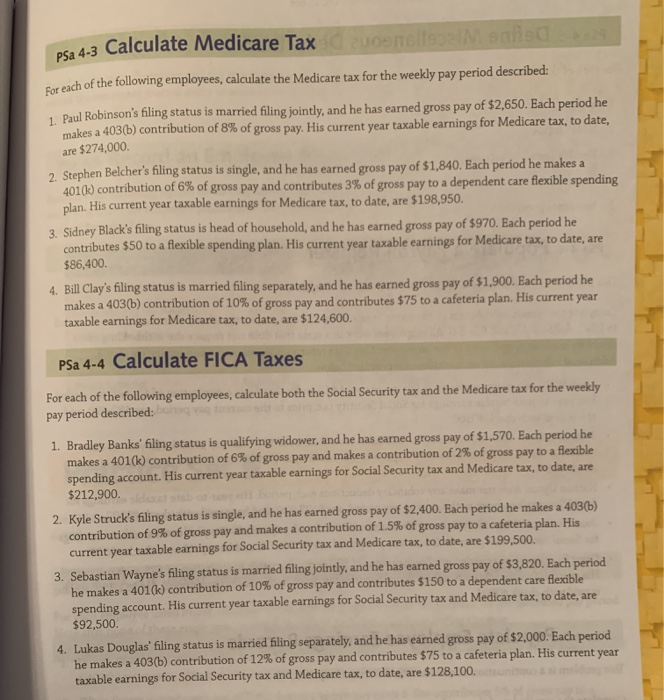

How do you calculate Medicare taxes?

Jan 15, 2022 · To calculate FICA taxes from an employee’s paycheck, you will need to know: The amount of gross pay for the employee for that pay period The total year-to-date gross pay for that employee The Social Security and Medicare withholding rates for that year Any amounts deducted from that employee’s pay for pre-tax retirement plans.

What percentage of your paycheck is Medicare?

Apr 20, 2017 · The taxable wages for Social Security and Medicare taxes are defined below: Gross Pay (Including tips and taxable fringe benefits) Less: Section 125 deductions (medical, dental, vision, dependent care, pre-tax commuter benefits, etc.) Equals: Social Security and Medicare taxable wages. If you compare the definition of these taxable wages to the definition …

How to calculate additional Medicare tax properly?

How Contributions are Calculated. The FICA (for Federal Insurance Contributions Act) tax (also known as Payroll Tax or Self-Employment Tax, depending on your employment status) is your contribution to Social Security and Medicare as a percentage of your salary: If you're an employee, then you pay one half of this total (probably as a withholding on your paycheck); your employer …

What percent is Medicare tax?

Jul 01, 2020 · Just multiply an employee's gross pay by each tax rate—that's 0.062 for Social Security and 0.0145 for Medicare—and subtract that number from the gross pay. Employees who make more than $200,000 a year pay an additional Medicare tax of 0.09%, which employers don't need to match. Learn more about the Additional Medicare Tax on the IRS's website.

How do you calculate FICA and Medicare tax 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.Mar 23, 2021

How do you calculate Medicare tax 2020?

The FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

How do you calculate FICA and Medicare tax 2022?

For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021). For 2022, an employee will pay: 6.2% Social Security tax on the first $147,000 of wages (6.2% of $147,000 makes the maximum tax $9,114), plus.Jan 12, 2022

How much what %) is taken out of paycheck for Medicare?

What percentage of a person's income is withheld from their paycheck for Medicare and Social Security taxes? Employers withhold a total of 7.65% of an employee's pre-tax wages for Medicare and Social Security. Of that amount, 6.2% goes to Social Security and the remaining 1.45% goes to Medicare.

What is the payroll tax rate for 2020?

Types of Payroll Taxes (2020)Employer PaysTotalSocial Security6.2%12.4%Medicare1.45%2.9%State UnemploymentVariableVariableFederal Unemployment6.0%^^^6.0%1 more row•Sep 15, 2016

How is Futa calculated?

How to calculate FUTA Tax?FUTA Tax per employee = (Taxable Wage Base Limit) x (FUTA Tax Rate).With the Taxable Wage Base Limit at $7,000,FUTA Tax per employee = $7,000 x 6% (0.06) = $420.Feb 15, 2022

How is FICA and Medicare calculated?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.Jan 12, 2022

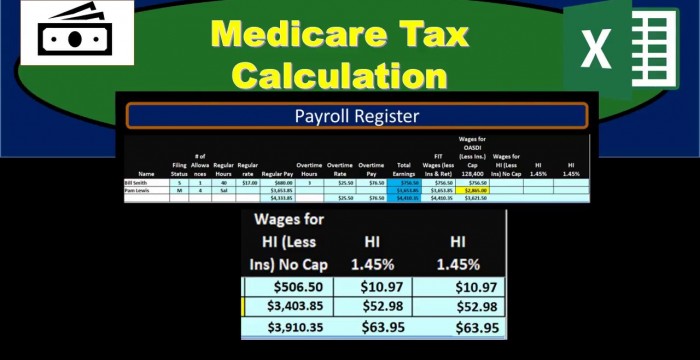

How do I calculate Medicare wages?

The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction. Dental – subtract the YTD employee dental insurance deduction.

What is the federal payroll tax rate for 2022?

6.2%2022 Federal Wage Tax Rate Summary2022 Current Year2021 Prior YearFICA / OASDI Employee rate Maximum liability – employee Employer rate Maximum liability – employer Wage limit6.2% $9,114.00 6.2% $9,114.00 $147,000.006.2% $8,853.60 6.2% $8,853.60 $142,800.003 more rows•Dec 14, 2021

What percent is Medicare tax?

1.45%The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.Mar 15, 2022

Do I have Medicare if I pay Medicare tax?

According to the Internal Revenue Service (IRS), taxes withheld from your pay help pay for Medicare and Social Security benefits. If you're self-employed, you generally still need to pay Medicare and Social Security taxes. Payroll taxes cover most of the Medicare program's costs, according to Social Security.

Is Medicare tax based on gross income?

The tax is based on "Medicare taxable wages," a calculation that uses your gross pay and subtracts pretax health care deductions such as medical insurance, dental, vision or health savings accounts.Mar 28, 2022

How much tax do you pay on Medicare?

There are no tax limits for Medicare. You will pay taxes at a rate of 1.45% on all of your taxable wages. In addition, employers are required to withhold Additional Medicare tax of 0.9% once taxable wages are over $200,000 for the year.

Why do Medicare and Social Security go hand in hand?

Social Security and Medicare taxes go hand in hand. One reason for this is because the taxable wages for these two taxes are generally the same. The taxable wages for Social Security and Medicare taxes are defined below:

What is the Social Security tax limit for 2017?

Social Security tax limit for 2017 is $7,886.40. One of the differences between Social Security and Medicare is that Social Security is taxed only on the first $127,200 of taxable wages, or $7,886.40 in taxes. Once you hit that limit, you will no longer be taxed for Social Security in 2017.

How much is Bob's semi monthly salary?

Example: Bob is paid semi-monthly. On this paycheck, he earned $8,000 in salary. Bob gets a semi-monthly auto allowance of $1,000. He has a medical deduction of $1,500, and he contributes 10% of his income to his 401k.

Is there a cap on Medicare taxes?

There is no Medicare cap, and employers are required to withhold an additional Medicare Tax of 0.9% for wages over $200,000. Now that we’ve covered Social Security and Medicare taxes, we’ll tackle state taxes in our next segment. Bookmark ( 0) Please login to bookmark. Username or Email Address.

What is the Medicare tax rate for 2013?

Starting in 2013, people with high salaries will pay a new additional Medicare tax of 0.9%. Unlike the rest of Medicare, this new tax depends on your filing status:

What is FICA tax?

The FICA (for Federal Insurance Contributions Act) tax (also known as Payroll Tax or Self-Employment Tax, depending on your employment status) is your contribution to Social Security and Medicare as a percentage of your salary: If you're an employee, then you pay one half of this total (probably as a withholding on your paycheck);

How much did the employee contribute to Social Security in 2011?

For 2011 and 2012 only, the employee's "half" didn't equal the employer's "half" for Social Security: they contributed 4.2% and 6.2% respectively. For 2013, both contribute 6.2%. For 2017, there is a very large increase in the Social Security income limit, from $118,500 to $127,200.

Do self employed people pay FICA?

And so, if you're self-employed, you don't have to pay FICA on all your salary, just on 92.35% of it (92.35 being 100 minus 7.65 - which is the contribution that your employer would have paid, if you had an employer, which you don't).

How much of your paycheck is Medicare matched?

As an employer, you match that contribution out of your own wallet. The same is true of Medicare contributions, which are 1.45% of an employee's paycheck, matched by you. To see what you need to pay, multiply your employee's gross pay by the going tax rates.

What are the types of payroll taxes?

Types of payroll taxes. First, let's make sure you know what you're responsible for calculating, withholding, and paying: Employee payroll taxes, or the amount you deduct from your employees' paychecks for federal and state income taxes, Social Security, and Medicare. Employer payroll taxes, or the taxes your business pays based on your employees' ...

What is FIT in payroll?

Federal income taxes (FIT) Before you can calculate employee payroll taxes, you need to collect your employees' W-4 tax forms. On Form W-4, employees indicate their withholding allowances, which lets you know how much to deduct from each paycheck for federal income taxes (FIT). Employees should fill out and return these forms ...

What is FICA tax?

FICA (Federal Insurance Contributions Act) tax, or the amount your business contributes to Social Security and Medicare alongside your employees. If you own your business and don't have any employees, you'll pay a self-employment tax on your own income. Like payroll taxes, the self-employment tax includes Social Security and Medicare taxes.

What is the FICA rate for self employed?

Currently, the self-employed FICA tax rate is 15.3% of your net income. And like any other employee, you'll also pay state and federal income taxes. Make sure to calculate and remit those taxes quarterly to avoid any unpleasant surprises come tax season.

How much do you have to contribute to Social Security?

The Federal Insurance Contributions Act requires employees and employers to contribute to Social Security and Medicare. For the 2020 tax year, employers and employees both pay 6.2% of the employee's wages toward Social Security (the total contributions must equal 12.4%). And employers and employees both pay 1.45% towards Medicare for a matched total of 2.9%.

How much do employers pay for unemployment?

Per the Federal Unemployment Tax Act, employers pay 6% on the first $7,000 each employee earns per calendar year. Employees do not pay FUTA taxes —these taxes are an employer-paid contribution to state unemployment agencies.

What is the most straightforward way to calculate payroll tax?

Most employers have two options, the wage bracket method and the percentage method. While not exactly simple, the wage bracket method is the more straightforward way to calculate payroll tax.

What is payroll tax?

Despite the name, payroll tax is not a single tax, but a blanket term used to refer to all taxes paid on the wages of employees. If you have employees, you are going to be responsible for both: Deducting a portion of employee wages to pay certain taxes on their behalf.

What is the current FICA rate?

The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Combined, the FICA tax rate is 15.3% of the employees wages.

What is FICA in tax?

FICA stands for “Federal Insurance Contributions Act.” It’s a mandatory payroll tax deduction used to pay for programs like Social Security (disability insurance, old age, survivors) and Medicare (covering health insurance for folks over 65).

What taxes come out of your pocket?

Payroll taxes that come out of your pocket: FICA tax: covers social security and Medicare. This cost is shared by employer and employee. The employer portion is 6.2% for social security and 1.45% for Medicare, and you’ll collect and remit the same amount from your employees.

How to calculate Social Security withholding?

To calculate Social Security withholding, multiply your employee’s gross pay for the current pay period by the current Social Security tax rate (6.2%). This is the amount you will deduct from your employee’s paycheck and remit along with your payroll taxes.

How much does an employee pay for FICA?

When it comes to funding FICA, your employee pays 50% from their paycheck while you, the employer, pay 50% out of your own revenue. As the employer, you are required to withhold and pay the amount your employee is responsible for from her paycheck, and remit those funds on their behalf.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

How much is Medicare tax?

Medicare is also a flat tax, at a rate of 1.45%. There is no annual limit for Medicare taxes, but employees who earn more than $200,000 a year are subject to what’s called the Additional Medicare Tax of 0.9%. We multiply our employee’s gross wage of $2,083.33 by 1.45% and arrive at $30.21 for Medicare tax.

How much is federal unemployment tax?

Federal Unemployment Tax (FUTA) is 6.0% of the first $7,000 in wages you pay each employee each year. If your company is subject to state unemployment, you can receive a federal tax rate credit of up to 5.4%, which makes the effective tax rate 0.6%.

What is gross pay?

For hourly employees, gross pay is the number of hours worked during the pay period multiplied by the hourly rate. For example, if your receptionist worked 40 hours a week at a rate of $20 an hour, his gross pay for the week would be 40 x $20, or $800.

Is the IRS tax code complicated?

They all have fires to put out, employees to pay, futures to plan, and little to no time to grapple with the IRS tax code. The good news is that although the tax code may seem complicated, once you figure out what tax filings are required and learn how to do the math, the process is fairly straightforward.

Can you pay employee expenses out of pocket?

If your employee paid for any company expenses out of their own pocket, they expect to be reimbursed. Employers can either pay reimbursements separately from payroll or combine it with payroll.