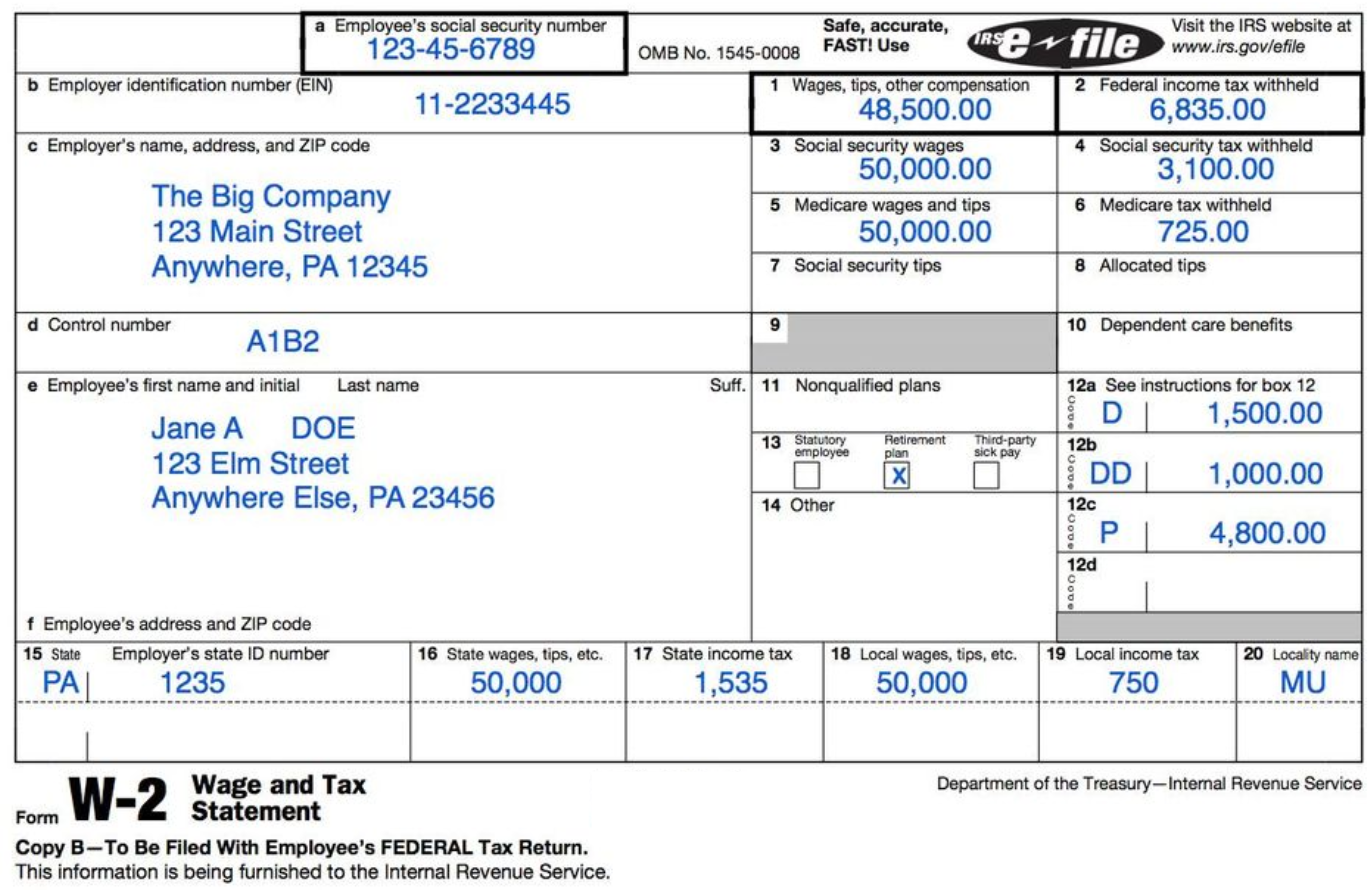

The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction. Dental – subtract the YTD employee dental insurance deduction. What is the percentage of Medicare tax withheld for 2020? 1.45 percent

How to calculate additional Medicare tax properly?

Dec 28, 2021 · How do you calculate additional Medicare tax in 2020? Based on the Additional Medicare Tax law, all income for an individual above $200,000 is subject to an additional 0.9% tax. Therefore, his Additional Medicare Tax bill is $50,722 X 0.9% = $456 .

Do employers match additional Medicare tax?

Feb 02, 2022 · What is the Medicare tax rate for 2020? NOTE: The combined Social Security and Medicare tax rate of 7.65 percent is shown in this figure. The Social Security part (OASDI) is 6.20 percent of earnings up to the corresponding taxable maximum amount, with the maximum amount being the taxable maximum amount (see below).

How to calculate Medicare surtaxes?

The FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold). Is Medicare calculated on gross income? Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross …

What is additional Medicare tax withholding?

Mar 15, 2022 · Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual's wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period …

What is the formula for calculating Medicare tax?

For example, if an employee's taxable wages are $700 for the week, their social security contribution would be: $700.00 x 6.2% = $43.40. Their Medicare contribution would be: $700.00 x 1.45%= $10.15. These are also the amounts the employer would pay.Feb 24, 2020

What is the Medicare surcharge tax for 2020?

0.9 percentThe extra tax was announced as part of the Affordable Care Act and is known as the Additional Medicare Tax. The tax rate for the Additional Medicare Tax is 0.9 percent. That means you'll pay 2.35 percent if you receive employment wages. Self-employed taxpayers will pay 3.8 percent.

How do you calculate FICA and Medicare tax 2022?

For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021). For 2022, an employee will pay: 6.2% Social Security tax on the first $147,000 of wages (6.2% of $147,000 makes the maximum tax $9,114), plus.Jan 12, 2022

How do you calculate Medicare tax 2021?

Those sums are:12.4% for Social Security on the first $142,800 of net income (6.2% each for being both an employer and an employee)2.9% for Medicare (1.45% for employers plus 1.45% for employees)Mar 23, 2021

How are Medicare wages calculated?

The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction. Dental – subtract the YTD employee dental insurance deduction.

How does the 3.8 Medicare tax work?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

What is the Medicare tax rate?

2.9%Today, the Medicare tax rate is 2.9%. Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes.Jan 10, 2022

Is Medicare tax based on gross income?

The tax is based on "Medicare taxable wages," a calculation that uses your gross pay and subtracts pretax health care deductions such as medical insurance, dental, vision or health savings accounts.Mar 28, 2022

Are Medicare premiums based on adjusted gross income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Is Medicare taxed on gross income?

For Social Security and Medicare, deferred income (401k, 403b, Simple IRA's, etc.) is considered taxable and not subtracted from gross pay.Apr 20, 2017

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

How to calculate FICA?

Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%. It’s important to realize that FICA does serve a purpose and that it is funding federal programs that you will most likely utilize one day. This isn’t lost money by any means.

What does FICA mean?

When you see the acronym FICA, it simply means federal withholdings for Medicare and Social Security. FICA tax percentages help fund the Medicare and Social Security programs in the United States. Nearly everyone that works pays FICA because it is a federal tax, and the rates are eligible to change each year.

Who is exempt from paying FICA?

For example, only a few religious groups, college students working a campus job, and some residential foreigners can apply for an exemption.

Who is Dan Marzullo?

Dan Marzullo. As a professional copywriter, Dan produces strategic marketing content for startups, digital agencies, and established brands. He helps organizations tell stories, achieve online presence, and builds brands that communicate with their customers. Dan is also a regular contributor to Forbes.

Do you have to contribute to Social Security 2020?

Those in a certain tax bracket ($137,700 as of 2020) are not required to contribute towards Social Security. The exemption does not apply to Medicare and those in the higher tax bracket are still responsible for paying the Medicare tax.

US Tax Calculators

Current and historical tax calculators supported and maintained by iCalculator™

Tax Guides

We hope you found the United States Annual Tax Calculator for 2020 useful, we have collated the following US Tax guides to support the US Tax Calculators and US Salary Calculators published on iCalculator. Each tax guide is designed to support you use of the US tax calculators and with calculating and completing your annual tax return.

What is the Medicare tax rate for 2013?

Starting in 2013, people with high salaries will pay a new additional Medicare tax of 0.9%. Unlike the rest of Medicare, this new tax depends on your filing status:

What is FICA tax?

The FICA (for Federal Insurance Contributions Act) tax (also known as Payroll Tax or Self-Employment Tax, depending on your employment status) is your contribution to Social Security and Medicare as a percentage of your salary: If you're an employee, then you pay one half of this total (probably as a withholding on your paycheck);

How much did the employee contribute to Social Security in 2011?

For 2011 and 2012 only, the employee's "half" didn't equal the employer's "half" for Social Security: they contributed 4.2% and 6.2% respectively. For 2013, both contribute 6.2%. For 2017, there is a very large increase in the Social Security income limit, from $118,500 to $127,200.

Do self employed people pay FICA?

And so, if you're self-employed, you don't have to pay FICA on all your salary, just on 92.35% of it (92.35 being 100 minus 7.65 - which is the contribution that your employer would have paid, if you had an employer, which you don't).