What is the 401k calculator?

401K Calculator. The 401(k) Calculator can estimate a 401(k) balance at retirement as well as distributions in retirement based on income, contribution percentage, age, salary increase, and investment return. It is mainly intended for use by U.S. residents.

How do you calculate tax withholding from a 401 (k)?

To determine federal income tax withholding, consult IRS Circular E for the tax-withholding table that matches the allowances and filing status on your W-4 form and your wages and pay period. Figure out your Medicare and Social Security taxes based on your gross wages. These two federal taxes are not exempt from pretax 401 (k) withholding.

How much tax do I pay if I have a 401 (k)?

For example, as of 2019, your gross salary of $2,000 would be subject to Social Security tax at 6.2 percent and Medicare tax at 1.45 percent. The 2019 annual wage limit for Social Security tax is $132,900, while Medicare tax is withheld from all earnings. Contact your state revenue agency for pretax 401 (k) regulations, if applicable.

How are 401k contributions deducted from gross income?

This is your entire earnings for the pay period before any taxes are taken out. Subtract your 401(k) contributions from gross income before calculating federal income tax – this is the only federal withholding tax that 401(k) pretax contributions are exempt from.

Do you pay Medicare tax on 401k contributions?

Note that Social Security and Medicare taxes go hand in hand, as they are both authorized by the Federal Insurance Contributions Act. Specifically, if Social Security tax applies, so does Medicare tax. Your 401(k) contributions are subject to Medicare tax of 1.45 percent, as of 2012.

Are 401k deferrals subject to Medicare tax?

The amounts deferred under your 401(k) plan are reported on your Form W-2, Wage and Tax Statement. Although elective deferrals are not treated as current income for federal income tax purposes, they are included as wages subject to Social Security (FICA), Medicare, and federal unemployment taxes (FUTA).

What is the formula for calculating Medicare tax?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.

How is Medicare 2020 withholding calculated?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

Is FICA calculated after 401k?

You are required to pay FICA tax on all contributions you make to your 401(k) plan. However, if your employer makes contributions to your 401(k), these funds are not subject to FICA tax.

Do 401k distributions affect Medicare premiums?

Money coming out of a 401(k) is subject to income tax rates, which top out at 37%. To tailor your taxes in retirement, you'll need a combination of taxable, tax-deferred and tax-free savings. Manage your withdrawals from these accounts to keep your Medicare premiums down.

How do you calculate Medicare tax 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

How much Medicare tax is withheld from my paycheck?

1.45%The FICA tax includes the Social Security tax rate at 6.2% and the Medicare tax at 1.45% for a total of 7.65% deducted from your paycheck.

What is the Medicare tax rate?

Medicare tax: 1.45%. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000. Federal income tax.

How do you calculate FICA and Medicare tax 2022?

For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021).

How are Medicare and Social Security withholdings calculated?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

What income is subject to the 3.8 Medicare tax?

The tax applies only to people with relatively high incomes. If you're single, you must pay the tax only if your adjusted gross income (AGI) is over $200,000. Married taxpayers filing jointly must have an AGI over $250,000 to be subject to the tax.

What is 401(k) tax?

A 401 (k) is a form of retirement savings plan in the U.S. with tax benefits that are mainly available through an employer. It is named after subsection 401 (k) in the Internal Revenue Code, which was made possible by the Revenue Act of 1978.

When do you have to take 401(k) distributions?

Anyone that reaches age 72 is required to take distributions from their 401 (k). This is called a required minimum distribution (RMD). Traditional, SIMPLE, and SEP IRAs have similar rules imposed by the IRS. The exact date at which RMDs are required is April 1st of the year after a retiree reaches the age of 72. In order to determine the exact amount, retirees can take their 401 (k) retirement assets and divide it by a life-expectancy factor, which changes slightly every year.

What happens if you withdraw early from 401(k)?

Early 401 (k) withdrawals will result in a penalty. This calculation can determine the actual amount received if opting for an early withdrawal.

Why do employers require a vesting period for 401(k)?

Some employers require a vesting period for their 401 (k) plans in order to incentivize employees to stay long-term. Vesting refers to how much of a 401 (k)'s employer contributions are owned by an employee. An employee that is fully vested has full ownership of the funds in their retirement plan.

How long does a 401(k) vest?

A 4-year vesting period is fairly common. After the first year of employment, an employee is entitled to 25% of employer contributions even if they leave the company. This increases to 50% in the second year and 75% in the third year, with the employee becoming fully vested after 4 years. This is referred to as graded vesting. Some companies do not have schedules that increase vested amounts each year, but instead allow employees to become fully vested after a certain period of time. This is called cliff vesting, which means all of the vestings take place at a certain point in the vesting schedule. In this case, an employee that leaves a company before becoming fully vested will have to forfeit all employer contributions. Different 401 (k) plans have different rules regarding vesting. For more accurate information, it is best to speak with human resources or 401 (k) plan administrators.

How long do you have to wait to get 401(k)?

Waiting periods–Some employers don't allow participation in their 401 (k)s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

How old do you have to be to receive 401(k)?

Anyone older than 59 ½ can begin receiving distributions from their 401 (k)s, but they can also choose to defer receiving distributions to allow more earnings to accumulate. Distributions can be deferred, at the latest, until the age of 72. Between the ages of 59 ½ and 72, participants have several options:

How much tax is due on 401(k) in 2020?

Taxes on a Traditional 401 (k) For the tax year 2020, for example, payable on May 17, 2021, a married couple who files jointly and earns $80,000 together would pay 10% tax on the first $19,400 of income, 12% on the next $59,550, and 22% on the remaining $1,050. If the couple's income rose enough that it entered the next tax bracket, ...

When do you have to start a Roth 401(k)?

Like the traditional 401 (k), the terms of Roth 401 (k)s stipulate that required minimum distributions (RMDs) must begin by age 72 (unlike Roth IRAs), though this requirement was also waived for these accounts in 2020 following the introduction of the CARES Act. 8. However, your Roth 401 (k) isn't completely in the clear, tax-wise.

What is the capital gains tax rate for 2020?

As of the 2020 and 2021 tax years, the capital gains tax rates are zero, 15%, and 20% , depending on the level of your income. 9.

Can you take a distribution from a Roth 401(k)?

Unlike the traditional 401 (k), you can take distributions of your contributions from the Roth variety at any time without penalty. The earnings, however, still need to be reported on your tax return; in fact, the entire distribution does. 7. Like the traditional 401 (k), the terms of Roth 401 (k)s stipulate that required minimum distributions ...

Do you have to pay taxes on 401(k) withdrawals?

When you withdraw funds from your 401 (k) —or "take distributions," in IRS lingo—you begin to enjoy the income from this retirement mainstay and face its tax consequences. For most people, and with most 401 (k)s, distributions are taxed as ordinary income. However, the tax burden you’ll incur varies by the type of account you have: traditional or Roth 401 (k), and by how and when you withdraw funds from it.

Is a Roth 401(k) withdrawal taxable?

In general, Roth 401 (k) withdrawals are not taxable provided the account was opened at least five years ago and the account owner is age 59½ or older. Employer matching contributions to a Roth 401 (k) are subject to income tax. There are strategies to minimize the tax bite of 401 (k) distributions.

Is a 401(k) distribution taxed?

For most people, and with most 401 (k)s, distributions are taxed as ordinary income. However, the tax burden you’ll incur varies by the type of account you have: traditional or Roth 401 (k), and by how and when you withdraw funds from it.

How much tax do you pay on Medicare?

There are no tax limits for Medicare. You will pay taxes at a rate of 1.45% on all of your taxable wages. In addition, employers are required to withhold Additional Medicare tax of 0.9% once taxable wages are over $200,000 for the year.

What are the tax rates for Social Security and Medicare?

Social Security has a tax rate of 6.2% and Medicare has a tax rate of 1.45%. In the example above, Bob’s Social Security taxes would be calculated as follows:

Why do Medicare and Social Security go hand in hand?

Social Security and Medicare taxes go hand in hand. One reason for this is because the taxable wages for these two taxes are generally the same. The taxable wages for Social Security and Medicare taxes are defined below:

What is the Social Security tax limit for 2017?

Social Security tax limit for 2017 is $7,886.40. One of the differences between Social Security and Medicare is that Social Security is taxed only on the first $127,200 of taxable wages, or $7,886.40 in taxes. Once you hit that limit, you will no longer be taxed for Social Security in 2017.

What are the big amounts that come out of our paychecks?

Some big amounts that come out of our paychecks are for Social Security and Medicare taxes. How are they calculated? Read on for a complete guide.

Is 401(k) income taxable?

For Social Security and Medicare, deferred income (401k, 403b, Simple IRA’s, etc.) is considered taxable and not subtracted from gross pay. Using Bob again as our example:

Is there a cap on Medicare taxes?

There is no Medicare cap, and employers are required to withhold an additional Medicare Tax of 0.9% for wages over $200,000. Now that we’ve covered Social Security and Medicare taxes, we’ll tackle state taxes in our next segment. Bookmark ( 0) Please login to bookmark. Username or Email Address.

What is the federal tax rate for 401(k)?

These two federal taxes are not exempt from pretax 401 (k) withholding. For example, as of 2019, your gross salary of $2,000 would be subject to Social Security tax at 6.2 percent and Medicare tax at 1.45 percent. The 2019 annual wage limit for Social Security tax is $132,900, while Medicare tax is withheld from all earnings.

How much is a biweekly 401(k) contribution?

Your biweekly 401 (k) contributions equal $120 , leaving $1,880 of your salary subject to federal income tax.

What is the difference between a Roth 401(k) and a traditional 401(k)?

Whereas a Roth 401 (k) retirement plan is structured so you make contributions with after-tax dollars, a traditional 401 (k) plan allows you to make contributions with pretax money. If you have the latter, your employer subtracts your contributions from your gross income before deducting the required taxes. Understanding the differences between a Roth 401 (k) vs 401k will help ensure that you are prepared to manage your tax duties during your filing. The Internal Revenue Service has standard requirements for calculating federal taxes on pretax contributions, but state and local laws might vary.

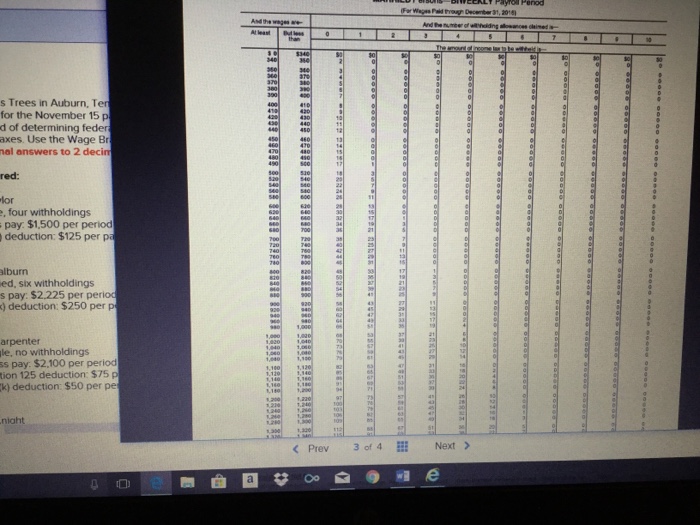

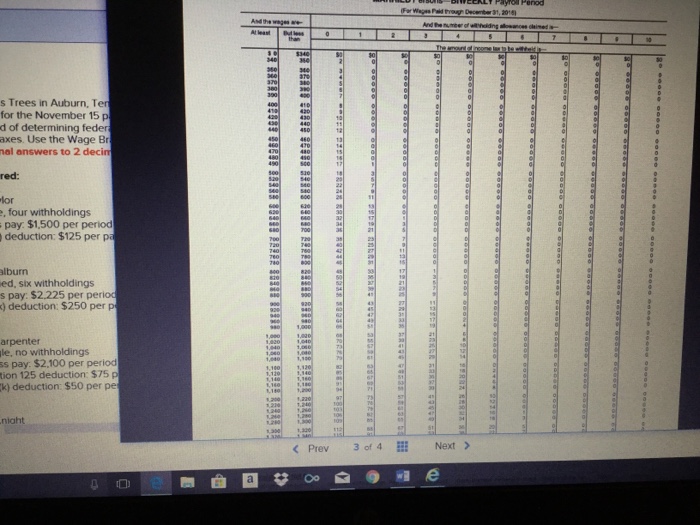

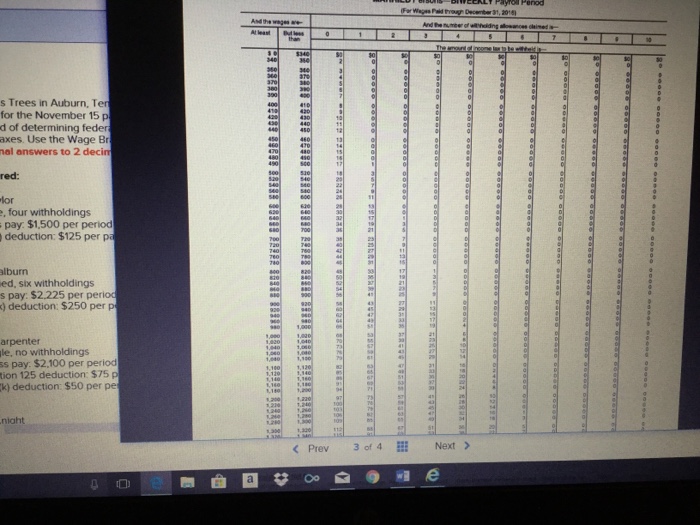

How to determine federal income tax withholding?

To determine federal income tax withholding, consult IRS Circular E for the tax-withholding table that matches the allowances and filing status on your W-4 form and your wages and pay period.

Is Section 125 health insurance subject to federal tax?

Section 125 or cafeteria plans, such as pretax medical, dental and group-term life insurance are not subject to federal income tax, Medicare tax, Social Security tax, and in many cases, state and local income tax. Deduct the premiums from gross wages before calculating those taxes.

Is 401(k) taxed in California?

While pretax 401 (k) contributions are not subject to personal income tax in California, they are subject to state disability insurance.

Do you have to pay taxes on 401(k)?

Contact your state revenue agency for pretax 401 (k) regulations, if applicable. Many states do not require 401 (k) contributions to be included in wages for state income tax withholding, but a few do.

How is Medicare tax calculated?

Medicare tax is calculated as your gross earnings times 1.45%. Unlike the Social Security tax, there is no annual limit to the Medicare tax. Starting in 2013, an additional Medicare tax of 0.9% is withheld on all gross earnings paid in excess of $200,000 in a calendar year. If you enter an amount for the year-to-date gross earnings, this additional Medicare tax will be calculated based on the current period's gross earnings that exceed the annual $200,000 threshold. If no year-to-date amount is entered, any additional Medicare tax withholding will be calculated only for any gross earnings in excess of $200,000 for the current payroll period. If year-to-date wages prior to the current payroll period have exceeded $200,000, the year-to-date wages must be entered to calculate an accurate additional Medicare tax.

How much is a 50% 401(k) match?

For example, let's assume your employer provides a 50% 401 (k) contribution match on up to 6% of your annual salary. If you have an annual salary of $100,000 and contribute 6%, your contribution will be $6,000 and your employer's 50% match will be $3,000 ($6,000 x 50%), for a total of $9,000. If you only contribute 3%, your contribution will be $3,000 and your employer's 50% match will be $1,500, for a total of $4,500.

What is the deferral percentage for Medicare?

While your plan may not have a deferral percentage limit, this calculator limits deferrals to 75% to account for FICA (Social Security and Medicare) taxes. This rule may not apply to all plans.

How many allowances can you claim on federal taxes?

The number of allowances you should claim depends largely on the number of dependents you have and your itemized deductions. This calculator allows from 0 to 99 allowances.

How to calculate federal tax withholding per pay period?

Dividing the amount of tax by the number of pay periods per year to arrive at the amount of Federal tax withholding to be deducted per pay period.

What is the maximum 401(k) contribution for 2020?

For 2020, the maximum contribution for this type of plan is $19,500 per year for individuals under 50 and $26,000 for individuals 50 or older. Employer contributions do not count toward the IRS annual contribution limit. Employees classified as "Highly Compensated" may be subject to additional limits based on their employer's overall 401 (k) ...

What is considered high compensated 401(k)?

Employees classified as "Highly Compensated" may be subject to additional limits based on their employer's overall 401 (k) participation. If you expect your salary to be $130,000 or more in 2020 or was $125,000 or more in 2019, you may need to contact your employer to see if these additional contribution limits apply to you.

How much money do you put in a 401(k) before taxes?

Contributions to a traditional 401 (k) plan come out of your paycheck before the IRS takes its cut. So if you earn $1,000 before taxes at work and you contribute $200 of it to your 401 (k), that's $200 less that you'll be taxed on. When you file your tax return, you’d report $800 rather than $1,000.

How much tax do you have to pay on 401(k) withdrawals?

The IRS generally requires automatic withholding of 20% of a 401 (k) early withdrawal for taxes. So if you withdraw the $10,000 in your 401 (k) at age 40, you may get only about $8,000. The IRS will penalize you. If you withdraw money from your 401 (k) before you’re 59½, the IRS usually assesses a 10% penalty when you file your tax return.

How to offset taxes on 401(k)?

You might be able to offset the taxes on your 401 (k) withdrawal by selling underperforming securities at a loss in some other regular investment account you might have . Those losses can offset some or all of the taxes on your 401 (k) withdrawal.

How long is a distribution not taxed?

Withdrawals of contributions and earnings are not taxed as long as the distribution is considered qualified by the IRS: The account has been held for five years or more and the distribution is:

What does Roth 401(k) mean?

If your employer offers a Roth 401 (k), that means you contribute after-tax money instead of pre-tax money as with the traditional 401 (k). This has a few advantages (see the section about withdrawals). Back to top.

Do 401(k) plans have taxes?

Here is a list of our partners and here's how we make money. For most 401 (k) plans, 401 (k) taxes only apply on withdrawals. Most 401 (k) plans are tax-deferred, which means no income tax on contributions or on gains, interest or dividends the money produces until the owner withdraws it. That makes the 401 (k) not just a way to save ...

Is 401(k) a good way to save for retirement?

That makes the 401 (k) not just a way to save for retirement; it’s also a great way to cut your tax bill. But there are a few rules about 401 (k) taxes to know, as well as a few strategies that can get your tax bill even lower. Here’s an overview of how 401 (k) taxes work, how a 401 (k) can affect your tax return and how to pay less tax when ...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

Is there a wage base limit for Medicare?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.

How are 401(k) contributions made?

How 401 (k) Contributions Are Made. Most 401 (k) contributions are made on a pre-tax basis. "Pre-tax" simply means that your income tax on these contributions is deferred until you take payouts during retirement. In other words, your contributions to the 401 (k) are taken out of your gross pay, and so they reduce your taxable income.

How much do you contribute to your 401(k) if you have a biweekly pay period?

Suppose your gross pay is $1,788.54 for the biweekly pay period; you contribute 10 percent of your pay in your employer's 401 (k) plan, and contributions are deducted on a pre-tax basis. This means that if you contribute 10 percent every pay period, your employer deducts 10 percent from your gross pay, or $178.85, and deposits this amount to your 401 (k) account.

What Are FICA Taxes?

FICA taxes consist of Social Security tax and Medicare tax. For the 2019 tax year, the FICA tax rate is 7.65 percent, which breaks down to 6.2 percent for Social Security and 1.45 percent for Medicare. Employers calculate the FICA tax using your gross pay.

How much is FICA tax?

The Medicare tax portion is $25.93, or 1.45 percent multiplied by $1,788.54. Your total FICA taxes are $136.82.

What is the maximum amount you can make on Social Security?

For 2019, the wage limit is $132,900. If you make more than that amount, you will only pay Social Security tax on $132,900 of your gross annual pay.

Do you pay taxes on 401(k) after retirement?

This arrangement also allows your 401 (k) account to grow tax-deferred, which means you won't pay the income taxes on that income until you begin receiving distributions from the 401 (k) after you retire.

Do 401(k) contributions reduce your income?

While 401 (k) contributions from your wages are a great way to save for retirement and reduce your taxable income, your 401 (k) deductions do not reduce your wages for purposes of calculating FICA taxes. Most 401 (k) deductions are taken out of your pay on a "pre-tax" basis, but in that case, "pre-tax" refers only to income taxes.

Information

General Pros and Cons of A 401

A 401(k) Is A Defined Contribution Plan

- Unlike a defined benefit plan (DBP), also known as a pension plan, which is based on formulas for determining retirement withdrawals, defined contribution plans (DCPs) allow their participants to choose from a variety of investment options. DCPs, 401(k)s in particular, have been gaining in popularity as compared to DBPs. Today, the 401(k) defined contribution pension plan is the mos…

Investments

- To generalize, most 401(k) offerings allow an individual to invest in a variety of portfolios. These vary between mutual funds, index funds or exchange-traded funds, all of which have an assorted mixture of stocks, bonds, international market equities, treasuries, and much more. All have different pros and cons. The above options usually provide slow and steady growth of assets ov…

Employer Match

- A 401(k) match is an employer's percentage match of a participating employee's contribution to their 401(k) plan, usually up to a certain limit denoted as a percentage of the employee's salary. There can be no match without an employee contribution, and not all 401(k)s offer employer matching. As an example, an employer that matches 50% of an emplo...

Early Withdrawal

- Contributions and their subsequent interest earnings as part of a 401(k) plan cannot be withdrawn without penalty before the age of 59 ½. In some cases (described below), exceptions are made and early withdrawals are permitted. Under these circumstances, early 401(k) withdrawals are still subject to ordinary income taxes, but not the 10% penalty. 401(k) Hardship Withdrawal Some 40…

Distributions in Retirement

- Anyone older than 59 ½ can begin receiving distributions from their 401(k)s, but they can also choose to defer receiving distributions to allow more earnings to accumulate. Distributions can be deferred, at latest, until the age of 72. Between the ages of 59 ½ and 72, participants have several options: Option 1: Receive Distributions Distributions can be received in the form of either a lum…

Required Minimum Distributions

- Anyone that reaches age 72 is required to take distributions from their 401(k). This is called a required minimum distribution (RMD). Traditional, SIMPLE, and SEP IRAs have similar rules imposed by the IRS. The exact date at which RMDs are required is April 1st of the year after a retiree reaches the age of 72. In order to determine the exact amount, retirees can take their 401…

Self-Directed 401

- A self-directed (SD) 401(k), sometimes called a solo 401(k), is a way for self-employed individuals to participate in a 401(k) plan. Although their purpose is aimed specifically at the self-employed, SD 401(k)s can also be offered to employees as an alternative to a traditional 401(k) plan through their employers, though it is uncommon. For the most part, SD 401(k)s share the same characte…

Roth 401

- The Roth 401(k) is somewhat different from the traditional 401(K) as a retirement savings plan. It combines some features of the traditional 401(k) along with some features of the Roth IRA. The main difference is the timing of taxation. Similar to Roth IRAs, Roth 401(k)s are retirement plans that utilize after-tax contributions instead of pre-tax income. What this means is that taxes are p…