To make this process simple for those wanting to leave the TRS Medicare Advantage plan, you must call TRS Health & Insurance Benefits at 888-237-6762 and request a TRS cancellation form. Because you did not return the cancellation form to TRS, you are now enrolled in the TRS Medicare Advantage plan. This is what happened to you, Josie.

- Contact TRS for a cancellation form (700B). You must sign and notarize the form. ...

- Cancellations will be effective the first day of the month after TRS receives the notarized 700B form.

- If you are a surviving spouse of a TRS retiree and are enrolled in TRS-Care, send in a written request to cancel your TRS-Care coverage.

What happens if I cancel my TRS-Care Coverage?

If you are a surviving spouse of a TRS retiree and are enrolled in TRS-Care, send in a written request to cancel your TRS-Care coverage. The request must have your signature. Medical Questions: UnitedHealthcare

How do I terminate my TRS health&insurance benefits?

Dec 07, 2017 · If you have not yet submitted a request to terminate your TRS-Care coverage, you must do so in order for TRS to terminate your TRS-Care coverage. Please contact TRS Health & Insurance Benefits at 1-888-237-6762 to request a termination form (700B). TRS is closely monitoring the situation to ensure that the terminations are processed. If you would like TRS to …

What does TRS-Care not pay for Medicare Advantage?

TRS-Care plan changes will not occur until Jan. 1, 2018. If, after you carefully compare TRS coverage with plans available in the individual market and you choose not to enroll in TRS-Care Medicare Advantage and TRS-Care Medicare Rx coverage for 2018, you may have options available to you, depending on your current TRS-Care plan.

How much does Medicare cost for a TRS retiree?

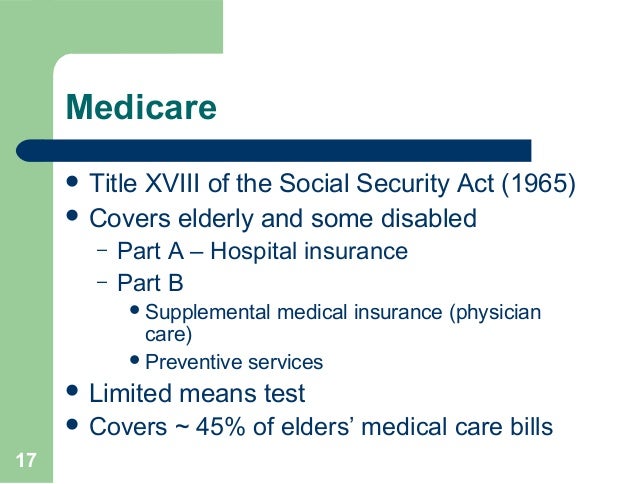

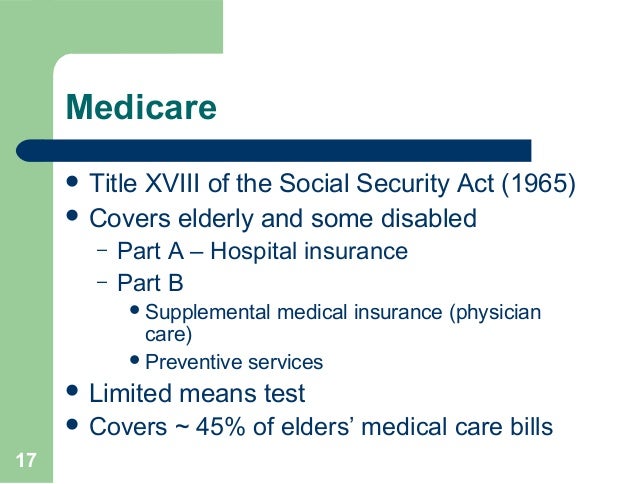

How to cancel Medicare Part A. Most people do not pay a premium for Medicare Part A hospital insurance, so there is no mechanism to cancel it in this case. But if you do pay a premium for Part A and wish to cancel it, you may do so by visiting your local Social Security office or by calling 1-800-772-1213 (TTY 1-800-325-0778).

How do I cancel my TRS-care?

What do I need to do to cancel my TRS-Care coverage completely? Contact TRS for a cancellation form (700B). You must sign and notarize the form. Once TRS cancels your TRS-Care coverage, you cannot re-enroll in the TRS-Care program unless you experience a special enrollment event or you turn 65 years of age.

How does TRS-care work with Medicare?

If you are eligible for TRS-Care coverage, and once TRS verifies your Medicare enrollment, TRS will enroll you in the TRS-Care Medicare Advantage® and TRS-Care Medicare Rx® plans. If TRS does not receive your Medicare number, TRS will not be able to enroll you, and you risk losing TRS-Care coverage altogether.

How much is TRS Medicare?

TRS-Care Medicare Advantage medical plan — you pay $135 per month if you are a retiree or surviving spouse covering just yourself.

Are TRS-care premiums tax deductible?

Thanks to funding from the 86th Texas Legislature, premiums will stay the same for the TRS-Care program through 2020. TRS-Care follows a calendar year deductible, meaning that your deductible will reset on Jan. 1, 2020. For 2020, TRS enhanced benefits for both the TRS-Care plans.

Is TRS-care a Medicare Advantage Plan?

TRS-Care Medicare Advantage is the medical plan and TRS-Care Medicare Rx is the prescription drug plan. It features copays, plus a low medical deductible and out-of-pocket maximum. TRS-Care Standard is a high-deductible health plan offered to retirees and their family members under 65 and not eligible for Medicare.

Do retired Texas teachers get Medicare?

For over 30 years, the state of Texas has provided healthcare to retired teachers through the Teacher Retirement System, or TRS-Care. Medicare and TRS-Care work together to provide benefits for hundreds of thousands of retired teachers and their dependents.Apr 19, 2020

What are the Medicare income limits for 2022?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

What happens if you opt out of TRS-Care?

If you opt out of TRS-Care Medicare Advantage and return to original Medicare and you do not enroll in a Medicare Prescription Drug Plan —or Medicare Part D—you will likely later face an enrollment penalty. Because original Medicare doesn’t cover all medical expenses, you may also choose to enroll in a Medicare Supplement plan, often called a Medigap policy, if you’re eligible for one. Different rules will apply to you if you want to sign up for Medigap coverage if you ever leave the TRS-Care Medicare Advantage plan.

When does Medicare Advantage take effect?

Individual Medicare Advantage plan coverage under this special enrollment can take effect as early as Jan. 1, 2018 if you apply before Jan. 1, 2018. However, if you don’t purchase an individual Medicare Advantage plan before Jan. 1, 2018, it will take effect later and you might experience a gap in plan coverage.

When is Medicare open enrollment?

Medicare holds an annual open enrollment period from Oct. 15 to Dec. 7. During this time, you can sign up for an individual Medicare Advantage plan if you have Medicare Part A and Part B or if you already have a Medicare Advantage plan. If you miss this open enrollment period and you disenroll from TRS-Care, you’ll get another chance to sign up for an individual Medicare Advantage plan.

Do you have to have Medicare Part A and Part B?

Individual Medicare Advantage and Medigap plans require people to have both Medicare Part A and Part B. The 2018 TRS-Care Medicare Advantage plan only requires that you enroll in Medicare Part B, so if you drop TRS-Care and get an individual Medicare Advantage or Medigap plan, you’d have to also purchase Medicare Part A.

When does Medicare Part C end?

If you wish to cancel your Medicare Part C (Medicare Advantage) plan, here is one option for cancelling your coverage: The Fall Annual Enrollment Period (AEP, sometimes called the Open Enrollment Period for Medicare Advantage and Medicare prescription drug coverage) lasts from October 15 to December 7 each year.

When is Medicare open enrollment?

Starting in 2019, you can take advantage of the Medicare Advantage Open Enrollment Period, which runs each year from January 1 through March 31. During this time, you can change from one Medicare Advantage plan to another, whether or not either plan includes prescription drug coverage. You can also disenroll from your Medicare Advantage plan ...

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

About Your Coverage

We're dedicated to providing quality health care you can count on for the right price.

Helpful Information

Learn about plan benefits, in-network providers, claims and wellness programs.

Notice about TRS-Care

TRS-Care is currently funded on a pay-as-you-go basis and is subject to change based on available funding. At the inception of the plan in fiscal year 1986, funding was projected to last 10 years through fiscal year 1995. The original funding was sufficient to maintain the solvency of the fund through fiscal year 2000.

Nondiscrimination Notice and Language Services

If you (or someone you’re helping) have questions regarding your coverage, you can get help and information in your language at no cost. To talk to an interpreter, call TRS-Care Customer Service at 1-888-237-6762 (TTY: 711). See this information in other languages: 1557-Texas-Taglines (pdf)

Thinking of canceling your Medicare Advantage Plan? The Annual Dis-enrollment Period gives you one opportunity

The Medicare Advantage program gives you the opportunity to compare Medicare Advantage plans and enroll in the plan that you believe best suits your circumstances on an annual basis.

What is allowed during the Annual Dis-enrollment Period?

The Annual Dis-enrollment period is designed to allow you to do one thing: Cancel your Medicare Advantage Plan membership and return to original Medicare. Once you cancel your Medicare Advantage Plan you have a couple of choices.

A word of caution

First, if you have not enrolled in a Medicare Advantage plan and there is still time remaining in the Annual Enrollment Period, decide now if an Advantage Plan is right for you. If so, enroll in the plan of your choice.

Can You Cancel Original Medicare?

Original Medicare, or Medicare Part A and Part B, is administered by the federal government through the Centers for Medicare & Medicaid Services (CMS).

How Do You Cancel a Medicare Advantage Plan or a Part D Drug Plan?

You typically have to wait for the Medicare Annual Enrollment Period (AEP, also called the fall Medicare Open Enrollment Period) to cancel a Medicare Advantage (Medicare Part C) or Medicare Part D prescription drug plan. The fall Open Enrollment Period takes place from October 15 to December 7 every year.

How Do You Cancel a Medicare Supplement Plan?

You may cancel a Medicare Supplement plan (also called Medigap) at any time by simply contacting your plan and notifying them that you wish to cancel.

Do You Have to Take Medicare When You Turn 65?

The answer is no. If you are collecting Social Security retirement benefits or Railroad Retirement Board benefits at least four months before you turn 65, you will be automatically enrolled in Medicare Part A and Part B.

When is TRS care effective?

During your Initial Enrollment Period , you may postpone the effective date of your TRS-Care coverage to the first of any of the three months immediately following the month after your retirement date. For example, if your retirement date is May 31, the TRS-Care coverage effective date (normally June 1) may be deferred to July 1, Aug. 1, or Sept. 1.

What is the deductible for TRS Care?

The plan deductible is the amount of covered medical expenses that you pay each plan year (Jan. 1 – Dec. 31) before TRS-Care pays for eligible, non-preventive covered medical expenses. The TRS-Care Medicare Advantage® plan has a $500 deductible and there is no deductible for the TRS-Care Medicare Rx® plan. The office visit copays, precertification penalties, charges for services not covered and any payment for charges greater than the plan’s allowable reimbursement do not apply to the deductible. Preventive services are still 100% covered even if you have not met the deductible.

What is TRS care?

TRS-Care Medicare Advantage® is the sole medical option for TRS-Care participants who are eligible for Medicare. The plan covers everything that original Medicare covers, along with extras. TRS-Care Medicare Advantage® is designed to give you richer benefits at a lower cost than your current combination of original Medicare and your TRS-Care Standard plan.

How long does it take to get Medicare Part B reinstated?

If you lose Medicare Part B B for any reason, including not paying the premium, but you take steps to get Medicare Part B reinstated within 90 days of losing it, TRS will work with you to ensure your TRS-Care coverage isn’t terminated.

When will my deductible start for TRS?

31, 2021. Your $500 deductible will begin Jan. 1, 2022.

Who administers TRS care?

SilverScript Insurance Company , an affiliate of CVS Caremark, administers the TRS-Care Medicare Rx® prescription drug plan. This plan is approved by the federal Centers for Medicare & Medicaid Services (CMS). It offers more coverage than an individual Medicare Part D plan. This plan was specifically created for TRS-Care and is the only option for Medicare-eligible TRS-Care participants. Participants will not have to pay a higher TRS-Care premium to enjoy the benefits of this plan. Because the plan has been designed specifically for TRS retirees, it bridges the coverage gap or “donut hole” found in many Medicare prescription drug plans − resulting in lower prescription drug costs.

What is creditable coverage?

Creditable coverage means that, according to Medicare, your health care coverage provides equal or better coverage than an individual prescription drug plan purchased from a Medicare-approved insurer. Having creditable prescription drug coverage allows you to enroll in an individual Medicare Part D plan during future Medicare annual enrollment periods without the penalty of higher premiums.

How to switch

If you're already in a Medicare Advantage Plan and want to switch, follow these steps:

If you have other coverage

Talk to your employer, union, or other benefits administrator about their rules before you join a Medicare Advantage Plan. In some cases, joining a Medicare Advantage Plan might cause you to lose employer or union coverage. If you lose coverage for yourself, you may also lose coverage for your spouse and dependents.