What is the Nevada Medicaid check up provider web portal?

Welcome to the Nevada Medicaid and Nevada Check Up Provider Web Portal. Through this easy-to-use internet portal, healthcare providers have access to useful information and tools regarding provider enrollment and revalidation, recipient eligibility, verification, prior authorization, billing instructions, pharmacy news and training opportunities.

How do I verify PA requirements for Nevada Medicaid?

To verify PA requirements, please refer to the Medicaid Services Manual (MSM) Chapter for your service type at dhcfp.nv.gov and the Billing Guide for your provider type at www.medicaid.nv.gov . Welcome to the Nevada Medicaid and Nevada Check Up Provider Web Portal.

What is the easiest way to change the Tax ID number?

I think the easiest change is updating the practice management or billing software. Depending on the software this is usually done under the provider or practice set up screens. For most it's just a matter of changing the tax ID number. Once it's changed this will be the number used on all future claims.

How do I register to file and pay Nevada Tax?

Register, File and Pay Online with Nevada Tax. Registering to file and pay online is simple if you have your current 10 digit taxpayer’s identification number (TID), a recent payment amount and general knowledge of your business. File and Pay Online; Nevada Tax FAQ's; How-to videos for Nevada Tax; Validate Resale Certificate/Report Tax Evasion

How do I update my Medicaid in Nevada?

If you need to manage your Medicaid or Nevada Check Up plan, you can call 1-877-543-7669, visit Access Nevada, or visit the Division of Welfare and Supportive Services for a list of local numbers.

How do I change my Pecos authorized official?

The Authorized Official will need to Login. Select Account Management. Select Update user account information. Select YES to continue.

How do I contact Nevada Medicaid?

If you do not know who is the provider administrator is in your office, call the Customer Service Center at (877) 638-3472.

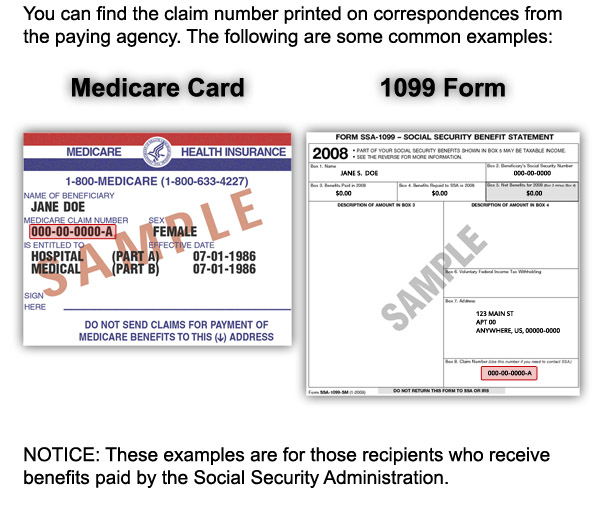

What is reassigning Medicare ID?

A. Reassigning Medicare benefits allows an eligible individual or entity to submit claims on behalf of and receive payment for Medicare Part B services that the performing practitioner provides for the eligible billing individual or entity.

How do I update my Pecos information?

1. Sign in to the PECOS system using your CMS Identity and Access login credentials. 2. Select “Account Management” in the middle of the page to update PECOS account information.

What is a Pecos ID number?

The PECOS system is a database of providers who have registered with CMS. A National Provider Identifier (NPI) is necessary to register in PECOS. Use that identifier to search for the provider in the database. If you don't know the provider's NPI number, you can search for their information in the NPI registry.

What is the income limit for Nevada Medicaid?

In Nevada, households with annual incomes of up to 138% of the federal poverty level may qualify for Medicaid. This is $16,753 per year for an individual, or $34,638 per year for a family of four.

What is Medicaid called in Nevada?

Nevada Check Up is a program designed for children who do not qualify for Medicaid but whose incomes are at or below 200% of the Federal Poverty Level (FPL). Participants in the Nevada Check Up program are charged a quarterly premium based on income. Nevada Medicaid is often confused with Medicare.

Can I use my Nevada Medicaid in another state?

Can I use my Medicaid coverage in any state? A: No. Because each state has its own Medicaid eligibility requirements, you can't just transfer coverage from one state to another, nor can you use your coverage when you're temporarily visiting another state, unless you need emergency health care.

How do I reassign my Pecos benefits?

1. The User will go to the PECOS web site at https://pecos.cms.hhs.gov, enter their I&A User ID and Password, and select "Log In." Page 2 Page 3 2. The User selects "My Associates." Page 4 Page 5 3. The User selects "View Enrollments" beside the application where they need to add or remove a reassignment of benefits.

How do I fill out Form 855R?

3:579:17How to complete the CMS 855R Form to Reassign Medicare BenefitsYouTubeStart of suggested clipEnd of suggested clipNumber must coincide with the information on the Internal Revenue Service. Record this includes anyMoreNumber must coincide with the information on the Internal Revenue Service. Record this includes any suffixes also supply the organization or groups type to national provider identification NPI.

What is Medicare Form 855R?

Complete this application if you are reassigning your right to bill the Medicare program and receive Medicare payments for some or all of the services you render to Medicare beneficiaries, or are terminating a currently established reassignment of benefits.

How do I add a provider to Pecos?

0:146:13Medicare Provider Enrollment Through PECOS - YouTubeYouTubeStart of suggested clipEnd of suggested clipNumber if you do not already have an active NPI number you can register for one through the nationalMoreNumber if you do not already have an active NPI number you can register for one through the national plan and provider enumeration system or n Pez.

How do I add an organization to Pecos?

0:3711:41PECOS Enrollment Tutorial – Initial Enrollment for an ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipYou'll then be able to select the new application button located over here on the left. You'll thenMoreYou'll then be able to select the new application button located over here on the left. You'll then be brought to the applicant identification.

How do I add an associate to Pecos?

1. The User will go to the PECOS web site at https://pecos.cms.hhs.gov, enter their I&A User ID and Password, and select "Log In." Page 2 Page 3 2. The User selects "My Associates." Page 4 Page 5 3. The User selects "View Enrollments" beside the application where they need to add or remove a reassignment of benefits.

How do I correct my Medicare application?

Users may still request a correction via phone and/or e-mail if the enrollment application is currently being processed by a Medicare contractor. The new information, however, cannot be given and accepted via phone or e-mail. It must still be submitted through Internet-based PECOS.

Register Online with SilverFlume

Use Nevada Secretary of State's SilverFlume as an invaluable tool to s tart and expand your businesses. It guides you through:

Register, File and Pay Online with Nevada Tax

Registering to file and pay online is simple if you have your current 10 digit taxpayer’s identification number (TID), a recent payment amount and general knowledge of your business.

Notifications

Paper claims are no longer accepted by Nevada Medicaid. Please refer to Web Announcement 1733 and Web Announcement 1829 for additional information.

Welcome

Welcome to the Nevada Medicaid and Nevada Check Up Provider Web Portal. Through this easy-to-use internet portal, healthcare providers have access to useful information and tools regarding provider enrollment and revalidation, recipient eligibility, verification, prior authorization, billing instructions, pharmacy news and training opportunities.

Getting clients

Besides networking .. visiting their offices, how else can you attract their business? When you close the collections month, how do you bill the physicians?

Pricing for Claims Editing, Resolution, and Insurance Verification

I have a potential client that is requested claim scrubbing resolutions (only corrections on claims submission errors) and insurance verification on the

What to Do When a Provider Has a New Tax ID

The provider that I bill for just advised that he has a new tax ID. What is the process for this change? Would every insurance company need to be contacted?

What is the taxable wage base for experience rating?

The taxable wage base is as follows: Once an employer becomes eligible for "experience rating," he will receive one of 18 unemployment insurance (UI) tax rates, ranging from .25 percent to 5.40 percent of taxable wages.

What is the Nevada tax rate for 2021?

Following is the tax rate schedule for 2021. Employers are taxed on wages paid to each employee up to the taxable wage base in effect during a calendar year. The tax base is calculated annually, and is equal to 66 2/3 percent of the average annual wage for Nevada employees.

What is the unemployment rate in Nevada?

Unemployment Insurance Rates: Employers starting a new business in Nevada must pay unemployment insurance (UI) tax at a rate of 2.95 percent (.0295) of wages paid to each employee up to the taxable wage limit. The employer retains this rate for a period of 14 to 17 calendar quarters (depending on the quarter in which he becomes subject to the law), ...

How much is Nevada tax base?

The tax base is calculated annually, and is equal to 66 2/3 percent of the average annual wage for Nevada employees. Although the total wages paid to each employee must be reported to the division each quarter, any wages paid to an individual which exceed the taxable wage base during the calendar year are not taxed.

How is unemployment insurance funded?

The system is funded through payroll taxes on employers.

When are additional requests required for the 4th quarter?

The most likely months in which additional requests will be necessary are the months prior to each reporting cycle: January - wages for the 4th quarter, prior to January 31 due date. April - wages for the 1st quarter, prior to April 30 due date. July - wages for 2nd quarter, prior to July 31 due date.

What is billing agency?

billing agency/agent is a company or individual that you contract with to prepare and submit your claims. If you use a billing agency/agent you must complete this section. Even if you use a billing agency/agent, you remain responsible for the accuracy of the claims submitted on your behalf.

What is a mobile facility?

“mobile facility” is generally a mobile home, trailer, or other large vehicle that has been converted, equipped, and licensed to render health care services. These vehicles usually travel to local shopping centers or community centers to see and treat patients inside the vehicle.

What to do if there is no subsection in section 2B?

If no subsection is associated with your supplier type, check the box stating the information is not applicable.

Where are Medicare records stored?

If your Medicare beneficiaries’ medical records are stored at a location other than the Practice Location Address shown in section 4A complete this section with the name and address of the storage location. This includes the records for both current and former Medicare beneficiaries.

Can an OTP provider be a W2 employee?

Under the OTP Standards in 42 C.F.R § 424.67, an OTP provider must not employ, as a W2 employee or not, or contract with anyone who meets any of the ineligibility criteria outlined below, whether or not the individual is currently ordering or dispensing at the OTP facility.

Does this supervising physician provide supervision at any other IDTF?

Does this supervising physician provide supervision at any other IDTF? ....................................... YES NOIf yes, list all other IDTFs for which this physician provides supervision. For more than five, copy this sheet.

Do radiologists bill E&M codes?

A radiologist’s practice is generally different from those of other physicians because radiologists usually do not bill E&M codes or treat a patient’s medical condition on an ongoing basis. A radiologist or group practice of radiologists is not necessarily required to enroll as an IDTF. If enrolling as a diagnostic radiology group practice or clinic and billing for the technical component of diagnostic radiological tests without enrolling as an IDTF (if the entity is a free standing diagnostic facility), it should contact the carrier to determine that it does not need to enroll as an IDTF.