...

Search.

| toll free: | 1-800-MEDICARE (1-800-633-4227) |

|---|---|

| TTY/TDD: | 1-877-486-2048 |

| website: | MEDICARE.gov |

What is a Medicare deductible/coinsurance look-up?

Medicare Deductible / Coinsurance Look-Up Medicare beneficiaries who receive covered Part A services may be subject to deductible and coinsurance. Covered Part B services are subject to an annual deductible and coinsurance.

How much does Medicare cost through the Railroad Retirement Board?

Generally, your Medicare costs through the RRB will be the same as those paid by people who qualify for Medicare via Social Security. Just like workers outside the railroad industry, you’ll see Medicare deductions from your paycheck during your working years. These are the same for all workers: 1.45% of your income in 2020. 1

What is the Railroad Retirement Board responsible for collecting my Premiums?

• The RRB is responsible for collecting your Original Medicare premiums if you receive Railroad Retirement Board benefits or annuity checks for railroad disability. Your Medicare Part B premium, and Part A if you do not qualify for premium-free Part A coverage, are deducted from your check each month, automatically.

How do I enroll in Medicare as a railroad worker?

If you are enrolling in Medicare as a current or former railroad worker, you’ll need to follow specific steps to enrollment in Medicare: • Your enrollment in Original Medicare is handled by the RRB rather than by Social Security.

How do I check my railroad Medicare claims?

If you'd like to use the IVR, you can do so by calling 800–833–4455. From the main menu, press one (1) for claim status. You will need your Railroad Medicare number, date of birth, name, and date of service for the claim you are searching for. Claim status is available Monday thru Friday from 7 a.m. through 11 p.m. ET.

How do I check my Medicare coverage?

Checking the BasicsYou can use the enrollment check at Medicare.gov.You can call Medicare at 1-800-633-4227.Members can visit a local office to review the coverage in person.

Is there a difference between railroad Medicare and regular Medicare?

A: The only difference is that retired railroad beneficiaries have their Part B benefits administered by the Palmetto GBA Railroad Retirement Board Specialty Medicare Administrative Contractor (RRB SMAC) regardless of where they live. Members should be certain to advise providers of this when they receive treatment.

How do I bill railroad Medicare claims?

Getting Started With Railroad Medicare BillingStep 1: Ensure your enrollment information is correct with your local Part B Medicare Administrative Contractor (MAC) ... Step 2: Request a Railroad Medicare PTAN. ... Step 3: Receive your Railroad Medicare PTAN. ... Step 4: File Electronically. ... Step 5: Go Green — Electronic Remits.

What is the Medicare deductible for 2022?

$233The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Can providers check Medicare claims online?

Providers can submit claim status inquiries via the Medicare Administrative Contractors' provider Internet-based portals. Some providers can enter claim status queries via direct data entry screens.

Does railroad Medicare have a deductible?

To enroll, you must have Medicare Part A and live in the plan's service area. You will generally pay a monthly premium (averaging about $43 in 2022) and an annual deductible (up to $480 in 2022). You must also pay a share of your prescription drug costs. Costs vary depending on the drug plan you choose.

Is railroad Medicare a Medicare Advantage Plan?

Yes, Railroad Medicare beneficiaries can choose to enroll in Medicare Advantage plans.

How do I contact railroad Medicare?

Contact Railroad MedicareProvider Contact Center: 888-355-9165.IVR: 877-288-7600.TTY: 877-715-6397.

What is the payer ID for Medicare Railroad?

MR018Payer Name: Medicare - Railroad|Payer ID: MR018|Professional (CMS 1500)

How do I submit a Medicare claim electronically?

How to Submit Claims: Claims may be electronically submitted to a Medicare Administrative Contractor (MAC) from a provider using a computer with software that meets electronic filing requirements as established by the HIPAA claim standard and by meeting CMS requirements contained in the provider enrollment & ...

What does a railroad Medicare number look like?

It will contain capital letters (all letters with the exception of S, L, O, I, B and Z) and numbers (0-9). The 2nd, 5th, 8th, and 9th characters will always be a letter, while characters 1, 4, 7, 10, and 11 will always be a number. The 3rd and 6th characters will be a letter or a number.

What is the number to call a railroad retirement board?

Call a Licensed Agent: 833-271-5571. Due to COVID-19, the Railroad Retirement Board closed offices as of March 16, 2020. We’ll keep you updated on when offices reopen. In the meantime, visit RRB.gov to learn about your online self-serve options.

How long do you have to enroll in Medicare if you have end stage renal disease?

Whether you become eligible for Medicare via age or disability, you’ll have seven months, called your Initial Enrollment Period (IEP), in which to enroll.

What is the RRB in 2020?

Licensed Insurance Agent and Medicare Expert Writer. June 15, 2020. Before the Social Security Administration (SSA) was formed, the Railroad Retirement Board (RRB) developed retirement, disability, and unemployment benefits for railroad workers who were hit hard by the Great Depression. Today, the RRB offers railroad workers a similar safety net.

When do you become eligible for Medicare?

Typically, you’ll become eligible when you turn 65 or reach your 25th month of receiving disability benefits. The main difference is that the RRB classifies disability differently than the SSA does, so check with a representative ...

Does Medicare pay through the RRB?

Generally, your Medicare costs through the RRB will be the same as those paid by people who qualify for Medicare via Social Security. Just like workers outside the railroad industry, you’ll see Medicare deductions from your paycheck during your working years.

Does RRB have Medicare?

Today, the RRB offers railroad workers a similar safety net. RRB beneficiaries can tap into Medicare benefits, much like Social Security beneficiaries, with a few differences. If you are a railroad worker, learn what you can expect from Medicare in terms of eligibility, enrollment, costs, and health benefits—and how your RRB benefits differ ...

Do you pay Medicare Part D premiums through RRB?

If you add Medicare Part D, Medigap, or Medicare Advantage, you’ll pay additional premiums for these as well, but not through your RRB income checks. You’ll pay for each of these coverages separately, directly to the insurance company that provides each plan.

Where is the railroad retirement board on my Medicare card?

Your Medicare card is similar to the new Medicare cards that all beneficiaries receive, with the exception that “Railroad Retirement Board” is printed in a red banner at the bottom of the card .

What happens if you receive a railroad retirement?

If you receive Railroad Retirement benefits or disability annuity benefits from the railroad at the time of eligibility for Medicare, you are automatically enrolled in Medicare Parts A and B by the RRB. After the RRB automatically enrolls you, you receive your Medicare card together with a letter from the RRB explaining ...

What is the RRB?

The RRB administers insurance and retirement benefits to all railroad workers in the country. Instead of getting retirement benefits from the U.S. Social Security Administration as other workers do, the RRB provides railroad workers and their families with retirement benefits, along with unemployment and sickness benefits, ...

Do you have to go through the Social Security Administration if you are employed by the railroad?

However, if you have end-stage renal disease (ESRD) and qualify for Medicare, you must go through the Social Security Administration even if you are employed by the railroad.

Does Medicare cover railroad employees?

Medicare offers coverage to railroad employees just as it does for people who have Social Security. The payroll taxes of railroad employees include railroad retirement and Medicare hospital insurance taxes.

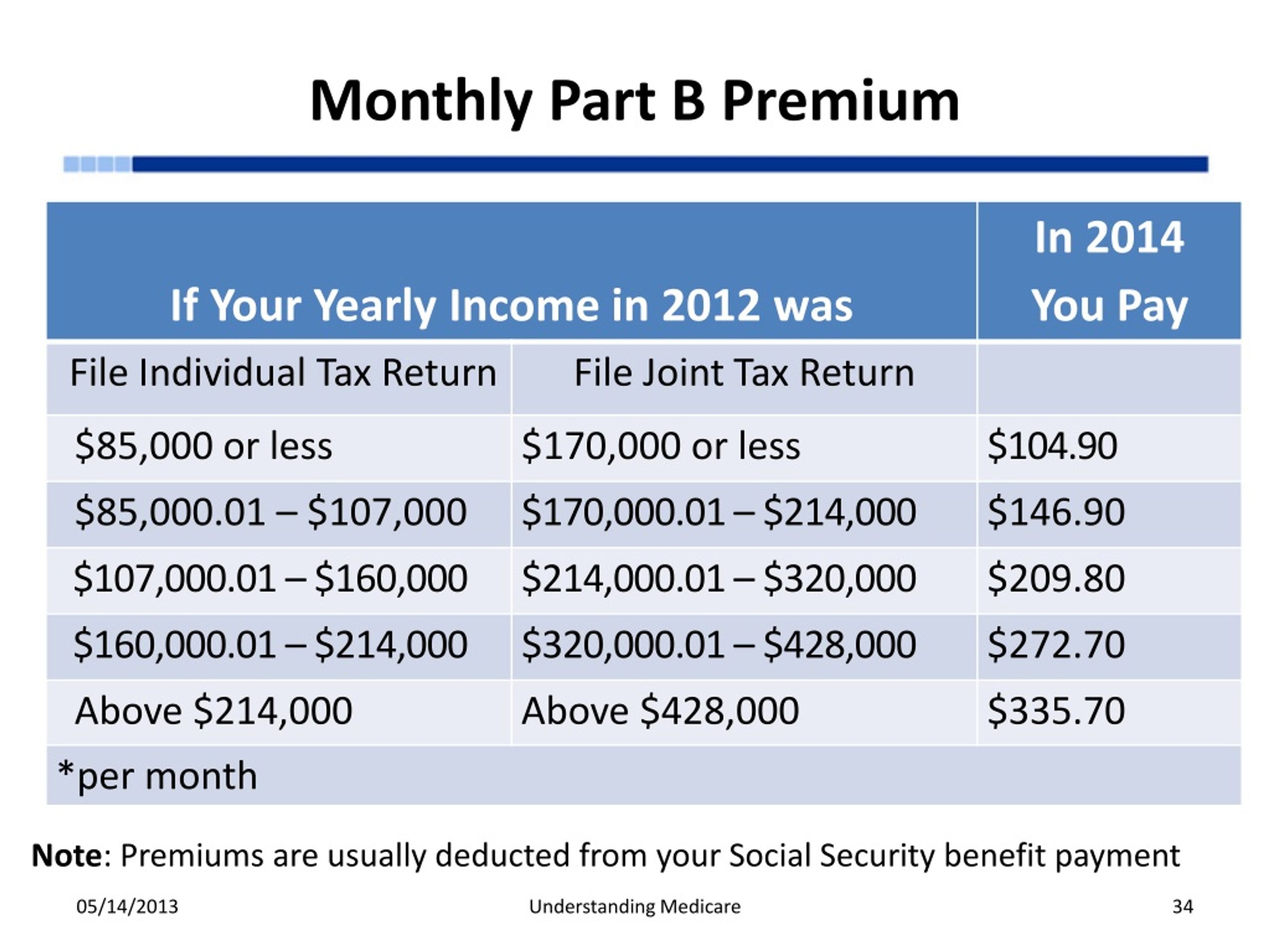

Why do Medicare beneficiaries pay less than Medicare?

Some Medicare beneficiaries will pay less than this amount because, by law, Part B premiums for current enrollees cannot increase by more than the amount of the cost-of-living adjustment for social security (railroad retirement tier I) benefits.

What percentage of Medicare beneficiaries pay the larger premiums?

CMS estimates that about 7 percent of Medicare beneficiaries pay the larger income-adjusted premiums. Beneficiaries in Medicare Part D prescription drug coverage plans pay premiums that vary from plan to plan. Part D beneficiaries whose modified adjusted gross income exceeds the same income thresholds that apply to Part B premiums also pay ...

How much is the Part B premium?

Total monthly Part B premium amount. Less than or equal to $88,000. Less than or equal to $176,000. $0.00.

When can I disenroll from Medicare Advantage?

A: You can generally disenroll from a Medicare Advantage plan only during the Medicare open enrollment period of October 15-December 7, the Medicare Advantage Plan disenrollment period of January 1-February 14, or when you qualify for a Special Enrollment Period (SEP). For more information on SEPs, go to www.Medicare.gov.

What is the difference between Medicare Part B and Medicare Part B?

A: The only difference is that retired railroad beneficiaries have their Part B benefits administered by the Palmetto GBA Railroad Retirement Board Specialty Medicare Administrative Contractor (RRB SMAC) regardless of where they live. Members should be certain to advise providers of this when they receive treatment. Also, be sure to provide your Railroad Medicare card at time of service as the information on the card identifies you as a Railroad Medicare beneficiary to the provider.

Does Medicare cover dental implants?

A: In most cases, Medicare does not cover dental services, specifically, services related to the care, treatment, filling, removal, or replacement of teeth, or structures directly supporting teeth. This would include check-ups, cleanings, and dental devices (such as dentures, dental plates, dental implants, or bridges) as well as extractions or other procedures performed to prepare the mouth for dentures (including reconstruction of the ridge) or titanium implants.

Does Medicare cover injectable cancer drugs?

A: Only in limited instances will Medicare Part B provide for prescription drug coverage, such as for certain injectable cancer drugs or immunosuppressive drugs. All other Medicare benefits for prescription drugs require enrollment in a Part D Prescription Drug Program.

Do I need to sign up for Medicare Part B?

A: As an active employee covered under the active employee H&W Plan, you do not need to sign up for Medicare Part B. You should, however, sign up for Medicare Part A (for which there is no cost) to avoid any future Medicare enrollment problems. It is strongly recommended that you contact the Railroad Retirement Board three (3) months before you turn age 65 to start the Medicare enrollment process.

Can Medicare cards be similar?

A: This can easily happen as the two Medicare cards are very similar. The doctor’s office should pay close attention to the specific details printed on your Railroad Medicare card.

Does Medicare pay for hearing aids?

A: No, Medicare does not pay for hearing aids or hearing exams, when the purpose of the exam is to determine whether you need hearing aids or for fitting hearing aids.

1. If, prior to the hospital billing Medicare, a liability insurer settles and makes a payment directly to the patient, do we still submit a claim as MSP? Will the claim deny for us to bill the patient for the allowed amount?

1. If, prior to the hospital billing Medicare, a liability insurer settles and makes a payment directly to the patient, do we still submit a claim as MSP? Will the claim deny for us to bill the patient for the allowed amount? Yes, the claim is still MSP. Once the claim is processed, beneficiary liability can then be determined.

2. If a beneficiary only has Part A hospital coverage, do we have to bill Medicare if it is primary and the patient was seen in-office?e

2. If a beneficiary only has Part A hospital coverage, do we have to bill Medicare if it is primary and the patient was seen in-office?e No. If the beneficiary does not have Part B coverage, then a provider would not need to bill for an office visit unless you need the denial stating the beneficiary has no Part B coverage.

5. We have a patient who fell asleep at the wheel and hit a tree. She stated she did not want us to file a claim with her auto insurance. What should we do when a patient does not want us to bill their auto insurance, although the care they seek is related to the auto accident?

If you know the claim is an MSP issue, providers are required to bill the primary insurance prior to submitting to Medicare.

7. We have a patient who was in an auto accident, but they received the full med pay payment. What should we do?

When the beneficiary is paid directly by no-fault insurer, payment should be paid to the provider by the beneficiary. Report the amount paid by the primary insurer with appropriate coding on the claim. Medicare will process as secondary payer and the provider will need to contact the beneficiary for the primary payment resolution.

8. What is the proper use of condition code 08?

Condition code 08 should be submitted on claims when the beneficiary would not furnish information concerning the other insurance coverage. The Common Working File (CWF) monitors these claims and alerts the Benefits Coordination & Recovery Center (BCRC). The BCRC will then contact the beneficiary if necessary.

9. When filing a claim with condition code 08 when beneficiary is not cooperating, how do we prevent these from returning to the provider?

The Part A claim should reject and assign responsibility to the patient. Contact customer service for assistance with the claim.

10. Where are the instructions for completing the CMS-1500 when billing MSP? Is there another form specific for MSP billing rather than the CMS-1500 to submit MSP claims?

No. The CMS-1500 (or the electronic equivalent) is the Part B claim form, which is used for billing MSP claims as well.