What is the best Medicare supplement insurance?

Aug 17, 2021 · How do I shop for a Medigap policy? Enter your ZIP code on the Medicare search tool to see which plans are offered in your state. Contact your State Health Insurance Assistance Program (SHIP) to find out which insurance companies sell Medigap policies in your state. Ask for a ... Call your state ...

What are the top 5 Medicare supplement plans?

Medicare Part A pays for about 80% of inpatient care, while Medicare Part B pays for about 80% of outpatient care, including medically required supplies. You can get Medigap insurance from a commercial insurance provider to cover the remaining 20% of your medical expenses.

What is the best Medicare insurance plan?

You can only purchase a Medigap plan if you have Original Medicare Part A and B. Medigap plans are available in every state from most private insurers. There are ten standardized plans with a wide variation of coverage and premiums. Every Medigap provider must offer plans A, C, and F. Shop carefully ...

What is the best Medicare plan for You?

Original Medicare. Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). You can join a separate Medicare drug plan to get Medicare drug coverage (Part D). You can use any doctor or hospital that takes Medicare, anywhere in …

What are the pros and cons of Medicare Supplement plans?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

Is Plan G as good as Plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

What is the most basic Medicare Supplement plan?

There are 10 different Medicare Supplement plans approved by Medicare, each with a different level of provided benefits. Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold).Sep 25, 2021

What is the most common form of supplemental Medicare coverage?

Plan C. While Plan F is the most popular plan, Medigap Plan C, Plan G and Plan N are the next most popular Medicare Supplement Insurance plans. The most popular Medigap plans include: 49% of all Medigap beneficiaries are enrolled in Plan F.Oct 6, 2021

Is Plan G guaranteed issue in 2021?

Plan G rates are among the most stable of any of the plans. There are several significant reasons for this. First of all, Plan G is not offered as a “guaranteed issue” (no health questions) option in situations where someone is losing group coverage or Medicare Advantage plan coverage.Nov 8, 2021

What is difference between Plan G and N?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

What is the average cost of a Medicare Supplement plan?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

Does Plan N cover Medicare Part B deductible?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctor's office and emergency room visits.Nov 23, 2021

Does Plan G cover Medicare deductible?

Get online quotes for affordable health insurance Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

What is the difference between an Advantage plan and a supplemental plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What are the 4 phases of Medicare Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.Oct 1, 2021

Is Medigap and supplemental insurance the same thing?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What Are the Different Types of Medicare?

Let’s start with Original Medicare. Original Medicare is made up of Medicare Parts A and B. Part A provides coverage for hospitalizations, hospice care, some skilled nursing facility care, and home health care. Part B provides physician and outpatient services, as well as preventive care. Government cost-sharing is in place for both parts A and B.

What Is Medigap?

Medigap, also known as Medicare Supplement, is a private insurance policy that can be bought to help pay for things that Original Medicare doesn’t cover. These secondary coverage plans are only available with Original Medicare.

Who Is Eligible for Medigap?

You’re eligible for Medigap if you are already enrolled in Original Medicare Parts A and B and don’t have a Medicare Advantage plan. You must also meet one of the following conditions:

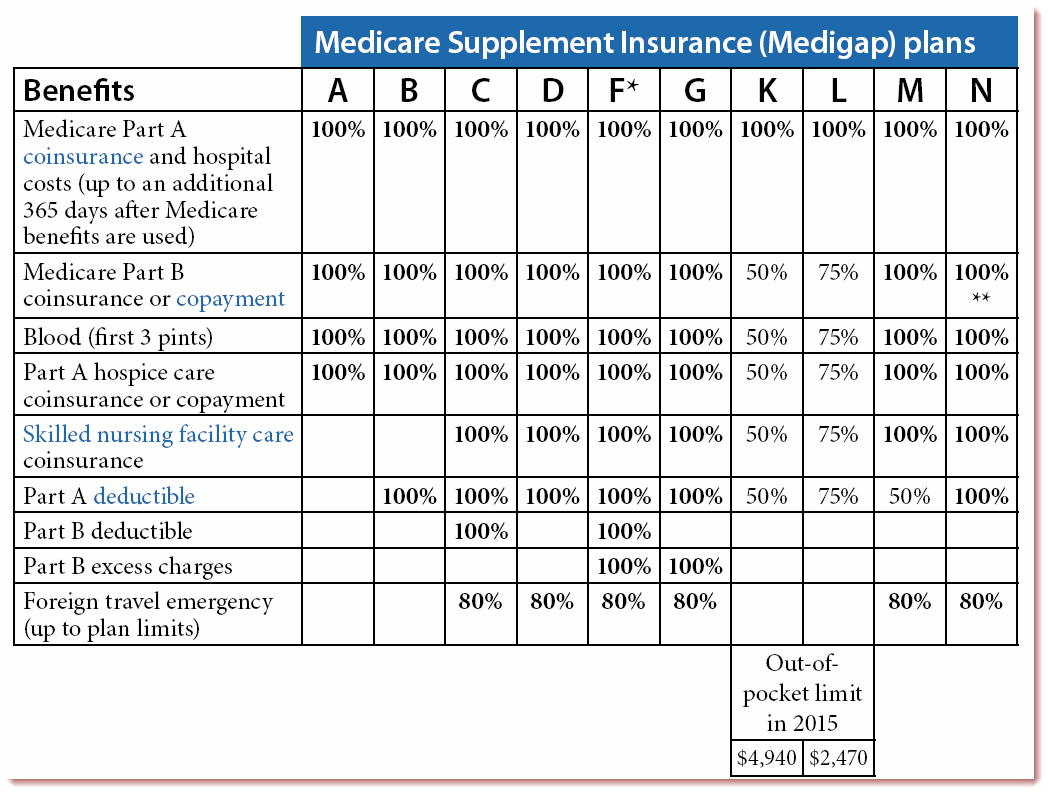

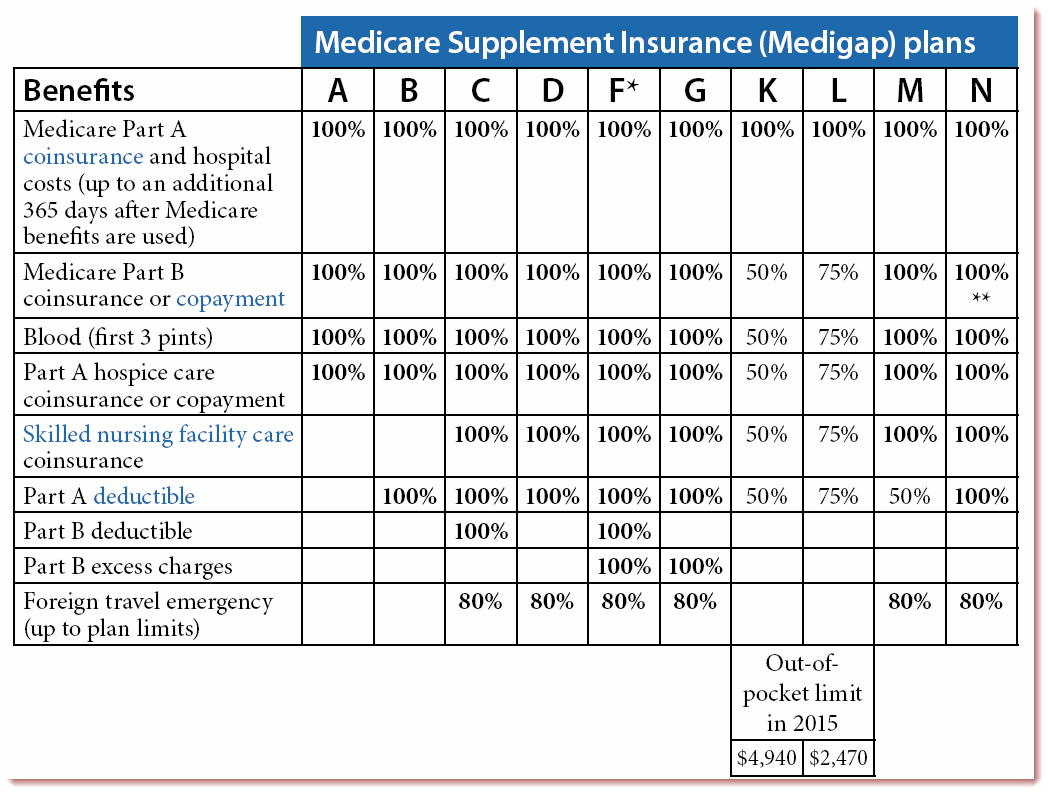

Medigap Comparison

In order to compare Medicare supplement plans, you need to know that there are ten standardized Medigap plans, denoted by the letters A through N and that plans with the same letter must have the same basic benefits regardless of insurer.

Do I Need a Medigap Plan?

If you have a Medicare Advantage (Part C) plan, you do not need to go any further. Medigap plans do not work with Medicare Advantage plans. In fact, it is illegal for an insurance company to see you a Medigap plan if you have Part C.

Important Facts to Know about Medigap Plans

There are some things common to all Medigap plans. The most important are these:

How Does a Medigap Plan Work?

In most policies, part of the agreement you will sign allows the Medigap carrier to receive your Medicare claim after the primary carrier processes it. This is sometimes known as “piggyback” coverage.

Best Time to Purchase a Policy

When you enroll in Original Medicare Part A and B, you have an automatic six-month open enrollment period. During this window, you may purchase any Medigap policy sold in your state, no matter what your health situation is. These are known as “guaranteed issue rights.”

Basic Comparison of Plans

There are thousands of Medicare Supplemental Insurance plans available in every state. With this many choices, you might wonder where to start.

Start Your Comparison Search

Medicare’s website has a good tool to start your search. Input your zip code and whether you already have a policy and click “continue.” You can also include your health status, but that’s not necessary at this point.

A Note Regarding Pricing Methods

In the middle of this screen is a column called “Pricing Method.” This is how each insurance company sets its own premiums. This method can greatly influence the pricing of their policies. There are three rating systems:

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is the best Medicare Supplement Insurance Plan?

If you’re looking for minimal coverage, the best Medicare Supplement Insurance plan to consider might be Plan A, which offers the most basic level of coverage. If you prefer more coverage, Plans F* and G cover nearly all of the available benefits. Plans K and L may be the best Medicare Supplement Insurance plans for those want a yearly ...

When do you sign up for Medicare Supplement?

This is the six-month period that starts the first month you’re 65 or over , and enrolled in Medicare Part B.

What is issue age rated?

Issue-age rated: premiums are based on your age when you enroll and don’t go up as you get older. Community-rated: all plan members pay the same premium, regardless of their age. Attained-age rated: premiums are based on your current age, so your premium costs rise as you get older.

Is Medicare Supplement insurance one size fits all?

The truth is that when it comes to Medicare Supplement insurance there is not a one-size-fits-all solution. The best Medicare Supplement Insurance plan for you depends on your needs and budget. Here are five steps to help you find the best Medicare Supplement Insurance plan for your situation.

Is a plan available in all areas?

All plans are not available in all areas and are subject to plan limitations and applicable laws, rules, and regulations. The general information in this article is not intended to fully explain any specific plan. Please see the official plan documents for more complete information about any specific plan.

Does Medicare Supplement Insurance come with a monthly premium?

Medicare Supplement Insurance plans typically come with a monthly premium. However, insurance companies that sell Medicare Supplement Insurance coverage may price their plans differently. As you’re deciding on the best Medicare Supplement Insurance plan for your financial situation, keep in mind that insurance companies may use three types ...

Health Care Costs and Original Medicare

Original Medicare provides health insurance coverage for hospital stays, doctor's office visits, lab testing, medical supplies and some other services. For Medicare beneficiaries, other out-of-pocket costs can add up quickly.

Choosing the Best Medicare Supplement Plan for You

Medigap plans supplement your Original Medicare coverage with benefits that help fill in some key cost gaps. The basic benefits of each type of Medicare Supplement Insurance plan are standardized by Medicare, though the policies themselves are sold by private companies.

Getting the Most From Medicare Supplement Insurance

If you buy a plan during your Medigap open enrollment period, insurers cannot deny you a policy or charge more for your Medigap plan based on your health or pre-existing conditions. If you don't purchase a Medicare Supplement Insurance plan during your open enrollment period, you could potentially be denied coverage or pay higher monthly premiums.

Medicare Advantage Plans Replace Original Medicare Benefits

Another health plan option is Medicare Advantage plans. It is important to note that Medicare Advantage and Medicare Supplement Insurance are different. Medicare Advantage plans are an alternative to Original Medicare, while Medigap plans work alongside your Original Medicare benefits to help cover out-of-pocket costs.

Get Help Buying the Right Medigap Plan for You

The right Medicare Supplement Insurance plan is the one that best matches your health care cost requirements and your budget. A licensed agent can answer your questions and help you determine which plan is right for you.

Compare Medigap plans in your area

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareSupplement.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.