The right Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What are the benefits of Medicare Plan D?

What Does Medigap Plan D Cover?

- Medicare Part A Coinsurance. Medicare Part A is known as hospital insurance and it includes cost-sharing measures like coinsurance.

- Medicare Part B Coinsurance and Copayment. ...

- First 3 Pints of Blood. ...

- Part A Hospice Care Coinsurance or Copayment. ...

- Coinsurance for Skilled Nursing Facility Care. ...

- Medicare Part A Deductible. ...

- Foreign Travel Emergency Care Costs. ...

What is best Medicare Part D plan?

Medicare beneficiaries will have fewer Medicare Part D stand-alone prescription drug plans ... says Medicare beneficiaries need to review their current plan and determine whether it’s still their best option or if they need to change providers.

How to pick the best Medicare supplement plan?

- Do your important physicians participate in any Medicare Advantage plans or do they only accept Original Medicare?

- What insurance is accepted by your preferred hospitals?

- Do you travel out of the area frequently? ...

- What is your risk tolerance? ...

- How about peace of mind? ...

How to find the best Medicare Part D drug plan?

Why you should compare Medicare Part D plans

- The plan provides coverage for all your prescription drugs.

- You’ve evaluated the copayment and coinsurance costs for your prescription drugs.

- You’ve weighed your options between a standalone Medicare prescription drug plan (PDP) as a supplement to Original Medicare or a Medicare Advantage prescription drug plan (MAPD).

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is the difference between basic and enhanced Part D plans?

Enhanced plans charge higher monthly premiums than basic plans but typically offer a wider range of benefits. For instance, these plans may not have a deductible, may provide extra coverage during the donut hole, and may have a broader formulary. Some of these plans may also cover excluded drugs.

How do I know which Medicare plan is right for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

Is SilverScript a good Part D plan?

All of Aetna's PDPs have a Medicare star quality rating of 3.5 out of five stars. CVS/Aetna's SilverScript Smart RX plan has the lowest average monthly premium in 2022, and CVS is one of four main providers of stand-alone Part D prescription drug plans in the United States.

What is the problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

What is the average Medicare Part D premium?

The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.

What You Should Know About 2021 Medicare prescription drug plans?

In 2021, a large majority of PDPs (86%) will charge a deductible, with most PDPs (67%) charging the standard amount of $445 in 2021. Across all PDPs, the average deductible in 2021 will be $345 (weighted by September 2020 enrollment).

What are the 4 phases of Medicare Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

Who is the best person to talk to about Medicare?

Do you have questions about your Medicare coverage? 1-800-MEDICARE (1-800-633-4227) can help. TTY users should call 1-877-486-2048.

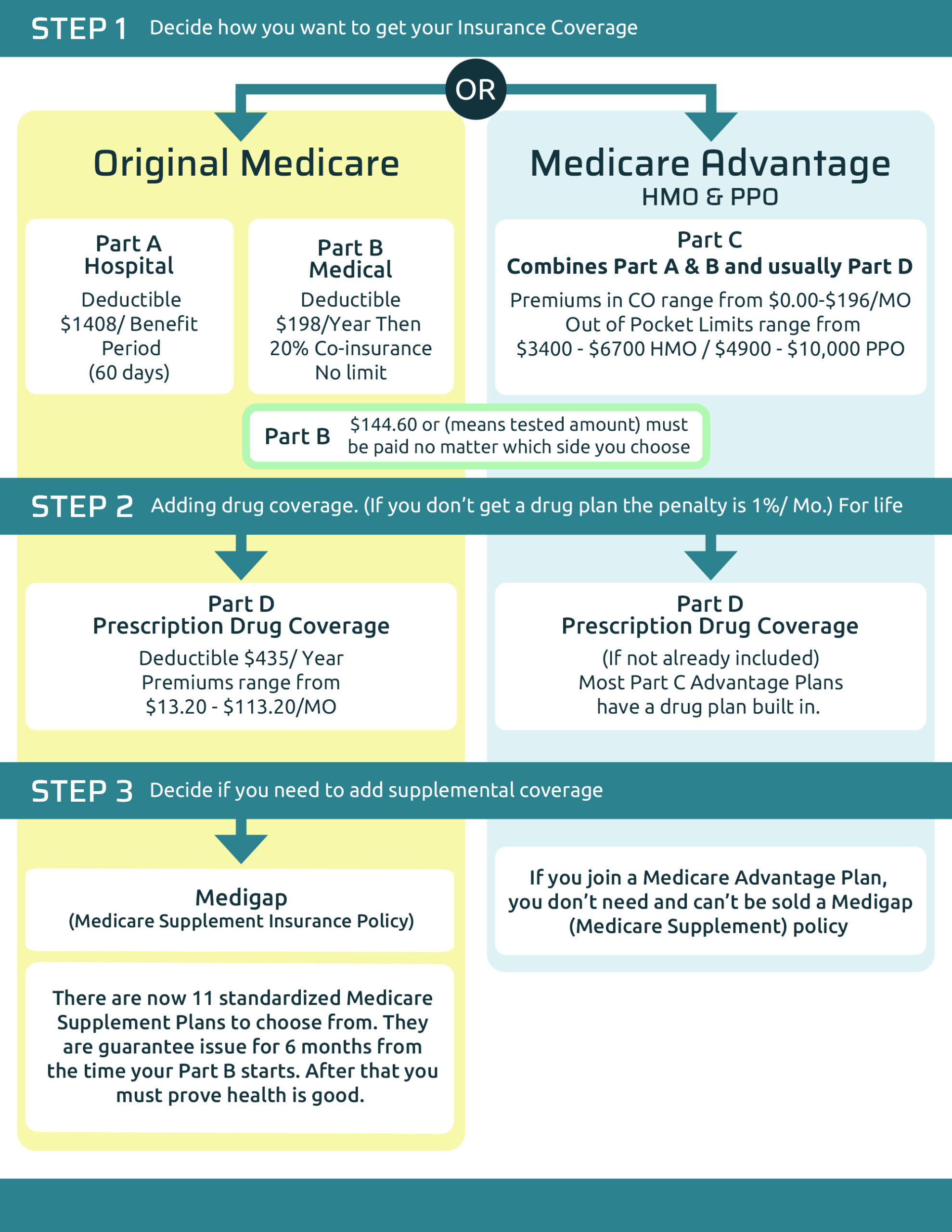

Can you have a Medicare Advantage plan and a supplemental plan at the same time?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

Will Medicare Part D go up in 2022?

The Medicare Part D total out-of-pocket threshold will bump up to $7,050 in 2022, a $500 increase from the previous year. The true (or total) out-of-pocket (TrOOP) marks the point at which Medicare Part D Catastrophic Coverage begins.

What is the cost of Medicare Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

Is there a coverage gap in 2022?

In 2022, the coverage gap ends once you have spent $7,050 in total out-of-pocket drug costs. Once you've reached that amount, you'll pay the greater of $3.95 or 5% coinsurance for generic drugs, and the greater of $9.85 or 5% coinsurance for all other drugs. There is no upper limit in this stage.

What will the donut hole be in 2022?

$4,430In 2022, that limit is $4,430. While in the coverage gap, you are responsible for a percentage of the cost of your drugs. How does the donut hole work? The donut hole closed for all drugs in 2020, meaning that when you enter the coverage gap you will be responsible for 25% of the cost of your drugs.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , or with additional coverage in the. coverage gap.

What is a low monthly premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for drug coverage. If you need prescription drugs in the future, all plans still must cover most drugs used by people with Medicare.

What is a formulary drug?

formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. (a list of prescription drugs covered by a drug plan). Then, compare costs.

Does a lower tier drug cost less?

Generally, a drug in a lower tier will cost you less than a drug in a higher tier. ” that charge you nothing or low copayments for generic prescriptions. I don't have many drug costs now, but I want coverage for peace of mind and to avoid future penalties. Look at Medicare drug plans with a low monthly. premium.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage Plans offer prescription drug coverage. with prescription drug coverage. Now that you have some information for how to choose a Medicare drug plan, you may want to learn more about Medigap and Medicare drug coverage.

What Are the Different Types of Medicare?

Let’s start with Original Medicare. Original Medicare is made up of Medicare Parts A and B. Part A provides coverage for hospitalizations, hospice care, some skilled nursing facility care, and home health care. Part B provides physician and outpatient services, as well as preventive care. Government cost-sharing is in place for both parts A and B.

What Is Medigap?

Medigap, also known as Medicare Supplement, is a private insurance policy that can be bought to help pay for things that Original Medicare doesn’t cover. These secondary coverage plans are only available with Original Medicare.

Who Is Eligible for Medigap?

You’re eligible for Medigap if you are already enrolled in Original Medicare Parts A and B and don’t have a Medicare Advantage plan. You must also meet one of the following conditions:

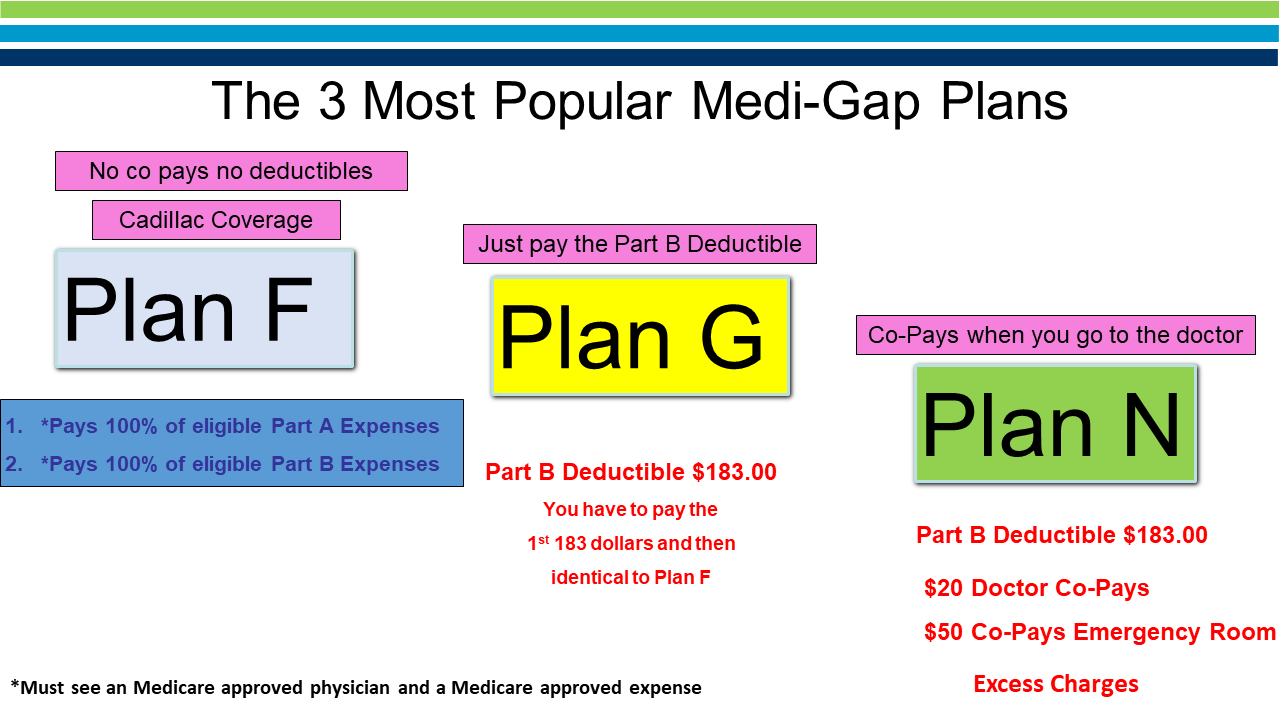

Medigap Comparison

In order to compare Medicare supplement plans, you need to know that there are ten standardized Medigap plans, denoted by the letters A through N and that plans with the same letter must have the same basic benefits regardless of insurer.

Health Care Costs and Original Medicare

Original Medicare provides health insurance coverage for hospital stays, doctor's office visits, lab testing, medical supplies and some other services. For Medicare beneficiaries, other out-of-pocket costs can add up quickly.

Choosing the Best Medicare Supplement Plan for You

Medigap plans supplement your Original Medicare coverage with benefits that help fill in some key cost gaps. The basic benefits of each type of Medicare Supplement Insurance plan are standardized by Medicare, though the policies themselves are sold by private companies.

Getting the Most From Medicare Supplement Insurance

If you buy a plan during your Medigap open enrollment period, insurers cannot deny you a policy or charge more for your Medigap plan based on your health or pre-existing conditions. If you don't purchase a Medicare Supplement Insurance plan during your open enrollment period, you could potentially be denied coverage or pay higher monthly premiums.

Medicare Advantage Plans Replace Original Medicare Benefits

Another health plan option is Medicare Advantage plans. It is important to note that Medicare Advantage and Medicare Supplement Insurance are different. Medicare Advantage plans are an alternative to Original Medicare, while Medigap plans work alongside your Original Medicare benefits to help cover out-of-pocket costs.

Get Help Buying the Right Medigap Plan for You

The right Medicare Supplement Insurance plan is the one that best matches your health care cost requirements and your budget. A licensed agent can answer your questions and help you determine which plan is right for you.

Compare Medigap plans in your area

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareSupplement.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

What is Supplemental Insurance?

The cost of supplemental insurance is in addition to the premium you pay Medicare for Part B. Prescription drug coverage is also available through a separate stand-alone Prescription Drug Plan. Plan Comparison. The plans are labeled as A, B, C, D, F, G, K, L, M and N. Compare plans to find the coverage and costs that fit into your budget ...

Is there an optional Medicare plan?

However, be assured there are optional plans designed to supplement the Original Medicare program.

Is Medicare Supplement Insurance a private insurance?

Additionally, it is mandated that they be identified as Medicare Supplement Insurance. This insurance is also known as Medigap.

How many standardized Medigap plans are there?

There are 10 standardized Medigap plans with letter names A through N. Plans with the same letter must offer the same basic benefit regardless of the insurance company providing the plan. For example, all Medigap Plan A policies provide the same benefit, but health insurance company premiums vary based on the way they choose to set rates—community-rated, entry age-rated or attained-age-rated.

What are the requirements to be eligible for a Medigap plan?

To be eligible for a Medigap plan, you must be enrolled in Original Medicare Parts A and B, but not a Medicare Advantage plan. You must also be in one of the following categories:

How long does it take to get a Medigap policy?

To buy a Medigap policy, it’s best to enroll during your Medigap Open Enrollment period, which lasts six months. This period begins the first month you have Medicare Part B and are 65 or older. You can buy any Medigap policy sold in your state during this time, even if you have health problems.

How long can you delay Medicare coverage?

Companies could delay coverage up to six months for a pre-existing condition if you didn’t have creditable coverage (other health insurance) before enrolling in Medicare.

Is Medigap the same as Medicare Advantage?

Medigap plans aren’t the same as Medicare Part C, also known as Medicare Advantage. While a Medicare Advantage plan can serve as an alternative way to get Medicare Part A and Part B coverage, Medigap plans only cover what Part A and Part B do not.

Does Medigap cover prescriptions?

Medigap plans generally don’t cover prescriptions, so you may want to consider enrolling in Medicare Part D, which specifically covers prescription drugs, or a Medicare Advantage plan that includes drug coverage.

Does Medicare cover outpatient care?

Medicare doesn’t cover all of your health care expenses when you turn 65. Medicare Part A covers 80% of inpatient care in hospitals and skilled nursing facilities, and Medicare Part B covers 80% of outpatient care and medically necessary supplies. For the 20% not covered by Medicare, you have the option to purchase Medigap insurance from a private insurance company. Here’s what to know when comparing Medigap plans.

How does Medicare Supplement Plan D work?

1 If you have total medical charges are $20,000, for instance, your coinsurance would be $4,000. The higher your total charges, the higher your coinsurance, and there’s no limit to how much you can be charged under Original Medicare. With Medicare Plan D, you pay a monthly premium each month, and the plan covers your Part B coinsurance at 100%. 2

What is Medicare Plan D?

Medicare Plan D is a Medicare Supplement plan, also known as a Medigap plan. Plan D is one of the 10 standardized Medicare Supplement plans available in most states: A, B, C, D, F, G, K, L, M, and N. The names “Medicare Plan D”, “Medicare Supplement Plan D”, and “Medigap Plan D all mean the same thing. But these plans are not the same thing as ...

When is the best time to get a Medigap plan?

The best time to get Medigap Plan D (or any Medicare Supplement plan) is during your Medigap Open Enrollment Period (OEP) because you won’t have to go through medical underwriting. 4. Your Medigap OEP last for six months and begins the month you turn 65 and are enrolled in Part B.

How much is the cost of a Plan D in 2021?

The average monthly premiums can vary, depending on your state of residence. In 2021, it ranged between $192-265 for Plan D and $202-280 for Plan C for a nonsmoking male living in Orlando, Florida. 6.

What is Plan D?

Plan D covers 80 percent of the cost for qualified emergency care you receive in a foreign country after you pay a $250 deductible. You’re covered for the first 60 days of foreign travel with a lifetime limit of $50,000. 3. No networks. You can visit any provider nationwide who accepts Medicare. Guaranteed renewable.

Does Medicare cover copays?

Helps play some of the costs original Medicare doesn’t cover, which are mostly copays, coinsurance, and deductibles. Only works with Original Medicare. Must have both Parts A and B to enroll. Provides prescription drug coverage to Medicare beneficiaries.

Can you keep Plan C?

If you do, you will be “grandfathered in,” which means you can keep Plan C for as long as you continue to pay the premiums. Plan C was one of the guaranteed issue plans insurance companies offered. But starting 2020, Medicare Plan D replaced Plan C as one of the guaranteed issue plans for new enrollees.

What is Medicare Part D?

Medicare Part D. Medicare Part D plans provide coverage for many prescription drugs. There are many different types of Medicare Part D plans, and each one offers its own formulary, which is the list of drugs covered by the plan. How it works with Original Medicare: Part D plans are used alongside Original Medicare or a Medicare Advantage plan ...

What is a Part D plan?

The Part D plan provides the prescription drug coverage that Original Medicare and some Medicare Advantage plans do not. You might consider this type of Medicare plan if: You want to have some help paying for your prescription drug costs. You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online ...

How does Medigap work with Medicare?

How it works with Original Medicare: A Medigap plan works in conjunction with Original Medicare and helps to pay for some of Medicare’s out-of-pocket costs. You might consider this type of Medicare plan if: You wish to have less uncertainty with your out-of-pocket health care costs.

What is the difference between Medicare Part A and Part B?

Step 1: Determine which Medicare plan coverage option you want. Medicare beneficiaries could potentially only be enrolled in Medicare Part A (hospital insurance). Medicare Part B (medical insurance) is optional, as are several other types of Medicare coverage .

What is a Medigap plan?

Medigap plans can help provide coverage for some of the out-of-pocket expenses that are tied to Original Medicare. These can include Medicare deductibles, coinsurance, copayments and more. There are 10 different types of standardized Medigap plans available in most states, and each type of plan offers its own combination of benefits.

What are the benefits of Medicare Advantage?

Some of these additional benefits can include coverage for prescription drugs, dental, hearing, vision and more.

What are the different types of Medicare Advantage plans?

There are several different types of Medicare Advantage plans. These plan types include Medicare HMO plans, Medicare PPO plans and others. Learn more about the different types of Medicare Advantage plans to help you decide which one might be the best fit for you. Medicare Part D plans can also come in different types of formats, ...

What is Medicare Supplement Insurance?

You can get a Medicare Supplement Insurance (Medigap) policy to help pay your remaining out-of-pocket costs (like your 20% coinsurance). Or, you can use coverage from a former employer or union, or Medicaid.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What are the extra benefits that Medicare doesn't cover?

Plans may offer some extra benefits that Original Medicare doesn’t cover—like vision, hearing, and dental services.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

When Can I Enroll In Medicare?

Remember, you are automatically eligible to receive Medicare the day you turn 65. If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare.

Can I Add, Drop, And Change Coverage?

You can’t add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.