Below, we’ve listed step-by-step instructions on how to conduct your own Part D comparison:

- Go to Medicare’s website, Medicare.gov.

- Click the “Find Plans” tile (may have to scroll down a bit) on the right hand side.

- Either log in or continue without logging in. (Note: if you log in, your medications will get saved in their system for...

Full Answer

What are the best Medicare Part D plans?

They include:

- Switching to generics or other lower-cost drugs;

- Choosing a plan (Part D) that offers additional coverage in the gap (donut hole);

- Pharmaceutical Assistance Programs;

- State Pharmaceutical Assistance Programs;

- Applying for Extra Help; and

- Exploring national and community-based charitable programs.

How to choose the best Medicare Part D plan?

Your 5-Point Checklist for Choosing a Medicare Part D Plan

- Low or $0 Copays. Some Medicare Part D plans offer $0 copays for certain drugs on their formularies (drug list). ...

- Medication Home Delivery. Trips to the pharmacy can be time consuming and may require advance planning. ...

- Drug Pricing Tool. ...

- Prescription Refill Reminders. ...

What is the cheapest Medicare Part D plan?

which is as good or better than what Part D would provide. Medicare contracts with private plans to offer drug coverage under Part D. There are two ways to enroll in Part D. You can purchase a stand-alone Part D plan or enroll in a Medicare Advantage plan ...

What to consider when comparing Medicare plans?

What to Ask When Comparing Medicare Advantage Plans

- How much are monthly premiums?

- What portion of costs do you have to pay before the plan begins coverage (also known as the deductible)?

- How much of the cost of a doctor’s visit or hospital stay are you required to pay?

- What is the plan’s cap on annual out-of-pocket costs? ...

- Does your current doctor accept the plan? ...

Which Medicare Part D plan is best?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What are the differences in Part D plans?

The different plans for Medicare Part D vary based on the list of prescription drugs they cover and how those medications are placed into tiers, or categories. This list is called a formulary. Because of these differences, it's important to research your options to help determine the one that's best for you.

How do you compare drug plans?

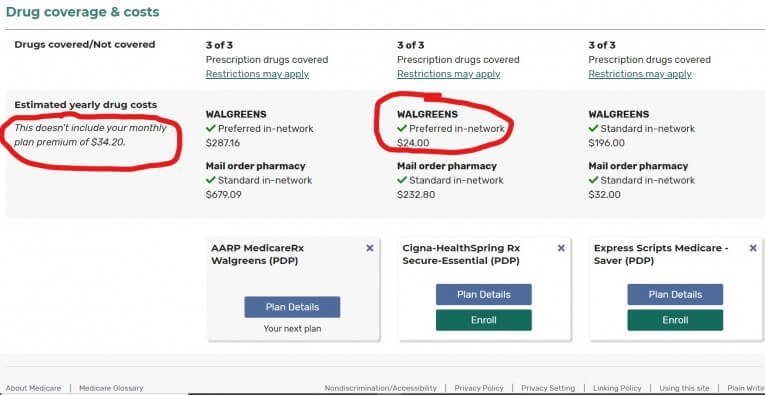

Visit Medicare.gov/plan-compare to find and compare plans. If you: Take specific drugs, look at drug plans that include your drugs on their formulary (a list of prescription drugs covered by a drug plan). Then, compare costs.

Are Medicare Part D plans all the same?

All Medicare drug coverage must give at least a standard level of coverage set by Medicare. However, plans offer different combinations of coverage and cost sharing. Plans offering Medicare drug coverage may differ in the drugs they cover, how much you have to pay, and which pharmacies you can use.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Who has the cheapest Part D drug plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

Why do Medicare Part D premiums vary?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

What are the 4 phases of Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

Can you change Medicare Part D plans anytime?

When Can You Change Part D Plans? You can change from one Part D plan to another during the Medicare open enrollment period, which runs from October 15 to December 7 each year. During this period, you can change plans as many times as you want.

How many different Medicare Part D plans are there?

The average Medicare beneficiary has a choice of 54 Medicare plans with Part D drug coverage in 2022, including 23 Medicare stand-alone drug plans and 31 Medicare advantage drug plans.

What Does Medicare Part D Cover?

Before 2006, there was no meaningful prescription drug coverage under Medicare. Part D was created in the Medicare Modernization Act of 2003 to help offset the cost of prescription drugs.

How Do You Get Medicare Part D?

There are two ways to get your prescription drug coverage through Medicare. If you have Original Medicare (Part A and Part B), you have to buy a standalone Part D plan.

Did the Medicare Part D Donut Hole Close in 2020?

Technically, the donut hole is closed, but you still pay for prescription drugs if you hit the coverage gap.

Using the Medicare Part D Plan Finder 2020

When you’re ready to compare Medicare Part D plans, there are several things you should keep in mind:

Compare Medicare Part D Plans 2020

Most insurers release new plans and change-of-coverage notices in the fall for the upcoming plan year. The 2020 plans are generally listed in Part D plan finder tools by October, so you should already have access to the most current information for this year when you’re ready to shop.

Why you should compare Medicare Part D plans

Prescription drug costs are a huge concern for people enrolled in Medicare. The good news is help is available thanks to Medicare Part D. Part D prescription drug plans are offered by private insurance companies. PDPs split the cost of prescriptions with you and help protect you from out-of-control drug costs.

Medicare Part D plan finder: Coverage in 2021

When shopping for a PDP, it is important to know which medications are covered under each plan, and which are not. There are two reasons a drug would not be covered by a plan:

Non-Medicare-approved drugs

Medicare has listed certain types of medications as being ineligible for Medicare Part D coverage, meaning no PDP will cover them. These include:

Part D drug plan formularies

Every Part D drug plan must meet certain minimum coverage rules set by Medicare. However, PDPs are not required to cover every Medicare-approved drug. Instead, every plan publishes a list of the drugs they do cover, which is called a formulary.

Medicare drug plan coverage stages

The copayment and coinsurance amounts you pay depend on the tier of the drug, and also on how much you and your plan have paid altogether for drugs during the year. As you and your plan pay more, you move through the following four coverage stages:

What about the Medicare donut hole?

The “donut hole” is a nickname for Coverage Stage 3, the Coverage Gap Stage. The name arose from the fact that in the past, the coverage was not as comprehensive as it is now. Specifically, during the Coverage Gap Stage, Medicare Part D plans did not cover any portion of your drug costs.

Use a Medicare Part D plan finder

Getting Medicare drug coverage is an important step in lowering your healthcare costs. As you are researching, make sure any plan you are considering covers the specific drugs you take. Review various plans’ formularies and compare drug costs in your area to find the right plan for you.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

5 Steps to Compare Medicare Part D Prescription Drug Plans

Write down the prescription names, dosages, and the amounts you take every 30 or 90 days. Collecting this list will help improve your ability to pick the best plan for your coverage needs.

When (and How) to Get Enrolled in Medicare Part D

Typically, you will want to enroll in a Medicare prescription drug plan once you turn 65, unless you have other qualifying coverage. Otherwise, missing your first chance to enroll could cost you a late enrollment penalty. If you opt for Medicare Part C (known as Medicare Advantage), your plan may already include prescription coverage.

HealthMarkets Takes the Hassle out of Comparing Medicare Drug Plans

When you want to compare Medicare Part D drug plans, HealthMarkets can find which plans cover your current prescriptions, estimate your drug costs, and help you apply for a plan. Compare Medicare Part D plans now. It’s fast, easy, and comes at no cost to you.