How to Choose a Medicare Prescription Drug Plan in 5 Steps

- Stay up to date with your current plan. Each year by early October, your plan will send you an Annual Notice of Change. ...

- Use the Medicare.gov Plan Finder. Because plans can change each year and because new plans become available each year, it makes sense to shop for the best Part D ...

- Look for other restrictions. In addition to tiered pricing, prescription drug coverage may come with other restrictions. ...

- Understand the exemption process. Many times patients will undergo an unexpected health change well into the calendar year that changes their prescription drug needs, which may include a medication ...

- Ask for help. Even people with modest drug needs can find comparing the various options challenging. ...

How do I choose a Medicare drug plan?

If you’re wondering how to choose a Medicare drug plan that works for you, the best way is to start by looking at your priorities. See if any of these apply to you: expand I take specific drugs. Look at drug plans that include your prescription drugs on their Formulary (a list of prescription drugs covered by a drug plan). Then, compare costs.

How often should I Use my Medicare Prescription Drug Plan?

You should use it once per year to make sure your Medicare prescription drug plan continues to be the best available option for you, in terms of drug coverage, total out-of-pocket costs, and restrictions. If, however, you do not wish to tackle this yourself, you can have a Medicare professional do it for you free of charge.

How do I choose a Medicare Part D plan?

En español | Your goal in choosing a Part D plan is to pick a plan that covers all of your drugs with the lowest out-of-pocket cost, provides good service, and meets your own needs and preferences. You can do this in three ways: Use the online plan finder on Medicare’s website.

What kind of drug plans are available with Medicare?

Medicare drug plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private Fee‑for‑Service plans, and Medical Savings Account plans. You must have Medicare Part A (Hospital Insurance) and/or Medicare Part B (Medical Insurance) to join a separate Medicare drug plan.

Which Medicare Part D plan is the best?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What should I look for in a Part D plan?

En español | Your goal in choosing a Part D plan is to select a plan that 1) covers all your drugs with the lowest out-of-pocket cost, 2) provides good service and 3) checks the box on any other personal requirements you might have.

What is the Best Medicare Plan D for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

What is the best way to provide prescription drug coverage for seniors?

For older adults who are eligible, there are three ways to apply for Extra Help:Apply online at www.ssa.gov/benefits/medicare/prescriptionhelp/Call Social Security at 1-800-772-1213 to apply over the phone or to request an application.Apply at the local Social Security office.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

What is the difference between basic and enhanced Part D plans?

Enhanced plans charge higher monthly premiums than basic plans but typically offer a wider range of benefits. For instance, these plans may not have a deductible, may provide extra coverage during the donut hole, and may have a broader formulary. Some of these plans may also cover excluded drugs.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Can you change Medicare Part D plans anytime?

You can sign up for a Medicare Part D plan or switch from one Part D plan to another during each year's open enrollment period. You also can sign up for a Medicare Advantage plan or switch to a different Medicare Advantage plan — with or without drug coverage — during that time.

Is Medicare Part D deducted from Social Security?

If you are getting Medicare Part C (additional health coverage through a private insurer) or Part D (prescriptions), you have the option to have the premium deducted from your Social Security benefit or to pay the plan provider directly.

What are two options for Medicare consumers to get Part D prescription drug coverage assuming they meet all eligibility requirements )? Select 2?

There is no other way a Medicare consumer could get Part D prescription drug coverage. They could enroll in a Medicare Supplement Insurance Plan. They could enroll in a Medicare Advantage Plan or other Medicare health plan that includes prescription drug coverage.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the cost of Medicare Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

How to compare Medicare Advantage plans?

Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in to get more details. For help comparing plan costs, contact your State Health Insurance Assistance Program (SHIP).

What is Medicare drug plan?

These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private Fee‑for‑Service plans, and Medical Savings Account plans. You must have

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

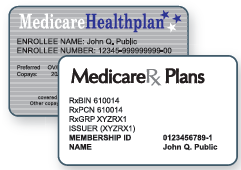

What do you give when you join a Medicare plan?

When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started. This information is on your Medicare card.

What happens if you don't get prescription drug coverage?

If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later.

What is a PACE plan?

Programs of All-inclusive Care for the Elderly (PACE) organizations are special types of Medicare health plans. PACE plans can be offered by public or private companies and provide Part D and other benefits in addition to Part A and Part B benefits. with drug coverage.

What to do if you have questions about your current health insurance?

Talk to your current plan if you have questions about what will happen to your current health coverage.

How to get help with drug insurance?

Even people with modest drug needs can find comparing the various options challenging. You can get help with the process through your local State Health Insurance Assistance Program, so find the SHIP nearest you. Or, as Greeno suggests, check with your local senior center for help. Often staff can assist in open enrollment questions or will know a good resource.

Can Plan D change?

It's important to remember that the drugs covered and the costs you pay under Plan D can change year to year.

Can you take generics with a high deductible?

If you take only generics with very low copays that don’t count toward your deductible, you may decide a low-premium, high-deductible plan is the most affordable option. Someone with expensive out-of-pocket prescription drug needs, however, may well opt for the lower deductible, slightly higher premium plan. 3.

Does Medicare Advantage include a prescription drug?

The majority of Medicare Advantage plans, also administered by private insurance companies, include Medicare Part D prescription drug coverage. People who sign up for Medicare Advantage plans that do not provide Part D coverage may also purchase a stand-alone Part D plan.

Does Medicare Advantage have step therapy?

In 2019, Medicare Advantage plans were allowed to implement “step therapy.” With this strategy, patients must try cheaper medicines first before they are allowed to move to costlier drugs.

Can you search for pharmacies by name?

You can include mail order as one of your options. The tool allows you to search pharmacies by name, but it will also automatically provide a list of nearby in-network pharmacies. An interactive map allows you to check pharmacies farther from you that may offer lower prices. Drug copays can vary significantly from pharmacy to pharmacy, so you’ll want to take advantage of this tool, Greeno says.

Does prescription drug coverage come with caps?

In addition to tiered pricing, prescription drug coverage may come with other restrictions. Coverage caps. Some plans have coverage caps, or limits on how many pills of a certain medicine they’ll pay for each month and other volume restrictions. In most cases, this works fine.

How to choose a prescription plan?

When choosing a prescription medication plan, think about how much you can afford to pay out of pocket for each prescription—but also consider the overall costs and coverage. Sometimes, a plan may have higher premiums or deductibles but provide good coverage once you meet the deductible.

What to do before looking at Medicare prescriptions?

Before you look at a Medicare prescription medication plan, take stock of any healthcare insurance you already have or are eligible for because it could affect your decision to get Medicare drug coverage .

How much will it cost?

The amount you’ll pay for a Medicare prescription drug plan and your medications will depend on a number of factors, such as:

What is a formulary in Medicare?

A formulary is a list of medications that a Medicare drug plan will cover. If the formulary doesn’t include your medication, ask your doctor if a similar medication is on the list or if they can help you get an exception for coverage.

What is Medicare for 65?

Medicare is a federal health insurance program for people 65 years old or older, younger people with specific disabilities, and people with end-stage renal (kidney) disease.

What is part A in nursing?

Part A covers inpatient hospital stays, care you receive in a skilled nursing facility, hospice care, and some home healthcare.

Can you add prescription drug coverage to Medicare?

You can add prescription drug coverage to original Medicare (Parts A, B, or both) or to special plans such as Medicare Cost Plans, Medicare Private Fee-for-Service Plans, and Medicare Medical Savings Account Plans. If you go this route, you are covered under Part D, also known as a prescription drug plan or PDP.

How often does Medicare Advantage change?

Insurance companies review – and may change – their Part D and Medicare Advantage (Part C) plans every year. This means you could have different benefits and services added and/or removed each year.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is Part D formulary?

Part D formulary changes, such as certain medications moving from one formulary tier to another. (Low-tier drugs generally cost you less than high-tier drugs.)

When do insurance companies send out an ANOC?

Be sure to read it and pay attention to coverage changes that may affect you. Most plans send ANOCs out in September.

Do you need to consider thesewhen choosing your plan?

ON SCREEN TEXT: Ok, you don't need to consider thesewhen choosing your plan then.

Can a pharmacy plan change from year to year?

Plans can also change their provider and pharmacy networks from year to year. You need to check your plan details carefully to make sure that your doctor and other providers are still in the network. If they aren’t, you could pay more if your plan considers them out-of-network.

Can Medicare premiums change year over year?

Your costs for Medicare can also change year-over-year. Both Original Medicare (Parts A & B) and private Medicare plans (Medicare Advantage, Part D, etc.) can change their premiums, deductibles and other costs annually. Those costs are worth noting.

What is the best Medicare plan for 2021?

SilverScript. Humana. Cigna. Mutual of Omaha. UnitedHealthcare. The highest rating a plan can have is 5-star. Just because a policy is 5-star in your area doesn’t mean it’s the top-rated plan in the country. There is no nationwide plan that has a 5-star rating.

When will Medicare Part D be updated?

Home / FAQs / Medicare Part D / Top 5 Part D Plans. Updated on June 3, 2021. Medicare prescription drug plan changes in 2021 are noteworthy. Also, by knowing what to expect, you can stay ahead of the game. Drugs can be costly, and new brand-name drugs can be the most expensive. With age, you’re more likely to require medications.

How many pharmacies does Cigna have?

As far as in-network, Cigna has contracts with over 63,000 pharmacies nationwide. Preferred pharmacies include Kroger, Rite Aid, Walmart, Sam’s Club, Walgreens, and MANY more.

What is Humana Pharmacy?

Humana Pharmacy is a mail-order program that saves you time and money.

What is the SilverScript plan?

SilverScript Medicare Prescription Drug Plans. There are three different plans available with SilverScript. The Choice, the Plus plan, and the SmartRx plan. All policies are a great option, depending on the medications you take, one could be more beneficial to you than the other.

How much is Value Plan deductible?

The Value policy has no deductible on the first two tiers at preferred pharmacies. But, the Value plan has a $445 deductible on all other tiers. The Plus Plan has a deductible of $445 that applies to all tiers. However, the Plus plan has a broader range of drugs that have coverage.

Which insurance company monitors drug plans?

Plans that have accurate price information are more likely to have higher ratings. Further, Medicare monitors plans for drug safety.

How to contact a counselor for Medicare?

Contact your state health insurance assistance program (SHIP). This provides personal help from trained counselors on all Medicare and Medicaid issues, free of charge. A counselor can use the plan finder to review your options and identify the plan that suits you best. SHIPs go by different names in some states; to find yours, go to the SHIP website and select your state.

What is the goal of Part D?

En español | Your goal in choosing a Part D plan is to pick a plan that covers all of your drugs with the lowest out-of-pocket cost, provides good service, and meets your own needs and preferences. You can do this in three ways:

How to find a prescription drug plan?

Plan Finder takes you step-by-step through the process of entering medications you take and other personal information. It then provides a list of prescription drug plans in your geographic area that fit your criteria. If used correctly, it can be quite helpful in selecting the right plan for you at the lowest possible cost. (Truth be told, the tool is so helpful that even the professional Medicare consultants use it.)

How to add prescriptions to Plan Finder?

Plan Finder will present a list of possibilities that include both the drug’s name and the dosage. Select the correct one by clicking “ Add Drug ” next to its name. Then select the quantity, the frequency with which you refill the drug, and whether you buy this drug through a retail pharmacy or through mail order (you are presented with choices for each). Then click “ Add drug and dosage ” (meaning add it to the list of drugs you take).

How many times a day do you refill a prescription?

The quantity you receive when you refill the prescription. For instance, if you take two pills a day, and you refill the prescription every month, the quantity would be 60 (2 pills times 30 days) The frequency with which you refill the prescription (e.g., every month, every 2 months, etc.)

What is the best drug plan?

The best drug plan for you is the one that has the lowest total out-of-pocket costs (premiums, deductibles, and co-pays or co-insurance, combined) for the medications that you currently take, without placing too many restrictions on getting those drugs.

Which insurance plans cover all three prescription drugs?

The two prescription drug plans shown above – AARP MedicareRx Saver Plus and Cigna-HealthSpring Rx Secure-Extra – both cover all three prescription drugs entered in Step 2. Each plan has different monthly premiums, deductibles, and co-pays/co-insurance amounts. They also both have some drug restrictions, although it is not clear from this display what those are.

What does ER stand for in a drug?

The exact name of the drug, including any abbreviations that indicate the form in which you take it (e.g., ER for Extended Release, SR for sustained release, TAB for tablet, etc.)

Why don't you choose a medical plan?

DO NOT choose a plan just because it has the lowest premium. Often co-pays and co-insurance amounts for your medications, not the plan’s monthly premium, make the biggest difference in annual costs. DO NOT fall for pitches by sales agents that approach you.

What is the Medicare plan Finder?

The Medicare.gov Plan Finder can help. The Centers for Medicare & Medicaid Services have added new features to the Plan Finder tool. This makes it easier for you to find out if your medications are covered , which pharmacies are available near you, and what your total out of pocket costs will include copays.

Can Plan D change?

It’s important to remember that the drugs covered and the costs you pay under Plan D can change year to year.

Does Medicare cover asthma?

Medicare sets a minimum level of coverage for all plans. They must cover the same types of drugs as Medicare, including asthma and diabetes medications. However, plans can select which drugs are included in each drug category.

Does Medicare Part D have a formulary?

Each Medicare Part D plan lists the drugs it covers in what’s called a formulary. Your medicine may not be included in a specific formulary, but it may contain a similar option. Before you start your plan search, it is a good idea to talk to your doctor to determine if there are any other options.

Does Medicare Advantage have private insurance?

Private insurance companies also manage the majority of Medicare Advantage plans. These plans include Medicare Part D prescription drug coverage. Individuals who are not eligible for Part D coverage under Medicare Advantage plans may be able to purchase a standalone Part D plan.

Does prescription drug coverage come with restrictions?

Prescription drug coverage can come with additional restrictions, such as tiered pricing.