In order to defer Medicare in its entirety, one must: • Have health insurance coverage from their employer or their spouse’s employer of 20 or more employees. • Defer enrollment in Social Security retirement benefits.

Full Answer

What happens if I delay enrolling in Medicare?

- COBRA

- Retiree benefits

- TRICARE (unless you, your spouse, or dependent child are an active-duty member)*

- Veterans’ benefits

What are the pros and cons of delaying Medicare enrollment?

The takeaway

- Most people benefit by signing up for original Medicare when they first become eligible.

- In some situations, though, it may make sense for you to wait.

- Talk to your current employer or plan administrator to determine how you can best coordinate your current plan with Medicare.

- Don’t let your healthcare coverage lapse. ...

What to do if you missed Medicare open enrollment?

- You moved out of your plan’s service area.

- You moved into, out of, or still live in a skilled nursing facility, or another institution such as a long-term care hospital.

- You left your employer-based or union-based health insurance.

- You used to be eligible for Medicaid, but now you’re not.

- You just got out of jail.

How to avoid late penalties when enrolling in Medicare?

The parts of Medicare that charge a late enrollment fee are:

- Part A (inpatient hospital insurance

- Part B (outpatient medical insurance)

- Part D (prescription drug coverage)

Can you delay enrolling in Medicare?

You will NOT pay a penalty for delaying Medicare, as long as you enroll within 8 months of losing your coverage or stopping work (whichever happens first). You'll want to plan ahead and enroll in Part B at least a month before you stop working or your employer coverage ends, so you don't have a gap in coverage.

How do I defer Medicare enrollment?

If you want to defer Medicare coverage, you don't need to inform Medicare. It's simple: Just don't sign up when you become eligible. You can also sign up for Part A but not Part B during initial enrollment.

Can you put Medicare on hold?

Generally speaking, if you (or your spouse) have group coverage at a company with 20 or more employees, you can delay signing up for Medicare. Some workers sign up for Part A (hospital coverage) because it typically comes with no premium and then delay Part B (outpatient care) and Part D (prescription drug coverage).

Can I delay Medicare Part A without a penalty?

If you were eligible for Part A for 2 years but didn't sign up, you'll have to pay the higher premium for 4 years. Usually, you don't have to pay a penalty if you meet certain conditions that allow you to sign up for Part A during a special enrollment period.

Do I automatically get Medicare when I turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

What happens if you don't enroll in Medicare Part A at 65?

If you don't have to pay a Part A premium, you generally don't have to pay a Part A late enrollment penalty. The Part A penalty is 10% added to your monthly premium. You generally pay this extra amount for twice the number of years that you were eligible for Part A but not enrolled.

Can I delay Medicare Part B if I am still working?

You may defer Medicare Part B enrollment because you are still working. Contact the SSA at (800) 772-1213 to defer. This will ensure that you avoid a late enrollment penalty when you decide to retire and enroll in Medicare Part B upon retirement.

Can I decline Medicare Part B?

You can decline Medicare Part B coverage if you can't get another program to pay for it and you don't want to pay for it yourself. The important thing to know about declining Part B coverage is that if you decline it and then decide that you want it later, you may have to pay a higher premium.

Can I drop Medicare Part B anytime?

So long as you have creditable coverage elsewhere, you can disenroll from Medicare Part B without incurring late penalties. Although Medicare offers very good coverage for most enrollees, there are various reasons why you may want to cancel your coverage.

How long is a member responsible for a late enrollment penalty for Medicare?

63 daysMedicare beneficiaries may incur a late enrollment penalty (LEP) if there is a continuous period of 63 days or more at any time after the end of the individual's Part D initial enrollment period during which the individual was eligible to enroll, but was not enrolled in a Medicare Part D plan and was not covered under ...

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

What happens if you don't enroll in Medicare?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

How long is the enrollment period for Medicare?

These periods of time vary, depending on which part of Medicare you have deferred. For example, there is an eight-month special enrollment period to sign up for Part A and/or Part B that starts the month after employment ends or the group health insurance ends, whichever happens first.

What is the average age for Medicare?

The normal age for Medicare enrollment is 65. Medicare has costs. Some of these costs are substantial. To list a few: • Medicare B premiums are based on an individual’s income, meaning the premium includes a tax for those with higher incomes. Annual 2016 Part B premiums for an individual range between $1,258 and $4,677.

How much does a Medigap policy cost?

• In addition to original Medicare, a Medigap policy can cost approximately $2,000. Medicare coverage is, overall, extensive. If your client, however, has comprehensive coverage provided by an employer or even their spouse’s employer, ...

Is Medicare Part D coverage creditable?

I advise getting written documentation each year from the employer’s benefits department stating that the insurance coverage is creditable. “Creditable” is a Medicare term, which basically states that the prescription-drug coverage is extensive enough to work in lieu of Medicare Part D prescription-drug coverage.

What happens if you don't wait for Medicare open enrollment?

If this happens, don’t wait for the next Medicare open enrollment period, otherwise you may have a lapse in coverage and owe penalty fees.

How long do you have to enroll in Medicare if you have lost your current plan?

No matter your reasons for deferring, you must enroll in Medicare within 8 months of losing your current coverage.

What happens if you don't have Medicare?

If you don’t, you’ll incur penalties that may last your whole life. Like many people, you or a loved one might not be ready to take the plunge into Medicare coverage, despite being eligible. In some instances, it might make sense to defer coverage. In others, it may wind up costing you long-lasting or even permanent penalties.

How much is Medicare Part B in 2021?

Medicare Part B covers outpatient medical costs and comes with a monthly premium for all Medicare beneficiaries. The standard premium is $148.50 per month in 2021, but this rate could be higher based on your income. You can also defer Part B coverage. However, if you defer Medicare Part B coverage, you may receive significant financial penalties ...

How long do you have to work to get Medicare Part A?

Medicare Part A covers hospital expenses. If you or your spouse worked for at least 10 years (40 quarters), you will most likely be eligible for premium-free Part A when you turn 65 years old. You can defer Medicare Part A.

What happens if you miss your Part A?

If you miss both initial enrollment and special enrollment, your late enrollment penalties may be steep and may last a long time. If you’re not eligible for premium-free Part A and buy it late, your monthly premium will rise by 10 percent for double the number of years you didn’t sign up.

Is Medicare mandatory?

Medicare isn’t mandatory. You can defer Medicare coverage if you feel it’s in your best interest to do so. Keep in mind, though, that most people who are eligible for Medicare do benefit from enrolling in both Part A and Part B ( original Medicare) during their initial enrollment period.

When is Medicare Part B enrollment due?

If you delay Medicare Part B enrollment while covered by any of those types of insurance, you will have to wait for the General Enrollment Period (January 1 through March 31 each year; coverage becomes effective July 1) to enroll in Medicare and you may have a late enrollment penalty. 2.

How do I contact Social Security about Medicare Part B?

Riley, before you make a decision about Medicare Part B, you should always contact Social Security by dialing 800-772-1213 or visiting your local Social Security office. When you contact Social Security, use this list of questions to gather the correct information. – Marci. Back to top.

Does secondary insurance pay Medicare?

Secondary insurance pays only after the Primary insurer has paid, and an insurance that is secondary to Medicare may refuse to pay for care and may take back any primary payments that it has made. Your insurance from current employment may pay primary to Medicare.

Can you use SEP to enroll in Medicare?

If you use this SEP to enroll, then you will not have a late enrollment penalty for delaying Part B enrollment. You cannot use this SEP if you delay Medicare enrollment while covered by retiree insurance from a former employer, COBRA, or retiree FEHB.

What happens if you delay Medicare Part D?

If you delay enrolling in Medicare Part D, you save yourself from paying this premium. However, there are two major cons of delaying enrollment in Medicare Part D. If you don’t have prescription drug coverage and suddenly need to take an expensive prescription, you could pay out of pocket. If you enroll in Medicare Part D after your Initial ...

When is open enrollment for Medicare Part D?

The Open Enrollment Period for stand-alone Medicare Part D Prescription Drug Plans and Medicare Advantage plans is October 15-December 7 every year. The changes you make during that period will apply to the following year.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. Since Medicare Part A and Part B generally don’t cover prescription drugs you take at home, you need Medicare Part D if you want help paying for your prescriptions. Most stand-alone Medicare Part D plans are offered by private companies approved by Medicare and charge a monthly premium. If you delay enrolling in Medicare Part D, you save yourself from paying this premium. However, there are two major cons of delaying enrollment in Medicare Part D.

What services does Medicare not cover out of pocket?

The major con of delaying enrollment in Medicare Advantage is you could be paying for various services that Original Medicare generally doesn’t cover out of pocket, such as routine dental, routine vision, and routine hearing.

What is Medicare Supplement Insurance?

A Medicare Supplement Insurance Plan can work alongside Original Medicare and cover costs like coinsurance, copayments, and deductibles. When you are first eligible to enroll, you can select any plan available to you without being subjected to medical underwriting.

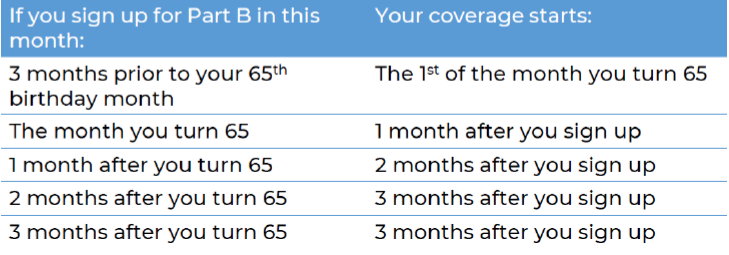

How long before you turn 65 can you enroll in Medicare?

If you want to delay enrolling in Medicare, you typically will have the opportunity to enroll later. You’re generally first eligible to enroll in Medicare 3 months before you turn 65 if you qualify through age or 3 months before your 25th month of receiving Social Security disability benefits if you qualify through disability.

How long is the initial enrollment period for a new student?

Your Initial Enrollment Period is 7 months. It includes the three months before your qualifying event, the month of your qualifying event, and three months after your qualifying event. If you miss this Initial Enrollment Period, there could be both benefits and penalties for enrolling later.

How long does it take to sign up for a 401(k)?

If you need to sign up when first becoming eligible you must sign up during your Initial Enrollment Period. Your enrollment period lasts 7 months and begins three months prior to the month you turn 65, the month you turn 65 and 3 months after the month you turn 65.

When will my Social Security card arrive in Puerto Rico?

You live in Puerto Rico and receive Social Security or Railroad benefits. Your card will arrive 3 months prior to your 65th birthday or your 25th month of disability.

Is Medicare automatic if you are 65?

Your circumstances will determine whether or not Medicare enrollment is automatic. If you are turning 65 or are disabled and receiving Social Security benefits you may be wondering whether or not you are automatically enrolled in Medicare or if you need to take some action to sign up. The short answer is that your individual circumstances will ...

Do you get another Medicare card if you have Part A?

You will receive another card which shows that you have Part A coverage only. With the information in this article you should be able to anticipate whether or not you will be enrolled automatically or whether you should take action during your Initial Enrollment Period to obtain Medicare coverage.