What happens if I delay enrolling in Medicare?

Jan 05, 2022 · If someone eligible for Medicare is enrolled in a health savings account-eligible employer health plan, enrolling in Part A will end their eligibility to contribute to their HSA. These individuals may be able to delay enrollment in Part A, but only if they are not already receiving Social Security payments.

What are the pros and cons of delaying Medicare enrollment?

May 03, 2016 · How to properly defer Medicare enrollment. • Medicare B premiums are based on an individual’s income, meaning the premium includes a tax for those with higher incomes. Annual 2016 Part B ... • The national average for an annual 2016 Part D premium is $409. This premium is also means-tested meaning ...

What to do if you missed Medicare open enrollment?

Dec 12, 2016 · You cannot use this SEP if you delay Medicare enrollment while covered by retiree insurance from a former employer, COBRA, or retiree FEHB. If you delay Medicare Part B enrollment while covered by any of those types of insurance, you will have to wait for the General Enrollment Period (January 1 through March 31 each year; coverage becomes effective July 1) …

How to avoid late penalties when enrolling in Medicare?

If you delay, you will incur penalties that may last for the entire duration of your Medicare coverage. ... If this happens, don’t wait for the next Medicare open enrollment period, otherwise ...

How do I delay Medicare Part B?

If you have other creditable coverage, you can delay Part B and postpone paying the premium. You can sign up later without penalty, as long as you do it within eight months after your other coverage ends.

What happens if you don't enroll in Medicare in time?

Specifically, if you fail to sign up for Medicare on time, you'll risk a 10 percent surcharge on your Medicare Part B premiums for each year-long period you go without coverage upon being eligible. (Since Medicare Part A is usually free, a late enrollment penalty doesn't apply for most people.)

How do I suspend my Medicare?

You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 (PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA (1-800-772-1213) to get this form.Sep 24, 2021

What is the late enrollment period for Medicare?

It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month. If you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

Can I opt out of Medicare Part B at any time?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.Nov 24, 2021

What parts of Medicare are mandatory?

There are four parts to Medicare: A, B, C, and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse.

Can you lose Medicare benefits?

If you qualify for Medicare by age, you cannot lose your Medicare eligibility.

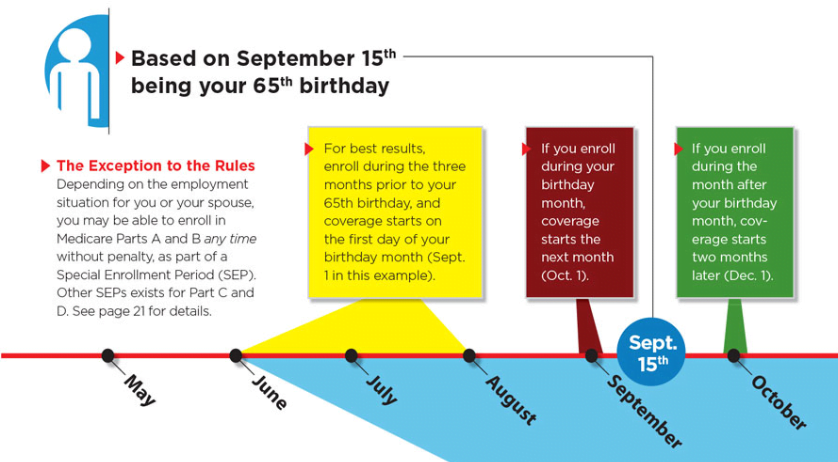

What are the 3 enrollment periods for Medicare?

When you turn 65, you have a seven month window to enroll in Medicare. This includes three months before the month you turn 65, your birth month, and three months after the month you turn 65.

Do I automatically get Medicare when I turn 65?

Medicare will automatically start when you turn 65 if you've received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday. You'll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks.

What is the Part B late enrollment penalty?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

How long is the enrollment period for Medicare?

These periods of time vary, depending on which part of Medicare you have deferred. For example, there is an eight-month special enrollment period to sign up for Part A and/or Part B that starts the month after employment ends or the group health insurance ends, whichever happens first.

What is the average age for Medicare?

The normal age for Medicare enrollment is 65. Medicare has costs. Some of these costs are substantial. To list a few: • Medicare B premiums are based on an individual’s income, meaning the premium includes a tax for those with higher incomes. Annual 2016 Part B premiums for an individual range between $1,258 and $4,677.

How much does a Medigap policy cost?

• In addition to original Medicare, a Medigap policy can cost approximately $2,000. Medicare coverage is, overall, extensive. If your client, however, has comprehensive coverage provided by an employer or even their spouse’s employer, ...

What is an HSA account?

An HSA is an account offered in conjunction with a high-deductible health insurance plan. The account allows you to contribute funds and take a full tax deduction for the contribution. The earnings on the funds grow tax-free and can be distributed free of taxes for a broad range of health care expenditures.

How long does Cobra last?

Many employees elect to use COBRA for their insurance for 18 months upon retirement. Note that the special enrollment period begins when your client retires, not at the end of the COBRA period. The penalties for missing the special enrollment, and thereby enrolling late, are significant.

Is Medicare Part D coverage creditable?

I advise getting written documentation each year from the employer’s benefits department stating that the insurance coverage is creditable. “Creditable” is a Medicare term, which basically states that the prescription-drug coverage is extensive enough to work in lieu of Medicare Part D prescription-drug coverage.

How long do you have to enroll in Medicare?

To avoid penalties, you must enroll within 8 months of when your current coverage ends. This is known as a special enrollment period. Certain events can trigger special enrollment periods, such as losing your current health insurance. If this happens, don’t wait for the next Medicare open enrollment period, otherwise you may have ...

What happens if you don't have Medicare?

If you don’t, you’ll incur penalties that may last your whole life. Like many people, you or a loved one might not be ready to take the plunge into Medicare coverage, despite being eligible. In some instances, it might make sense to defer coverage. In others, it may wind up costing you long-lasting or even permanent penalties.

How long do you have to work to get Medicare Part A?

Medicare Part A covers hospital expenses. If you or your spouse worked for at least 10 years (40 quarters), you will most likely be eligible for premium-free Part A when you turn 65 years old. You can defer Medicare Part A.

Who is eligible for tricare?

Active duty and retired military members and their families are typically eligible for TRICARE health insurance through the Department of Defense. Those who aren’t eligible, such as surviving spouses and children, may be eligible for CHAMPVA (Civilian Health and Medical Program of the Department of Veterans Affairs) coverage.

How much is Medicare Part B in 2021?

Medicare Part B covers outpatient medical costs and comes with a monthly premium for all Medicare beneficiaries. The standard premium is $148.50 per month in 2021, but this rate could be higher based on your income. You can also defer Part B coverage. However, if you defer Medicare Part B coverage, you may receive significant financial penalties ...

Does the VA cover outside facilities?

VA benefits typically won’t cover services you get at outside facilities, unless specifically authorized by the VA.

Does the VA cover prescriptions?

VA benefits include prescription drug coverage that’s considered to be at least as good as Medicare coverage. But it requires you to use a VA medical provider and pharmacy. If you lose your VA benefits or decide you want a Part D plan, you may enroll without penalty, even after your initial enrollment period expires.

How long is the Medicare enrollment period?

Initial Enrollment Period (IEP) An Initial Enrollment Period (IEP) for Medicare Part A and B is a 7-month period that begins three months before you turn age 65, or, in the case of disability, three months before your 25th month of disability. It includes the 3 months before, the month of, and the 3 months after the triggering event ...

What happens if you don't sign up for Medicare?

In most cases, you’ll have to pay a late enrollment penalty. We’ll talk about the General Enrollment Period later. FRAME 4.

When can I sign up for Part A and Part B?

You can sign up anytime during the Initial Enrollment Period. You also may delay Part A and/or Part B coverage. If you sign up for Part A and/or Part B during the first three months of your Initial Enrollment Period, your coverage will start in most cases on the first day of your birthday month.

What is the penalty for late enrollment?

If you are paying for Part A and delay enrollment into Part A after your IEP, you may have to pay a late enrollment penalty of 10% of the current Part A premium for each 12-month period you delayed enrollment. The penalty lasts twice the number of years that enrollment was postponed.

When is the SEP period?

may enroll in either or both Parts A and B during the General Enrollment Period (GEP). General Enrollment Period runs from January 1 to March 31 of each year.

When can I enroll in Part B?

Here is the summary of “When can you Enroll in Part B”. Initial Enrollment Period – 7-month period surrounding your birthday month. General Enrollment Period – January 1 through March 31 each ear.

Can you delay Medicare enrollment?

Your decision whether to delay enrollment depends on how good is your group health coverage relatively to Medicare. If you have group health coverage based on the current employment, then you MAY delay Part A and Part B and will not have to pay a lifetime late enrollment penalty if you enroll later.

If I delay taking Medicare Part B, when can I enroll?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during the eight-month Special Enrollment Period that starts when your employer or union group coverage ends or you stop working (whichever happens first).

What are the risks of enrolling late in Medicare Part B?

Remember that if you do not enroll in Medicare Part B during your Special Enrollment Period, you’ll have to wait until the next General Enrollment Period, which happens from January 1 to March 31 each year. You may then have to pay a late-enrollment penalty for Medicare Part B because you could have had Part B and did not enroll.

Medicare Part B enrollment – avoiding the Part B penalty

There are a few situations when you may be able to delay Medicare Part B without paying a late-enrollment penalty.

What happens if you don't get Part B?

NOTE: If you don’t get Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part B because you have coverage based on your (or your spouse’s) current employment.

When do you get Part A and Part B?

You will automatically get Part A and Part B starting the first day of the month you turn 65. (If your birthday is on the first day of the month, Part A and Part B will start the first day of the prior month.)

What is the individual health insurance marketplace?

NOTE: The Individual Health Insurance Marketplace is a place where people can go to compare and enroll in health insurance. In some states the Marketplace is run by the state and in other states it is run by the federal government. The Health Insurance Marketplace was set up through the Affordable Care Act, also known as Obamacare.

Do you have to pay a penalty if you don't get Part A?

NOTE: If you don’t get Part A and Part B when you are first eligible, you may have to pay a lifetime late enrollment penalty. However, you may not pay a penalty if you delay Part A and Part B because you have coverage based on your (or your spouse’s) current employment.