Use the IRS Schedule SE to determine what amount you personally owe in Medicare taxes based on what was reported in the business tax return. The good news is that half of the amount paid based on SECA can be deducted from the individual’s total income when calculating income tax.

What is Medicare tax and how is it calculated?

What Is Medicare Tax? Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1

How is Medicare tax deducted from your paycheck?

Half of the Medicare tax i.e. 1.45% is automatically deducted by the employer from its employee’s gross employment income i.e. salaries plus bonuses and the other half i.e. 1.45% is matched by the employer.

How does the Medicare tax break work?

This process gives the employee a tax break since it reduces the amount of wages subject to Medicare tax. If the employee has no pretax deductions, her entire gross pay is also her Medicare wages.

Who is required to pay Medicare taxes?

Just about anyone who works in the U.S. is required to pay Medicare taxes. Under the Federal Insurance Contributions Act (FICA), employers are required to withhold Medicare tax and Social Security tax from employees’ paychecks.

How do you calculate Medicare tax 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

How do I calculate Medicare wages?

The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction. Dental – subtract the YTD employee dental insurance deduction.

How do you calculate Medicare tax 2022?

For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021).

What income is subject to Medicare tax?

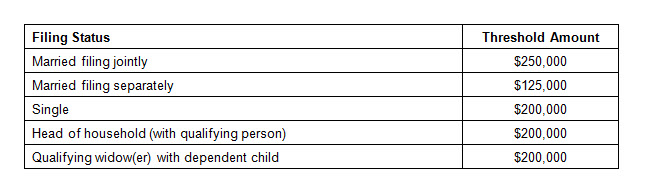

When are individuals liable for Additional Medicare Tax?Filing StatusThreshold AmountMarried filing jointly$250,000Married filing separate$125,000Single$200,000Head of household (with qualifying person)$200,0001 more row•Jan 18, 2022

Is Medicare tax based on gross income?

The tax is based on "Medicare taxable wages," a calculation that uses your gross pay and subtracts pretax health care deductions such as medical insurance, dental, vision or health savings accounts.

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee's paycheck or paid as a self-employment tax. 1.

What is the Medicare tax rate for 2020?

1.45%NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

What is the Medicare tax limit for 2020?

There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax. The Medicare tax rate applies to all taxable wages and remains at 1.45 percent with the exception of an “additional Medicare tax” assessed against all taxable wages paid in excess of the applicable threshold (see Note).

What is the SS tax rate for 2022?

6.2%Payroll taxes are based on an employee's net wages, salaries, and tips. These taxes are typically withheld by an employer and forwarded to the government on the employee's behalf. In 2022, the Social Security tax rate is 6.2% for the employer and 6.2% for the employee.

Who is exempt from paying Medicare tax?

The Code grants an exemption from Social Security and Medicare taxes to nonimmigrant scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other non-students temporarily present in the United States in J-1, Q-1 or Q-2 status.

Can I opt out of Medicare tax?

If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later.

Does everyone pay the same Medicare tax?

The takeaway Everyone who earns income pays some of that income back into Medicare. The standard Medicare tax is 1.45 percent, or 2.9 percent if you're self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

Is the Medicare tax mandatory?

Generally, if you are employed in the United States, you must pay the Medicare tax regardless of your or your employer’s citizenship or residency s...

Are tips subject to Additional Medicare Tax?

If tips combined with other wages exceed the $200,000 threshold, they are subject to the additional Medicare tax.

Is there a wage base limit for Medicare tax?

The wage base limit is the maximum wage that’s subject to the tax for that year. There is no wage base limit for Medicare tax. All your covered wag...

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

Where are Medicare and Social Security taxes put?

Medicare taxes and Social Security taxes are put into trust funds held by the U.S. Treasury . Medicare tax is kept in the Hospital Insurance Trust Fund and is used to pay for Medicare Part A. Costs of Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage) are covered by the Supplemental Medical Insurance Trust Fund, ...

What is the Medicare tax rate for a person earning $225,000 a year?

However, the additional 0.9% only applies to the income above the taxpayer’s threshold limit. 8 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45% and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

Is Medicare income taxable?

An individual’s Medicare wages are subject to Medicare tax. This generally includes earned income such as wages, tips, vacation allowances, bonuses, commissions, and other taxable benefits up to $200,000.

Do employers have to pay Medicare taxes?

Under the Federal Insurance Contributions Act (FICA ), employers are required to withhold Medicare tax and Social Security tax from employees’ paychecks. Likewise, the Self-Employed Contributions Act (SECA) mandates that self-employed workers pay Medicare tax and Social Security tax as part of their self-employment tax. 1. ...

Will the Hospital Insurance Trust Fund be exhausted?

However, the Hospital Insurance Trust Fund has been facing solvency and budget pressures and is expected to be exhausted by 2026, according to the 2019 Trustees Report. 5 If this happens, then Medicare services may be cut, or lawmakers may find other ways to finance these benefits.

Is Medicare surtax withheld from paycheck?

Like the initial Medicare tax, the surtax is withheld from an employee’s paycheck or paid with self-employment taxes. However, there is no employer-paid portion of the additional Medicare tax. The employee is responsible for paying the full 0.9%. 8.

How much is Medicare tax?

The Medicare Tax is an additional 0.9% in tax an individual or couple must pay on income thresholds above $200,000 for singles and $250,000 for couples. People who owe this tax should file Form 8959, with their tax return.

What happens if you don't pay quarterly estimated taxes?

If an individual has too little withholding or fails to pay enough quarterly estimated taxes to also cover the Net Investment Income Tax, the individual may be subject to an estimated tax penalty. The Net Investment Income Tax is separate from the Additional Medicare Tax, which also went into effect on January 1, 2013.

What is net investment tax?

In addition to the Medicare Tax, there is also the Net Investment Income Tax an individual or couple must pay if their respective incomes are over $200,000 and $250,000. Net Investment Income Tax includes, but is not limited to: interest, dividends, capital gains, rental and royalty income, and non-qualified annuities.

How to be more flexible with your income?

One of the best ways to be more flexible with your income is to start and operate a business. You have more flexibility in terms of receiving payment, purchasing business equipment, and investing in your companies future to adjust your income accordingly.

Is investment income subject to income tax?

To the extent the gain is excluded from gross income for regular income tax purposes, it is not subject to the Net Investment Income Tax. If an individual owes the net investment income tax, the individual must file Form 8960. Form 8960 Instructions provide details on how to figure the amount of investment income subject to the tax.

For Those Who Qualify There Are Multiple Ways To Have Your Medicare Part B Premium Paid

In 2022, the standard Medicare Part B monthly premium is $170.10. Beneficiaries also have a $233 deductible, and once they meet the deductible, must typically pay 20% of the Medicare-approved amount for any medical services and supplies.

What To Know About Medicare Part B Premiums

There are many things to look forward to as you contemplate the next chapter of your life the chapter after full-time work comprised of travel, family, leisure and more purposeful work. However, in all of my years offering advice and guidance, I have never heard of planning for Medicare as one of them.

If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal.

What Is The Medicare Part B Premium

The Medicare Part B premium is a monthly fee that Medicare beneficiaries pay if they choose to enroll in it to supplement the services available to most seniors for free with Medicare Part A.

If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

The Daily Journal Of The United States Government

This site displays a prototype of a Web 2.0 version of the daily Federal Register. It is not an official legal edition of the Federal Register, and does not replace the official print version or the official electronic version on GPOs govinfo.gov.

How Much Are Part D Irmaa Surcharges

For Part D, the IRMAA amounts are added to the regular premium for the enrollees plan .

Additional Medicare Tax

Additional Medicare Tax is a Medicare tax charged on the employees only at the rate of 0.9% of the income exceeding a certain threshold (i.e. $200,000 for a single filer, $250,000 for a couple filing jointly and $150,000 for a married person filing separately).

Formula

The following formulas can be used to work out the total Medicare tax, employee deduction and employer contribution:

How to determine Medicare tax amount?

To determine the amount of Medicare tax an employee should pay, you must first figure the wages. Determine whether the employee has voluntary pretax deductions. These are deductions the employer offers and the employee accepts.

How much Medicare tax is paid if there is no pretax deduction?

If the employee has no pretax deductions, her entire gross pay is also her Medicare wages. Calculate Medicare tax at 1.45 percent of the employee’s Medicare wages to arrive at the amount of tax to withhold. Notably, the employer pays an equal portion of Medicare tax.

What is pretax deduction?

Pretax deductions are those that meet the requirements of IRS Section 125 code, such as a traditional 401k plan, a Section 125 medical or dental plan or a flexible spending account. Subtract applicable pretax deductions from the employee’s gross pay – earnings before deductions – to arrive at Medicare wages.

Is Medicare based on wages?

Unlike federal income tax, which depends on varying factors such as the employee’s filing status and allowances, Medicare tax is based on a flat percentage of wages. Furthermore, unlike Social Security tax, which has an annual wage limit, Medicare has none.

Can an employer withhold Medicare from employee wages?

An employer is legally required to withhold Medicare tax from employee wages. The employee is exempt from withholding only if an exception applies, such as if she works for a university at which she is also a student.

How much Medicare tax is required to be deducted?

The 0.9% additional Medicare tax must be deducted when the employee's wages reach $200,000 each year, and the additional amount is calculated on only the amount over $200,000.

What is Medicare additional tax?

The Additional Medicare Tax. The pay amount at which additional Medicare taxes must be withheld from higher-paid employees. The pay amount is different depending on the individual's tax status (married, single, etc.) At the specified level for the year, an additional 0.9% must be withheld from the employee's pay for the remainder of the year.

What is the Medicare withholding rate?

The Medicare withholding rate is gross pay times 1.45 % , with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9%. For a total of 7.65% withheld, based on the employee's gross pay. 2 .

How to calculate FICA taxes?

First, multiply 40 hours x $12.50 = $500. Then multiply 4 overtime hours x $18.75 (1 1/2 times the hourly rate) = $75.00. Add $500 + $75 for a total of $575 in gross wages for the week. Determine the amount of employee wages/salaries that are subject to FICA taxes.

What to do if you deduct too much tax?

If you deducted too much tax from an employee's pay, either for Social Security or for Medicare tax, you may have several things to fix: Refund the employee. You will need to pay the employee back for the excess deduction amount. You can give this amount back to the employee in a paycheck or as a separate check.

How to calculate gross pay for hourly?

The gross pay for an hourly employee is the total calculated pay, multiplying hours times hourly rate and including hours for overtime and the overtime rate . First, multiply 40 hours x $12.50 = $500. Add $500 + $75 for a total of $575 in gross wages for the week.

What to do if you have a 941 error?

Change the employee's payroll record. Deduct the over-payment of Social Security taxes from the employee's payroll tax record.