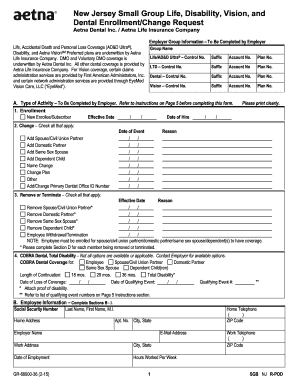

Simply choose the options that work best for you and enroll online. Or, enroll in an Aetna Medicare plan over the phone by calling a licensed agent at 1-855-335-1407 (TTY: 711), Monday to Friday, 8 AM to 8 PM. You can also enroll in an Aetna Medicare plan by mail.

Full Answer

How to find Aetna Medicare providers?

- Your plan may pay less toward your care. ...

- The fees for health services may be higher. ...

- Any amount you pay might not contribute to your plan deductible, if you have one.

- You may need preauthorization for any services you receive in order for any coverage to apply.

How to enroll in an Aetna Health Plan?

- Both parties have a mutual understanding of the plan design and effective date requested.

- Both parties meet to agree upon implementation responsibilities and schedules.

- Develop contact list for both parties.

- Discuss services in progress and the transition of claim history, if applicable.

Is Aetna part of Medicare?

The Aetna Supplemental Retiree Medical Plan is a fully insured, non-network-based commercial retiree group health product. In all states but Florida and Minnesota, it is offered as a supplementary medical plan, not a Medicare plan. In Florida and Minnesota, it is approved as a group Medicare Supplement product.

What are the benefits of Aetna Insurance?

• 60% of base monthly earnings, as defined by Aetna, to a maximum benefit of $5,000 per month • 180-day elimination period • 6-month waiting period before you’re eligible for this benefit, based on start work date San Francisco Superior Court: Superior Court Reporters Superior Court Local 1021 Superior Court Unrepresented Clerical Workers

Is Aetna Medicare the same as Medicare?

Aetna Medicare is a HMO, PPO plan with a Medicare contract. Our SNPs also have contracts with State Medicaid programs. Enrollment in our plans depends on contract renewal.

What is the best way to enroll in Medicare?

Apply online (at Social Security) – This is the easiest and fastest way to sign up and get any financial help you may need. You'll need to create your secure my Social Security account to sign up for Medicare or apply for Social Security benefits online. Call 1-800-772-1213. TTY users can call 1-800-325-0778.

Do you have to enroll in Medicare Part B every year?

In general, once you're enrolled in Medicare, you don't need to take action to renew your coverage every year. This is true whether you are in Original Medicare, a Medicare Advantage plan, or a Medicare prescription drug plan.

What is the initial enrollment period for Medicare?

7 monthsGenerally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

What documents do I need to apply for Medicare?

What documents do I need to enroll in Medicare?your Social Security number.your date and place of birth.your citizenship status.the name and Social Security number of your current spouse and any former spouses.the date and place of any marriages or divorces you've had.More items...

When should you apply for Medicare?

Generally, we advise people to file for Medicare benefits 3 months before age 65. Remember, Medicare benefits can begin no earlier than age 65.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Are you automatically enrolled in Medicare Part B?

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If you're not getting disability benefits and Medicare when you turn 65, you'll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

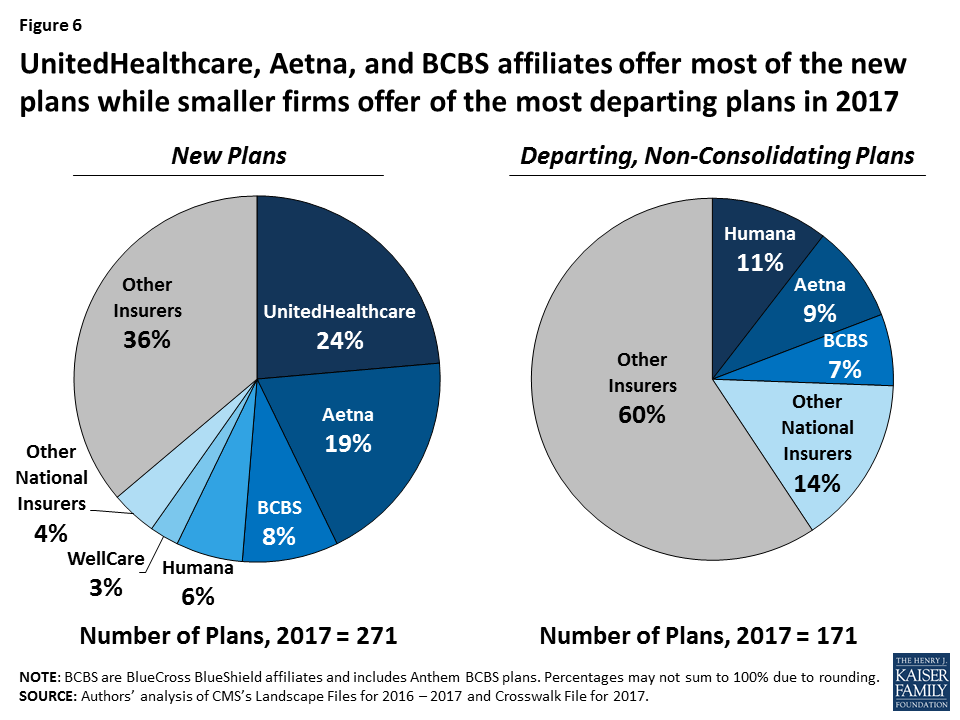

Who is the largest Medicare Advantage provider?

AARP/UnitedHealthcareAARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

How much is Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Understanding Medicare enrollment periods

Turning 65 may be important when it comes to Medicare, but you’ll need to keep track of several other key dates. Learn more about the enrollment periods that cover everything from signing up for the first time to making changes to your Medicare plan.

So, I enrolled in Medicare, now what?

You’ve signed up for Medicare. Congratulations! But keep in mind there are a few key actions to take before coverage begins. Here are some important steps to take as you continue on your enrollment journey.

Avoid penalties

Learn when you should enroll in Medicare and what you should do if you already have health coverage. Signing up when you’re eligible could help you avoid paying penalties later.

Need help paying for Medicare?

You’ve earned each and every benefit associated with Medicare. But if you think you can’t afford it, help may be available. Learn more about Medicare Savings Programs, Medicaid and other forms of financial assistance for your health care costs.

How to control your Medicare costs

Frankie Satterfield-Vaughn has more than two decades of experience helping people budget for Medicare costs. Listen to her share some of her best insider tips.

Research Medicare benefits

A satisfied Medicare member shares advice on what to focus on when researching plans.

How an insurance agent can help you

Insurance agents like Jim Soucy can be a valuable resource before and after you enroll. Jim explains how he educates his clients about Medicare and shops the market for them.

When can I enroll in Aetna?

When can I enroll in an Aetna Medicare plan? You can enroll in a Medicare plan during one of the following four enrollment periods: Initial Enrollment Period (IEP), which begins when you’re first eligible for Medicare. Annual Enrollment Period (AEP), which occurs from October 15 through December 7.

When does Medicare enrollment end?

Medicare’s Annual Enrollment Period begins October 15 and ends December 7 of each year. The choices you make generally take effect January 1 of the following year. During AEP you may: Switch Medicare plans. Join a new Medicare plan. Cancel your Medicare plan.

What is a special enrollment period?

The Special Enrollment Period allows you to join, switch or cancel a Medicare plan when you have special circumstances. Some examples include: You newly get, lose or have a change in your Medicaid or Extra Help status. You recently involuntarily lost your creditable coverage (as good as Medicare’s)

What is a SEP in Medicare?

What is the Special Enrollment Period (SEP)? The Special Enrollment Period allows you to join, switch or cancel a Medicare plan when you have special circumstances.

How long can you go without prescription coverage?

You went longer than 63 days without creditable prescription drug coverage (as good as Medicare's) The 63 days without creditable coverage was after the end of your Initial Enrollment Period (IEP), as described above on this page.

Medicare enrollment milestones

Turning 65 may be important when it comes to Medicare, but you’ll need to keep track of several other key dates. Learn more about the enrollment periods that cover everything from signing up for the first time to choosing a different Medicare plan.

Medicare enrollment guidance

There’s a whole team of professionals who can support you along your Medicare journey. Insurance agents, call center reps, doctors and pharmacists are just some of the experts who can help.

Be prepared for enrollment

Ready to sign up for Medicare? Make the process easy by ensuring you have all your information and documentation organized before you sit down to sign up. Having everything mentioned in our guide will help make the process a breeze.

What else can I learn about Medicare?

Stay connected to Medicare information through each step on your eligibility path.

How long does Medicare last after your 65th birthday?

That’s the period of seven-months around your 65th birthday – running from the three months before your birthday month, through the month of your birthday and through the three months after your birthday month. But should you enroll in Medicare when you first become eligible?

What is the Medicare program for 65?

For over 50 years, most Americans have received a pretty memorable present on their 65th birthday: Medicare. Medicare is the government-sponsored health care program for people 65 and over, as well as a few others who aren’t yet 65. Your first opportunity to enroll when you turn 65 is during your Initial Enrollment Period (IEP).

Do you have to check with your Medicare administrator before making a decision?

Be sure to check with your benefits administrator before making a decision. If you’re worried about paying the premiums associated with certain parts of Medicare, consider the benefits that come with your premiums . After all, you’ve earned those benefits .

Do you have to pay late enrollment penalty for Medicare?

Second, if you wait until after your Initial Enrollment Period to enroll in Medicare, you might have to pay a late enrollment penalty for coverage. Not everyone who delays enrollment is subject to penalties.

What is Aetna Life Insurance?

Aetna is the brand name used for products or services provided by one or more of the Aetna group of subsidiary companies, including Aetna Life Insurance Company and its affiliates (Aetna). This material is for informtion only.

Is Aetna responsible for the content of linked sites?

Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites. Continue. You are now being directed to the US Department of Health and Human Services site.

Is Aetna a part of CVS?

and its subsidiary companies are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites. Aetna is proud to be part of the CV S Health family . You are now being directed to the CVS Health site.

Is Aetna liable for non-Aetna sites?

You are now leaving the Aetna website. Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites. Continue.

What is Aetna Life Insurance?

Legal notices. Aetna is the brand name used for products and services provided by one or more of the Aetna group of companies, including Aetna Life Insurance Company and its affiliates (Aetna). This material is for information only. Health benefits and health insurance plans contain exclusions and limitations.

Does Aetna provide care?

Provider participation may change without notice. Aetna does not provide care or guarantee access to health services. Estimated costs not available in all markets. The tool gives you an estimate of what you would owe for a particular service based on your plan at that very point in time.

Is Aetna Inc. responsible for the CDC?

You are now being directed to the CDC site. Links to various non-Aetna sites are provided for your convenience only. Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites. Continue.

Is Aetna liable for the content of linked sites?

Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites. Please log in to your secure account to get what you need. You are now leaving the Aetna Medicare website.

Is Aetna Inc. responsible for the content of its websites?

Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites. Links to various non-Aetna sites are provided for your convenience only.

Why Would Anyone Wait to Enroll in Medicare?

So, What If I Already Have Coverage?

- There are also specific rules that apply to whether you pay a penalty for late enrollment in Medicare Part D. Do you have prescription drug coverage through your employer that pays, on average, at least as much as Medicare’s standard? If not, then you could be subject to a penalty if you don’t enroll in prescription drug coverage when you first become eligible for Medicare. Once …

What Are The Penalties Associated with Late Enrollment?

- If you don’t meet the criteria for an exception, you may be subject to a penalty. This comes in the form of higher premiums for Part B and/or Part D. How much do your premiums go up if you don’t have alternate coverage and don’t enroll when you first become eligible? That depends on how long you wait. But the longer you delay, the higher your premium will be. For example, your mont…

Do I Wait Or Not?

- Ultimately, only you can determine when it’s best for you to enroll in Medicare once you’re eligible. Will you have coverage that gives you an exception to delay enrollment without being subject to a penalty? Be sure to check with your benefits administrator before making a decision. If you’re worried about paying the premiums associated with certain parts of Medicare, consider the ben…