To enroll in Medicare Supplement coverage, you’ll need to complete the personal information, subscription, and authorization portions of the Medicare Supplement Enrollment, Waiver, or Withdrawal form. This form is included in the personalized retirement packet you receive after you notify the Board of Pensions of your retirement date.

Full Answer

How do you sign up for a Medicare supplement plan?

Dec 12, 2019 · How to apply for a Medicare Supplement plan: The basics. Step 1: Research your plan options. There are currently 10 plans to choose from, so you have some decisions to make (for example, if you want coverage ... Step 2: See pricing and availability for your area. Step 3: Apply for the plan you want. ...

How do I pick a Medicare supplement plan?

Oct 01, 2021 · How To Enroll In A Medicare Supplement Plan. You must reside in Massachusetts, which means your permanent home address is within the state of Massachusetts. You may also be eligible if you are under age 65 and have a disability other than End Stage Renal Disease (ESRD). You must be entitled to ...

How do you enroll in a Medicare Advantage plan?

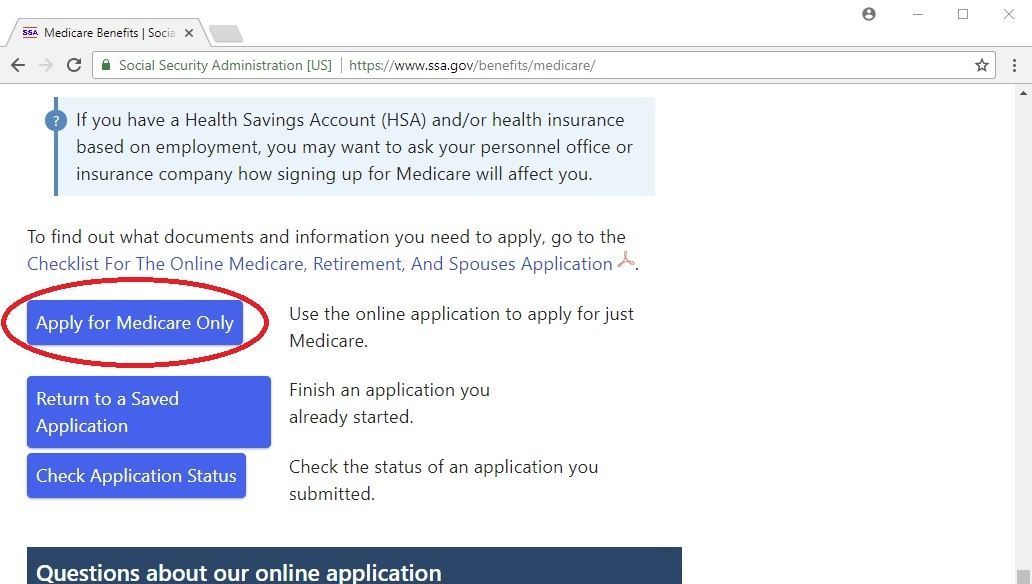

Apr 12, 2022 · There are three ways to enroll yourself in Medicare Part A and Part B: Online at www.SocialSecurity.gov . Call Social Security at 1-800-772-1213 (TTY users 1-800-325-0778), Monday through Friday, from 7a.m. to 7p.m. In-person at your local Social Security office.

How to enroll in Medicare if you have ALS?

Most people get Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) when first eligible (usually when turning 65). Answer a few questions to check when and how to sign up based on your personal situation. Learn about Part A and Part B sign up periods and when coverage starts.

What is the open enrollment period for Medicare Supplements?

Under federal law, you have a six-month open enrollment period that begins the month you are 65 or older and enrolled in Medicare Part B. During your open enrollment period, Medigap companies must sell you a policy at the best available rate regardless of your health status, and they cannot deny you coverage.

How much are supplemental plans to Medicare?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.Mar 21, 2022

Can you switch from Medicare Advantage to Medigap without underwriting?

For example, when you get a Medicare Advantage plan as soon as you're eligible for Medicare, and you're still within the first 12 months of having it, you can switch to Medigap without underwriting. The opportunity to change is the "trial right."Jun 3, 2020

Is Medicare supplemental insurance based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the least expensive Medicare Supplement plan?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.Mar 16, 2022

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

What is difference between Medigap and advantage?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is the difference between an Advantage plan and a supplemental plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

How much does Medicare take out of Social Security?

What are the Medicare Part B premiums for each income group? In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

Is Social Security considered income for Medicare?

For purposes of the Medicare Prescription Drug Discount Card, we have defined “income” as money received through retirement benefits from Social Security, Railroad, the Federal or State Government, or other sources, and benefits received for a disability or as a veteran, plus any other sources of income that would be ...

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What happens after you enroll in Medicare Supplement?

After you enroll in Medicare Supplement, you will receive new ID cards for medical and prescription drug coverage. You should destroy your old cards and carry the new ones — in addition to your Medicare card — for emergency and routine use.

How old do you have to be to be eligible for Medicare Supplement?

To meet the Rule of 70: You must be age 55 or older when you terminate eligible active service. You must have at least five years of Medical Plan participation.

How long do you have to file a medical claim before retirement?

Submit the completed, signed form at least 45 days before your retirement date, but no later than 30 days after your last day of medical coverage through the Board as an active employee.

How long before retirement do you call the Board of Pensions?

This form is included in the personalized retirement packet you receive after you notify the Board of Pensions of your retirement date. Three to six months before your retirement date, call the Board at 800-773-7752 (800-PRESPLAN) to request a packet.

How long does it take to re-enroll in Medicare?

To apply for re-enrollment in Medicare Supplement coverage, you must provide the Board with the following — if not in advance, then within 30 days of disenrollment from (or termination of) your previous plan: The completed subscription section of the Medicare Supplement Enrollment, Waiver, or Withdrawal form.

What happens when you retire from Medicare?

When you retire, your medical coverage through the Board of Pensions ends. If you are eligible for Medicare and about to retire, contact the Board of Pensions to discuss your eligibility for Medicare Supplement coverage. When you retire, you may enroll in Medicare Supplement if you.

When do you have to retire to continue medical coverage?

If you retire before age 65, you will need to maintain continuous coverage through another qualified health plan, such as medical continuation coverage through the Board or a spouse's employer's health plan, until you turn 65 and are eligible to enroll in Medicare.

How to enroll in Medicare online?

Enroll in Original Medicare online at the Social Security website or by calling or visiting your local Social Security office. Enroll directly in the plan; e.g., on the plan’s website or Medicare.gov . Enroll directly in the plan; e.g., on the plan’s website or Medicare.gov .

When is Medicare open enrollment?

The Medicare Annual Enrollment Period (AEP), October 15 – December 7. The Medicare Advantage Open Enrollment Period, January 1 – March 31.

Who offers Medigap insurance?

Medigap plans are offered by private insurance companies, and you’ll have to enroll directly with the insurance plan provider. Below are some helpful steps for enrolling in a Medigap plan.

Is it easy to enroll in Medicare?

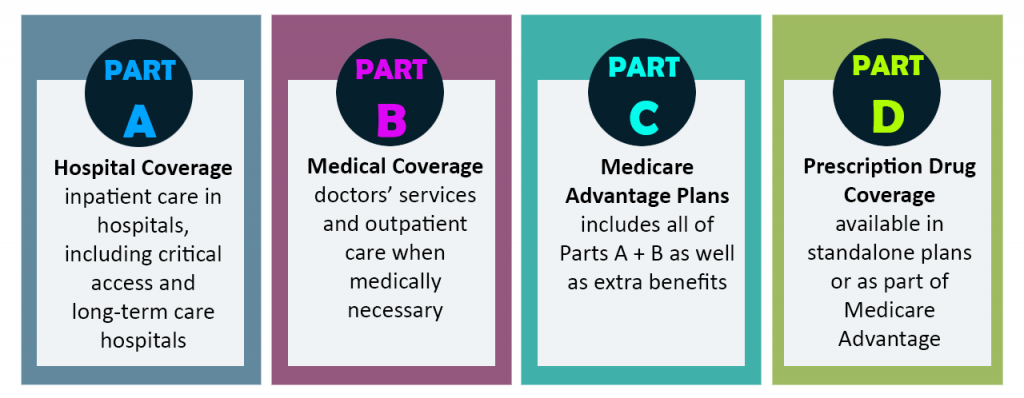

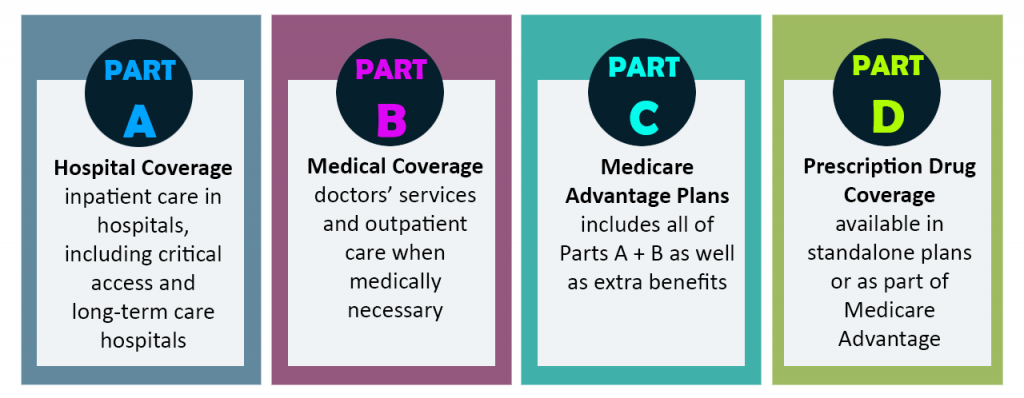

Enrolling in Medicare is easy once you understand how to do so. It's important to know that how you enroll in Medicare Part A and Part B is different from how you enroll in Medicare Advantage (Part C), Part D or Medicare supplement insurance.

Is UnitedHealthcare a Medicare Advantage?

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract and a Medicare-approved Part D sponsor. Enrollment in these plans depends on the plan's contract renewal with Medicare.

Check when to sign up

Answer a few questions to find out when you can sign up for Part A and Part B based on your situation.

When coverage starts

The date your Part A and Part B coverage will start depends on when you sign up.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap or MedSup), sold by private companies, helps pay some health care costs that Original Medicare (Part A and Part B) doesn’t cover. Policies can include coverage for deductibles, coinsurance, hospital costs, skilled nursing facility costs, and sometimes health care costs when traveling outside the U.S.

How long is the free look period for Medigap?

If you’re within your six-month Medigap Open Enrollment Period and considering a different Medigap plan, you may try a new Medigap policy during a 30-day “free look period.”. During this period, you will have two Medigap plans, and pay the premium for both.

What happens if a Medigap policy goes bankrupt?

Your Medigap insurance company goes bankrupt and you lose your coverage , or your Medigap policy coverage otherwise ends through no fault of your own. You leave a Medicare Advantage plan or drop a Medigap policy because the company hasn’t followed the rules, or it misled you.

When will Medicare Part A be sent to my Social Security?

resident, the government automatically enrolls you in both Medicare Part A and Medicare Part B at age 65. Three months prior to your 65th birthday, your Medicare card will arrive in the mail with instructions.

When does Medicare open enrollment take effect?

Any changes you make during general open enrollment will take effect January 1. If you make a change during the Medicare Advantage open enrollment period, it will take effect the first of the following month.

What happens if you don't enroll in Part D?

If you don’t enroll during this period, you may pay a late-enrollment penalty that will raise your Part D premium when you do decide to purchase coverage (the late enrollment penalty doesn’t apply if you had creditable drug coverage during the time that you delayed your Part D enrollment).

What is Medicare Part D?

Enrolling in Medicare Part D. Medicare Part D covers prescription drugs. You can add a stand-alone prescription drug plan (PDP) to augment your Medicare A and B, or you can choose a Medicare Advantage plan that provides all of the benefits of Medicare A and B, plus prescription drugs and often other benefits as well.

How to find out about Medigap insurance?

To find out about Medigap policies in your state, contact your State Department of Insurance or your State Health Insurance Assistance Program, or call 1-855-593-5633 to speak with one of our partners, who can help you find a plan in your area .

How long does it take to get a Medicare plan D card?

Once you apply for Plan D, it generally takes about five weeks for your membership card to arrive.

When does Part D start?

Your Part D coverage will start at the beginning of your 25th month of receiving RRB or Social Security benefits. If you don’t have Part A and enroll in Part B during the Part B General Enrollment Period, you can enroll in Part D between April 1 and June 30. Or, if you have Part A coverage and then enroll in Part B during ...

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.

What is a select Medicare policy?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. . If you buy a Medicare SELECT policy, you have rights to change your mind within 12 months and switch to a standard Medigap policy.

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

Can Medigap refuse to cover out-of-pocket costs?

A health problem you had before the date that new health coverage starts. . In some cases, the Medigap insurance company can refuse to cover your. out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance.

Can you get Medicare if you are 65?

Some states provide these rights to all people with Medicare under 65. Other states provide these rights only to people eligible for Medicare because of disability or only to people with ESRD. Check with your State Insurance Department about what rights you might have under state law.

Can you charge more for a Medigap policy?

Charge you more for a Medigap policy. In some cases, an insurance company must sell you a Medigap policy, even if you have health problems. You're guaranteed the right to buy a Medigap policy: When you're in your Medigap open enrollment period. If you have a guaranteed issue right.