First, you need to look at all the costs charged by the Medicare plan you have or are thinking of getting. Then, you also need to consider how you use health care and your Medicare benefits. What this means is that you need to think about what specific health services or items you need, how often and then match potential costs to that.

Full Answer

How do I decide what coverage I Want for Medicare?

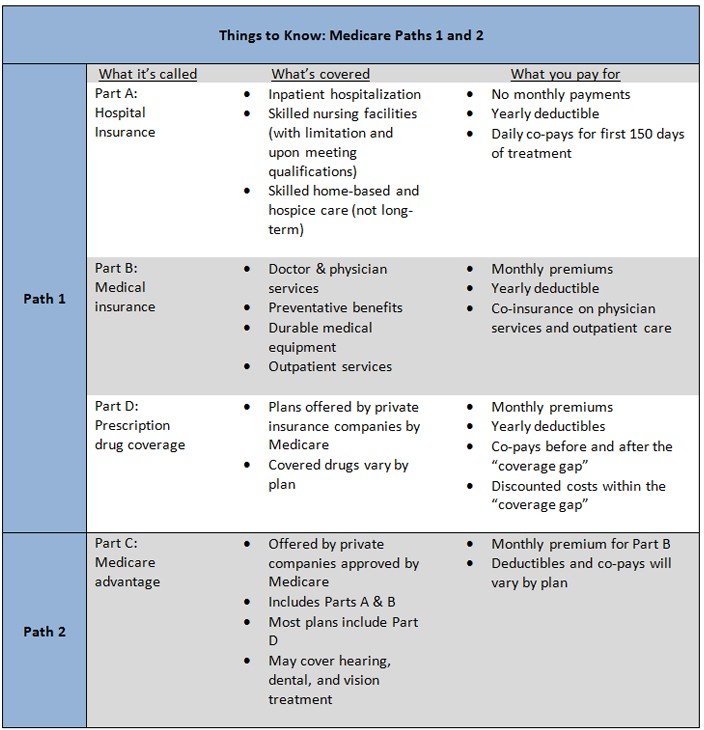

Use these steps to help you decide what coverage you want: 1 Decide if you want Original Medicare or a Medicare Advantage Plan (like an HMO or PPO). 2 Decide if you want prescription drug coverage (Part D). 3 Decide if you want supplemental coverage.

What are Medicare Advantage plans and how do they work?

Medicare Advantage Plans provide all of your Part A and Part B benefits, with a few exclusions, for example, certain aspects of clinical trials which are covered by Original Medicare even though you’re still in the plan. Medicare Advantage Plans include: • Most Medicare Advantage Plans offer prescription drug coverage. .

What is the difference between Original Medicare and Medicare Advantage?

Learn more about how Original Medicare works. Medicare Advantage is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D. In most cases, you’ll need to use doctors who are in the plan’s network.

What should I know before comparing health insurance plans?

Knowing just a few things before you compare plans can make it simpler. The 4 “metal” categories: There are 4 categories of health insurance plans: Bronze, Silver, Gold, and Platinum. These categories show how you and your plan share costs.

How do I know which Medicare plan is right for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

What is the best way to compare Medicare Advantage plans?

The Medicare Plan Finder on Medicare.gov is currently the most comprehensive tool for comparing Medicare Advantage plan benefits, prescription drug coverage and costs.

How are Medicare Advantage plans evaluated?

Plans are rated on a one-to-five scale, with one star representing poor performance and five stars representing excellent performance. Star Ratings are released annually and reflect the experiences of people enrolled in Medicare Advantage and Part D prescription drug plans.

Which Medicare Advantage plan has the highest rating?

What Does a Five Star Medicare Advantage Plan Mean? Medicare Advantage plans are rated from 1 to 5 stars, with five stars being an “excellent” rating. This means a five-star plan has the highest overall score for how well it offers members access to healthcare and a positive customer service experience.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

What does a 5-star Medicare rating mean?

excellentA 5-star rating is considered excellent. These ratings help you compare plans based on quality and performance. Medicare updates these ratings each fall for the following year. These ratings can change each year.

What Medicare has a 5-star rating?

The 21 health plans earning 5 stars include KelseyCare Advantage, Kaiser Permanente, UnitedHealthcare, CarePlus by Humana, Tufts Health Plan, Health Partners, Capital District Physicians' Health Plan, Quartz Medicare Advantage of Wisconsin, Cigna, Health Sun - Anthem, BCBS - Health Now New York and Martins Point.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What states have 5 star Medicare Advantage plans?

States where 5-star Medicare Advantage plans are available:Alabama.Arizona.California.Colorado.Florida.Georgia.Hawaii.Idaho.More items...•

What is the average cost of a Medicare Advantage plan?

The average premium for a Medicare Advantage plan in 2021 was $21.22 per month. For 2022 it will be $19 per month. Although this is the average, some premiums cost $0, and others cost well over $100. For more resources to help guide you through the complex world of medical insurance, visit our Medicare hub.

Can I switch from a Medicare Advantage plan back to Original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Medicare 101

Before we dive into the many intricacies of Advantage plans, let’s go back to square one and take a look at what Original Medicare is and what it entails.

What is a Medicare Advantage Plan?

A Medicare Advantage plan, also known as Medicare Part C, is a Medicare enrollment election through a private insurance company. How it works is that a private insurance provider is contracted with Medicare, with all of the benefits being managed through the insurance company, not Medicare.

What is the difference between HMO and PPO plans?

A Health Maintenance Organization, or HMO, Medicare Advantage Plan can offer great benefits such as a low or even non-existent monthly premiums. But it is important to know that whenever you need to see a doctor or specialist, your insurance provider will need to review and approve the referral before you can make an appointment.

The Costs of Advantage Plans

On the surface, Medicare advantage plans seem to be an ideal situation. They offer more benefits in an all-inclusive setting streamlining the process for many customers. But there are some important caveats to keep in mind before enrolling in an Advantage Plan.

Set a Budget and Look for Medicare Plans That Meet It

It’s important to note that changes in your health, as well as plan costs, can impact your financial well-being. That’s why it’s important to evaluate your Medicare coverage during the Annual Enrollment Period to determine if there are options that better fit your medical and financial needs.

Look at Medicare Plan Quality Ratings to Learn More About a Plan Before Committing to It

Another important factor in determining plan choice is reviewing the annual Star Ratings published by the Centers for Medicare & Medicaid Services (CMS) for all Medicare Advantage plans and Part D prescription drug plans.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the original Medicare?

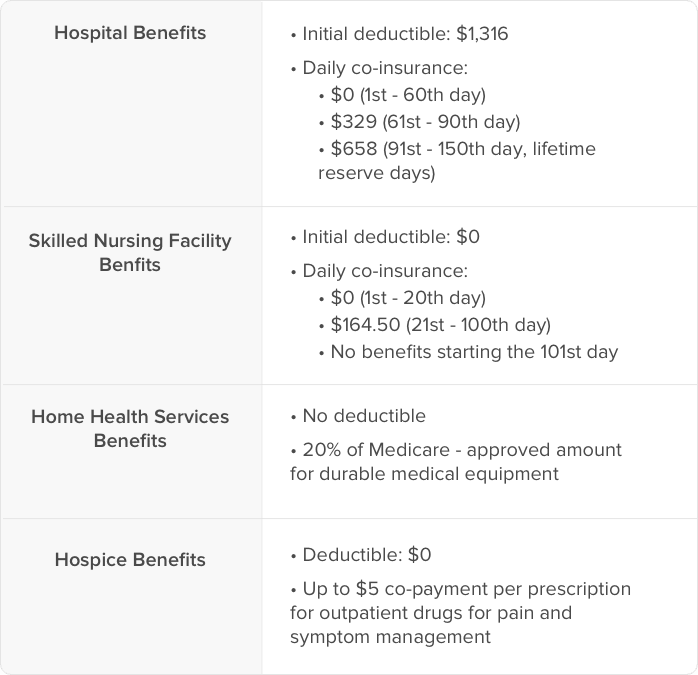

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

When Can I Enroll In Medicare?

Remember, you are automatically eligible to receive Medicare the day you turn 65. If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare.

Can I Add, Drop, And Change Coverage?

You can’t add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.

What are the 4 metal categories of health insurance?

The 4 “metal” categories: There are 4 categories of health insurance plans: Bronze, Silver, Gold, and Platinum. These categories show how you and your plan share costs. Plan categories have nothing to do with quality of care. Your total costs for health care: You pay a monthly bill to your insurance company (a "premium"), ...

What is a premium plan?

Your total costs for health care: You pay a monthly bill to your insurance company (a "premium"), even if you don’t use medical services that month. You pay out-of-pocket costs, including a deductible, when you get care.