The Biggest Medicare Changes for 2021

- Increased Coverage for Telehealth Services. One of the most important changes happening within Medicare is the addition of more coverage for telehealth services and telemedicine.

- New Long-Term Care Coverage Options. Long-term care coverage isn’t exactly comprehensive under Medicare. ...

- More Choices and Coverage for Seniors With End-Stage Renal Disease. In years past, individuals living with end-stage renal disease (ESRD) had very limited options under Medicare.

- Make Changes to Your Medicare Coverage Before Open Enrollment Ends. You only get one opportunity to make changes to your Medicare coverage – and it’s during open enrollment.

How much will Medicare cost this year?

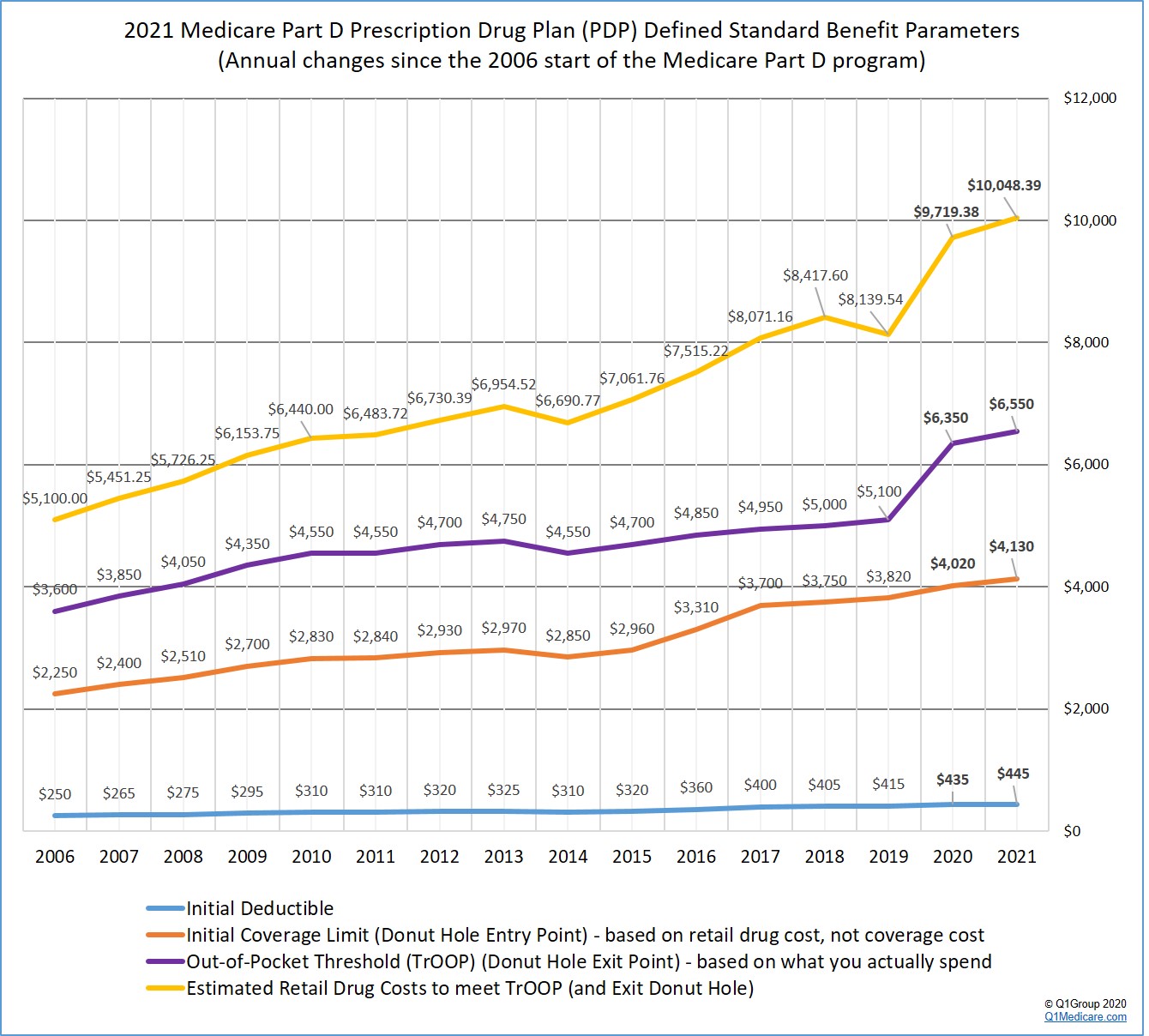

In 2021, the maximum out-of-pocket limit for Medicare Advantage plans will double to $7,550. The Part D donut hole no longer exists, but the maximum deductible for a standard health plan is increasing to $445 in 2021, and the threshold for entering the catastrophic coverage phase (where out-of-pocket spending is significantly reduced) is growing to $6,550.

How will Medicare change?

Nov 06, 2020 · The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What is the best Medicare plan?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. …

Does Medicare have monthly premiums?

Jan 04, 2021 · Changes to Medicare Part B Part B premiums are dependent upon income. The income brackets for 2021 have increased to $88,000 for an individual and $176,000 for a couple with fees increasing as income increases beyond those thresholds. For Part B coverage, the premium for people under the income threshold is now $148.50 an increase of only $3.90.

What big changes are coming to Medicare?

What are the 2021 proposed changes to Medicare?Increased eligibility. One of President Biden's campaign goals was to lower the age of Medicare eligibility from 65 to 60. ... Expanded income brackets. ... More Special Enrollment Periods (SEPs) ... Additional coverage.Nov 22, 2021

What is the new Medicare payment for 2021?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Will Medicare benefits increase in 2021?

The increase in the standard monthly premium—from $148.50 in 2021 to $170.10 in 2022—is based in part on the statutory requirement to prepare for expenses, such as spending trends driven by COVID-19, and prior Congressional action in the Continuing Appropriations Act, 2021 that limited the 2021 Medicare Part B monthly ...Nov 12, 2021

How much does Medicare take out of Social Security?

You will pay no monthly premium for Medicare Part A if you are older than age 65 and any of these apply: You receive retirement benefits from Social Security....Is Medicare Part A free?Amount of time worked (and paid into Medicare)Monthly premium in 2021< 30 quarters (360 weeks)$47130–39 quarters (360–468 weeks)$259Dec 1, 2021

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Why did I get an extra Social Security payment this month 2021?

According to the CMS, the increases are due to rising prices and utilization across the healthcare system, as well as the possibility that Medicare may have to cover high-cost Alzheimer's drugs like Aduhelm.Jan 12, 2022

What is the Social Security increase for 2021?

With COLAs, Social Security and Supplemental Security Income (SSI) benefits keep pace with inflation. The latest COLA is 5.9 percent for Social Security benefits and SSI payments. Social Security benefits will increase by 5.9 percent beginning with the December 2021 benefits, which are payable in January 2022.

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

Are Part A Premiums Going Up in 2021?

Only about 1% of Medicare Part A applicants pay premiums; the rest are eligible for free coverage based on their employment records or spouse’s work history. Part A premiums have increased over the years, and they have surged again for 2020 — despite being lower in 2020 than in 2010.

Is the Medicare Part A Deductible Getting Higher in 2021?

Part A provides the insurance deductible for each benefit period (rather than a calendar period deductible like Part B coverage or private insurance plans). The deductible typically doubles every year. It was $1,364 in 2019, but it will increase to $1,408 in 2020. It has also expanded to $1,484 for 2021.

What is the Cost of Medicare Part A Coinsurance in 2021?

The Part A deductible covers the first 60 inpatient days of an enrollee’s benefit period. There is a daily coinsurance charge if the individual needs additional inpatient coverage during the same benefit period. It is $371 per day for the 61st through 90th inpatient care in 2021 (up from $352/day in 2020).

How are Medicare Advantage Premiums Changing During 2021?

According to CMS, the median Medicare Advantage Plan (Part C) insurance rates in 2021 are around $21 per month, down from $23 per month in 2020. For several years, average Advantage costs have been declining, and the annual premium for 2021 is the lowest since 2007.

People with ESRD (End-Stage Renal Disease) can Sign Up for Medicare Advantage Plans

Long-standing rules prohibited people with end-stage renal disease (ESRD) from enrolling in Medicare Advantage plans unless an ESRD Special Needs Plan was available in their area. Nonetheless, starting in 2021, all Medicare beneficiaries, including those with ESRD, will be eligible for Medicare Advantage plans.

Is the Medicare Advantage Plan Out-of-Pocket Maximum Changing for 2021?

Medicare Advantage plans must limit enrollees’ out-of-pocket expenses for Part A and Part B medical care (unlike Original Medicare, which has no cap on out-of-pocket costs). The cap excludes the cost of prescribed medicines, as these are covered by Medicare Part D (even when combined with a Medicare Advantage plan).

How is Medicare Part D Prescription Drug Plan Changing for 2021?

The maximum allowable deductible for stand-alone Part D prescription drug coverage will be $445 in 2021, slightly higher than $435 in 2020.

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is a 504.90?

504.90. Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follow s: Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses:

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What will Medicare do in 2021?

What Are The Changes To Medicare For 2021? Your Medicare coverage in 2021 may expand to provide lower costs and more services. This year will bring a cap on insulin prices and extended coverage for telehealth and COVID-19 services. Medicare Advantage coverage expands to acupuncture and beneficiaries with end stage renal disease.

How much has Medicare increased in 2020?

For comparison, the premium increased 6.7% from 2019 to 2020. The Part A premium — which must only be paid by enrollees who paid Medicare taxes for less than 10 years (40 quarters) through an employer — also experienced modest increases.

How much is Medicare tax for 30 quarters?

The premium for those who paid Medicare taxes for 30-39 quarters increased from $252 to $259; those who paid for less than 30 quarters, it increased from $458 to $471. If you have questions about any of these changes to Medicare or how they affect your coverage, GoHealth can help. We have experienced, licensed insurance agents ...

What is Medicare Advantage?

Medicare Advantage ( Medicare Part C) is health insurance for Americans aged 65 and older that blends Medicare benefits with private health insurance. This typically includes a bundle of Original Medicare (Parts A and B) and Medicare Prescription Drug Plan (Part D). starting in 2021. Telehealth and telemedicine coverage will extend to 2021, ...

What is a copayment for insulin?

Insulin copayment. A copayment is the fixed amount you pay directly to your provider for medical services or prescription drugs covered in your plan. For example: If your plan includes a copayment of $20 for office visits, you'll pay $20 to your doctor whenever you have an appointment.

How long does back pain last?

To be eligible, your back pain must: Have lasted 12 weeks or longer. Not be associated with pregnancy or past surgery.

Does Medicare cover end stage renal disease?

Medicare Advantage will cover End-Stage Renal Disease (ESRD) Starting in 2021, Patients with ESRD can enroll in a Medicare Advantage plan. Now, those with ESRD can take advantage of the out-of-pocket maximums many Medicare Advantage plans offer. And while MA beneficiaries may have different costs and restrictions than those with Original Medicare, ...

Original Medicare changes in 2021

The Centers for Medicare and Medicaid Services, or CMS, announced in November that it is increasing premium and deductible costs in the Original Medicare program. Here’s a snapshot:

Medicare Part A premium

The premium for Medicare Part A (hospital insurance) is free for beneficiaries who have paid into Medicare through working at least 40 quarters of eligible employment. This population includes around 99% of beneficiaries.

Medicare Advantage changes 2021

The cost of Medicare Advantage premiums and deductibles vary based on the plan a beneficiary chooses and the zip code in which they live. Overall, CMS expects that the average premium cost for 2021 Medicare Advantage plans will decline by 11% to $21, down from $23.63 on average in 2020.

2021 Medicare Supplement changes

Medicare Supplement or Medigap monthly premiums vary depending on the plan you choose.

Changes to Medicare in the COVID-19 pandemic

The coronavirus pandemic brought significant changes to the Medicare program. Critically, CMS announced in October that Medicare would cover 100% of the cost of COVID-19 vaccines approved by the Food and Drug Administration. You will not need to pay a deductible or coinsurance for vaccine administration.

How much will Medicare premiums be in 2021?

Most people with Part A coverage don’t pay a premium. For those who do pay and have worked 30-39 quarters, premiums are increasing by $7 for a total of $259 per month according to the changes outlined by the Center for Medicare & Medicaid Services (CMS) for 2021. For individuals who have worked under 30 quarters, it’s increasing by $13 for a total of $471 per month. The deductible for each 60 day benefit period has risen by $76 for a new total of $1,484.

What is the income limit for Part B insurance in 2021?

Part B premiums are dependent upon income. The income brackets for 2021 have increased to $88,000 for an individual and $176,000 for a couple with fees increasing as income increases beyond those thresholds. For Part B coverage, the premium for people under the income threshold is now $148.50 an increase of only $3.90. Additionally, the deductible for Part B is $203, $5 more than 2020.

What is the donut hole for Part D?

What is known as “the donut hole” for Part D coverage was closed last year, which meant a smaller percentage of the cost for medications. However, 2021 will see an even tighter closure of the donut hole. The coverage for 2021 will start when recipients and their drug plan have spent $4,130 on covered medications. After that, recipients will pay no more than 25% for the cost of covered medications in all tiers.

Will Medicare be extended into 2021?

These additional Medicare benefits will carry over into 2021 including: