Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048.

What to do if you receive an overpayment from Medicare?

Medicare Overpayments 1 Reasons for Overpayment. A provider is liable for an overpayment received unless they are "without fault". ... 2 Appeal. If you disagree with a refund request, you may choose to appeal the notice of overpayment. ... 3 Extended Repayment Schedule. ...

How are overpayments reported to the Medicare Secondary Payer?

Overpayments are either communicated to a provider via a Noridian Demand Letter or self-reported by a provider. To be in compliance with Medicare policies for reporting and repaying overpayments, selecting the appropriate payment method for each situation is critical. Is the overpayment Medicare Secondary Payer (MSP) | Non MSP related?

How long does it take to collect Medicare overpayments?

Overpayment Collection Process Through reasonable diligence, you or a staff member identify receipt of an overpayment and quantify the amount. According to . SSA Section 1128J(d), you must report and return a self-identified overpayment to Medicare within: 60 days of overpayment identification

What is an overpayment and how do I report it?

An overpayment occurs when too much has been paid to a provider and a refund to Medicare is necessary. Overpayments are either communicated to a provider via a Noridian Demand Letter or self-reported by a provider.

How do I get a refund from Medicare overpayment?

Overpayment Collection Process If you fail to pay in full, you get an ITR letter 60–90 days after the initial demand letter. The ITR letter advises you to refund the overpayment or establish an ERS. Otherwise, your debt is referred for collection.

What should you do if Medicare overpays you for patient treatment?

If Medicare Finds the Overpayment You can reply using the Immediate Recoupment Request Form, request immediate recoupment via the eRefunds or Overpayment Claim Adjustment (OCA) features in the WPS-GHA portal, or wait for Medicare to implement their standard recoupment process.

What happens if I overpaid Medicare?

When Medicare identifies an overpayment, the amount becomes a debt you owe the federal government. Federal law requires we recover all identified overpayments. When you get an overpayment of $25 or more, your MAC initiates overpayment recovery by sending a demand letter requesting repayment.

How do I request a recoupment from Medicare?

To request an immediate recoupment by fax, you must complete the Immediate Recoupment Request Form. A request for immediate offset must be received no later than the 16th day from the date of the initial demand letter. Immediate recoupment forms can be found on the NGSMedicare.com website under the Forms tab.

How long does Medicare have to request a refund?

What is the timeframe in which Medicare may request return of an overpayment? For Medicare overpayments, the federal government and its carriers and intermediaries have 3 calendar years from the date of issuance of payment to recoup overpayment.

Does Medicare have to be paid back?

The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later. You're responsible for making sure Medicare gets repaid from the settlement, judgment, award, or other payment.

What is the lookback period for overpayments?

within six yearsThe rule also states that an overpayment must be reported and returned if it is identified within six years of the date it was received. This time period is generally referred to as the “lookback” period.

How do insurance carriers deal with overpayment?

If the insurance company overpays:Contact the insurance company. ... Ask the insurer to explain the payment when they request a refund. ... If there was an overpayment, ask the insurer to reprocess the claim and send a formal request for the overpayment.

What is the Medicare refund?

Medicare reimbursement is the process by which a doctor or health facility receives funds for providing medical services to a Medicare beneficiary. However, Medicare enrollees may also need to file claims for reimbursement if they receive care from a provider that does not accept assignment.

How often does a provider need to set up an immediate recoupment?

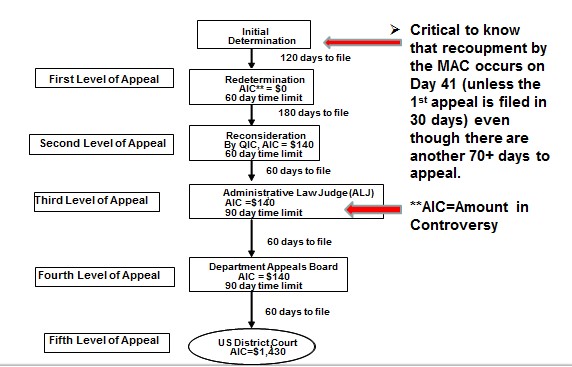

Request Immediate Recoupment The form must be received, by , within 30 days from the date of the overpayment demand letter in order for the immediate recoupment to be created before any interest starts to accrue. Recoupment on the overpayment will begin after the 41st day from the overpayment demand letter.

What is overpayment recovery?

Overpayments can be recovered by sending back the incorrect paycheck, setting up an overpayment on the Additional Pay page or allowing the automatic retro process to recover the overpaid amount.

What is an overpayment letter?

What do I do if I receive an overpayment letter? A. An overpayment letter is a formal request to repay a debt owed to the Medicare Trust Fund.

How long does it take for Medicare to report overpayments?

The Centers for Medicare & Medicaid Services (CMS) has published a final rule that requires Medicare Parts A and B health care providers and suppliers to report and return overpayments by the later of the date that is 60 days after the date an overpayment was identified, or the due date of any corresponding cost report, if applicable.

When is an overpayment identified?

This final rule states that a person has identified an overpayment when the person has or should have, through the exercise of reasonable diligence, determined that the person has received an overpayment and quantified the amount of the overpayment.

Who is the contractor for Medicare overpayment?

Once a determination of an overpayment has been made, the amount of the overpayment is a debt owed to the United States Government, via Novitas Solutions , as one of its Medicare contractors.

What are some examples of overpayments?

Examples of overpayments where you could be liable include, but are not limited to, the following: Payment exceeds the reasonable charge for the service. Duplicate payments of the same service (s) Incorrect provider payee. Incorrect claim assignment resulting in incorrect payee.

What to call if you don't file a Medicare claim?

If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227) . TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got. If it's close to the end of the time limit and your doctor or supplier still hasn't filed the claim, you should file the claim.

How long does it take for Medicare to pay?

Medicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. If a claim isn't filed within this time limit, Medicare can't pay its share. For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020.

How to file a medical claim?

Follow the instructions for the type of claim you're filing (listed above under "How do I file a claim?"). Generally, you’ll need to submit these items: 1 The completed claim form (Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB]) 2 The itemized bill from your doctor, supplier, or other health care provider 3 A letter explaining in detail your reason for submitting the claim, like your provider or supplier isn’t able to file the claim, your provider or supplier refuses to file the claim, and/or your provider or supplier isn’t enrolled in Medicare 4 Any supporting documents related to your claim

What happens after you pay a deductible?

After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). , the law requires doctors and suppliers to file Medicare. claim. A request for payment that you submit to Medicare or other health insurance when you get items and services that you think are covered.

When do you have to file Medicare claim for 2020?

For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020. Check the "Medicare Summary Notice" (MSN) you get in the mail every 3 months, or log into your secure Medicare account to make sure claims are being filed in a timely way.

Does Medicare Advantage cover hospice?

Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Most Medicare Advantage Plans offer prescription drug coverage. , these plans don’t have to file claims because Medicare pays these private insurance companies a set amount each month.

Do you have to file a claim with Medicare Advantage?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. , these plans don’t have to file claims because Medicare pays these private insurance companies a set amount each month.

Pay an Overpayment

We’re pleased to announce that we’ve expanded the options for you to repay overpayments online. If you have an overpayment debt, you may be eligible to make a full or partial payment using Pay.gov or your bank’s online bill pay option. Pay.gov is a secure online service provided by the Department of the Treasury.

Using Pay.gov to Make Your Payment

Our billing notices now include the Pay.gov website information as well as a new Remittance ID. The Remittance ID is a 10-digit alphanumeric number used instead of your Social Security number for online payments. To make a payment, follow these steps: