To get a refund or reimbursement from Medicare, you will need to complete a claim form and mail it to Medicare along with an itemized bill for the care you received. Medicare’s claim form is available in English and in Spanish.

Full Answer

How to get reimbursement from Medicare?

How to Get Reimbursed From Medicare To get reimbursement, you must send in a completed claim form and an itemized bill that supports your claim. It includes detailed instructions for submitting your request. You can fill it out on your computer and print it out.

Do I need to file a claim for Medicare reimbursement?

In rare cases, Medicare beneficiaries may need to file a claim for reimbursement. Learn more about the Medicare refund policy and how you can file a claim. In rare cases, Medicare beneficiaries may need to file a claim for reimbursement.

How do I file a Medicare claim?

Contact your doctor or supplier, and ask them to file a claim. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got.

How do I get reimbursement for my claim?

To get reimbursement, you must send in a completed claim form and an itemized bill that supports your claim. It includes detailed instructions for submitting your request. You can fill it out on your computer and print it out.

How far back can you file Medicare claims?

12 monthsMedicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. If a claim isn't filed within this time limit, Medicare can't pay its share.

How do I get reimbursed for Medicare payments?

How do you file a Medicare reimbursement claim?Once you see the outstanding claims, first call the service provider to ask them to file the claim. ... Go to Medicare.gov and download the Patient Request of Medical Payment form CMS-1490-S.Fill out the form by carefully following the instructions provided.More items...

Can Medicare ask for money back?

When Medicare identifies an overpayment, the amount becomes a debt you owe the federal government. Federal law requires we recover all identified overpayments. When you get an overpayment of $25 or more, your MAC initiates overpayment recovery by sending a demand letter requesting repayment.

Can you submit your own claims to Medicare?

If you have Original Medicare and a participating provider refuses to submit a claim, you can file a complaint with 1-800-MEDICARE. Regardless of whether or not the provider is required to file claims, you can submit the healthcare claims yourself.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

How do I claim unclaimed Medicare rebates?

0:181:15Unclaimed Medicare rebates waiting to be collected | 7NEWS - YouTubeYouTubeStart of suggested clipEnd of suggested clipDetails are up to date on the mygov. Website simply click on view and edit my details the averageMoreDetails are up to date on the mygov. Website simply click on view and edit my details the average amount people are missing out on is two hundred and thirteen.

How do I request a recoupment from Medicare?

To request an immediate recoupment by fax, you must complete the Immediate Recoupment Request Form. A request for immediate offset must be received no later than the 16th day from the date of the initial demand letter. Immediate recoupment forms can be found on the NGSMedicare.com website under the Forms tab.

Can you submit Medicare claims online?

Submit your completed Patient's Request for Medical Payment form, itemized medical bill or bills, and any supporting documents to your state's Medicare contractor. All claims must be submitted by mail; you can't file a Medicare claim online.

How does Medicare Part B reimbursement work?

The Medicare Part B Reimbursement program reimburses the cost of eligible retirees' Medicare Part B premiums using funds from the retiree's Sick Leave Bank. The Medicare Part B reimbursement payments are not taxable to the retiree.

How do I submit a Medicare claim electronically?

How to Submit Claims: Claims may be electronically submitted to a Medicare Administrative Contractor (MAC) from a provider using a computer with software that meets electronic filing requirements as established by the HIPAA claim standard and by meeting CMS requirements contained in the provider enrollment & ...

Who is eligible for Medicare Part B reimbursement?

1. How do I know if I am eligible for Part B reimbursement? You must be a retired member or qualified survivor who is receiving a pension and is eligible for a health subsidy, and enrolled in both Medicare Parts A and B.

What is Medicare reimbursement account?

Medicare Reimbursement Account (MRA) Basic Option members who pay Medicare Part B premiums can be reimbursed up to $800 each year! You must submit proof of Medicare Part B premium payments through the online portal, EZ Receipts app or by fax or mail.

What is the Medicare rebate?

Medicare rebates are paid as a percentage of the. Medicare Schedule Fee as follows: 100% for consultations provided by a general practitioner; 85% for all other services provided by a medical practitioner in the community; and. 75% for all services that are provided by a medical practitioner during an episode of.

Is reimbursement for Medicare Part B taxable?

The Medicare Part B reimbursement payments are not taxable to the retiree.

How long does it take for Medicare to process a claim?

Medicare claims to providers take about 30 days to process. The provider usually gets direct payment from Medicare. What is the Medicare Reimbursement fee schedule? The fee schedule is a list of how Medicare is going to pay doctors. The list goes over Medicare’s fee maximums for doctors, ambulance, and more.

What to do if a pharmacist says a drug is not covered?

You may need to file a coverage determination request and seek reimbursement.

What happens if you see a doctor in your insurance network?

If you see a doctor in your plan’s network, your doctor will handle the claims process. Your doctor will only charge you for deductibles, copayments, or coinsurance. However, the situation is different if you see a doctor who is not in your plan’s network.

Does Medicare cover out of network doctors?

Coverage for out-of-network doctors depends on your Medicare Advantage plan. Many HMO plans do not cover non-emergency out-of-network care, while PPO plans might. If you obtain out of network care, you may have to pay for it up-front and then submit a claim to your insurance company.

Do participating doctors accept Medicare?

Most healthcare doctors are “participating providers” that accept Medicare assignment. They have agreed to accept Medicare’s rates as full payment for their services. If you see a participating doctor, they handle Medicare billing, and you don’t have to file any claim forms.

Do you have to pay for Medicare up front?

But in a few situations, you may have to pay for your care up-front and file a claim asking Medicare to reimburse you. The claims process is simple, but you will need an itemized receipt from your provider.

Do you have to ask for reimbursement from Medicare?

If you are in a Medicare Advantage plan, you will never have to ask for reimbursement from Medicare. Medicare pays Advantage companies to handle the claims. In some cases, you may need to ask the company to reimburse you. If you see a doctor in your plan’s network, your doctor will handle the claims process.

How to file a claim for Medicare Part B?

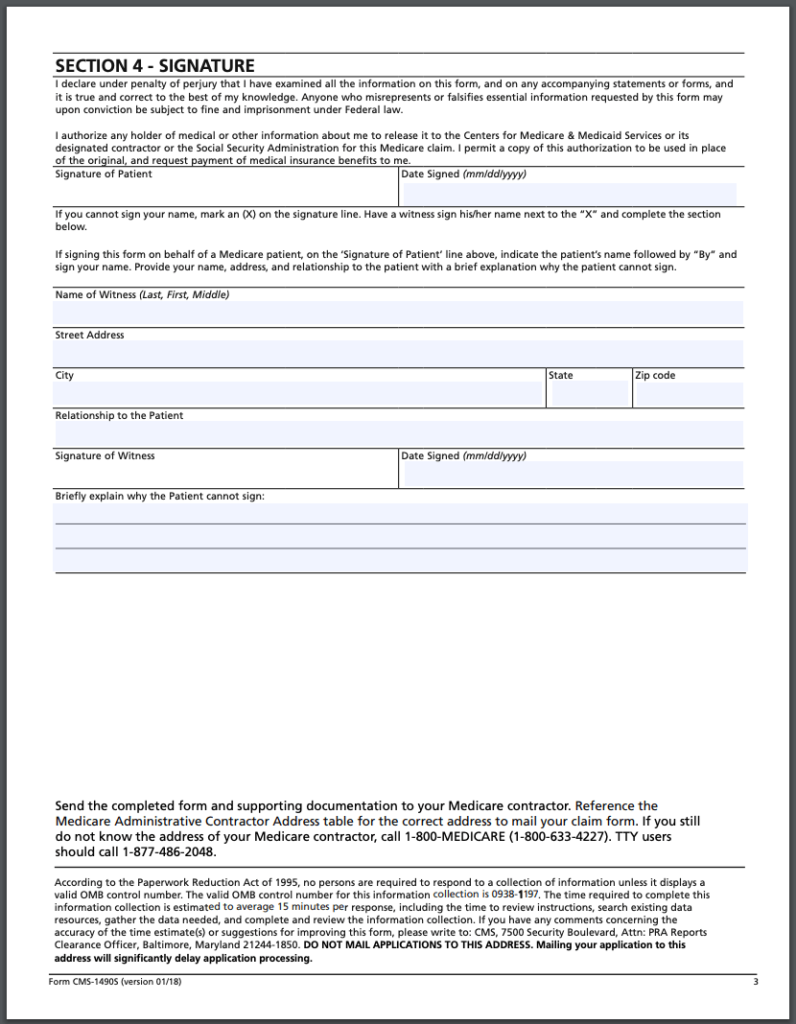

To file a claim, fill out the Patient Request for Medical Payment form and send the completed form to your state’s Medicare contractor. Instructions for submitting your claim vary depending on the type of claim you’re filing: Claims for Medicare Part B services. Claims for durable medical equipment (DME)

How to find Medicare Advantage plan?

To learn more about Medicare or to find Medicare Advantage plans in your area, speak with a licensed insurance agent by calling. 1-800-557-6059 . 1-800-557-6059 TTY Users: 711 24 hours a day, 7 days a week. 1 Medicare.gov. Lower costs with assignment.

How to contact Medicare if you don't accept Medicare?

Speak with a licensed insurance agent. 1-800-557-6059 | TTY 711, 24/7. If you go to a provider that does not accept Medicare assignment, you may have to pay for the service out of pocket and then file a claim to be reimbursed by Medicare.

What are the benefits of Medicare Advantage?

Still, there are several advantages to having a Medicare Advantage plan. For instance, many Medicare Advantage plans can offer benefits that aren’t covered by Original Medicare, including: 1 Prescription drug coverage 2 Dental coverage 3 Vision coverage 4 Hearing coverage 5 Health and wellness program benefits, such as membership to SilverSneakers

What is Medicare assignment?

Providers that accept Medicare assignment are required by law to accept the Medicare-approved amount as full payment for covered services. Providers that don’t accept assignment can charge up to 15 percent more for covered services, which you are typically responsible for paying. 1

What should be included in a medical bill?

The bill should include: The date of service. A description of each service. The charge for each service. The place of service. Diagnosis. Name and address of the provider. A letter explaining your reason for the claim, including why you received the medical care from the provider.

Does Medicare have an out-of-pocket maximum?

Original Medicare does not have an out-of-pocket maximum.

How Do I File a Medicare Reimbursement Claim?

To file your claim, you’ll need to fill out a Patient’s Request for Medical Payment form. You then send both this form and the bill from your provider to your state’s Medicare contractor.

What To Submit With The Claim

When filling out the form, you must choose the service type then provide the following information:

Where to Send Your Medicare Claim

Each state has a different address to send your claim. There are two places where you can find the address. You can find the address on the claim form on page two, or on your quarterly Medicare Summary Notice.

What if My Healthcare Provider is Not Sending the Claims Promptly?

The first thing you should do is call the provider and ask them to send your claim. If they do not file the claim, call Medicare and find out how much time is left to file the claim. If it’s close to the end of the allowed time and your healthcare provider has not filed the claim, you should go ahead and file the claim.

FAQs

When a claim is submitted to Medicare, it should come straight from the doctor or other provider of services. If for some reason they don’t submit the claim on your behalf, then you can call Medicare and submit it yourself. You can also submit the claim online.

What is Medicare beneficiary?

The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals (ORM). For ORM, there may be multiple recoveries ...

What is included in a demand letter for Medicare?

The demand letter also includes information on administrative appeal rights. For demands issued directly to beneficiaries, Medicare will take the beneficiary’s reasonable procurement costs (e.g., attorney fees and expenses) into consideration when determining its demand amount.

Can CMS issue more than one demand letter?

For ORM, there may be multiple recoveries to account for the period of ORM, which means that CMS may issue more than one demand letter. When Medicare is notified of a settlement, judgment, award, or other payment, including ORM, the recovery contractor will perform a search of Medicare paid claims history.

When Can I Request a Medicare Refund?

Typically, beneficiaries won’t need to request refunds or reimbursements for Medicare Part A and Part B services because health care providers bill Medicare directly and will only bill patients for deductibles, copayments, coinsurance or for services or items that are not covered by Medicare.

What Is a Medicare Premium Refund?

There are certain cases in which Medicare may issue a refund on your monthly premium.

Who Qualifies for a Medicare Premium Refund?

Members of Medicare Advantage plans that offer Part B premium reimbursements can be eligible for a full or partial refund of their Medicare Part B premium. In addition, retirees of certain organizations such as a city fire department are sometimes eligible for subsidies that issue full or partial reimbursements of Medicare premiums.

How Do I Get My Money Back from Medicare?

To get a refund or reimbursement from Medicare, you will need to complete a claim form and mail it to Medicare along with an itemized bill for the care you received. Medicare’s claim form is available in English and in Spanish.

How long does Medicare take to respond to a request?

How long your plan has to respond to your request depends on the type of request: Expedited (fast) request—72 hours. Standard service request—30 calendar days. Payment request—60 calendar days. Learn more about appeals in a Medicare health plan.

How long does it take to get a decision from Medicare?

Any other information that may help your case. You’ll generally get a decision from the Medicare Administrative Contractor within 60 days after they get your request. If Medicare will cover the item (s) or service (s), it will be listed on your next MSN. Learn more about appeals in Original Medicare.

What is an appeal in Medicare?

An appeal is the action you can take if you disagree with a coverage or payment decision by Medicare or your Medicare plan. For example, you can appeal if Medicare or your plan denies: • A request for a health care service, supply, item, or drug you think Medicare should cover. • A request for payment of a health care service, supply, item, ...

What to do if you didn't get your prescription yet?

If you didn't get the prescription yet, you or your prescriber can ask for an expedited (fast) request. Your request will be expedited if your plan determines, or your prescriber tells your plan, that waiting for a standard decision may seriously jeopardize your life, health, or ability to regain maximum function.

How to ask for a prescription drug coverage determination?

To ask for a coverage determination or exception, you can do one of these: Send a completed "Model Coverage Determination Request" form. Write your plan a letter.

How long does it take to appeal a Medicare denial?

You, your representative, or your doctor must ask for an appeal from your plan within 60 days from the date of the coverage determination. If you miss the deadline, you must provide ...

How long does it take for a Medicare plan to make a decision?

The plan must give you its decision within 72 hours if it determines, or your doctor tells your plan, that waiting for a standard decision may seriously jeopardize your life, health, or ability to regain maximum function. Learn more about appeals in a Medicare health plan.

When Do I Need to File A Claim?

How Do I File A Claim?

- Fill out the claim form, called the Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB). You can also fill out the CMS-1490S claim form in Spanish.

What Do I Submit with The Claim?

- Follow the instructions for the type of claim you're filing (listed above under "How do I file a claim?"). Generally, you’ll need to submit these items: 1. The completed claim form (Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB]) 2. The itemized bill from your doctor, supplier, or other health care provider 3. A letter explaining in detail your reason for subm…

Where Do I Send The Claim?

- The address for where to send your claim can be found in 2 places: 1. On the second page of the instructions for the type of claim you’re filing (listed above under "How do I file a claim?"). 2. On your "Medicare Summary Notice" (MSN). You can also log into your Medicare accountto sign up to get your MSNs electronically and view or download them anytime. You need to fill out an "Author…

Medicare’s Demand Letter

- In general, CMS issues the demand letter directly to: 1. The Medicare beneficiary when the beneficiary has obtained a settlement, judgment, award or other payment. 2. The liability insurer (including a self-insured entity), no-fault insurer, or workers’ compensation (WC) entity when that insurer or WC entity has ongoing responsibility for medicals ...

Assessment of Interest and Failure to Respond

- Interest accrues from the date of the demand letter, but is only assessed if the debt is not repaid or otherwise resolved within the time period specified in the recovery demand letter. Interest is due and payable for each full 30-day period the debt remains unresolved; payments are applied to interest first and then to the principal. Interest is assessed on unpaid debts even if a debtor is pu…

Right to Appeal

- It is important to note that the individual or entity that receives the demand letter seeking repayment directly from that individual or entity is able to request an appeal. This means that if the demand letter is directed to the beneficiary, the beneficiary has the right to appeal. If the demand letter is directed to the liability insurer, no-fault insurer or WC entity, that entity has the ri…

Waiver of Recovery

- The beneficiary has the right to request that the Medicare program waive recovery of the demand amount owed in full or in part. The right to request a waiver of recovery is separate from the right to appeal the demand letter, and both a waiver of recovery and an appeal may be requested at the same time. The Medicare program may waive recovery of the amount owed if the following con…