Providers must determine if Medicare is the primary or secondary payer by obtaining MSP information such as group health coverage through employment or non-group health coverage resulting from an injury or illness.

Full Answer

What does it mean when Medicare is a secondary payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility; that is, when another entity has the responsibility for paying beforeMedicare. Over the years, Congress has made an effort to shift costs from Medicare to the appropriate private sources of payment, which has resulted in significant savings to the Medicare Trust Fund.

How does Medicare calculate secondary payment?

How does Medicare calculate secondary payment? Medicare's secondary payment will be based on the full payment amount (before the reduction for failure to file a proper claim) unless the provider, physician, or other supplier demonstrates that the failure to file a proper claim is attributable to a physical or mental incapacity of the ...

Does Medicare ever pay for secondary?

The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs. If your group health plan or retiree health coverage is the secondary payer, you may need to enroll in Medicare Part B before your insurance will pay.

How to bill Medicare as secondary?

Medicare Secondary Payer BILLING & ADJUSTMENTS Page 2 Process A: Working Aged or Disability insurance is primary. Billing Medicare secondary. Submit your claim to the primary insurance. After receiving payment from the primary insurance, you may bill Medicare secondary using the following instructions.

What is Medicare Secondary Payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare.

How do I know if my Medicare is primary or secondary?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Is Medicare primary or secondary payer?

The secondary payer (which may be Medicare) may not pay all the remaining costs. If your group health plan or retiree coverage is the secondary payer, you may need to enroll in Medicare Part B before they'll pay.

How do I submit Medicare secondary payer claims?

Medicare Secondary Payer (MSP) claims can be submitted electronically to Novitas Solutions via your billing service/clearinghouse, directly through a Secure File Transfer Protocol (SFTP) connection, or via Novitasphere portal's batch claim submission.

Is Medicare always the primary payer?

Medicare is always primary if it's your only form of coverage. When you introduce another form of coverage into the picture, there's predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

How does it work when you have 2 insurances?

Secondary insurance: once your primary insurance has paid its share, the remaining bill goes to your “secondary” insurance, if you have more than one health plan. Your secondary insurance may cover part or all of the remaining cost.

Does Medicare automatically forward claims to secondary insurance?

If a Medicare member has secondary insurance coverage through one of our plans (such as the Federal Employee Program, Medex, a group policy, or coverage through a vendor), Medicare generally forwards claims to us for processing.

What is the purpose of the Medicare Secondary Payer questionnaire?

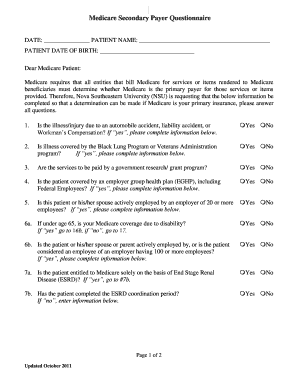

CMS developed an MSP questionnaire for providers to use as a guide to help identify other payers that may be primary to Medicare. This questionnaire is a model of the type of questions you should ask to help identify MSP situations.

Will secondary pay if primary denies?

If your primary insurance denies coverage, secondary insurance may or may not pay some part of the cost, depending on the insurance. If you do not have primary insurance, your secondary insurance may make little or no payment for your health care costs.

Is Medicare Secondary Payer questionnaire required?

CMS electronic tools help identify and verify MSP situations. Get more information in Medicare Secondary Payer Manual, Chapter 3, Section 20 or contact your MAC. Providers must keep completed MSP questionnaire copies and other MSP information for 10 years after the service date.

When should MSPQ be completed?

every 90 daysAs a Part A institutional provider rendering recurring outpatient services, the MSP questionnaire should be completed prior to the initial visit and verified every 90 days.

How do I get a CMS 1500 form?

In order to purchase claim forms, you should contact the U.S. Government Printing Office at 1-866-512-1800, local printing companies in your area, and/or office supply stores. Each of the vendors above sells the CMS-1500 claim form in its various configurations (single part, multi-part, continuous feed, laser, etc).

What is Medicare Secondary Payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare. When Medicare began in 1966, it was the primary payer for all claims except for those covered by Workers' Compensation, ...

What age is Medicare?

Retiree Health Plans. Individual is age 65 or older and has an employer retirement plan: Medicare pays Primary, Retiree coverage pays secondary. 6. No-fault Insurance and Liability Insurance. Individual is entitled to Medicare and was in an accident or other situation where no-fault or liability insurance is involved.

Why is Medicare conditional?

Medicare makes this conditional payment so that the beneficiary won’t have to use his own money to pay the bill. The payment is “conditional” because it must be repaid to Medicare when a settlement, judgment, award or other payment is made. Federal law takes precedence over state laws and private contracts.

How long does ESRD last on Medicare?

Individual has ESRD, is covered by a GHP and is in the first 30 months of eligibility or entitlement to Medicare. GHP pays Primary, Medicare pays secondary during 30-month coordination period for ESRD.

What are the responsibilities of an employer under MSP?

As an employer, you must: Ensure that your plans identify those individuals to whom the MSP requirement applies; Ensure that your plans provide for proper primary payments whereby law Medicare is the secondary payer; and.

When did Medicare start?

When Medicare began in 1966 , it was the primary payer for all claims except for those covered by Workers' Compensation, Federal Black Lung benefits, and Veteran’s Administration (VA) benefits.

Does GHP pay for Medicare?

GHP pays Primary, Medicare pays secondary. Individual is age 65 or older, is self-employed and covered by a GHP through current employment or spouse’s current employment AND the employer has 20 or more employees (or at least one employer is a multi-employer group that employs 20 or more individuals): GHP pays Primary, Medicare pays secondary.

What is Medicare Secondary Payer Recovery Portal?

The Medicare Secondary Payer Recovery Portal (MSPRP) is a web-based tool designed to assist in the resolution of liability insurance, no-fault insurance, and workers' compensation Medicare recovery cases. The MSPRP gives you the ability to access and update certain case specific information online.

What is the MSPRP user guide?

The MSPRP User Guide was written to help you understand how to use the MSPRP. The User Guide is available under the ‘Reference Material’ menu option of the MSPRP application.

What are the benefits of MSPRP?

MSPRP Features & Benefits: The MSPRP provides you with the following features and related benefits: 1. Submit Beneficiary Proof of Representation, Beneficiary Consent to Release or Insurer Letter of Authority documentation. 2.

What is Medicare Secondary Payer?

The Medicare Secondary Payer (MSP) provisions protect the Medicare Trust Fund from making payments when another entity has the responsibility of paying first. Any entity providing items and services to Medicare patients must determine if Medicare is the primary payer. This booklet gives an overview of the MSP provisions and explains your responsibilities in detail.

What happens if you don't file a claim with the primary payer?

File proper and timely claims with the primary payer. Not filing proper and timely claims with the primary payer may result in claim denial. Policies vary depending on the payer; check with the payer to learn its specific policies.

Why does Medicare make a conditional payment?

Medicare may make pending case conditional payments to avoid imposing a financial hardship on you and the patient while awaiting a contested case decision.

Can Medicare make a payment?

Medicare can’t make payment when payment “has been made or can reasonably be expected to be made” under liability insurance (including self-insurance), no-fault insurance, or a WC law or plan of the United States, called a primary plan.

Can Medicare deny a claim?

Medicare may mistakenly pay a claim as primary if it meets all billing requirements, including coverage and medical necessity guidelines . However, if the patient’s CWF MSP record shows another insurer should pay primary to Medicare, we deny the claim.

What is secondary payer?

A secondary payer assumes coverage of whatever amount remains after the primary payer has satisfied its portion of the benefit, up to any limit established by the policies of the secondary payer coverage terms.

Who is responsible for making sure their primary payer reimburses Medicare?

Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment. Medicare recipients are also responsible for responding to any claims communications from Medicare in order to ensure their coordination of benefits proceeds seamlessly.

How does Medicare work with insurance carriers?

Generally, a Medicare recipient’s health care providers and health insurance carriers work together to coordinate benefits and coverage rules with Medicare. However, it’s important to understand when Medicare acts as the secondary payer if there are choices made on your part that can change how this coordination happens.

Is Medicare a secondary payer?

Medicare is the secondary payer if the recipient is: Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization with more than 20 employees.

Is ESRD covered by COBRA?

Diagnosed with End-Stage Renal Disease (ESRD) and covered by a group health plan or COBRA plan; Medicare becomes the primary payer after a 30-day coordination period. Receiving coverage through a No-Fault or Liability Insurance plan for care related to the accident or circumstances involving that coverage claim.

Does Medicare pay conditional payments?

In any situation where a primary payer does not pay the portion of the claim associated with that coverage, Medicare may make a conditional payment to cover the portion of a claim owed by the primary payer. Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment.

What Does Secondary Payer Mean When You Are on Medicare?

Primary and secondary payers come into play when you have Medicare and some other type of medical or hospital insurance such as an employer group insurance plan, Veterans Affairs benefits, or workers’ compensation.

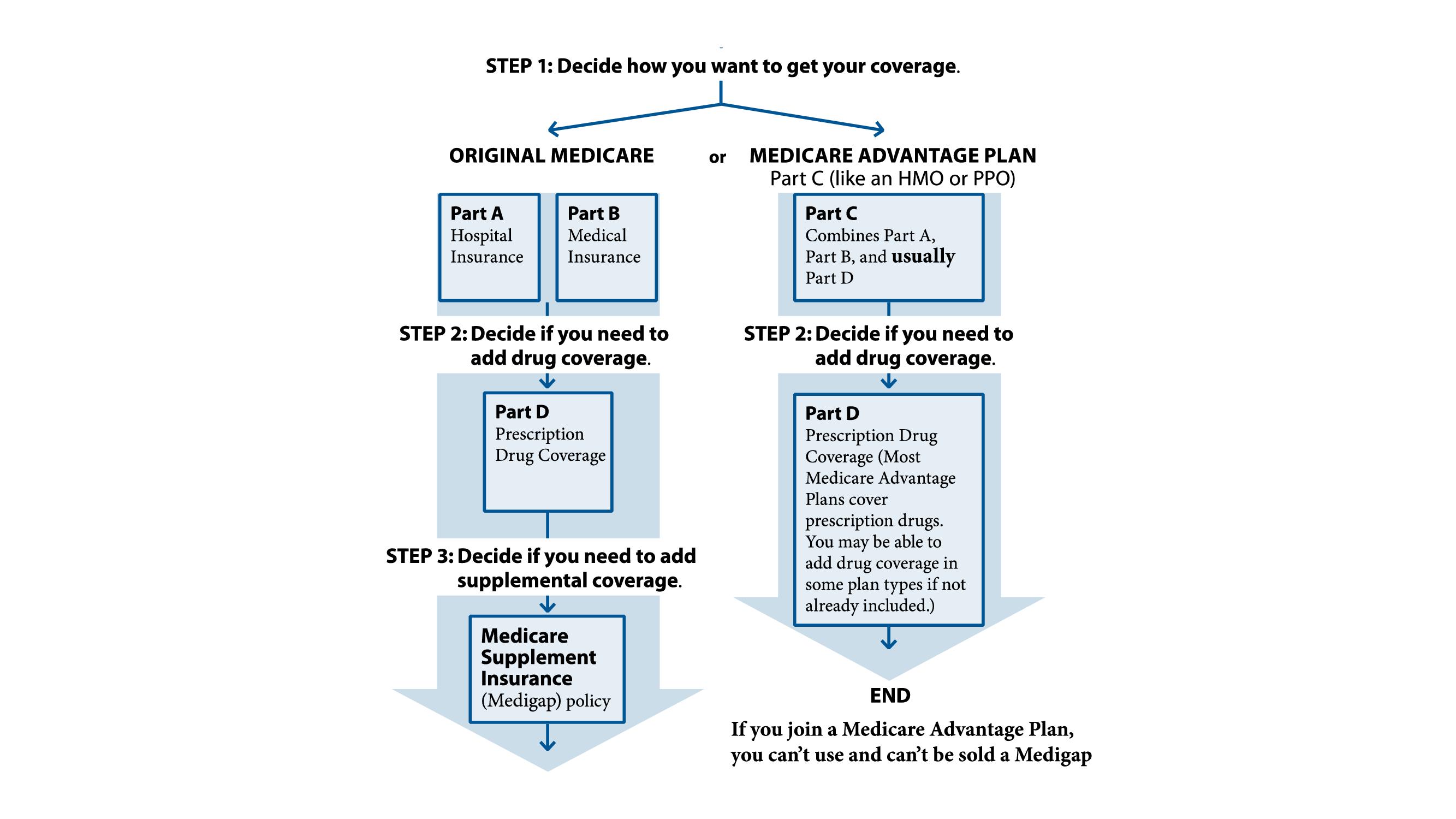

When Is Medicare a Primary Payer or a Secondary Payer?

Medicare is usually the secondary payer when you have other coverage. But Medicare is the primary payer if you do not have other coverage and is also the primary payer in certain circumstances if several conditions are met.

What to Do If Your Primary Payer Does Not Pay

If the primary payer fails to pay a medical claim, you may be able to request Medicare to make a conditional payment to cover the cost. Medicare will only make a conditional payment if there is “evidence that the primary plan does not pay promptly,” according to the Centers for Medicare and Medicaid Services.

When Is Medicare A Primary Payer?

Knowing the difference between Medicare being a primary or secondary payer matters when you are covered by at least one other insurance plan other than Medicare. So if Medicare is the only insurer you have, they’ll be the primary payer on all of your claims, and then you will have to pay the remainder of the bill.

When Is Medicare A Secondary Payer?

In situations where Medicare is a secondary payer, it will still cover all the same things as a primary payer situation—they’ll just be second-in-line for coverage after the primary payer takes care of as much as they can.